SPONSOR: Candente Copper owns 100% of the Canariaco copper project, which includes the Feasibility stage Canariaco Norte deposit. Canariaco is included in Goldman Sachs 84 Top Copper Projects Worldwide and Fortesque is a 19% owner of Candente.

Copper ore from La Viñita, Valle del Elqui, Chile. (Image by S. Rae, Wikimedia Commons)

- Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

In 2018, before the trade war between the US and China put the boots on copper demand, and covid-19 mine closures/ abandoned expansion plans crimped supply, we made a bold prediction: that copper supply is NOT going to be able to keep up with demand in the long-term. Even with expansions at existing mines and the ramp-up of the relatively few new copper mines like Cobre Panama, Radomiro Tomic and Toquepalain, it will not be enough to meet the onslaught of demand that is coming from China as it continues to modernize and urbanize, and electric vehicles, which use three times as much copper as regular ones. In 2016 Chinese automakers sold 28 million cars. If China follows through on its promise to go 100% electric, that would mean 2,380,000,000 kilograms of copper. At the current production rate of 20 million tonnes a year, that’s 119 years worth of copper! Just to produce enough copper for electric cars in China.

Do we expect 100% EV penetration? No. But the shift to electrification of our transportation system is real, it’s not going to go away or stop. Because it’s as real as the shift from wood to coal to fossil fuels and now to lithium. That means massive new copper supplies are needed just for Chinese EVs, whatever the EV penetration eventually turns out to be. And remember there’s the rest of the world to supply for EVs, charging infrastructure, and all of copper’s other uses.

Bottom line? We gotta find more copper.

‘Future-facing metals’

That sentiment is clearly shared by some of the world’s largest copper companies, who are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources.

In 2017 the Chilean government approved a $2.5 billion expansion of BHP’s Spence copper mine – the diversified miner’s second largest copper mine behind Escondida, the biggest copper operation in the world.

That followed closely behind BHP’s 2016 decision to raise its annual exploration budget by 29%, allocating nearly all of its $900 million budget to finding new copper and oil deposits – two commodities the world’s largest miner thinks it needs to bolster future growth. Potential acquisition targets include copper deposits in Peru, the US, Canada and South Australia.

In February of this year, chief executive Mike Henry said the company needs more “future-facing metals” such as copper. Last year, BHP became the top shareholder in SolGold, an Australian miner developing the Cascabel copper-gold project in Ecuador.

Last week, BHP announced it is ramping up work on the Spence mine expansion, to reach its production objective in the first half of 2021 (the project has been delayed due to covid-19 restrictions).

It’s interesting to note that BHP is planning to “go green” at Spence, with a focus on running the operation entirely on renewable energy by 2022. The Melbourne, Australia-based company also aims to stop drawing water from aquifers in Chile by 2030 – a reference to the problems mining companies are facing getting enough water in the bone-dry Atacama desert of northern Chile, the base of operations for several major copper and lithium mines.

The $2.5 billion expansion contemplates a concentrator plant to increase production, and extend the life of the deposit by about 20 years. The new mine will also feature an $800 million desalination plant located in the port city of Mejillones, about 60 km north of Antofagasta, that treats and pumps seawater at 1,000 liters per second.

BHP isn’t the only large mining firm taking a serious look at copper. Barrick Gold is interested in diversifying into the red metal from the yellow. CEO Mark Bristow sees Indonesia’s Grasberg, the second-largest copper mine in the world, as a potential buy-out target for Barrick. The company already owns the Porgera mine in Papua New Guinea, which borders Indonesia to the east, with China’s Zijin Mining. In May, Bristow told the Financial Times he was keen to expand in Asia, despite a recent dispute with the government of PNG over a renewal of Porgera’s license, which led Barrick and Zijin to shut the mine.

Meanwhile the CEO of Anglo American, another major diversified miner, indicated that South Africa would be a good jurisdiction to explore for base metals. “We will explore base metals across South Africa… We are already in Zambia and other places, we want to do more in South Africa so we are looking for adjustments in legislation there,” Mark Cutifani said during the 2020 Joburg Mining Indaba conference.

Copper, nickel, lead and zinc are among the base metals Anglo American is focusing its global discovery strategy in greenfield and brownfield projects.

Running out of ore

Why are major mining companies so intent on securing new supplies of copper? Quite simply, they’re running out of ore.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; they are having to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground.

Grasberg in Indonesia, the world’s second-largest copper mine, is emblematic of the problems copper miners are facing. The mine began as a large open pit but after decades of extracting the easy-to-reach ore is gone and future production is expected to come from a deep cave deposit known as the Deep Mill Level Zone. Copper concentrate exports have plunged dramatically as operations shift from open pit to underground.

Major South American copper miners have also been forced to cut production. State-owned Codelco has said it will scale back an ambitious $40-billion plan to upgrade its mines over the next decade, after reporting a drop in earnings, a prolonged strike at its Chuquicamata mine, and lower metals prices. The world’s largest copper company also said it will reduce spending through 2028 by 20%, or $8 billion.

Chuquicamata is expected to see a 40% fall in production by 2021. A $5 billion expansion, moving from open pit to underground, will take five years to reach full output of 300,000 tonnes per annum – this is not new production.

Shipments from BHP’s Escondida mine took a hit in 2019 due to operations moving from open pit to underground. The largest copper mine on the planet is expected to take until 2022 to re-gain full production, again not new production.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation — supplying 30% of the world’s red metal. Adding insult to injury, for producers, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

Country-wide protests over transit prices and perceived inequality have disrupted mining supply chains. The social unrest, along with a newly invigorated resource nationalism, has spooked would-be foreign investors in a country that only a few years ago was touted as an economic tiger.

Chile also has problems with water. The country’s underground reservoirs need to be recharged by rainfall and snowmelt from the Andes, but a study found more water was leaving the salars (salt flats) than returning, prompting water restrictions affecting both lithium and copper mines in the extremely arid Salar de Atacama, in northern Chile. In 2019 Chile’s water authority said it would double the number of areas off-limits to mining, from 30 to at least 70.

Escondida will stop drawing fresh water from the salt flat. Instead, the huge mine will bring desalinated water from the coast, where in 2018 BHP spent $3.4 billion on a desalination plant. Two pipelines transport water a steep 3,200m above sea level.

Antofagasta’s Zaldivar mine is nearing its mine life at 2029, and may be forced to close earlier if its water permits to draw water from the salar are not renewed.

A 2019 report by Moody’s Investors Service said that some of the worst droughts in half a century have led to tougher environmental regulations that are hiking miners’ costs and risks. Among the countries with mines exposed to decreasing water availability are Peru, Chile, Australia, South Africa and Mongolia.

On top of all this, there is the ongoing threat of strikes at South American copper mines which every year strip out some percentage of output. In a recent article, Bloomberg reports how a confluence of factors, including copper prices at a seven-year high, productivity gains (Chile is producing at similar levels to last year with fewer workers) and weak local currencies, are swelling industry margins, emboldening unions to down tools and ask for more pay/ benefits. Look for labor disruptions next year, when 31 contracts are due to expire in Chile, including at BHP’s Escondida, hit by a 44-day strike in 2017.

What about new copper mines? Surely mineral exploration companies are identifying new ore bodies, cueing up the next generation of copper producers?

Well, they are trying. Problem is, they are having to go further afield and dig deeper to find copper at the grades needed to economically produce copper products for end-users. This usually means riskier jurisdictions that are often ruled by shaky governments with an itchy trigger finger on the resource nationalism button. Combine that with production problems and you have the makings of a supply shortage.

In fact, new supply is concentrated in just five mines – Chile’s Escondida, Spence and Quebrada Blanca, Cobre Panama and the Kamoa-Kakula project in the DRC. And while these mines are expected to account for 80% of base-case output increases until 2022-23, their profitability depends on the copper price staying above $5,000 a tonne, according to analysts at Bank of America Merrill Lynch.

The current copper pipeline is the lowest it’s been in a century, and not improving. In 2018 Colin Hamilton, the director of commodities research at BMO Capital Markets, said that after the delivery of first copper from Cobre Panama (285-310,000t per year), BMO doesn’t see the next batch of +200,000-tonnes projects until 2022-23 — “when the likes of Kamoa (501,000t per year), Oyu Tolgoi Phase 2, and QB2 (316,000t per year) are likely to offer meaningful supply growth.”

Electrification 2.0

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An average electric vehicle contains about 4X as much copper as regular vehicles. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

A recent research report from Jefferies Research LLC concluded: “The copper market is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles. Secular demand driver in copper is electric passenger vehicles as the average EV is about four times as copper intensive as the average ICE automobile. Renewable power systems are at least five times more copper intensive than conventional power.”

President-elect Joe Biden plans a major shift away from fossil fuels to wind and solar power, and from gas/ diesel vehicles to EVs. In what would be a significant scale-up of President Obama’s 2009 plan to electrify the US transportation system, a kind of “electrification 2.0”, Biden aims to spend up to $1.7 trillion over 10 years on boosting renewable power and speeding introduction of electric vehicles.

Dubbed “Clean Energy Revolution”, the plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

One of the largest manufacturers of public charging stations, ChargePoint, is targeting a 50-fold increase in its global network of loading spots by the mid-2020s. The group in which German companies BMW, Daimler and Siemens hold stakes, aims to operate 2.5 million charging points by 2025, from 53,000 in 2018. A Level 2 charging station requires 7 kg of copper, a direct current fast charger (DCFC) or Level 3 station uses 25 kg.

BloombergNEF forecasts by 2040 there will be a need for 12 million charging points, each requiring about 10 kg of copper. The number of EV charging stations recently passed the one million mark.

Biden has also promised a $1.3 trillion infrastructure improvement plan, including: a $50 billion investment in repairs to roads and bridges; $10 billion for transit construction in poor areas of the country; a doubling of BUILD and INFRA grants, and more funding for the US Army Corps of Engineers.

The plan includes investments in high-speed rail, public transit, bicycling, school construction, expansion of rural broadband, and replacement of pipes and other water infrastructure — all of which will require millions more tonnes of copper, along with other infrastructure metals such as nickel, zinc and aluminum.

Is this going to happen for the US? Well if it is, it isn’t going to come cheap, as existing metal sources run dry. Across the Atlantic, the UK government has set a target of replacing all of its 31.5 million cars with electrics by 2050. A team of scientists led by the Natural History Museum’s head of earth sciences, Professor Richard Herrington, took the government to task and calculated how much raw materials that number of EVs would require.

The researchers found that to build 31.5 million EVs would take a jaw-dropping 207,900 tonnes of cobalt, 264,600 tonnes of lithium carbonate, at least 7,200 tonnes of neodymium and dysprosium, and 2,362,500 tonnes of copper — about 10% of global production. Just mining the amount of raw materials required to replace 2 billion cars globally would require four times the United Kingdom’s total annual electrical output.

Prof. Herrington told AutoExpress that, while there is urgency in cutting carbon dioxide emissions, “society needs to understand that there is a raw material cost of going green”.

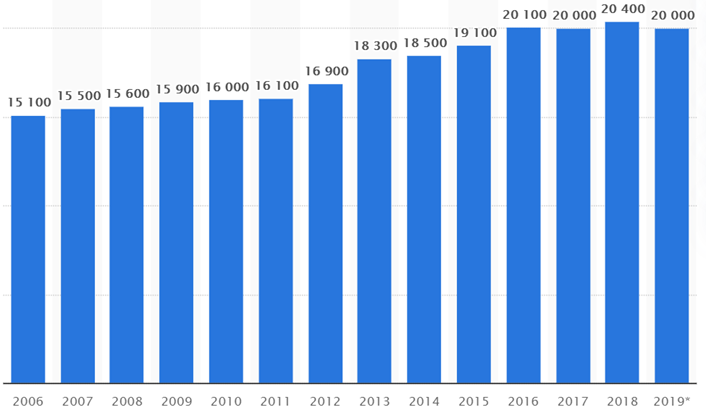

US and UK copper needs, of course, have to be put in context with global demand for the essential base metal. Total copper mine production worldwide from 2006 to 2019 (in 1,000 metric tons)

Total copper mine production worldwide from 2006 to 2019 (in 1,000 metric tons)

According to BloombergNEF, there are currently about 7 million electric vehicles in the world today. By 2040, they estimate around 30% of the world’s passenger cars will be electric. To me that’s a conservative and reasonable number. It means 500 million EVs will be on the road in 20 years, out of a total vehicle fleet of 1.6 billion. If each EV contains 85 kg of copper, that is 42,500,000,000 kg, or 42,500,000 tonnes of copper, roughly twice the current volume of copper produced by all of the world’s copper mines.

Just so we’re clear — in 20 years, BloombergNEF says copper miners need to double the amount of global copper production (20Mt), just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years! The world’s copper miners need to discover the equivalent of two Kamoas, at 500,000t, each and every year, while keeping current production at 20Mt.

Remember we still need to cover all the copper demanded by electrical, construction, power generation, charging stations, renewable energy, 5G, high-speed rail, etc., plus infrastructure maintenance/ buildout of new infrastructure.

That might be another 5-7Mt. So not only is there a 20Mt increase in copper usage required for a 30% EV penetration, but another (we estimate) 5-7Mt increase to meet demand for all of copper’s other applications. To keep up, the industry will need to find an additional two to three Kamoas a year, each producing 500,000t, for the next 20 years! Remember – Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place. It’s going to be hard enough to keep up the current 20mt per year let alone add so much more production.

Where is this new, and replacement, supply going to come from? When copper becomes so rare it hits $10,000 a tonne, what’s going to happen to 30% EV penetration? High-speed rail? 5G? We suggest that without new copper deposits, these well-intentioned plans are in jeopardy.

Did we mention China’s Belt and Road Initiative (BRI), consisting of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia?

Research by the International Copper Association found BRI is likely to increase demand for copper in over 60 Eurasian countries to 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

Another report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Remember total world mine production in 2019 was only 20Mt. In many countries it takes 20 years to go from discovery through permitting to mining.

Copper goes critical

But there’s a weird thing happening. The message of a looming copper shortage that could bring the global electrification shift to a screeching halt, and/or make copper so dear that only the rich can afford to buy finished products made from it, like EVs, isn’t getting through to the mining audience, because copper is not considered a critical mineral.

That term is reserved for minerals like lithium, cobalt, graphite, rare earths etc., which despite their presumed rarity, are actually fairly common. What makes them critical, is the fact that North America (and Europe) have virtually no domestic supply; without mines and a pipeline of deposits under development, and the smelters and know-how to process them, we are hopelessly reliant on foreign countries. Our supply chains are vulnerable and can be exploited at will by the countries that dominate production, through policies like domestic ore beneficiation, export restrictions, tariffs and quotas.

For years North America didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it. This has to change, if the US and Canada are to regain control of their critical minerals stockpiles.

For example, according to the US Geological Survey, of the 7 million tonnes of cobalt reserves available globally, nearly half — 3.6Mt — are in the Democratic Republic of the Congo (DRC). The DRC is the world’s leading cobalt supplier by far, in 2019 producing 100,000 tonnes of the EV battery ingredient. China locked up supply from the DRC with infrastructure for off-take, brings it home and refines it to sell to the world. But there is a lot of cobalt found elsewhere. Australia has 310,000 JORC-compliant tons of cobalt but only mined 5,100t last year. Canada has a reserve of 300,000t but only produced 3,000t. Of the 55,000 tonnes of cobalt reserves identified in the US, only 0.01% was mined in 2019, or 550t.

North America is well endowed with huge, quality rare earth deposits, enough to supply us with decades and decades of production. Examples include Commerce Resources’ (TSXV:CCE) Ashram rare earths deposit in Quebec, and Ucore Rare Metals’ (TSXV:UCU) Bokan Mountain REE project in Alaska. Graphite One (TSX.V:GPH) has an excellent graphite project in Alaska.

What we lack is processing and larger-scale manufacturing, ie. nearly all of the world’s mined rare earth oxides are processed in China; only very recently has REE processing started happening outside that country:

- Mountain Pass in California expects to start processing REEs by the end of 2020.

- Lynas signed a joint venture agreement with Blue Line Corp. to build a rare earths processing plant in Texas.

- Saskatchewan is setting up a processing facility.

(Europe is also starting to get smart and deal with its lack of critical minerals mined and processed on the continent. The EU recently launched the European Raw Materials Alliance, a partnership of over 300 companies, business associations and governments, that will focus on breaking Europe’s dependence on imports from China and other resource-rich countries. Analysts estimate the group of 29 nations will need about 60 times more lithium and 15 times more cobalt for EV batteries and energy storage by 2050.)

Graphite is another mineral that is mined and processed under a near monopoly by China but exists in large quantities elsewhere. According to the USGS, China in 2019 produced nearly three-quarters of the world’s graphite — 700,000 tonnes of the 1.1Mt total. The country indeed has a large proportion of global graphite reserves, 73Mt out of 300Mt. But China doesn’t host the majority of the world’s graphite. In fact Turkey has more, 90Mt, yet last year only mined 2,000t. 25 million tonnes are held by Mozambique but the African country only produced 100,000t. Brazil has nearly as much graphite as China, 72Mt, but in 2019, produced just 96,000 tonnes, about 13% of China’s mine production. Other countries with significant graphite reserves, are India (8Mt), Madagascar (1.6Mt), Mexico (3.Mt), Tanzania (18Mt) and Vietnam (7.6Mt).

Certainly the above-mentioned metals, and the rest of the 23 mineral commodities identifed by the US Department of the Interior, are critical, in that they are all important to the country’s economic and military security. You cannot, for example, make a lithium-ion battery without lithium, graphite and cobalt. But most of these metals are labeled critical because so much quantity comes from China, Russia or the DRC. Too much supply is coming from one country and China is where most of the refining is done. When we start mining and processing here in the West, or work with our mining country allies, some degree of ‘criticality’ will be removed. Why can’t we start mining all these minerals here? We have these materials in North America, South America, Australia and to a lesser extent, Europe. The next step is unfettered access and the creation of strong supply chains to get these metals from mine to market.

Copper, however, is different. Arguably, the red metal is the most critical of all critical metals, because of its necessity in electrification, and the fact that there is an actual shortage of copper coming.

There is no shift from fossil fuels to green energy without the red metal, which has no substitutes for its uses in EVs (electric motors and wiring, batteries, inverters, charging stations) wind and solar energy, and 5G.

Even with a 30% penetration of EVs, a relatively conservative estimate, we need to find another 20 million tonnes per year over 20 years.

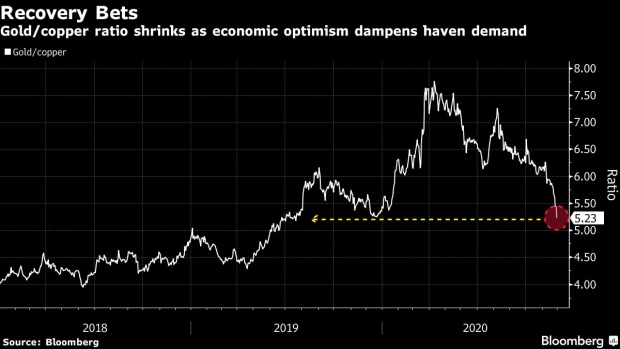

On Tuesday, Nov. 24 copper prices hit a fresh 2020 pinnacle of $3.52 per pound on the Comex in New York. The red metal’s best performance in seven years was on the strength of Chinese manufacturing and construction expanding at its fastest in a decade. The country’s manufacturing PMI for November, seen as a leading indicator of copper usage, rose to 52.1 while the Caixin manufacturing PMI, which includes both large and small firms, jumped to a 10-year high of 54.9. The construction index leapt from 59.8 in October to 60.5.

Iron ore has also been on a tear of late. The steelmaking ingredient hit $132.13 a tonne last Tuesday, a six-year high.

The numbers are so good, some market observers are pulling up charts from the “mining supercycle”. Reuters quotes Goldman Sachs predicting a return to the “structural bull market” of the 2000s, when most mined commodity prices got a lift due to demand (especially in China and India) outstripping available supplies. In a report the investment bank states:

“Covid is already ushering in a new era of policies aimed at social need instead of financial stability [which] will likely create cyclically stronger, more commodity-intensive economic growth, that should create the elusive cyclical upswing in demand.”

Metal traders say copper is looking like it did at the start of the ’03 supercycle start, having surged this year on a wave of bullish factors including a weakened dollar, optimism over covid vaccines, a move toward low-carbon power sources, and virus-related supply disruptions in the key copper-producing countries of Chile, Peru and Mexico. Prices are up more than 70% from a mid-March low, and Morgan Stanley predicts a substantial increase next year, to an average $7,716 a ton ($3.85/lb) in the fourth quarter.

However unlike the previous supercycle, which depended on China, Goldman says the next structural bull market will be driven by spending on green energy, for which copper is a key ingredient:

“Spending on green infrastructure could be as significant as the BRIC (Brazil-Russia-India-China) investment boom of that decade while the redistributive push in developed markets “is likely to lead to a large boost to consumer spending, comparable to the lending-fuelled consumption increase in the 2000s”.

The path of least resistance to the price of copper is, imo, higher.

SOURCE: https://www.mining.com/web/copper-the-most-critical-metal/