AGORACOM Chief Commentator, Peter Grandich, has offcially shed his permabear skin according to his latest blog post. This is a pretty important declaration because Grandich has an uncanny ability to call market tops and bottoms in commodities and equity indexes. In fact, it’s the primary reason I brought him on to AGORACOM and I would easily state that he ranks up there with Peter Schiff.

GRANDICH HAS BEEN JUST AS RIGHT AS PETER SCHIFF

I’m going to work on compiling a chronology over the past couple of years but go ahead and google “Grandich + robbing Peter to pay Paul and Peter is tapped out” (OK, I did it for you). Â It’s the phrase he’s been using for 3-4 years now to help illustrate the state of the US economy to his audience and a quick scan of the Google results finds at least one quote in Kitco from the summer of 2005.

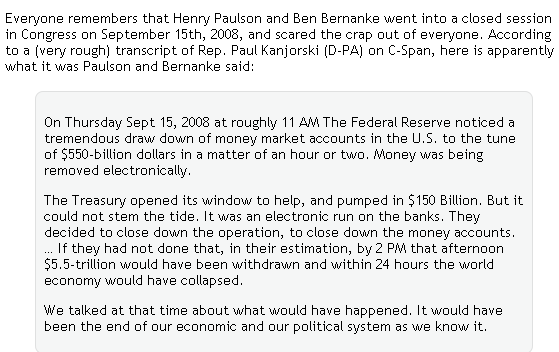

At the beginning of 2008, Grandich banged the table on going short the US market once the Dow crossed 13,000. In short, he’s just been dead on.

GRANDICH NOW BULLISH?

To be clear, he is not advocating running out and filling your boots today. Grandich believes Dow 5,000 vs. 8,000 is an even money bet right now. Given the fact his readers have been able to avoid the fall from 14,500 to 6,600, he’s willing to take small losses in order to be a year early, rather than a day late.

Like a freight train that takes miles to come to a full stop once the brakes have been applied, Grandich believes the markets are now in the same process and investors need to start reserving some choice seats for the turn around.

In the short-term however, he does state the following:

“At the minimum, we’re overdue for a sharp bear market rally. Never have my technical indicators suggested so in almost 25 years. Several market indexes are dramatically below key moving averages. Several have never seen this far of a spread between price and moving average while others only once or twice. Knowing in technical analysis you must look only at the charts, I do believe anyone experienced in this type of analogy would suspect as I do that a significant correction of an almost straight-down decline is overdue.”

He’s even put his money where his mouth is and provided specific equities and ETF’s that he would be buying, with a lot of emphasis on oil companies. Sound choices if you expect the global economy to begin turning around in the next 12-15 months and the stock market to anticipate it sooner.

He also believes gold and precious metals continue to be attractive investments that will run as inflation – due to extreme US deficits – hits the US economy over the next couple of years.

Read his full post. It is worth the read.

Regards,

George