3iQ is Canada’s first regulated multi crypto asset portfolio manager and will be utilizing the KoreConX platform

[New York, NY – April 04, 2019] – KoreConX is proud to announce that 3iQ Corp. (3iQ), Canada’s first regulated multi cryptoasset portfolio manager, has chosen the KoreProtocol for their Digital Securities Offering.

Founded in 2012, the company is the first Canadian investment fund manager to fully comply with the terms and conditions with the Canadian securities regulatory authorities to manage a multi-crypto asset investment fund, offering exposure to accredited investors for the first time.

3iQ focuses on educating individuals in disruptive technologies and the crypto asset space and providing innovative investments of institutional quality. Behind the company are the investment industry veterans Howard Atkinson and Fred Pye, both with more than 30 years of experience in the field.

“Moving to Digital Securities is a very important decision in the history of our company, and we need a protocol that is secure and robust, while never compromising compliance,†said Howard Atkinson, Chairman of 3iQ. “We believe KoreConX is not only the right choice when it comes to the Digital Securities Protocol, but also when it comes to management after issuance.†According to Fred Pye, President & CEO of 3iQ, “through our Exempt Market Dealer we will be able to offer these securities to Accredited Investors.â€

In the KoreConX all-in-one platform, companies can not only initiate their Digital Security Offering process, but they can also find a series of solutions tailored to their business needs, including the pre, during and post phases of capital raise. From the Due Diligence and the documentation gathering to Investor Relations with the shareholders, users can find the tools they need to grow their business.

Companies with a growing number of shareholders can also utilize CapTable Management solutions without compromising the safety of their most sensitive information.

“We created the platform with the business’ owners in mind. We created it for the dynamic entrepreneur who needs efficiency and agility when managing their companies so they can focus on perfecting their business,†said Oscar Jofre, Co-Founder and CEO of KoreConX. “We are very honored that an Investment Fund Manager of the magnitude of 3iQ chose our solutions to be the technology behind their Digital Securities Offering and their company.â€

About 3iQ Corp.

3iQ is a Canadian investment fund manager focused on providing innovative investment products of institutional quality. 3iQ currently manages the 3iQ Global Cryptoasset Fund, a private investment fund which holds bitcoin, either and litecoin and is eligible for investment by accredited investors in Canada or in reliance on other exemptions from the prospectus requirement. Founded in 2012, 3iQ is currently focused on disruptive technologies and the cryptoasset space

About KoreConX

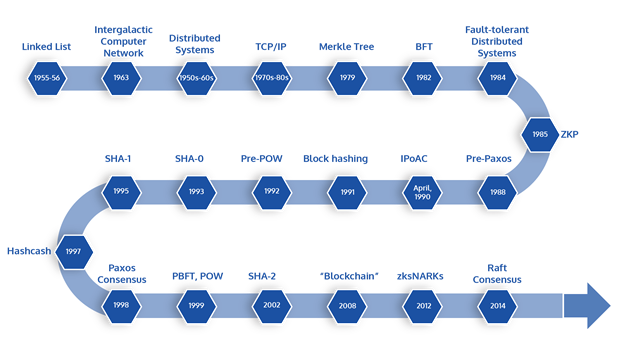

KoreConX is the world’s first highly-secure permissioned blockchain ecosystem for fully-compliant digital securities worldwide.

To ensure compliance with securities regulation and corporate law, the KoreConX all-in-one, AI-based blockchain platform manages the full lifecycle of digital securities including the issuance, trading, clearing, settlement, management, reporting, corporate actions, and custodianship. KoreConX connects companies to the capital markets and secondary markets facilitating access to capital and liquidity for private investors.

KoreConX is the first secure, all-in-one platform for private companies to manage their capital market activity and stakeholder communications. Removing the burden of fragmented systems and inefficient tools across multiple vendors, KoreConX offers a single environment to connect companies, investors and broker/dealers. Leveraged for investor relations and fundraising, private companies can share and manage corporate records and investments including portfolio management, capitalization table management, virtual minute book, security registers, transfer agent services and virtual deal rooms for raising capital. www.KoreConX.com

###

Media Contacts:

KoreConX

Oscar A Jofre