- Initiated 2000m Drill Program on 100% owned Dunwell Mine project

- Located in the heart of the Golden Triangle a few kilometers outside of Stewart, BC

- Dunwell has multiple bonanza grade vein systems found scattered over several kilometers around the mine itself.

Cardston, Alberta–(Newsfile Corp. – August 12, 2019) – American Creek Resources Ltd.

(TSXV: AMK) (“the Company”) is pleased to announce that a drill has

been mobilized to the Dunwell Mine project and drilling has now

commenced. As part of an overall exploration program it is anticipated

that Phase I will include up to 2,000 meters of drilling on several

targets.

The 100% owned Dunwell Mine project is located in the heart of the Golden Triangle a few kilometers outside of Stewart, BC.

Darren Blaney, CEO and President stated: “We are very excited to

begin drilling on this project. We have had our eye on this property

since 2006 and now we finally get to start showing the market what we

have. The Dunwell is an incredibly prospective property and has

everything going for it from amazing access and logistics to multiple

areas with past high grade production. All indications are that these

multiple bonanza grade vein systems found scattered over several

kilometers around the Dunwell mine itself are all related and form part

of a much larger system underlying the property.”

Property Description and History

Through a series of strategic acquisitions American Creek was able to

purchase the past producing Dunwell Mine as well as several adjoining

very prospective properties, combining them into one large land package

that encompasses the best gold and silver mineral occurrences and

historic workings in the Bear River valley. The amalgamated property

spans 1,655 hectares covering the northern portion of the Portland Canal

Fissure Zone, an area first prospected in the late 1800’s and hosting

some of the earliest producing gold and silver mines in the Stewart

area.

The property is located 8 km northeast of Stewart with a road right

to the mine site and a major highway and power line also running through

the property. The Dunwell Mine adit itself is located only 2 km from

Highway 37A and the power transmission line. Stewart hosts a deep sea

port including modern ore loading and shipping facilities.

Unlike the majority of mineral properties located near Stewart and

within the Golden Triangle, the Dunwell is relatively moderate and at

low elevation (600m and lower). These features allow for year-round work

which typically isn’t the case for exploration programs conducted in

the Stewart region where projects are typically at higher altitude in

very rugged terrain, are accessible only by helicopter, and lack

critical infrastructure such as roads and power. The Dunwell project may

just have the best logistics of any project in the Golden Triangle.

Although there has been a substantive amount of small-scale historic

work (pre-1940) in this area given its close proximity to Stewart, very

fractured ownership of individual mineral claims greatly hampered

meaningful larger scale exploration resulting in very little modern

exploration being conducted on the property or in the immediate region.

The Dunwell Mine is the most significant mineral occurrence within

the Portland Canal Fissure Zone. Production at the Dunwell occurred

between 1926 and 1937. From historic reports, it appears that a total of

45,657 tons averaging 6.63 g/t gold, 223.91 g/t silver, 1.83% lead,

2.43% zinc and 0.026% copper (approximately 11.3 g/t gold equivalent)

were produced. In one such report (#23345 summary report) the Dunwell

shows initial production of 4,872 oz gold, 102,855 oz silver, 1.2M lbs

lead, and 1.64M lbs zinc from 27,067 tons of ore milled. A further

23,231 tons was milled in 1941 yielding 4,878 oz gold, 233,017 oz

silver, 511,082 lbs lead, and 789,854 lbs zinc.

Strong potential exists to develop more reserves along strike with

the present workings and at depth below the No. 4 level. A drill program

conducted by prior owners in 2010 revealed a zone at least 300 metres

long and 200 metres along dip with a true thickness of 6-7 meters,

suggesting an extension of the ore body vein system previously mined.

Eight holes drilled 150 meters underneath and to the north of the old

underground workings resulted in the discovery of a wide quartz breccia

zone with strong sphalerite, galena, pyrite and chalcopyrite. Due to

unfavorable market conditions at the time, the work was never followed

up on. Significant reported results from the 2010 drilling are displayed

in the table below:

| Hole | From (m) | To (m) | Length | Au g/t | Ag g/t | Pb % | Zn % | Cu % |

| D4-10-09 | 215.55 | 222.26 | 6.71 | 14.27 | 37.81 | 0.25 | 0.63 | 0.02 |

| D4-10-10 | 216.77 | 221.95 | 5.18 | 5.31 | 62.4 | 0.52 | 0.80 | 0.03 |

| D4-10-11 | 217.07 | 222.93 | 5.85 | 4.74 | 55.88 | 0.09 | 0.72 | 0.02 |

| D4-10-12 | 218.35 | 225 | 6.64 | 7.68 | 37.40 | 0.330 | 0.90 | 0.02 |

| D4-10-15 | 208.84 | 213.14 | 4.3 | 15.62 | 42.0 | 0.04 | 0.40 | 1.44 |

The 2019 Phase I drill program is designed to confirm the promising results from the 2010 drilling and also to expand the known extent of the vein system with step out holes. Drill hole D4-2010-09 returned an impressive 14.27 g/t gold over 6.7 meters and along with similar results in adjacent holes, partially delineated a new high-grade vein system. The first hole to be drilled in the 2019 program will be located in close proximity to D4-2010-09. A series of holes will then be drilled to extend the known extent of this new vein system.

James McCrea, P. Geo for the Dunwell project, commented: “The

historic Dunwell Mine workings straddle a large shear zone that is

interpreted to be part of the Portland Canal Fissure Zone. The shear has

a surface expression of up to 3 km with a series of known vein

showings, along the shear, north and south of the Dunwell, that have an

extent of 2 km. The potential for further discoveries exists adjacent to

the shear in the area of the Dunwell Mine.”

In addition to the past producing Dunwell Mine itself, the property

package also contains other high-grade gold and silver occurrences and

historic small-scale gold/silver high-grading operations along a several

kilometer north/south trend that correlates to the fissure zone and

major faulting. A search of old reports produced an impressive number of

such occurrences on the property. The reported grades are even more

impressive. Some of these include the following:

Ben Ali: 5,000 tons yielding 3,000 ounces gold. 4,500 tons at 21.6 g/t gold.

Lakeview: 60 tons grading 4.7 g/t gold, 2,734 g/t silver, and 11.5% lead.

Tyee (Mother Lode): Produced 8.2 ton of ore grading 124.4 g/t gold and 4,478.8 g/t silver.

Mayflower: produced a few tons of ore running about $60 a ton

in gold values (1918 values). An adit sample assayed 78.2 g/t gold and

1,961.2 g/t silver.

Silver Ledge: Quartz veins with up to 0.36 ounces per ton gold, 5.04 ounces per ton silver, 5.4% lead and 0.65% zinc.

Goldie: Historic grab sample from 2 tons of galena assayed 2,880 g/t silver and 80% lead.

Victoria (Main Reef): Two separate numbers reported; perhaps

an initial 6 tons of 20.6 g/t gold, 1028.6 g/t silver, 35% lead, and 10%

zinc ore was shipped, later totaling 11 tons grading 20.15 g/t gold,

775 g/t silver, 25% lead, and 5% zinc.

Mimico: Historic grab samples of galena have assayed up to 5,345 g/t silver and 87.2% lead.

Rock sample from the Dunwell property grading 14 g/t Au, 46 g/t Ag with Cu, Pb, and Zn.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/682/46848_3d4a5951a4219a46_001full.jpg

For a summary about the Dunwell Mine project please click here: Dunwell Summary

Qualified Person

The Qualified Person directing the Dunwell exploration program is

James A. McCrea, P. Geo., for the purposes of National Instrument

43-101. He has read and approved the scientific and technical

information that forms the basis for the disclosure contained in this

news release.

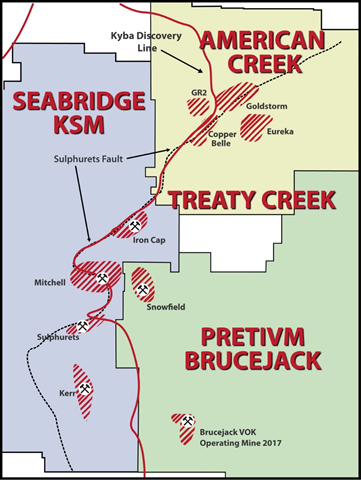

About American Creek

American Creek holds a strong portfolio of gold and silver properties in British Columbia.

In addition to the 100% owned Dunwell project, the portfolio includes

two other gold/silver projects located in the heart of the Golden

Triangle; the Treaty Creek and Electrum joint ventures with Walter

Storm/Tudor Gold.

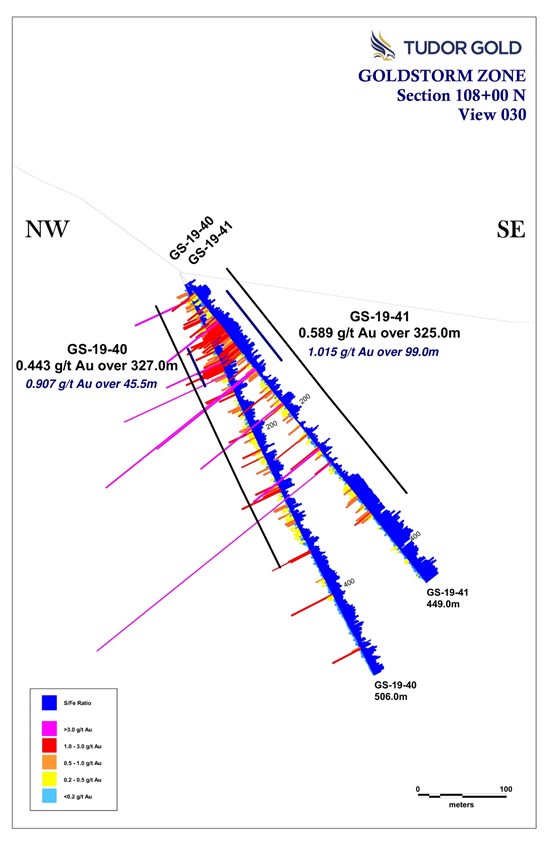

A major drill program is presently being conducted at Treaty Creek by

JV partner and operator Tudor Gold. There are now two drills working on

the Goldstorm zone with the objective of defining a significant maiden

gold resource. The last hole reported included a 780 meter intercept of 0.683 g/t gold including a higher grade upper portion of 1.095 g/t over 370.5 meters.

For a summary of the Treaty Creek project click here: Treaty Creek Summary

Other properties held throughout BC include the Gold Hill, Austruck-Bonanza, Ample Goldmax, Silver Side, and Glitter King.

For further information please contact Kelvin Burton at: Phone: 403 752-4040 or Email: [email protected]. Information relating to the Corporation is available on its website at www.americancreek.com