If you had told me 2 years ago that, in June of 2008, Gold and Oil would be trading over $US 925 and $US 130 respectively, I would have started eyeing super villas on the Greek islands from which to celebrate my impending fortune. I believe a lot of small-cap resource investors would agree.

Now, many of us can’t complain with gains made in the sector over the last couple of years – but they most certainly haven’t been commensurate to what you would expect given the prices of commodities these days.

So What Gives?

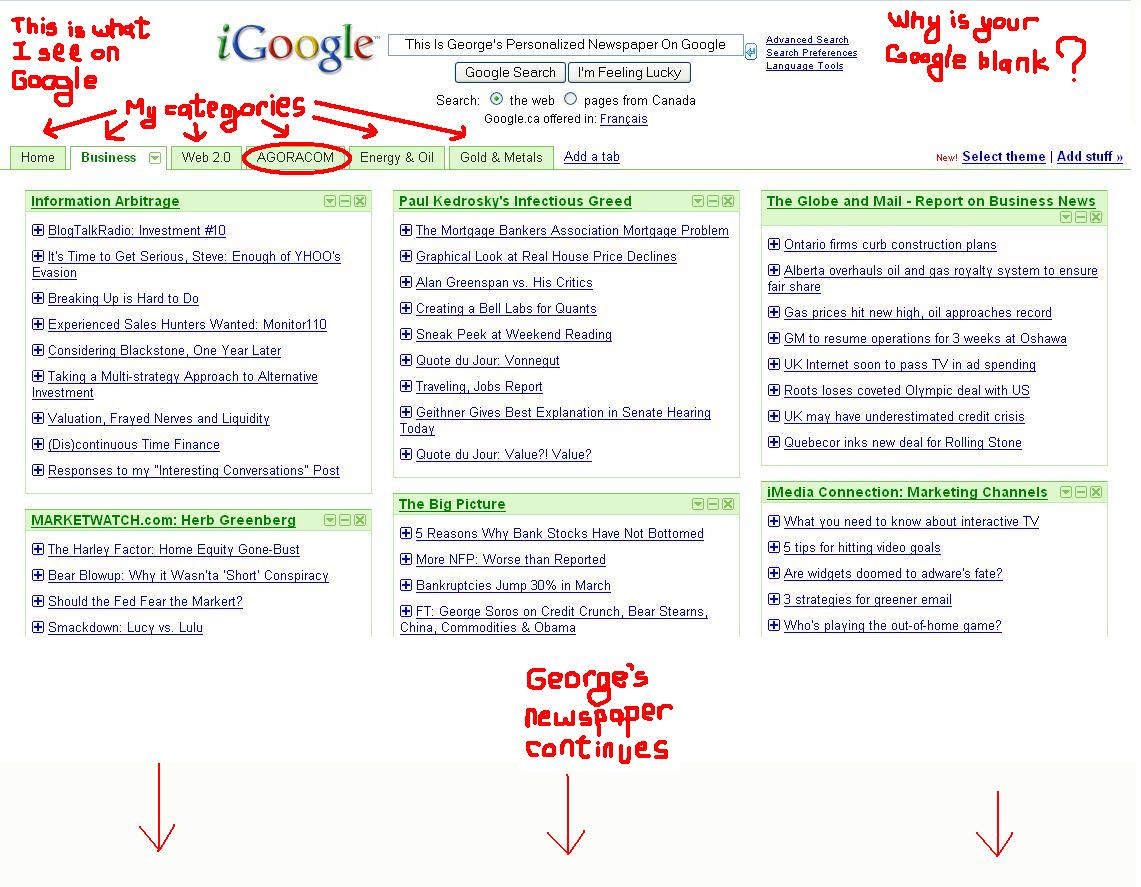

If the answer can’t be found in charts, filings, technical reports and general fundamentals, it’s time to put your ear to the ground and listen. If you don’t have such an ear, don’t despair. We found one for you that is willing to share his observations from the inner sanctum.

John Carlesso is the President of Cervello Capital Inc., a Toronto-based boutique private merchant bank with an area of focus in the resource sector. He is a good friend of mine and – more importantly to you – a very well respected member of the resources community. He’s younger than most of the “gray hairs” in the industry – but he is renowned for his integrity and project selection.

Please find enclosed his contribution below as a guest blogger on AGORACOM.

——————————————

CHECKING OUT IN THE (NOT-SO-SUPER) MARKET

I hate to advocate drugs, alcohol, violence, or insanity to anyone, but they’ve always worked for me.

Hunter S. Thompson

US journalist (1939 – 2005)

A writer known for rebelliousness, excess and, arguably, irrational behaviour isn’t what ordinarily comes to mind when contemplating financial markets. But it’s been a booze-worthy elevator ride from hell for most market participants lately, particularly in the smallcap space. And if you’re looking for a serial that’s full of melodrama, panic, despair, heartache, greed, jealousy, villains and some good ol’ animosity toward the Establishment, you needn’t look much further than a quotescreen or the Business section of any newspaper.

This has been mortal combat, blood-in-the-streets type stuff – a point that gets hammered home to me in just about every conversation I have these days. It seems everyone is miserable because they’re down big on something, or several things. That annoying little buzz that began in August eventually became the big sucking sound you’re hearing now that has deflated just about everybody’s balloon. None more so than the smallcaps.

And this makes sense on a certain level. Credit is choke-collar tight, money is scarce, and there doesn’t seem to be a clear perspective on when any of this improves. It all adds up to the market’s loss of appetite for smallish companies that aren’t generating cash flow, and a downright violent, bulimic attitude toward concepts that require equity infusions to continue forward.

At my day job we source, list publicly, finance and help manage smallcap growth companies. A lot of what we do has been in the resource arena. Much like almost everyone else in the game we pride ourselves on the quality of our assets, our people, and our integrity (really, we do!). Which we think makes us different (really, we do!). So how do we make sense of the market hawking a loogie right in our eye every time a positive development is announced?

A well-respected fund manager I met with recently congratulated me on the fundamental success that one of our companies has achieved. He even said he was surprised by it (I think it was meant as a compliment) and that the company was very clearly doing all the right things. His punchline was that, despite seeing far more value in the smaller names, he was selling all of them. Too illiquid and not enough correlation with the bigger picture. So he’s buying names that he doesn’t like nearly as much that will at least give him the opportunity to be active on.

An analyst I recently spoke with told me of his trip to New York to present his best ideas to institutional clients. “Don’t show me any small names” they said unanimously. “But that’s where the most value is” he replied. “Doesn’t matter” they shot back. “The decision’s being driven from upstairs”.

A retail stockbroker I met with last week told me that this is the absolute worst environment that he has seen in his 35 years in business. “Clients are apoplectic because they don’t understand the meaning of risk anymore. They’re down 50% on their bank stocks for chrissakes. There’s no way I can tell them that they should be buying some of the junior miners because there’s good value in them, but that’s what I think they should be doing.”

A retail stockbroker I met with last week told me that this is the absolute worst environment that he has seen in his 35 years in business. “Clients are apoplectic because they don’t understand the meaning of risk anymore. They’re down 50% on their bank stocks for chrissakes. There’s no way I can tell them that they should be buying some of the junior miners because there’s good value in them, but that’s what I think they should be doing.”

Is this a tale of insanity? Not really. It’s a process that needs to be worked through and unfortunately the collateral damage inflicted by the nauseatingly overwrought “Credit Crunch” is somewhat indiscriminate.

But all is not doomed and you can write your own happy ending by being very selective in your smallcap investing:

- 1] If your holdings have experienced management teams with accomplished track records, this is a quality that has never been more critical.

2] If they have assets which are undeniably creating value that someone will pay for in the near future, you can put another tick in the “plus” column.

3] Is the Balance Sheet solid? Not usually the first consideration when investing in juniors during a go-go phase, but again, never more critical than at this moment as it provides the ability to outlast the current lousy environment for financing.

Money is available for and will find these types of companies. Despite the amount of cash sitting on the sidelines being at record levels, it’s just not anywhere near as “available” as it once was, and those who hold it have quickly become very shrewd about the price it comes at. No book is complete without a cliché: the best companies to offer your investment dollars to are the ones that don’t necessarily need them.

Let me add a disclaimer here. You should be aware of the fact that I sit on the board of several publicly-traded companies in the resource sector, which provides me with some insight that you may not necessarily have and which you may find some value in. My conclusions are my own, but despite my goal of writing objective commentary to chew on, you should assume that my interests are conflicting and reach your own conclusions.

The panic chapter isn’t necessarily over yet. The horror-ride into the abyss may still accelerate before any euphoric form of relief arrives. The sharp yank up will come when the value in the small names with the best prospects becomes too great for the aforementioned big players to ignore. It may take a while but focusing on quality and value will ultimately be rewarded.

In this type of market it pays to be patient and prudent, so make your objective staying in the game without sustaining any fatal injuries. Keep your head. Relax, have a drink and grab some perspective. It could have the makings of a great story some day.

END

A retail stockbroker I met with last week told me that this is the absolute worst environment that he has seen in his 35 years in business. “Clients are apoplectic because they don’t understand the meaning of risk anymore. They’re down 50% on their bank stocks for chrissakes. There’s no way I can tell them that they should be buying some of the junior miners because there’s good value in them, but that’s what I think they should be doing.”

A retail stockbroker I met with last week told me that this is the absolute worst environment that he has seen in his 35 years in business. “Clients are apoplectic because they don’t understand the meaning of risk anymore. They’re down 50% on their bank stocks for chrissakes. There’s no way I can tell them that they should be buying some of the junior miners because there’s good value in them, but that’s what I think they should be doing.”