Vancouver, B.C., Nov. 24, 2020 (GLOBE NEWSWIRE) — Lomiko Metals Inc. (“Lomiko”) (TSX-V: LMR, OTC: LMRMF, FSE: DH8C) is focused on the exploration and development of flake graphite in Quebec for the new green economy. Lomiko is pleased to announce the Lomiko Technical, Safety and Sustainability Committee (“LTSSC”) has recommended the acceptance of a Proposal by SGS Canada Inc. to conduct a Metallurgical Process Development Program to the Board of Directors. This Program has been accepted and approved by the Lomiko Board.

SGS Metallurgical Process Development Plan

Lomiko plans to ship four composites weighing 30 – 35 kg each consisting of high-grade and low-grade samples from the Refractory and the Graphene Battery mineralized zones will be shipped to SGS in Lakefield. The main scope of the work program includes:

- Sample Preparation

- Chemical Characterisation

- Comminution Testing

- Flowsheet Development

- Environmental Testing

The samples will be stage-crushed in a series of jaw and cone crushers to minimize the risk of flake degradation and fines generation. Samples will be extracted for comminution testing, chemical characterization, and the generation of two Master composites.

Bond ball mill grindability tests will be carried out to establish grinding energy requirements to assist in the design of the preliminary comminution circuit.

Scoping level flowsheet development testing will be carried out on the two Master composites to establish a conceptual flowsheet. The primary objectives of the flowsheet development program are to maximize the graphite recovery into a flotation concentrate while minimizing flake degradation. The final concentrates will be subjected to size fraction analyses to determine the flake size distribution and total carbon grade profile of the two mineralized zones.

The high-grade and low-grade samples of the two mineralized zones will be subjected to variability flotation testing using the flowsheet and conditions that were developed for the two Master composites. Since a flowsheet must be able to treat all domains encountered in a deposit, these variability tests serve the purpose of assessing the robustness of the proposed flowsheet.

Static geochemical tests will be carried out to assess the acid-generating potential of the La Loutre tailings with and without a sulphide rejection circuit.

Lomiko’s Near Term Goals

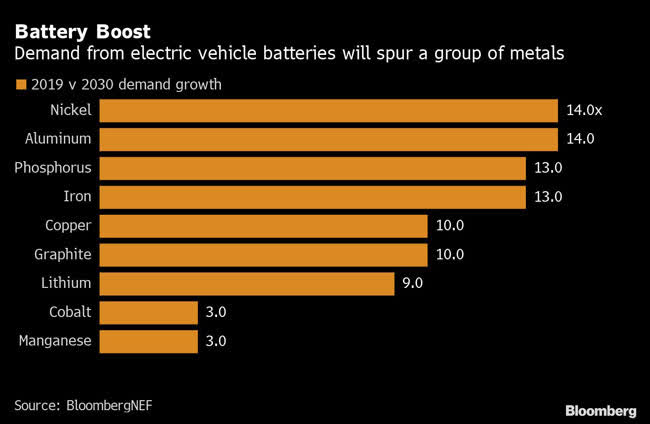

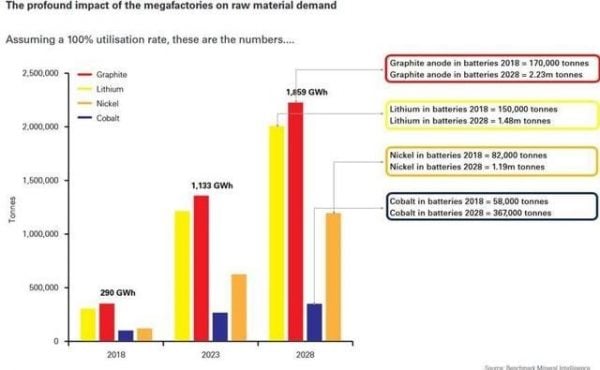

Graphite demand is expected to increase exponentially for the mined natural graphite material, as more is used in the production of spherical graphite for graphite in the anode portion of Electric Vehicle Lithium-ion batteries.

Lomiko completed a $ 750,000 financing October 23, 2020 and plans to work on its near-term goals:

1) Complete 100% Acquisition of the Property, currently 80% owned by Lomiko Metals.

2) Complete metallurgy and graphite characterization to confirm li-ion anode grade material.

3) Complete a Technical Report to confirm that the extent of the mineralization equals or surpasses the nearby Imerys Mine, owned by international mining conglomerate.

A “technical report” means a report prepared and filed in accordance with this Instrument and Form 43-101F1 Technical Report, and includes, in summary form, all material scientific and technical information in respect of the subject property as of the effective date of the technical report;

4) Complete Preliminary Economic Assessment (PEA)

A PEA means a study, other than a pre-feasibility or feasibility study, that includes an economic analysis of the potential viability of mineral resources.

For more information on Lomiko Metals, Promethieus, review the website at www.lomiko.com , and www.promethieus.com , contact A. Paul Gill at 604-729-5312 or email: [email protected].

On Behalf of the Board

“A. Paul Gill”

Director, Chief Executive Officer

.jpg;w=960)