- Announce the staking of 86 placer claims (approximately 1720 acres) in the San Emidio Desert, Washoe County, Nevada

- 95 km northeast of Reno, the home of Tesla Corporation’s new lithium-ion battery “Giga Factory

March 23, 2016 / Vancouver, British Columbia- Nevada Energy Metals Inc. “the Company” TSX-V: BFF (OTC: SSMLF) (Frankfurt: A2AFBV) is pleased to announce the staking of 86 placer claims (approximately 1720 acres) in the San Emidio Desert, Washoe County, Nevada, 95 km northeast of Reno, the home of Tesla Corporation’s new lithium-ion battery “Giga Factory”.

The San Emidio Desert basin is an alkali playa environment underlain by unconsolidated sediments and clays being fed by lithium bearing geothermal fluids (US. Geothermal analyses) reported in bounding faults, and/or faults along the east side of the basin. Since mid-Tertiary, the rocks on the eastern edge of the San Emidio Desert have undergone extensive hydrothermal alteration and the presence of near-surface thermal fluids, suggest that the thermal fluids represent deep circulation of meteoric water (Moore, J.N., 1997).

The property adjoins the Empire geothermal power plant with production of 4.6 MW of electricity from a 155?C resource thereby providing a substantial heat source for the circulation of meteoric groundwater believed important in the formation of lithium brine deposits as found at Clayton Valley, Nevada host to North Americas preeminent lithium brine production. US Geothermal has reported anomalous lithium values in the trace element analysis of their geothermal brines at Empire (USGS-Report 87-4062)

Previous work by other operators exploring the playa have reported lithium value in sediments up to 312 ppm and the average of sampling being in the order of 250 ppm.

Harry Barr, Chairman of Nevada Energy Metals stated “The company is pleased to report that no royalties, option payments or work expenditures have been incurred as a result of the acquisition of the San Emidio lithium exploration project. Nevada Energy Metals Inc strives to be a leader in the exploration and development of economic Lithium deposits. Our principal activities are in Nevada and our project portfolio is expanding.”

About Nevada Energy Metals: http://nevadaenergymetals.com/

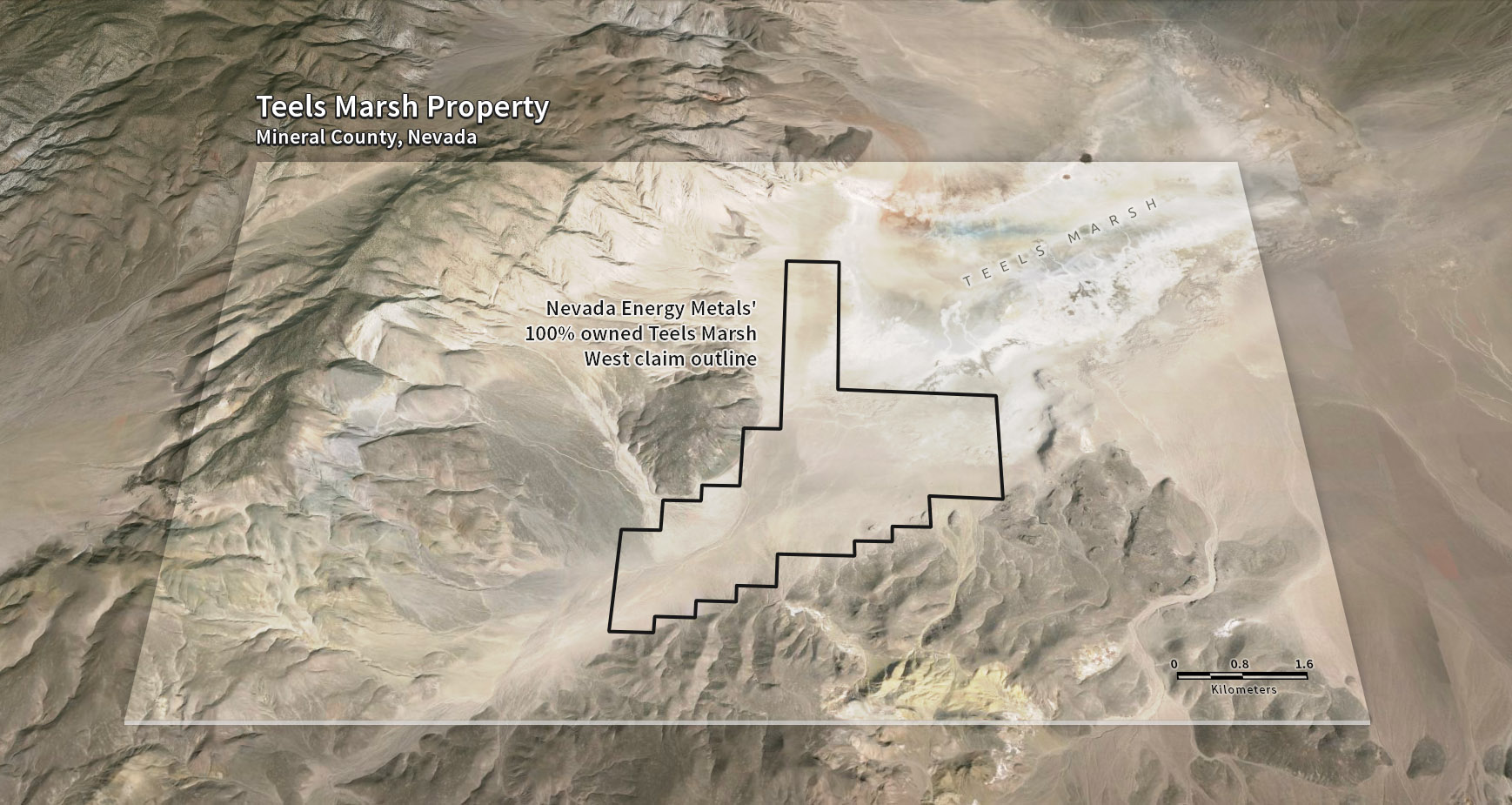

Nevada Energy Metals Inc. is a Canadian Based exploration and development company who’s primary listing is on the TSX Venture Exchange. The company’s main focuses are brine based lithium exploration targets located in the mining friendly state of Nevada. As of the 13th of January the company has completed a $900,000 CAD secondary funding to carry out an exploration program on the area known as Alkali Lake and Alkali Flats. This lithium target is located in Esmeralda County, Nevada, just 12km from Rockwood Lithium, the only brine based lithium producer in North America. Nevada Energy Metals must complete a one-time payment of shares, cash payments over three years and complete certain exploration milestones to earn its 60% interest. Nevada Energy Metals has acquired, by staking, 100 placer claims covering 200 acres (80.9 hectares) at Teels Marsh, Nevada. The property, called Teels Marsh West is a highly prospective L\lithium exploration project, 100% owned without any royalties, located on the western part of a large evaporation pond. With the addition of the San Emdio Dessert lithium property, Nevada Energy Metals has its third perspective lithium brine project in its project portfolio.

Qualified Person:

The technical content of this news release has been reviewed and approved by

Ali Alizadeh, MSc P.Geo, MBA, a director of the company and a Qualified Person under the provisions of National Instrument 43-101.

On Behalf of the Board of Directors

Harry Barr Chairman & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.