- Universal infrastructure once and for all

- Futuristic Know-How

- Complete Disruption in Chain

- Blockchanization of Industries

If you are one of those who, like myself, are working their way into the #blockchain industry for the first time, or are uncertain about whether to believe in the phenomenon or not, trust me: you aren`t alone. However, the reasons to be motivated about it are all about us. If we think back to the birth of Bitcoin in 2009, we might even compare it to the inception of the World Wide Web, developed with the help of Tim Berners-Lee around 1990.

Presently we are only in about year eight of adoption of blockchain technology, which is roughly equivalent to the web in 1998. We recall those hectic times in the DotCom era, during which rapid growth led to a bubble and wiped out a swathe of companies while making way for the success of companies like Amazon, Yahoo and Google, all of which have changed our global (digital) economy and society in previously unimaginable ways.

Can we think of blockchain and the multiplying variety of cryptocurrencies in the same way? Do cryptocurrency tokens have any potential? I would argue yes, knowing the fact that we have before us.

The more I learn, the more fascination I havefor this idea of blockchain computing. Based on my recent findings I would like to share some of thoughts. First of these reflections should be an expression of gratitude for those who are doing the stuff that is disrupting such powerful industries and pushing the human race forward.

Blockchain was developed as the nerve system of Bitcoin in the wake of the financial cataclysm of 2008. At its heart is a rebellious disdain for central authoritative control, offering instead a decentralized network of self-compliance and regulation. But the servant has become the master, offering business benefits not envisaged during its conception. In fact, it’s nothing short of a game changer for those who can master it.

But wait: What the hell is blockchain?

There are two major blockchains that we can say without hesitation are of global importance: the Bitcoin Blockchain and the Etherium Blockchain.

- A)Â Bitcoin is digital money. The Bitcoin blockchain stores and processes all past transactions since the start of its network. This ensures easy accounting and transfer of value (i.e. money).

- B)Â The Ethereum blockchain, apart from handling accounts and transactions, also stores programming logic.

Ethereum is different from Bitcoin because with Ethereum you can not only transfer money (i.e. Ether), you can execute smart contracts.

There are a lot of real-world scenarios where we trust third parties or escrow agents to enforce a transaction. In this way, they all earn their cut. With Ethereum, such parties will become useless as the technology matures and permits more activity to be processed in its revolutionary way.

So what are the five best reasons that indicate one should invest time in learning about the blockchain with a view to becoming a user, investor or developer? Here are my picks:

- Universal infrastructure once and for all

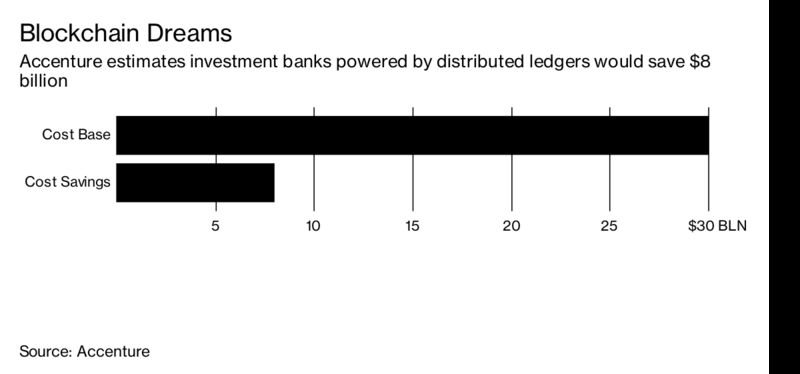

More than a single solution/ technology/infrastructure, blockchain and DLT (Distributed Ledger Technology) technologies essentially connect together to form a new type of market infrastructure that sits on top of – and integrates into – existing systems and processes. And in doing so, they are quickly and quietly changing the way firms, regulators, investors, and managers communicate and share data.

- Futuristic Know-How

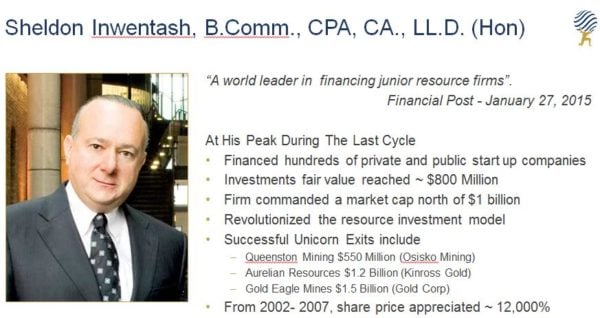

Blockchain investments may not be paying massive returns yet, but they are allowing some firms to create the right platform for future growth. The adoption of Blockchain and DLT is unlocking unprecedented business flexibility, improved efficiency and new capabilities that could be leveraged to rapidly respond to changing market dynamics and competition in the future. For example: Venture capital firm Mangrove Capital Partners has recently stated that if you had blindly invested into all ICOs, including all those that failed, you’d have a 1320% return.

- Complete Disruption in Chain

Blockchain will add significant value – improving confidence between parties, reducing friction in the value chain and speeding up complicated inter-party processes. But it will also mean the disintermediation (or, more likely a refocusing) of certain players in the value chain. Players should be sizing up their future position and managers should be reassessing their value chains.

- Blockchanization of Industries

Clearly, it will take many years – maybe decades – for Blockchain and DLT to become the dominant technology in the asset management space. But we expect to see many players (particularly in the mid- to large-sized funds) start to shift processes and transactions towards Blockchain and DLT platforms over the coming year, thereby creating the scale to drive ubiquity.

- November 29-30th Blockshow Asia, Singapore

Two hundred million dollars were raised by startups from BlockShow Europe 2017. Guess how much can be raised in Singapore given the weight advantage of Asia over the EU?

The show will feature over 1000+ attendees, 50+ handpicked speakers (making it a heaven for networking and learning), 40+ exhibitors and media will all be there for you to make the best use of your time and immerse yourself in the blockchain.

BlockShow Asia 2017, powered by CoinTelegraph, is a unique opportunity to meet those who are altering the financial and technological fabric of our world. In this most appropriate of contexts Genaro will be proud to present its revolutionary plans for #Decentralized Storage.

For those that are interested in understanding how blockchain is disrupting over 30+ industries, here are great pieces for you to look at: part-1, Part-2, Part-3

There is one more thing-I was really excited to learn that there’s a documentary movie coming that ought to help all us newbies dive deeper into the blockchain space and discover the ideas behind the paradigm shift.

Crypto Rush is a documentary by author and director Liliana Pertenava which will tell the story of the rise of cryptocurrencies such as #Bitcoin and #Etherium while also looking into some of the more intricate parts of the blockchain and the community around it.

The documentary has the potential to be a hit on two fronts when it comes to audience appeal – those who have an interest in the world of cryptocurrency but have a hard time understanding it, and those who have an interest in meeting some of the big players that are getting rich by investing in the new tech. Filming will take place all over the world including countries like Switzerland, USA, Germany and will end in Singapore, which has become one of the leading blockchain hubs.

Those in blockchain welcome to reach out to director, indeed, exciting project…

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

Source: https://yourstory.com/2017/11/5-reasons-learn-blockchain/