Archive for the ‘Gold $2,000’ Category

VIDEO: Eric Sprott Will Keep Buying Silver Today, Tomorrow ….

AGORACOM Wire – What Small-Cap Investors Are Reading This Weekend

FORBES: GOLD STANDARD IN 5 YEARS? .. Yes Says Steve Forbes

$2,000 GOLD BY YEAR END … Ian Telfer Of Goldcorp Makes A Big Call … Peter Munk Certain Gold Is Going Up Full Story

RING OF FIRE POLITICS … A Conservative Majority Government May Be Just What Noront And Other ROF Small Caps Needed …

SMALL-CAP GREEN ENERGY NEWS! Extreme Biodiesel Selected At Defense Summit and Afganistan Summit …Â View Photos and Videos Of Their Production Facility *CLIENT*

SORRY! CORRECT SURVEY LINK: Hundreds Clicked Through To Our Survey But There Was A Problem With The Link. PLEASE Try One-More Time …Â How will the Conservative Majority Government impact small-cap stocks and Investors?

INTERTAINMENT BUZZ …Â Glorieux Thinks He May Have Jumped The Gun … Others Think This Is The Time To Buy … George Waits …Â Thread

CHEAP CHINA: Some Fraud Amongst Chinese Small-Caps Has Affected All Stocks …Â Creating Huge Profit Opportunities Like This One

VIDEO: GREEN GOOGLE – The Internet Giant Is Investing In Green Energy …. Why And What It Means For Small Cap Watch On XZERES HUB

PIMCO Shorts US Debt, Goes To Cash – What Does This Mean For Small-Cap Investors?

The biggest news for small-cap investors to digest – by far – is that PIMCO has not only sold all of its US Debt Holdings, it has gone short. Find my comments below via Twitter (reverse chronology) and my follow on comments below on how this plays out (theory vs. practically):

WHAT DOES THIS MEAN – Theoretically?

On it’s surface (I stress SURFACE), Bill Gross, Founder of PIMCO, is telling us that QE3 isn’t coming and nobody will be stepping into to replace US Fed purchases of US Gov’t debt. That will lead to – at the very least – a drop in Debt prices, so he is getting the hell out of Dodge. Simple enough … until you get to my practical comments below.

First, here are the theoretical (I stress THEORETICAL) follow-on effects:

INTEREST RATES – Going higher, just a matter of degree

$USD – Should strengthen with rising rates

EQUITIES – Should weaken for two reasons: A) Corporate expenses rise on higher borrowing rates = lower profits; B) Investors sell stocks to raise cash. Small-cap resource stocks fall in unison.

GOLD / SILVER – Should weaken against the US Dollar at the very least, potentially against most major currencies

US REAL ESTATE – Bombs Away .. my real estate theory since October 2009 remains intact

WHAT DOES THIS MEAN – Practically?

Unfortunately, we have learned over the last decade that economic theory can no longer be relied upon. After all, interest rate easing that began after 9/11 was never intended to crash real estate markets, plunge the planet into a debt crisis and lead to record nominal gold prices … yet here we are despite the “brightest” minds at the US Fed, White House and Central Banks around the world.

What truly happens isn’t so linear because market manipulation has taken the natural ebb and flow out of all markets – debt, equities, commodities, currencies. Prices are no longer determined by value – they are determined by confidence or a lack thereof. As such, what should practically happen is the following:

CONFIDENCE CRISIS – When US Fed purchases of US debt vanishes and isn’t replaced by the market, a crisis of confidence will commence.

INTEREST RATES – Will move incrementally higher, then accelerate as US debt prices free fall

$USD – Will initially strengthen with rising rates and bond nibbling, then drop as investors realize bond/confidence risk is too great. Swiss Franc and Canadian Dollar will do very well.

EQUITIES – Double Dip probability rises dramatically. Small-cap resource stocks take an initial hit, followed by massive rebound on gold, silver moves (see below).

GOLD / SILVER- Will initially weaken by as much as 20% /30% respectively on early $USD strength, then rocket towards all-time inflation adjusted highs of ~ $2,200 and $150 within 12 months

US REAL ESTATE – Bombs Away .. my real estate theory since October 2009 remains intact

AM I A GENIOUS OR WHAT?

I’d like to think so – but I don’t think so for two reasons:

1] Obvious Reason – I could be very wrong and a number of other outcomes could occur. This time, I think I’m right – but see #2 below

2] The Fed / White House / Wall Street Financial Matrix Isn’t Stupid – Despite what many smart people have to say, the powers that be aren’t as stupid as they seem. They just don’t give a damn about your long-term interests. Despite damage to the current and long-term US economy, I firmly believe they have executed their plan perfectly in their best interests – and they’re not finished ….

QE3

It’s coming … 100% … only this time it will require the financial pain I have outlined above in order to politically justify it … but as I posted on March 30th, QE3 Will Be Delayed, Not Terminated.

At that point, the game plan resumes … but not before Bill Gross and PIMCO step back into US Debt, go long and make a killing on their cash thanks to rising debt prices, which leads to falling rates, much weaker $USD, stabilized stock markets, MUCH higher gold/silver, MUCH higher junior resource stocks.

Until then, plan accordingly.

Regards,

George

CNBC Reporting No QE3 … I Doubt It … The Real Danger Is A Delay In QE3

This CNBC guest and all the talking heads are making the case for no QE3. You should watch the video to understand their arguments and factor them into your decisions.

I personally find it hard to believe QE is coming to an end. Why? American small business continues to have no access to gazillions sitting in vaults of big banks, US housing is crashing (new home sales and existing home sales) and US consumer confidence is sitting at a 3-month low. If interest rates begin to rise from the lack of US bond purchases, things could get out of control pretty quickly.

DELAY TO QE3 IS MORE LIKELY … AND WOULD CAUSE HAVOC

The threat I do see comes from a delay in QE3. As things stand on the surface, Bernanke is going to find it difficult to get support for QE3 amongst other Fed Presidents. After all, the stock market is up and the White House is talking up a healthy jobs environment (bull). Moreover, inflation is on the rise even by a manipulated CPI view … how can Ben justify QE3?

He may not be able to. If not, look for the following effects:

- Climbing interest rates

- Stronger US Dollar

- Plunging Stock Market

- Plunging Exports

- Plunging Real Estate

- Plunging Consumer Confidence

- Plunging Gold

- …. QE3

Make no mistake about it, this is a real threat, unless you believe the true US economy (not the propaganda statistics) is ready to stand on its own two feet. I don’t see it.

QE2 comes to end on June 30th. The signals on QE3 will come loud and clear in the preceding two months, so be ready to act and adjust your portfolio accordingly.

UPDATE: This David Rosenberg Quote Via ZeroHedge Demonstrates Both The Risk Of A Delay AND Just How Fast The Markets Could Pull Back If QE3 Didn’t Materialize:

QE3 WILL COME BUT NOT AS EARLY AS MR. MARKET WOULD LIKE

Portfolio managers as a group are running their funds overweight equities by an average of 67% relative to their typical benchmarks. And polls show that one-third of them believe QE3 is coming this summer. We already know that this Bernanke-led Fed is willing to be extremely aggressive, but as we saw in 2010, the hurdle is high for quantitative easing. We need (i) signs of a double-dip, (ii) a stock market correction of at least 15%, and (iii) deflation, not inflation. How on earth will the Fed be able to do anything at all by then if headline inflation is running north of 4% and the other central banks of the world are either snuggling policy or moving in that direction ? unless the central bank really wants to trash the dollar. We are certainly not inflationists and still see deflation in credit, real wages and housing

Fire River Gold – Press Release Of The Week – 28.8 g/t (0.84 opt) gold over 13.7 m (44.9 ft)

The Japan disaster overshadowed any and all other news in the world on Monday and Tuesday, including Libya and Bahrain, so it was pretty easy to miss press releases coming out of TSX Venture companies.

One of those press releases came out of Fire River Gold (FAU:TSXV) (FVGCF:OTCQX) (FWR:FSE) and it was simply spectacular. In fact, it is the press release of the week. Here are the headline numbers, followed by the press release:

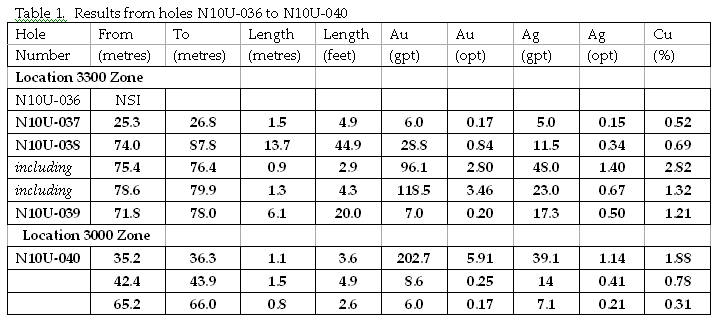

• 28.8 g/t (0.84 opt) gold over 13.7 m (44.9 ft) in hole N10U-038

o including 96.1 g/t (2.80 opt) gold over 0.9 m (2.9 ft)

o including 118.5 g/t (3.46 opt) gold plus 2.8% copper over 1.3 m (4.3 ft) at 3300 Zone

• 202.7 g/t (5.91 opt) Gold Over 1.0 m (3.6 ft) in hole N10U-040

o 8.6 g/t (0.25 opt) over 1.5 m (4.9 ft)

These results came out of the Company’s Nixon Fork Gold Mine In Alaska, which was acquired in September 2009. From 1995 – 2007, the project produced approximately 175,000 ounces of gold at an average grade of 39 grams per ton (1.14 opt).

GOLD PRODUCTION COMMENCING

As if the numbers on their own weren’t good enough, the company has announced that gold production is commencing in the summer of 2011 with a 200 tpd Mill and operating expenditures of $447/oz GOLD.

FULL PRESS RELEASE

March 14, 2011 Vancouver, Canada – Fire River Gold Corp (TSXV: FAU) (OTCQX: FVGCF) (FSE: FWR) (“FAU†or the “Companyâ€) is pleased to announce results obtained from the 2010 28,000 metre drill program at the Nixon Fork Gold Mine situated in Alaska’s Tintina Gold Belt. The Company has received assay results of holes 36 through 40 (N10U-036 – N10U-040) from the lower extension 3000 and 3300 Zones.

New significant intercepts include N10U-038 returning grades of 28.8 g/t (0.84 opt) gold over 13.7 m (44.9 ft), including 96.1 g/t (2.80 opt) over 0.9 m (2.9 ft) and including 118.5 g/t (3.46 opt) over 1.3 m (4.3 ft) at lower extension 3300 Zone and intercept N10U-040 returning grades of 202.7 g/t (5.91 opt) Gold Over 1.0 m (3.6 ft) at lower extension 3000 Zone. A complete list of significant intercepts is provided in Table 1. The widths of the intercepts are approximate to the true width of the mineralized intercept.

The Company is once again encouraged with the results from the 2010 drill program, because it is exhibiting the potential to provide additional resources to the mill. Drill results are being used to guide the six-month operating plan for the mine start up.

All core from the 2010 program was logged at the Nixon Fork Mine camp. The core was then sawn in half, and half of the sample shipped to ALS Minerals, a certified analytical laboratory located in Reno Nevada and a subsidiary of ALS Laboratory Group.

Nixon Fork Gold Mine

The Nixon Fork Gold Mine was acquired in September 2009. From 1995 – 2007, the project produced approximately 175,000 ounces of gold at an average grade of 39 grams per ton (1.14 opt). The mining and processing facilities at Nixon Fork are permitted and bonded. The deposit is a gold-rich copper silver skarn typical of other skarn systems found throughout the world. At Nixon Fork, the higher grades are found in steeply plunging pipe-like bodies which are oxidized to depths of up to 350 meters below the surface. Oxidization of the system has resulted both in secondary copper and gold, with high grades and a “nuggety” distribution.

The Qualified Person for this news release is Richard Goodwin, P.Eng, President & C.O.O for Fire River Gold.

About Fire River Gold Corp.

Fire River Gold Corp. is a near term production company with an experienced technical team focused on bringing its flagship project, the Nixon Fork Gold Mine, back into production in 2011. The Nixon Fork Gold Mine is a permitted and bonded mine which include a ~200 tpd processing plant with a gravity gold circuit, sulphide flotation circuit and a gold recovery system (CIL circuit) that is scheduled to be completed by Summer 2011. The mine also includes a fleet of surface & underground mining vehicles, a self-contained power plant, maintenance facilities, drilling equipment, an 85 person camp, office facilities and a 1.2 km long landing strip.

Fire River Gold Corp is a member of the International Metals Group.

On behalf of the Board of Directors, I look forward to keeping you updated with our corporate developments.

Richard Goodwin

President & C.O.O

VIDEO: Marc Faber On CNBC …. QE3, 4, 5, 6 ….

Faber on Japan, the Fed and QE ….. For those of you who think Faber is too pessimistic, he does view the current Japanese sell-off as a buying opportunity but says all bets are off if a meltdown takes place.

Further QE means greater inflation, higher gold / silver / commodities, which is bullish for TSX Venture Juniors and the TSX in general.

AGORACOM Wire – What Small Cap Members Are Reading On February 7th

AGORACOM WIRE – MONDAY FEBRUARY 7TH 2011

FEATURE STORY

Investors Bet $102 Billion On Gold In January (Summary). Bloomberg Top Rated Analysts Believe Silver and Gold Will Appreciate 23% and 20% By End of 2011 (Full Story)

TOP STORIES

1. Copper hits record; stocks, Treasury yields up Member Post. Also, forget Dow 12,000 … Think Copper $12,000. Great For Donner Metals!!

2. In Ontario, a major investment in the Ring of Fire region north of Thunder Bay is expected

3. NASDAQ Hacked ! George Says “This should come as no surprise. Bet the farm it has been happening for years at individual companies”

SPONSOR MESSAGE – BULLISH ON COPPER?

AGORACOM Is Supported By Great Small-Cap Companies That Want To Reach You. Please Take A Minute To Discover Them And Potentially Find Your Next Great Small-Cap Investment.

TODAY’S SPONSOR: Donner Metals (DON:TSXV)

On November 25th, 2010, Donner and Xstrata Received “Development Of The Year Award” At The Quebec Exploration 2010 Conference. Their Copper, Zinc, Gold, Silver Mine Is Under Construction, Will Be In Production In 2013 and expected to produce 83M lbs Copper … Full Summary & Video.

Gold and Economic Freedom by Alan Greenspan – 1966. He Knew All Along

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

“This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

From the last two paragraphs of Gold and Economic Freedom by Alan Greenspan. 1966.

Vicious Money Printing Cycle = Junior Resource Stocks

“Quote the chairman: “This fear of inflation is way overstated. We’ve looked at it very, very carefully. We’ve analyzed it every which way… We will not allow inflation to rise above 2% or less… I am 100% certain i can control inflation.” Presenting the Jefferies global commodity index (CRB) which just hit a 27 month high.” Tyler Durden – Zero Hedge

The downside to printing money for the purposes of stimulating the economy is that commodities rise, which makes things more expensive, which leaves people less money to stimulate the economy. Nonetheless, Ben Bernanke and The US Fed continue to claim inflation is under control. The data below clearly shows otherwise.

American disposable income is getting chiseled away at the gas pump and grocery store. Their pocket books don’t lie and they certainly won’t stimulate the economy by purchasing real estate and “stuff”. The ironic thing is that Bernanke will use the lack of consumer spending as a reason to keep printing money, which will lead to further inflation, which will lead to decreasing discretionary spending, which will lead to further deferral of “the recovery”, which will lead to more money being printed.

The answer to staying out of the vicious circle? Gold, Silver, Junior Resource Stocks.

Chart below courtesy of the good people at ZeroHedge.com

According To 60 Minutes, Each US State Is A Fiscal Banana Republic

Good morning to you all. The fiscal crisis at the US Federal level is well-documented but – outside of the most astute readers amongst small-cap investors – many are unaware of the depths of financial despair faced by almost every US State.

Don’t feel left out any longer, we’ve got the following 60 Minutes clip that you need to watch over hot cocoa in these next few days. After watching it, you may have to crank that up to Eggnog.

Most importantly, make sure you take these facts into consideration when planning your finances in 2011 and beyond. Further money printing is going to have an impact on the US financial scene, the price of gold, etc.

Hat-tip to Eric Jackson Via Twitter

Regards,

George