TORONTO, ONTARIO–(March 27, 2014) – Bold Ventures Inc. (TSX VENTURE:BOL) (“Bold“) and KWG Resources Inc. (TSX VENTURE:KWG) (“KWG“) are pleased to report that the 5,000 metre drilling program which commenced January 18th has been completed. The program met its objective of extending the Black Horse chromite deposit to depth.

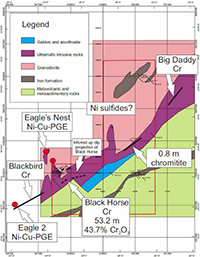

A total of six holes were drilled during the program: three on the Black Horse deposit and three on an untested gravity anomaly known as the C-6 target, one kilometer northeast of the Black Horse. It should be noted that further work, at depth, in the vicinity of the C-6 target remains to be accomplished in order to adequately test the nickel potential in this vicinity.

FN-14-038, the first hole at the C-6 target was drilled south to north and intersected low grade chromite mineralization from 73.77 metres to 107.20 metres totalling 33.4 metres (109.7 ft). Chromite was also intersected closer to surface in highly sheared rock with low core recovery. The hole was terminated in granite.

A second hole, FN-14-039, was collared 100 metres (328 ft) to the south, and drilled north underneath hole FN-14-038. After passing through some volcanic rock, the hole intersected a major shear zone from 116 to 265 metres for a total interval of 149 metres (488.7 ft), with abundant quartz-carbonate veining and trace sulphides. This is the northeastern extension of the JJJ zone first recognized on the Noront property where it contains elevated gold values, and which was drilled through many times during the 2013 Black Horse drilling campaign. Beyond the shear zone, the hole intersected pyroxenite with minor chromite and was also terminated in granite.

The third hole at the C-6 target, FN-14-041, was collared 105 metres (344.4 ft) to the east. It encountered the JJJ shear zone from 71.5 metres to 175.5 metres totalling 104 metres (341.1 ft) which was followed by pyroxenite to the end of the hole at 365 metres (1197.2 ft). The pyroxenite in this hole is not that of the east-west oriented Ring of Fire intrusion, but is rather a north-south dyke discernible from its faint gravity anomaly with a coincidental magnetic high that could be interpreted to be a feeder dyke to the Ring of Fire intrusion.

The objective of drilling the Black Horse chromite deposit was to expand the inferred resource category to depth. Three holes were completed:

FN-14-040 is a 1233 metre (4044.2 ft) hole in the central portion, southwest of the deep intercept of hole FN-10-026 drilled by Fancamp Exploration Ltd. in 2011; FN-14-042C is a 1131 metre (3709.7 ft) hole drilled near the western claim boundary; and FN-14-043 is an 850 metre (2788 ft) hole that targeted, at a shallower depth, the midpoint between the other two holes. All three holes intersected chromite mineralization:

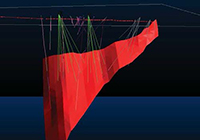

Hole FN-14-040 intersected chromite mineralization from 1041.67 metres to 1181.47 metres totalling 139.8 metres (358.6 ft), including a massive to semi-massive interval from 1099.5 metres to 1181.47 metres for a total interval of 82.0 metres (269.0 ft);

Hole FN-14-042C encountered chromite from 903.7 metres to 1070.96 metres totalling 167.3 metres (548.8 ft) containing mixed massive, semi-massive, and heavily disseminated intervals;

Hole FN-14-043 intersected heavily disseminated semi-massive and massive chromite from 712.59 metres to 800.52 metres for an interval of 87.93 metres (288.4 ft) including a massive unit from 756.25 metres to 790.06 metres for an interval of 33.81 metres (111 ft).

True widths of the intervals quoted in this release are not discernable at the present time. The core has been sampled and submitted to Actlabs, Thunder Bay for assay. The data from the assays will be added to the inferred resource estimate model with a view to updating the resource estimate.

M. J. (Moe) Lavigne, P. Geo., Vice-President of Exploration & Development for KWG, is the Qualified Person that has reviewed and approved the contents of this release.

About Bold Ventures:

Bold has interests in various mineral properties located in and around the Ring of Fire Area of Northern Ontario and in the Atikokan area of Northwestern Ontario. Additionally, Bold is exploring five base and precious metals properties in the Abitibi Greenstone belt of Northwestern Quebec.

About KWG:

KWG has a 30% interest in the Big Daddy chromite deposit and the right to earn 80% of the Black Horse chromite occurrence where inferred resources have been defined. KWG also owns 100% of Canada Chrome Corporation which has staked claims and conducted a $15 million surveying and soil testing program for the engineering and construction of a railroad to the Ring of Fire from Exton, Ontario.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forwardâ€Looking Statements: This Press Release contains forwardâ€looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forwardâ€looking statements. Such statements reflect our current views with respect to future events and are subject to such risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forwardâ€looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forwardâ€looking statements.

Bold Ventures Inc.

Richard Nemis

CEO and President

416-864-1456

Bold Ventures Inc.

David Graham

Executive Vice-President

416-864-1456

www.boldventuresinc.com