TORONTO, ON / September 24, 2020 / Tartisan Nickel Corp. (CSE:TN; OTC PINK:TTSRF; FSE:A2D) (“Tartisan”, or the “Company”) is pleased to update shareholders on the Company’s operations in the Republic of Peru. The Don Pancho polymetallic Silver-Lead-Zinc project (“Don Pancho”) located in the department of Lima, Peru, 110 kilometres north-northeast of Lima, comprising of two concessions totalling 849 hectares. The project is located in a prolific polymetallic mineral belt in central Peru with several operating mines in the area, including Minas de Buenaventura’s silver-lead-zinc-manganese (Ag-Pb-Zn-Mn) Uchucchacua mine located 66 kilometres north of Don Pancho which produced more than 15 million ounces of silver in 2018.

Previous exploration on the property includes an extensive surface mapping and sampling program, geophysics, and a small diamond drilling program conducted by a private Peruvian company in 2014. Mapping and sampling by the previous operators defined two main mineralized zones. The main zone called “Yanapallaca” is an extensive NNW-SSE-trending breccia zone covering a surface area of over 800 metres in length and up to 200 metres in width. Numerous small old workings and three underground drifts exist within this zone. One of the adits crosscut a two metre wide massive sulphide vein grading 106 g/t Ag, 3.26% Pb, 17.56% Zn and 2.58% Mn. Other untested mineralized structures located within this zone that are exposed on surface include chip over 1 metre returning 406 g/t Ag and 27.05% Pb.

The second mineralized zone called “La Cruz” is located several hundreds of metres NE of Yanapallaca shows two mineralized trends. Sampling across the main N-S trend returned 96.6 g/t Ag, 5.53% Pb and 0.88% Zn over 1.50 metres with a crosscutting WNW-ESE structure grading 360 g/t Ag and 12.66% Pb over a 1 metre width. Very little work has been conducted by the previous operators on this prospective area.

Tartisan is pleased to announce the appointment of Carlos Agreda Minaya as the General Manager for Tartisan’s Peruvian subsidiary, Minera Tartisan Peru S.A.C. Mr. Agreda is an experienced manager with a MBA from Peru’s highly reputable ESAN program. Mr. Agreda has extensive experience in permitting, accounting and mineral processing. Mr. Agreda is very knowledgeable of the Company’s Don Pancho property and has submitted the necessary permits to start an underground bulk sampling program. Mr. Agreda is also the General Manager of Peruvian Metals Corp., a Canadian junior explorer in Peru with a processing plant located in Northern Peru where mineral from the Don Pancho will be processed.

Jeffrey Reeder, P.Geo, a qualified person as defined in National Instrument 43-101, has prepared, supervised the preparation of, or approved the scientific and technical disclosure contained in this news release.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company which owns; the Kenbridge Nickel Project in northwestern Ontario, the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Silver-Lead-Zinc Project in Peru. The Company has an equity stake in; Eloro Resources Limited, Class 1 Nickel & Technologies Limited and Peruvian Metals Corp.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN; US-OTC:TTSRF; FSE:A2D). Currently, there are 101,603,550 shares outstanding (107,203,550 fully diluted).

For further information, please contact Mr. Mark Appleby, President & CEO and a Director of Tartisan Nickel Corp. at 416-804-0280 ([email protected]). Additional information about Tartisan Nickel Corp. can be found at the Company’s website at www.tartisannickel.com or on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

.png)

.png)

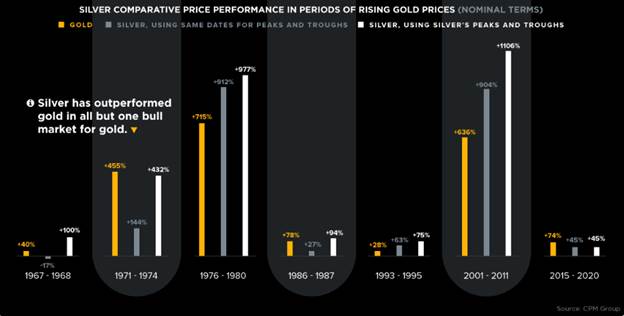

Silver Comparative Price Vs Rising Gold Prices

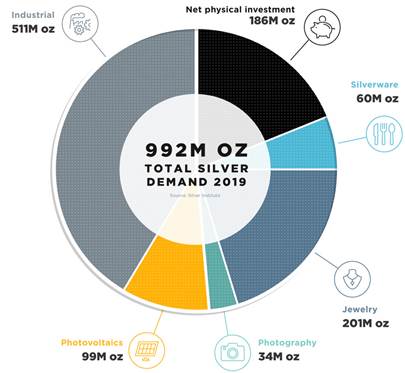

Silver Comparative Price Vs Rising Gold Prices Total Silver Demand 2019

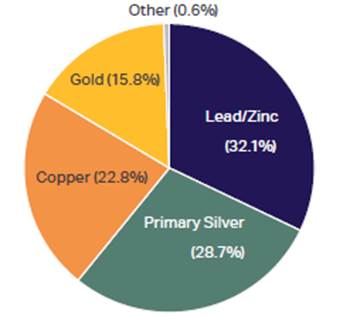

Total Silver Demand 2019 Silver Supply

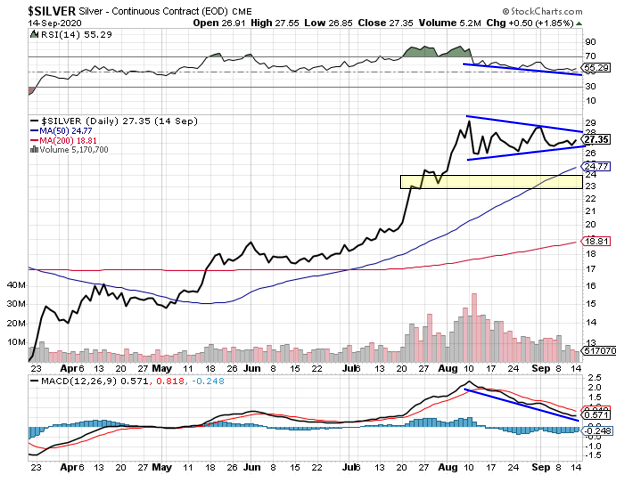

Silver Supply Silver Daily Chart

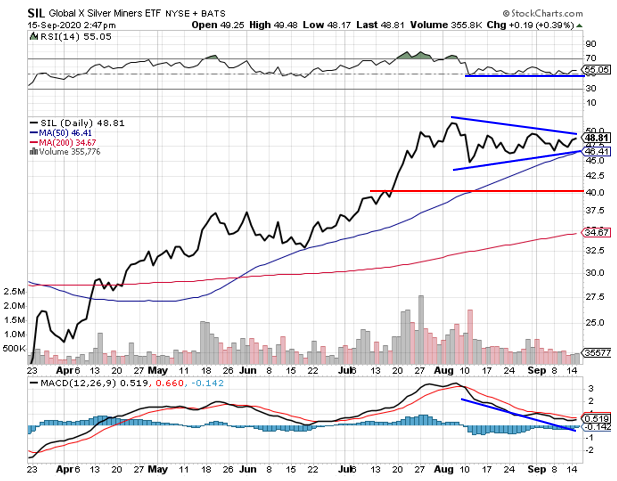

Silver Daily Chart SIL Daily

SIL Daily