Vancouver, British Columbia–(Newsfile Corp. – November 5, 2019) – Affinity Metals Corp. (TSXV: AFF) (“Affinity”) (“the Corporation”) is pleased to report that it has now completed the drilling portion of the 2019 Regal exploration program at the Regal property located in the northern end of the prolific Kootenay Arc approximately 35 km northeast of Revelstoke, British Columbia, Canada.

A total of 1,846 meters of diamond drilling was completed with 21 holes being drilled. The drilling was divided over two target areas with 10 holes allocated to testing one of the phyllite/limestone contacts in the ALLCO area and 11 preliminary confirmation holes designed to test the historic 1971 resource (pre NI43-101 and therefore not compliant) reported for the Regal/Snowflake mines.

The core is now being logged along with sampling and splitting in preparation for assaying. Core samples will be sent to MSA Laboratories in Langley, BC for assaying and assay results will be reported once received.

Robert Edwards, CEO of Affinity stated: “We are extremely pleased that the weather allowed us to get into the Regal property for as long as we did and to complete the drill program as planned. Thanks to MoreCore Diamond Drilling, our geological team and the efforts of our CFO/Exploration Manager, Mr. Blaney, in getting the job done as efficiently as possible given all the challenges mother nature can throw at you. At the end of it all, we are very encouraged by what we saw in the core and look forward to receiving assays back in due course.”

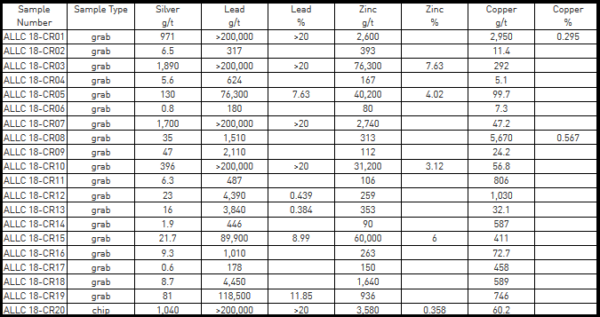

As previously reported, the Corporation recently received assay results for all 22 rock samples collected in September 2019 from the Black Jacket and ALLCO areas of the property. Of the 22 grab samples collected from surface outcrops, the majority contained bonanza grade silver, zinc, and lead with many samples reaching assay over-limits. Further assaying of over-limits has been initiated and those results will be reported in the future. Results for all 22 samples are presented in the table below.

| Sample Number | Sample Type |

Silver g/t |

Copper % | Zinc % |

Lead % |

Gold g/t |

| ALC19CR01 | grab | 0 | .035 | 0 | 0 | 0 |

| ALC19CR02 | grab | 1300 | .415 | 18.20 | >20.0 | 0.70 |

| ALC19CR03 | grab | 120 | .232 | .034 | .984 | 0.02 |

| ALC19CR04 | grab | 131 | .089 | .026 | .102 | 2.66 |

| ALC10CR05 | grab | 16.7 | .295 | .060 | .013 | 0.09 |

| ALC19CR06 | grab | 74.9 | .144 | >30.00 | .059 | 0.28 |

| ALC19CR07 | grab | 10.05 | .310 | .086 | .029 | 0.04 |

| ALC19CR08 | grab | 1870 | .495 | 24.5 | >20.0 | 1.85 |

| ALC19CR09 | grab | 88.1 | .077 | >30.00 | >1.88 | 0.08 |

| ALC19CR10 | grab | 1545 | .178 | 26.7 | >20.0 | 0.68 |

| ALC19CR11 | grab | 2360 | .366 | 16.80 | >20.0 | 0.11 |

| ALC19CR12 | grab | 3700 | .624 | 1.645 | >20.0 | 3.14 |

| ALC19CR13 | grab | 964 | .716 | 17.30 | >17.5 | 0.11 |

| ALC19CR14 | grab | 3530 | .350 | 1.945 | >20.0 | 1.57 |

| ALC19CR15 | grab | 3670 | .026 | 1.895 | >20.0 | 0.33 |

| ALC19CR16 | grab | 1790 | .107 | 5.28 | >20.0 | 0.37 |

| ALC19CR17 | grab | 751 | .069 | 6.45 | >18.05 | 0.45 |

| ALC19CR18 | grab | 1065 | .718 | .178 | .514 | 0.10 |

| ALC19CR19 | grab | 2510 | .299 | 5.58 | >20.0 | 0.06 |

| ALC19CR20 | grab | 4410 | 2.27 | 26.40 | >20.0 | 5.68 |

| ALC19CR21 | grab | 47.5 | .177 | .048 | .092 | 1.78 |

| ALC19CR22 | grab | 87.7 | .095 | .011 | .047 | 4.79 |

Property History & Background

The Regal Project hosts several past producing small-scale historic mines including the Regal Silver. The property also hosts numerous promising mineral occurrences. From the historic records it appears that most, and perhaps all, of the known mineralized showings/zones have not been previously drilled using modern diamond drilling methods.

Snowflake and Regal Silver (Stannex/Woolsey) Mines

The Snowflake and Regal Silver mines were two former producing mines that operated intermittently during the period 1936-1953. The last significant work on the property took place from 1967-1970, when Stannex Minerals completed 2,450 meters of underground development work and a feasibility study, but did not restart mining operations. In 1982, reported reserves were 590,703 tonnes grading 71.6 grams per tonne silver, 2.66 per cent lead, 1.26 per cent zinc, 1.1 per cent copper, 0.13 per cent tin and 0.015 per cent tungsten (Minfile No. 082N 004 – Prospectus, Gunsteel Resources Inc., April 29, 1986). It should be noted that the above resource and grades, although believed to be reliable, were prepared prior to the adoption of NI43-101 and are not compliant with current standards set out therein for calculating mineral resources or reserves.

ALLCO Silver Mine

The ALLCO Silver Mine is situated 6.35 Kilometers northwest of the above described Snowflake/Regal Mine(s). The ALLCO Silver Mine operated from 1936-1937 and produced 213 tonnes of concentrates containing 11 troy ounces of gold (1.55 g/t), 11,211 troy ounces of silver (1,637 g/t) and 173,159 lbs of lead (36.9%).

Airborne Geophysics to Guide Future Exploration

An extensive airborne geophysics survey conducted by Geotech Ltd of Aurora, Ontario, for Northaven Resources Corp. in 2011, identified four well defined high potential linear targets correlating with the same structural orientation as the Allco, Snowflake and Regal Silver mines. Northaven also reported that the mineralogy and structural orientation of the Allco, Snowflake and Regal Silver appeared to be similar to that of Huakan’s J&L gold project located to the north, and on a similar geophysical trend line. The J&L is reportedly now one of western Canada’s largest undeveloped gold deposits.

After completing the airborne survey, Northaven failed in financing their company and conducting further exploration on the property and subsequently forfeited the claims without any of the follow up work ever being completed. Affinity Metals is in the fortunate position of benefitting from this significant and promising geophysics data and associated targets.

The aforementioned Northaven airborne geophysical survey conducted at a cost of $319,458.95 in August of 2011 is described in The BC Ministry of Energy, Mines and Petroleum Resources Assessment Report #33054. The results of the survey are competently explained and illustrated by professionals on You Tube at: https://www.youtube.com/watch?v=GX431eBY_t0

Condor Consulting, Inc. who compiled the survey data and produced the original geophysics report was recently retained by Affinity in order to provide more detailed interpretations and potential drill target locations with the aim of testing two of the four target areas in the future.

Affinity Metals has been granted a 5 Year Multi-Year-Area-Based (MYAB) exploration permit which includes approval for 51 drill sites.

About Affinity Metals

Affinity Metals is focused on the acquisition, exploration and development of strategic metal deposits within North America.