Fresh off the heels of the battle for control of Aurelian Resources, in which Aurelian shareholders used their community on AGORACOM to launch a massive campaign against a “friendly bid” by Kinross Resources, the Canadian junior resource market is once again embroiled in what may be the mother of all battles for Noront Resource (NOT: TSXV).

(FULL DISCLOSURE: Noront Resources Is An AGORACOM Client)

Noront Resources has been the sector darling over the past 12 months, including being named to the 2008 TSX Venture 50, a ranking of Canada’s top emerging public companies listed on TSX Venture Exchange. Within the TSX Venture 50, Noront Resources was the #1 ranked company in the mining category.

Noront achieved much of its success and notoriety following the September 2007 discovery of a high-grade deposit of nickel, copper, platinum and palladium in the McFaulds Lake area in the James Bay Lowlands. The discovery created a surge of staking and exploration in the area, which is now commonly referred to as the “Ring Of Fire”.

Rosseau Asset Management Ltd. Proposes To Replace Noront’s Board At Upcoming AGM

Rosseau, a hedge fund, issued this press release at 7:30 AM today, advising it would be running its own slate of directors at the upcoming Noront AGM. You can review the reasons but it basically states “we can do better”.

In a huge twist of irony, the Rosseau press release names Patrick Anderson as one of the slate members. That’s right, the CEO of Aurelian Resources that many shareholders believe gave away the world’s best gold find over the last 20 years to Kinross Gold (please review links at the top of the page).

With respect to share ownership, Rosseau its officers and employees collectively own or control a total of 11,912,901 common shares of Noront, representing approximately 9.2 per cent of the common shares of Noront entitled to be voted at the meeting. However, I think it is fair to assume that Rosseau has already spoken to other shareholders sharing their views.

NORONT ISSUES PRESS RELEASE ADVISING SHAREHOLDERS TO VOTE AGAINST ROSSEAU SLATE AFTER ROSSEAU REJECTS COMPROMISE.

As expected, Noront Resources issued this press release shortly after 11 AM, advising shareholders to vote against the Rosseau slate. What was both surprising and a rallying point for Noront shareholders is the fact that Noront attempted to avoid a proxy battle and address Rosseau concerns:

“In an effort to avoid the cost and dislocation to all Noront shareholders that

would inevitably accompany a proxy fight, the Special Committee sought to

address Rosseau’s concerns and attempted to negotiate a compromise position

that would result in a more balanced Board of Directors than the slate of directors

suggested by Rosseau. Rosseau rejected Noront’s compromise proposal and

has commenced its proxy fight with the filing of the Dissident’s Circular.”

OPPORTUNISTIC MOTIVATIONS VS SHAREHOLDER VALUE MOTIVATIONS

Despite Noront’s best and reasonable efforts, Rosseau balked and went ahead with its plans. This clearly puts Rosseau’s motives in question, unless the Rosseau group wants investors to believe the entire current board and management team was worth jettisoning.

I’m a reasonable guy and just as interested as any shareholder to maximize the value of our 175,000 shares – but I’ve watched this team build Noront to where it is today, so don’t try selling shareholders on them suddenly being useless. Especially not under the guise of “enhancing value for the benefit of all shareholders of Noront.” The sector is weak, Noront’s share price is weak and you are moving in for the kill. I can respect that – but call it what it really is.

As such, in a post made earlier today but prior to seeing Noront’s press release, I stated as follows:

“…can you trust (Patrick) Anderson with Noront? Do you want to risk seeing Noront

flipped into a bigger company for a song? In my opinion, this is nothing more

than an opportunist move on Noront by people interested in getting their hands

on yet another incredible world-class project. It has nothing to do with creating

shareholder “value” for indiviudal shareholders. Their prosperity will come first. Period.”

Evidently, Noront saw things the same way once it was clear that Rosseau had no interest in negotiating a compromise – and stated as much in its press release:

NORONT’S SPECIAL COMMITTEE AND BOARD OF DIRECTORS BELIEVES

ROSSEAU’S ACTION IS NOT IN THE BEST INTERESTS OF NORONT SHAREHOLDERS.

IT IS AN OPPORTUNISTIC ATTEMPT, IN LIGHT OF EXTRAORDINARY RECENT

MARKET CONDITIONS, TO OBTAIN CONTROL OF NORONT THROUGH CONTROL

OF THE BOARD OF DIRECTORS.

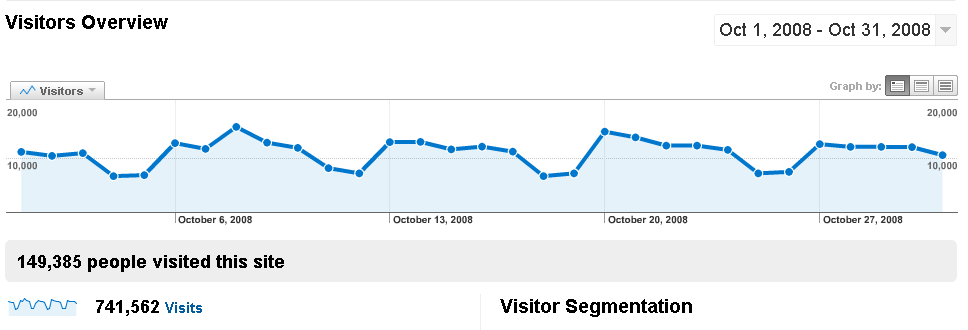

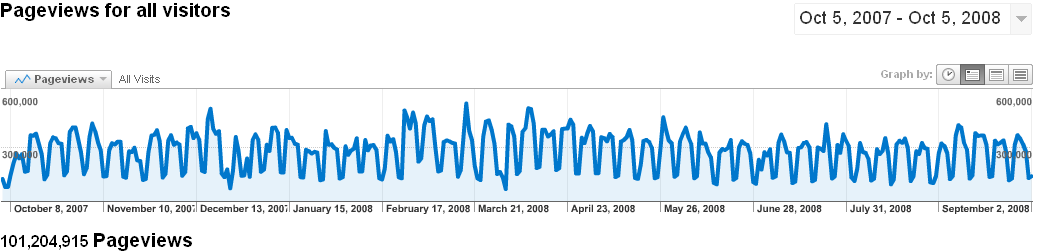

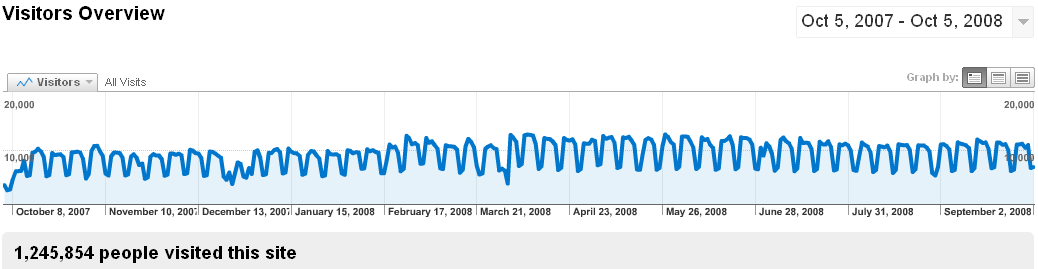

The press release rallied Noront Resources investors who, by an overwhelming majority, are up in arms and rallying against the Rosseau plan. I wish I could provide you with examples but there have been well over 450 posts made on the Noront Discussion Forum since 7:30 AM and climbing by about 1 per minute. Yes, some are unhappy with the company’s share price performance over the last few months but many acknowledge that much of this is attributed to general market weakness that should not affect the long-term value of Noront’s projects.

With the AGM less than 3 weeks away, this promises to be yet another example of shareholder activism 2.0. This time, however, shareholder and management interests are aligned against an uninvited guest.

Regards,

George