- Engaged IBK Capital Corp. to manage a private placement financing of up to C$2,000,000 by way of units of the Company at a price of $0.05 per Unit

- Each Unit consists of one common share and one share purchase warrant, where each Warrant entitles the holder to purchase one additional common share at a price of $0.10 per share for a period of two (2) years from the date of closing.

January 23rd, 2020 – Rockport, ON, Canada – New Age Metals Inc. (TSXV:NAM); (OTC:NMTLF); (FSE:P7J) has engaged IBK Capital Corp. to manage a private placement financing of up to C$2,000,000 by way of units (“Units”) of the Company at a price of $0.05 per Unit. Each Unit consists of one common share and one share purchase warrant (“Warrant”), where each Warrant entitles the holder to purchase one additional common share at a price of $0.10 per share for a period of two (2) years from the date of closing. This financing is fully subscribed and is anticipated to close on Friday January 31, 2020.

The securities to be issued in connection with the private placement will be subject to a four-month plus one-day hold period from the date of closing in accordance with applicable Canadian Securities Laws. Completion of the private placement and any finder’s fees payable are subject to regulatory approval.

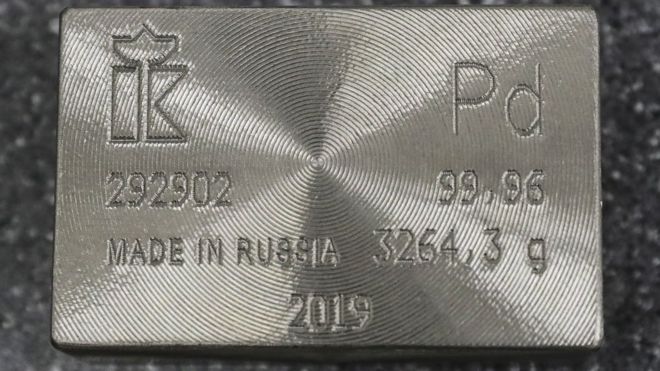

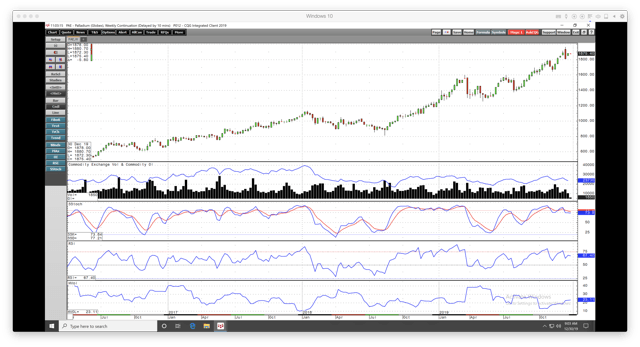

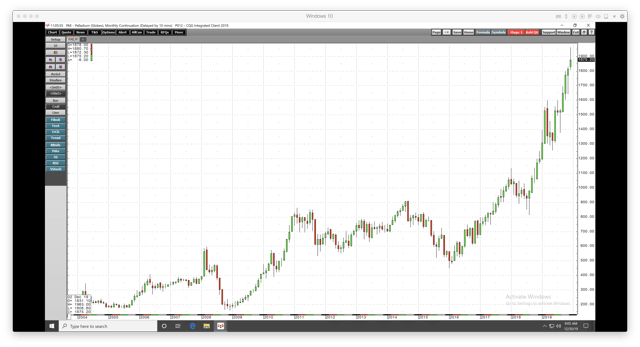

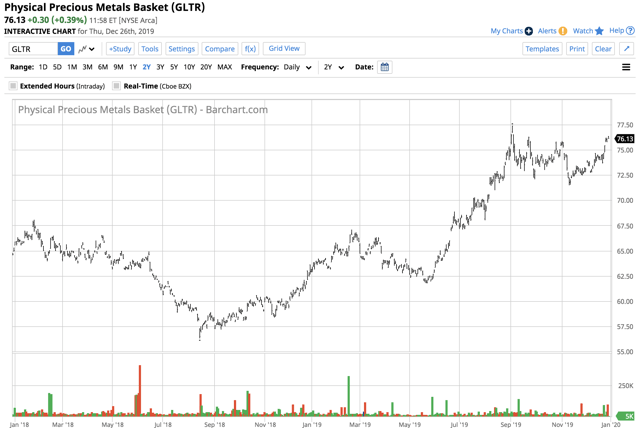

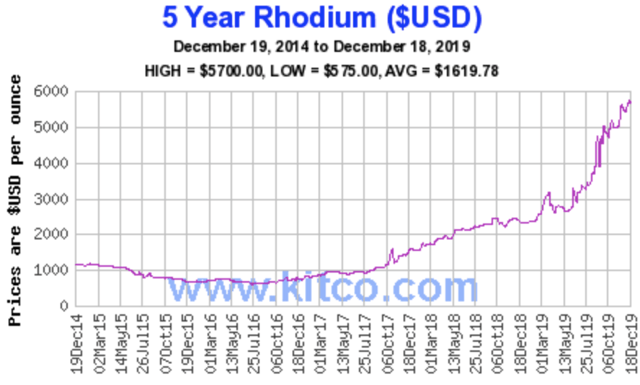

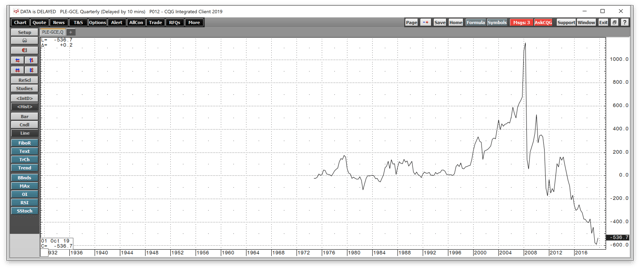

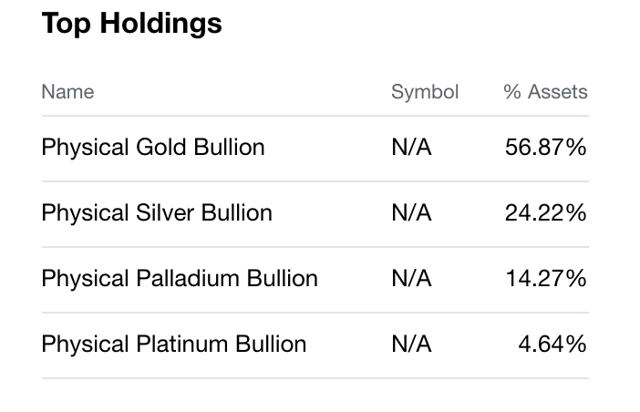

Harry Barr, Chairman and Chief Executive Officer of New Age Metals, reports: “This year’s palladium price increase to more than US$2,400 per ounce or C$3,100 highlights the potential of our River Valley PGM project as one of the largest undeveloped primary palladium projects in North America.”

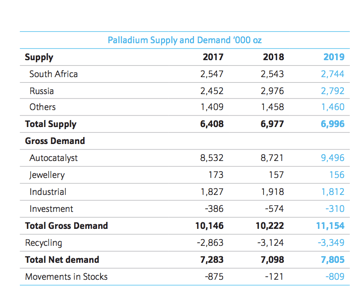

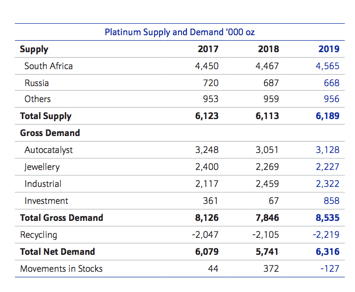

Michael White, Chief Executive Officer of IBK Capital Corp., states, “We believe there will be a positive rerating of the market value of palladium exploration companies. This would reflect the increasing value of the metal in the ground due to strong palladium prices based on a lack of stable supply from South Africa. We also believe the PGM producers of the world will need to acquire ounces in the ground in favourable jurisdictions to replace and geographically diversify their PGM reserves.”

Use of Proceeds

The Company intends to use the proceeds of this private placement to complete certain recommendations from the recent PEA completed on the company’s River Valley Project; one of North America’s largest undeveloped primary Platinum Group Metals, (PGM) Projects. Additionally, proceeds will be used to build global investor awareness in NAM, and for working capital purposes.

The River Valley PGM Project is 100% owned by New Age Metals and located in the Sudbury Mining District, 100 kms away from the Sudbury Metallurgical Complex.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration and development of green metal projects in North America. The Company has two divisions; a Platinum Group Metals division and a Lithium/Rare Element division. The PGM division includes the 100% owned River Valley Project, one of North America’s largest undeveloped Platinum Group Metals Projects, situated 100 kilometers from Sudbury, Ontario as well as the Genesis PGM Project in Alaska. The Lithium division is the largest mineral claim holder in the Winnipeg River Pegmatite Field where the Company is exploring for hard rock lithium and various rare elements such as tantalum and rubidium. Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production. New Age Metals is a junior resource company on the TSX Venture Exchange, trading symbol NAM, OTCQB: NMTLF; FSE: P7J with 96,843,766 shares issued to date.

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to [email protected] or Harry Barr at [email protected] or Cody Hunt at [email protected] or call 613 659 2773.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr, Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.