Introduction

Power Nickel Inc., a Canadian junior exploration company, has taken a significant step by engaging internationally renowned geoscientist Dr. Steve Beresford as a special adviser. This strategic move aims to strengthen the company’s development of the Nisk project, poised to become Canada’s first carbon-neutral nickel mine. The announcement underscores Power Nickel’s commitment to building a world-class nickel-copper-platinum group metals (PGE) project in Quebec, leveraging expert guidance to achieve its goals.

Industry Outlook and Power Nickel’s Trajectory

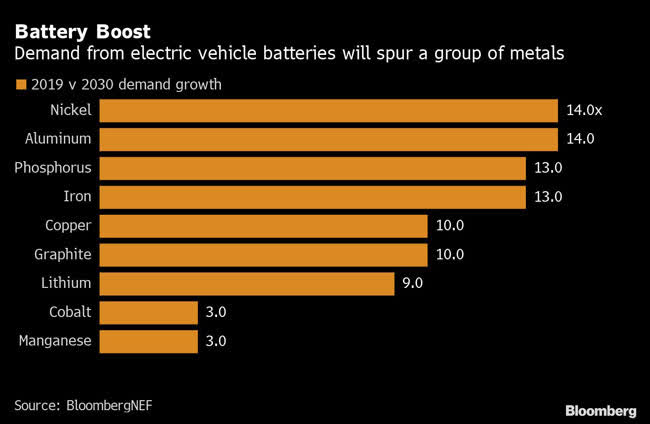

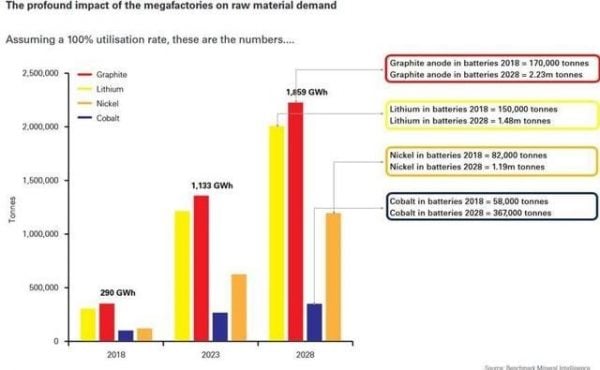

The shift toward electric vehicles and the broader adoption of clean energy technologies has amplified the demand for nickel and associated PGMs. With the Nisk project in Quebec, Power Nickel stands to capitalize on this trend. Dr. Beresford’s vast experience in exploring and assessing magmatic nickel-copper-PGE deposits across 66 countries brings invaluable expertise to Power Nickel’s operations. This strategic collaboration positions the company to meet the growing demand for these crucial metals while navigating the challenges in the exploration and development of such projects.

Voices of Authority

Power Nickel’s CEO, Terry Lynch, expressed enthusiasm about working with Dr. Beresford, citing the geoscientist’s expertise as a pivotal asset in advancing the Nisk project. “We are confident his knowledge will expedite our exploration program and understanding of Nisk to give us the best chance of success,” Lynch remarked. Dr. Beresford shared his optimism about joining Power Nickel, noting that the Nisk project’s geodynamic setting and prospect scale characteristics align with those of zoned polymetallic systems, which can yield substantial value from nickel, copper, and PGMs.

Key Highlights and Advantages

The Nisk property encompasses a 20-kilometer strike length with high-grade mineralization, shallow mineral depth, and favorable infrastructure, including a nearby Hydro-Quebec substation supplying low-carbon hydropower. Power Nickel’s decision to bring Dr. Beresford on board reflects its intention to tap into these advantages and maximize the project’s potential. The company’s upcoming exploration and drilling efforts are set to benefit from the technical advice provided by Dr. Beresford, which can lead to more efficient operations and enhanced resource assessments.

Real-World Relevance

Power Nickel’s work on the Nisk project has broader implications, with its focus on sustainability and carbon neutrality aligning with the global drive toward greener energy solutions. By advancing a high-grade nickel-copper-PGE project in Quebec, Power Nickel aims to contribute to the electric vehicle revolution and other emerging industries that rely on these metals. The company’s approach, emphasizing responsible exploration and collaboration with government and first nation partners, underscores its commitment to operating in an environmentally and socially responsible manner.

Looking Ahead with Power Nickel

With Dr. Beresford’s guidance, Power Nickel plans to continue its exploration and drilling programs to further define the Nisk project’s resource potential. The company’s forward-looking goals involve not only expanding its nickel-copper-PGE resources but also establishing a sustainable pathway toward production. As Power Nickel continues its journey, investors and industry stakeholders will be watching to see how the company’s strategic moves contribute to its growth trajectory and the broader nickel industry’s development.

Conclusion

Power Nickel’s collaboration with Dr. Steve Beresford marks a significant milestone in the company’s journey to establish a leading nickel-copper-PGE project in Quebec. By combining technical expertise, strategic planning, and a focus on sustainability, Power Nickel presents a compelling investment opportunity. As the demand for nickel and PGMs continues to rise, Power Nickel’s efforts to build a carbon-neutral nickel mine position it as a key player in the evolving landscape of clean energy and electric vehicle technology. Keep an eye on Power Nickel as it charts its course toward a greener and more sustainable future.

YOUR NEXT STEPS

Visit $PNPN HUB On AGORACOM: https://agoracom.com/ir/PowerNickel

Visit $PNPN 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/PowerNickel/profile

Visit $PNPN Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/PowerNickel/forums/discussion

Watch $PNPN Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions