A rising tide is lifting many boats, still plenty of tide to ride

Are the stars and planets aligned in the global emerging lithium sector? One would certainly think so, when looking at the performance of Australian-listed companies. Seven non-producers, one-year stock returns ranging from 257% to 1,369%, averaging 810%! However, most, but not all, are relatively advanced, as far as juniors go.

A few are slated to reach initial production this year or next. On the TSX Venture Exchange (TSX-V), things have been heating up as well. In the past 3 months, a group of 4 have soared between 106% to 266%, averaging about 180%. [Source: Google Finance]. How crazy are these astonishing moves? Crazy for sure, but how crazy is it really? I mean, could the electric transportation market be any stronger? Did anyone expect that lithium prices would triple from just 6 months ago?

In budding bull markets, things move fast…. Are we in a lithium bull market?

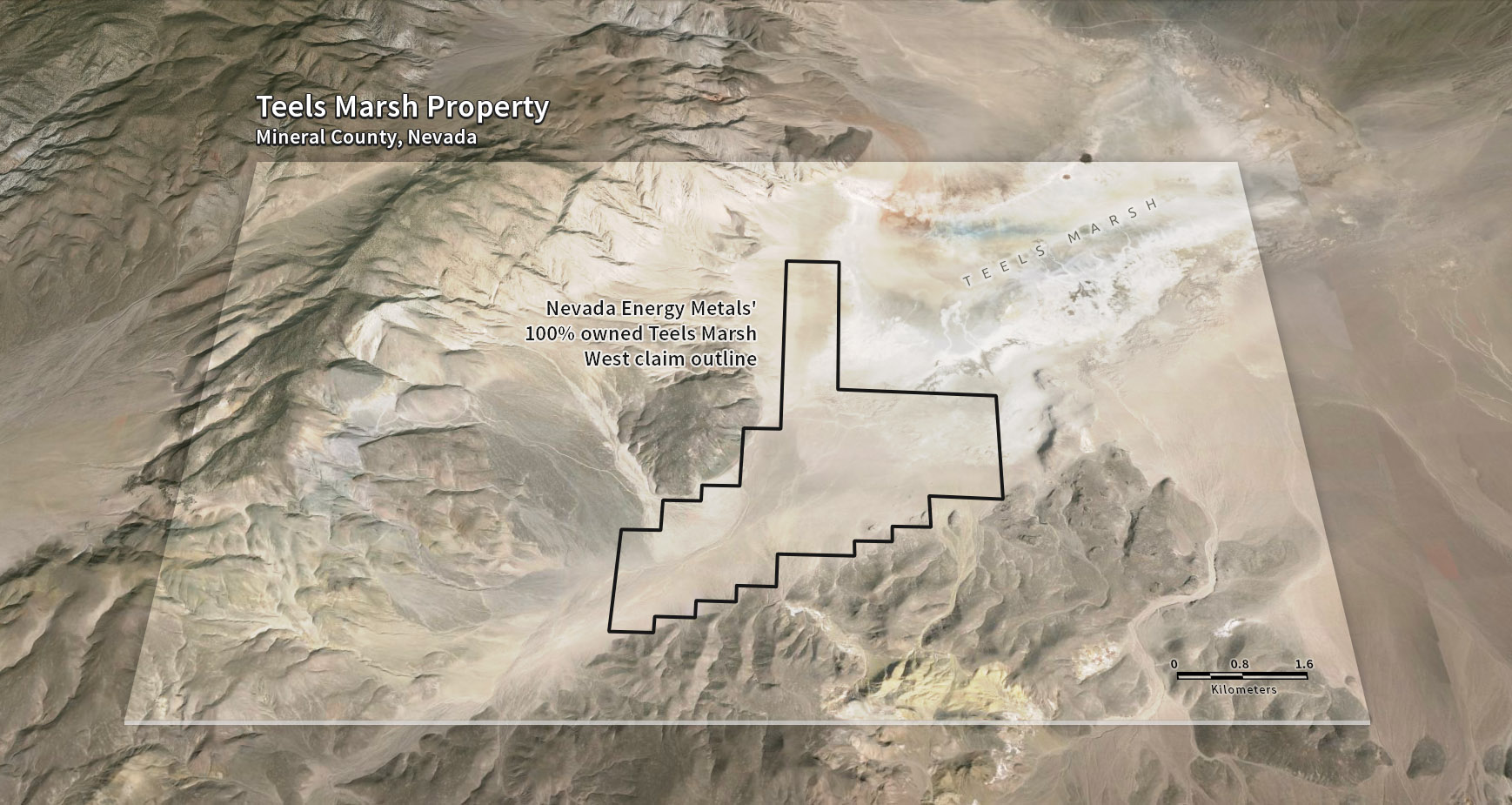

Spot prices in excess of 130,000 Yuan (US$20,000/Mt) [Source: 4/12/16 article on ChinaDaily.com.cn] proves  the existence of a pronounced undersupply in the market, if not a longer-lasting paradigm shift in Li-ion battery demand. In an interview I conducted a few weeks ago of Malcolm Bell, one of the Company’s Technical Advisors, he described how Nevada Energy Metals‘ TSX-V:BFF (OTC: SSMLF) (Frankfurt: A2AFBV) team sees remarkable opportunities to stake and acquire prospective properties. A key takeaway shared by Mr. Bell and management is that other “Clayton Valley-like†closed basins containing enriched brines could still be found. It’s not the zip code that matters most, but the geological setting and history of volcanic activity.Â

Staking ground is highly cost-effective, it conserves cash liquidity. Staking also sidesteps onerous third-party directed exploration and work requirements. The Company’s growing portfolio of lithium assets diversifies exploration risk. Low cash burn and business plan flexibility are hallmarks of a successful prospect generator model. Make no mistake, this Company is highly speculative, but it’s unassuming market cap and tremendous exposure to lithium prices, makes it a compelling risk-adjusted vehicle for those bullish on the industry.

The prospect generator model works in both bull & bear markets

These days, many companies are masquerading as lithium plays, but really they’re just squatting on land, hoping to sell or joint venture it ASAP. Perhaps not a bad idea, but the clock is ticking, there are holding costs involved. Many do not have the financial means, managerial experience or a competent business strategy to create shareholder value. That’s clearly not the case here. Look no further than yesterday’s announced acquisition of 60 claims (approximately 1,200 acres/484 hectares) in Clayton Valley, Esmeralda County, Nevada. The Clayton Valley BFF-1 Lithium Project’s (“BFF-1â€) southern boarder is 250 meters from Albemarle Corporation’s Silver Peak lithium brine operations.

Another promising exploration target

Clayton Valley is an internally drained, closed-basin, surrounded on all sides by mountains, hills & ridges. It contains an underground aquifer system which is host to trapped lithium-enriched brines. The decision to acquire BFF-1 was based on descriptions of geological modeling & historical drill results contained in a report by J.B. Hulen, PG, (July 31, 2008), in which he concluded that the area underlying the acquired portion had its highest subsurface temperatures.

A drill hole in 2007 by Western Geothermal Partners, returned 25 feet (from 280 to 305 feet) of volcanic ash. According to the press release,Â

“This unit may be correlative to the Main Ash Aquifer, which is a marker bed in other areas of the Clayton Valley Basin.â€

So, here we have it, proof positive that promising properties are still available for those smart and nimble enough to take action. Management is actively pursuing additional exploration targets in the state.

Could Nevada Energy Metals be the next high-flying lithium stock?

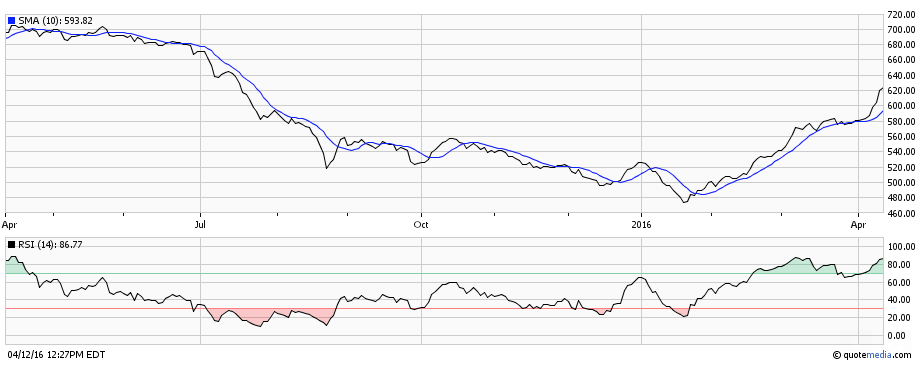

Over the past 3 months, Nevada Energy Metals’ stock is up a healthy 60%, but that’s just a third as much as the TSX-V group mentioned above. Yet, this Company embodies the true essence of a (high risk/high reward) emerging lithium company; a pure-play Nevada project generator of lithium-brine assets, with valuable long-term optionally on lithium pricing, demonstrated strong financial backing and a cheap valuation.

While hard rock spodumene, mostly in Australia, is a big part of the market’s near-term supply growth, concentrated lithium brines, mostly found in the, “Lithium Triangle†of Argentina, Chile & Bolivia, AND Nevada …. are expected  to meaningfully contribute to longer-term supply. New processing technologies in the works today, could make brine harvesting even cheaper than it already is compared to hard rock mining.

At the very center of any bullish lithium-brine thesis, is the great State of Nevada, USA, host to one of the very few known economic brine concentrations outside of South America. Nevada is the 3rd best mining jurisdiction on the planet. [Source: “Fraser Institute Mining Survey,†2015] It offers a lithium triad of geographic & geopolitical diversification away from Australia, Argentina Chile & China, as well as geological / processing diversification in the form of brines vs hard rock.

Nevada, a combination of geopolitical + geographic + geological diversification = Security of Supply

Like very successful newcomer Lithium X Energy, management intends to raise capital to execute even more ambitious corporate initiatives. A successful raise would enable it to have the best shot possible of locking down promising properties and pursing prospective tuck-in acquisitions. Each asset owned, controlled and optioned, stands to benefit from company-wide infrastructure and corporate overhead synergies, a key characteristic of the project generator model.Â

If Nevada’s, “Lithium Hub†hosts an economically viable source of new supply, it would be impossible to ignore a company like Nevada Energy Metals. In addition to the favorable attributes already mentioned, the Company would offer something even greater, Security of Supply in the U.S. market.

With this in mind, readers should take a closer look at the Company. As yesterday’s press release demonstrates, management is aggressively, yet prudently, building its lithium portfolio in an efficient and cost effective manner. The Company’s project generator model involves the active pursuit of not just potential lithium-bearing properties, but also mutually beneficial joint ventures and farm-outs, serving to minimize cash burn. This strategy is a tried and true one among emerging natural resource companies around the world.Â

Valuation

Speaking of relative valuation, unlike some companies that have already exploded higher by hundreds & hundreds of percent, the Company still offers an attractive risk/reward proposition. Perhaps under appreciated here is the strong financial backing of shareholders, most notably, Ron Loewen. I conducted an interview of Mr. Loewen in mid-March. [See interview here]. Reasoning that January 20th marked the low in the cycle, Loewen recommended taking on more risk, especially in emerging lithium companies. Â

This is hugely important, it’s what separates the wheat from the chaff, or potentially, the lithium from the ground. Without demonstrated financial resources, even the best prospects are dead in the water, awaiting an opportunistic takeout at a mediocre valuation or worse. By contrast, with each acquired property, Nevada Energy Metals’ fundamental valuation is increasing. And, the share price is likely (in my opinion, not a forecast by the author or management team) to catch up in due course.Â

Nevada Energy Metals has 72.4 million shares outstanding, for a market cap of roughly [C$11.9 million / US$9.3 million]. Compare that to 3 pure-play, Nevada focused TSX-V listed companies (not including Lithium Americas, as its primary asset is in Argentina) with an average market cap of about [C$45 million / US$35 million]. Should Nevada Energy Metals be trading at nearly a 75% discount to the average? I think this relative valuation could change in a heartbeat, especially if additional acquisitions and staking is in the pipeline.Â

Small cap natural resource companies coming back into favor?

Many companies are enjoying April-to-date stock price returns like nothing I’ve seen in quite some time. Just a few examples, in sectors other then lithium. NuLegacy Gold +85%, SantaCruz Silver +77%, Lucas Energy +82%, Alabama Graphite +58% and NexGen Energy (uranium) +50%. Stock price performance has little bearing on fundamental trends, but to the extent that speculative small-cap stocks frequently spike higher in short periods of time, the market might be signaling a window of opportunity. Caveat emptor, my technical analysis skills are non-existent, and my investment horizon is months, not days.Â

With the 4+ year bear market in natural resource stocks possibly ending, new money earmarked for well positioned companies could pour in sooner rather than later. Will Nevada Energy Metals’ TSX-V:BFF (OTC: SSMLF) (Frankfurt: A2AFBV) be a recipient of a wave of investment dollars?

Conclusion

Nevada Energy Metals is a pure-play, Nevada focused, lithium-brine exploration company operating as a project generator, with a market cap of just [C$11.9 million / US$9.3 million]. The Company has accumulated 4 distinct lithium targets, prudently diversifying the early-stage exploration risk of its Nevada portfolio. Yet, this is just the beginning. The Company has proven again and again the ability to move quickly and cost effectively. Management plans to raise capital to continue its successful growth, and pursue larger opportunities.Â

Besides Argentina & Chile, there are very few enriched lithium-brine operators or explorers. Given incredibly robust Li-ion battery demand, as evidenced by soaring prices, Nevada’s Lithium Hub could become a meaningful supplier. If one believes strongly in the future of electrified transportation and residential, commercial & grid-scale energy storage systems, then Nevada Energy Metals is a compelling way to articulate that investment view. Â

For more information, about Nevada Energy Metals:

Company website:Â http://www.nevadaenergymetals.com

Trading Symbols: TSX-V:Â BFFÂ Â OTC Markets:Â SSMLFÂ Frankfurt/Xetra:Â A2AFBV

Twitter:Â https://twitter.com/NVEnergyMetals

Facebook:Â https://www.facebook.com/NevadaEnergyMetals/

Disclosures: Readers are charged with conducting their own investment due diligence and recognize that small cap stocks can deliver a 100% loss of one’s investment capital. The author or interviewer as the case may be, Peter Epstein, CFA, MBA, believes that he’s diligent and prudent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities. However, he cannot guarantee that his efforts will (or have been) successful. Readers understand that Mr. Epstein cannot be held accountable or responsible for the accuracy of opinions, facts, estimates, forecasts and assumptions conveyed herein, or for investment actions taken by readers.

At the time this interview was published, Nevada Energy Metals was a sponsor of EpsteinResearch.com. Mr. Epstein owns stock in the Company. Mr. Epstein is not a registered or licensed financial advisor. His article(s) on Nevada Energy Metals and other small cap companies should be considered very carefully in this context. Readers are urged to consult with their own financial advisors before making investment decisions. This company, and all small cap companies, are highly speculative, not suitable for all investors.Â

Any commentary suggesting that a particular stock is, “under valued,†“over-sold,†a “compelling opportunity,†is “de-risked,†could be “re-rated,†or similar words and phrases, are not directed at any individual or group, and do not constitute investment advice. Each individual and group must make their own determination regarding the suitability of any stock mentioned herein. Any comparisons between or among stocks are for illustrative purposes only and are not be taken as fact or relied upon. Nothing herein is to be considered explicitly or implicitly a part of full and proper due diligence.

Source: http://epsteinresearch.com/2016/04/13/lithium-you-say-look-no-further-than-lithium-brine-project-generator-nevada-energy-metals-inc/