- Selected WSP Canada Inc as the consulting company heading up the new resource model for the River Valley PGM Project

- New resource estimation work will be directed and supervised by Todd McCracken

September 7th, 2017 / Vancouver, Canada – New Age Metals Inc. (TSX.V:NAM; OTCQB: PAWEF; FSE:P7J.F). The Company is pleased to have selected WSP Canada Inc (Sudbury Office) as the consulting company heading up the new resource model for the River Valley PGM Project. The new resource estimation work will be directed and supervised by Todd McCracken.

WSP is one of the world’s leading engineering professional services consulting firms. WSP brings together 40,000 staff, based in more than 500 offices, across 43 countries to provide engineering and multidisciplinary services in a vast array of industry sectors, with a focus on technical excellence and client service. WSP has a comprehensive and skilled team that can determine the sustainability of investment opportunities and related assets for the Mining and Resource Industry. There experienced multidisciplinary team of professionals can determine the engineering, geology, mining, infrastructure, transportation, financial, and operational sustainability of the targeted asset. WSP has been providing engineering services to the mining

industry for over 20 years.

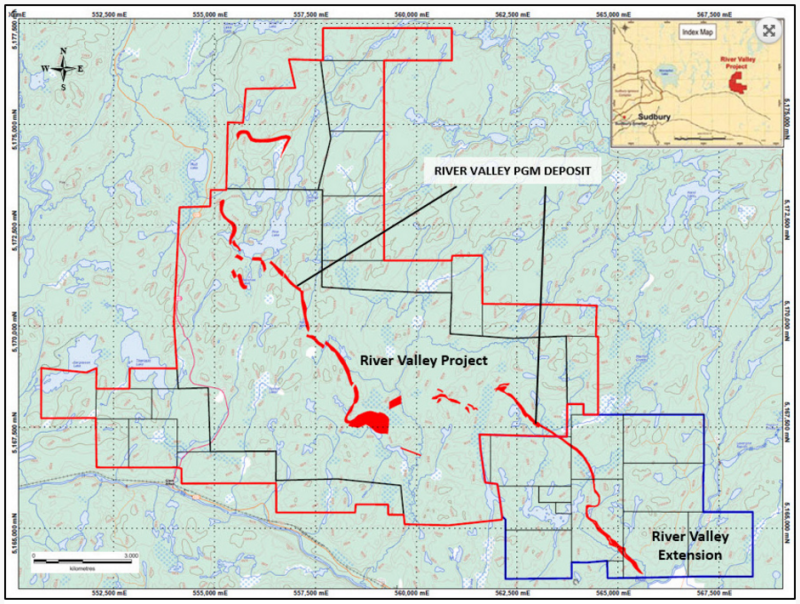

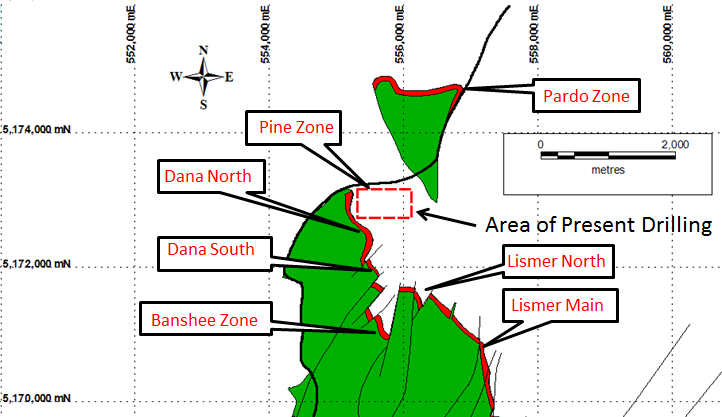

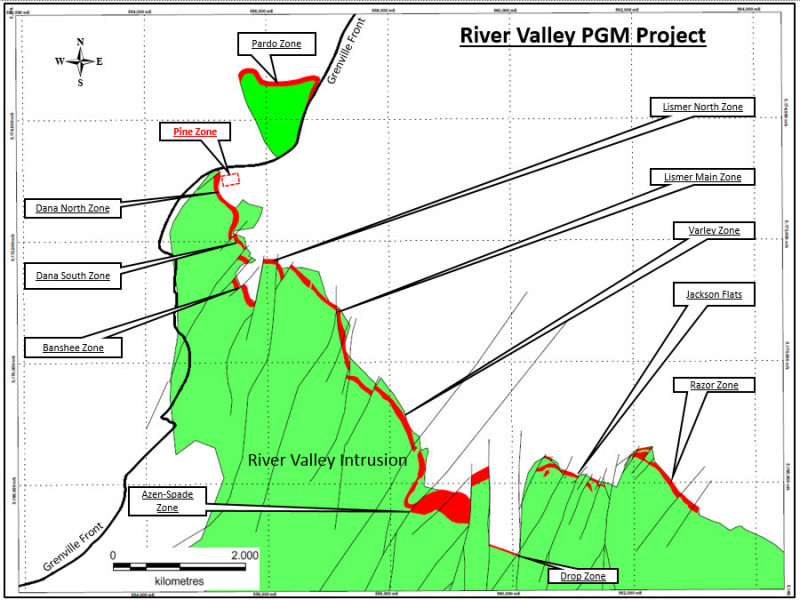

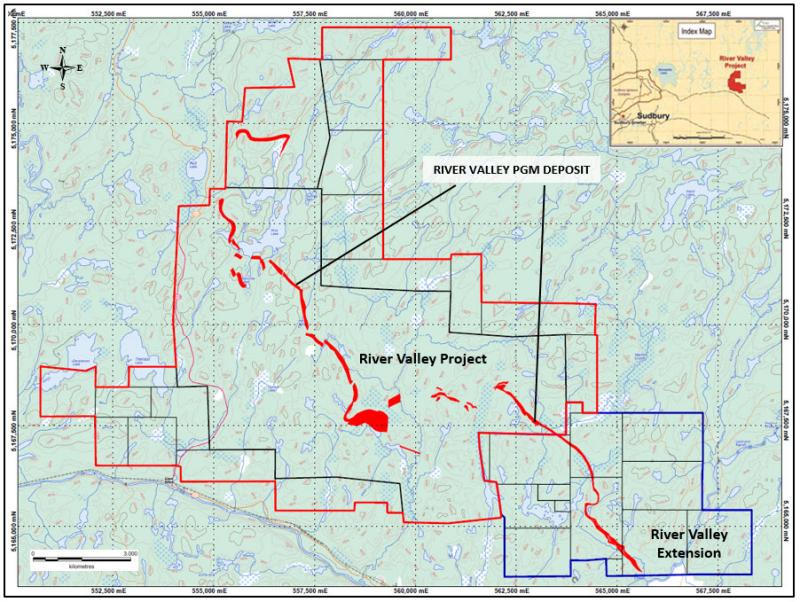

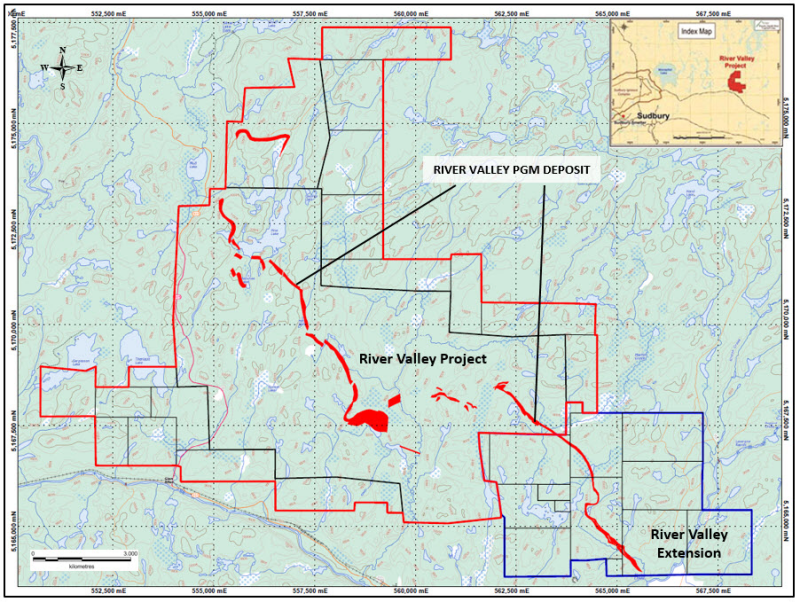

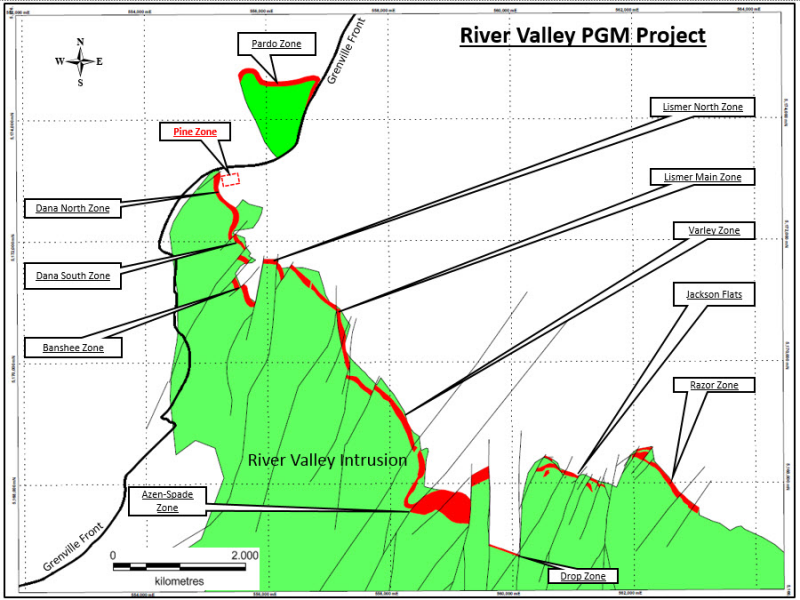

The last technical report on the River Valley Project was in 2012 which was also carried out by Todd McCracken (under Tetra Tech), thus ensuring technical continuity. Since that date, the company has carried out several drill programs, made a new PGM discovery on the project, carried out a ground IP geophysical survey (News Release: June 19th, 2017) and obtained the River Valley Extension (News Release: Oct 5th, 2016). The extension ground (Figure 1) adds approximately 4 kilometres of mineralized strike length to the River Valley PGM Project. It has approximately 100 drill holes carried out by the previous claim holder. The new resource estimate will incorporate all the data as well as the present drilling (News Release: July 18th, 2107).

Figure 1: River Valley PGM Project – Mineralized Contact Breccia Zone (Red)

Todd McCracken, P.Geo, is a professional geologist with more than 25 years of experience in mineral exploration, mine operations and resource estimation. Presently he is Manager-Mining at WSP Canada. He is experienced in both underground operations and exploration. Todd’s commodities expertise includes PGE, nickel, gold, base metals, Li-rare earths and vanadium. He has worked for numerous Canadian and International clients. He is responsible for the Front-end Mining Group’s activities at WSP, which include project management, QA/QC programs, due diligence reviews, resource estimations, mine design, ventilation, rock mechanics, tailing facilities, preliminary economic analysis (PEA), as well as pre-feasibility and feasibility studies. His team at WSP will include other geologists and mining engineers.

This technical addition strengthens the existing geological and geophysical expertise already present in the Company.

The Company also announces that it has issued an aggregate of 132,587 common shares to Agora Internet Relations Corp. (“AGORACOM”). The securities issued represent the final payment for services under the terms of the agreement and are subject to a four month plus one day hold period expiring January 2, 2018.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is Canada’s largest primary undeveloped PGM deposit with Measured + Indicated resources of 91 million tonnes @ 0.58 g/t Palladium, 0.22 g/t Platinum, 0.04 g/t Gold, at a cut-off grade of 0.8 g/t PdEq for 2,463,000 ounces PGM plus Gold. This equates to 3,942,910 PdEq ounces. The River Valley PGM-Copper-Nickel Sulphide mineralized zones remain open to expansion. Currently the company has completed new ground geophysics and is in the middle of a drill program focused on the Pine and Dana North Zones.

ABOUT NAM’S LITHIUM DIVISION

The Company has several hard rock Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is the largest mineral claim holder in the Winnipeg River Pegmatite Field and is seeking JV partners to further develop the company’s Li Division.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.