- Entered into two new agreements with its joint venture partner Barrick Gold (DRC) Limited which further strengthen the Loncor and Barrick joint venture relationship in the Ngayu gold belt in the northeast of the Democratic Republic of the Congo (“DRC”)

- The ground covered by these agreements includes a number of priority, exploration targets already outlined by Barrick, two of which are ready for initial scout, core drilling.

- Total acreage under the various Barrick/Loncor joint ventures in Ngayu now totals approximately 2,000 square kilometres.

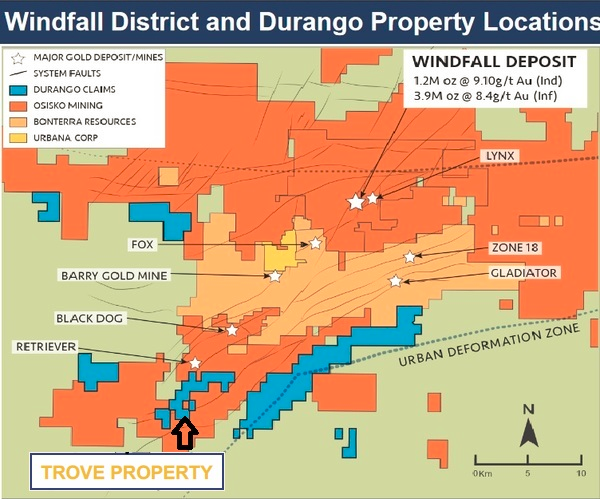

TORONTO, Nov. 11, 2020 — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQX: “LONCF”; FSE: “LO51”) is pleased to announce that it has entered into two new agreements with its joint venture partner Barrick Gold (DRC) Limited which further strengthen the Loncor and Barrick joint venture relationship in the Ngayu gold belt in the northeast of the Democratic Republic of the Congo (“DRC”). The ground covered by these agreements includes a number of priority, exploration targets already outlined by Barrick, two of which are ready for initial scout, core drilling. Total acreage under the various Barrick/Loncor joint ventures in Ngayu now totals approximately 2,000 square kilometres.

In the first new agreement, three exploration properties in the Ngayu gold belt previously held by Barrick outside of its joint ventures with Loncor, have now been added to an existing Loncor/Barrick joint venture agreement (the “Amended Barrick JV”). These three Barrick properties are located northwest of Loncor’s 100%-owned Makapela project where indicated mineral resources of 614,200 ounces (2.2 million tonnes grading 8.66 g/t Au) and 549,600 ounces (3.22 million tonnes grading 5.30 g/t Au) of inferrred mineral resources have already been outlined by Loncor. Two significant targets have been delineated by Barrick at Mongaliema (7 kilometres northwest of Makapela) and Ntokayulu (3 kilometres northwest of Makapela). At Mongaliema, trenching and augering is continuing along a west northwest trending shear zone with trench results including 37.3 metres grading 1.48 grammes per tonne of gold.

In the second new agreement (the “New Isiro JV”), Loncor and Barrick have replaced the existing joint venture agreement between Barrick and Loncor relating to the Isiro properties in the Ngayu gold belt, to focus on the three most prospective Isiro properties. These three Isiro properties include two of the drill targets identified by Barrick, Yambenda and Yasua, and which Barrick plans to drill as part of its ongoing drill campaign on priority targets in the Ngayu gold belt. At Yambenda, a 9.5 kilometre long banded ironstone ridge has a number of gold in soil anomalies.

In addition to the above agreements, a new drill target has been outlined by Barrick on one of the properties which is part of the Barrick/Loncor joint venture entered into in June of this year (reference is made to Loncor’s press release dated June 24, 2020). At the Mokepa target, scout core drilling is due to commence shortly on a +250ppb gold-in-soil anomaly extending over 1,600 metres and where encouraging trench results of 110 metres grading 0.5 grammes per tonne gold and 32 metres grading 0.99 grammes per tonne gold have been outlined. At Mokepa, the mineralized system consists of banded ironstones in mafic volcanics sandwiched between conglomerate and carbonaceous shale.

The Ngayu gold belt lies approximately 220 kilometres from the Kibali gold mine, operated by Barrick (TSX: “ABX”; NYSE: “GOLD”). Kibali produced record gold production of 814,000 ounces of gold in 2019, at “all-in sustaining costs” of US$693/oz.

Arnold Kondrat, CEO of Loncor, commented: “We are very encouraged with Barrick’s decision to further enhance the exploration potential of our joint ventures, especially when they have already delineated a number of high potential drill targets such as Yambenda and Mokepa. Barrick’s scout drilling program continues on other parts of our joint venture ground and we expect to announce preliminary drill results from other targets shortly.”

The terms of the Amended Barrick JV and the New Isiro JV are substantially the same. Under both JV agreements, Barrick manages and funds all exploration of the joint venture ground until the completion of a pre-feasibility study. Once the joint venture committee has determined to move ahead with a full feasibility study, a special purpose vehicle (“SPV“) would be created to hold the specific discovery area. Subject to the DRC’s free carried interest requirements, Barrick would retain 65% of the SPV with Loncor holding the balance of 35%. Loncor would be required to fund its pro-rata share of the SPV in order to maintain its 35% interest or be diluted.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 220 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (TSX: “ABX”; NYSE: “GOLD”). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs” of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in approximately 2,000 km2 of Loncor ground in the Ngayu Greenstone Belt that they are exploring. As per the joint venture agreements entered between Loncor and Barrick, Barrick manages and funds exploration on the said ground until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and have commenced confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

In addition to the Barrick joint ventures, certain parcels of land within the Ngayu Belt surrounding and including the Adumbi and Makapela deposits have been retained by Loncor and do not form part of any of the joint ventures with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 84.68% of this resource being attributable to Loncor via its 84.68% interest in the project. Loncor’s Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com.

Qualified Person

Peter N. Cowley, who is President of Loncor and a “qualified person” as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 17, 2020 and entitled “Independent National Instrument 43-101 Technical Report on the Imbo Project, Ituri Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Additional information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled “Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the “SEC“) permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used by the Company, such as “Indicated” and “Inferred” “Resources”, that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company’s Form 20-F annual report, File No. 001- 35124, which may be secured from the Company, or from the SEC’s website at http://www.sec.gov/edgar.shtml.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding drilling and other exploration under the joint venture agreements with Barrick, drill results, potential gold discoveries, mineral resource estimates,potential mineral resource increases, drill targets, exploration results,and future exploration and development)are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things,the possibility that drilling programs will be delayed, activities of the Company may be adversely impacted by the continued spread of the recent widespread outbreak of respiratory illness caused by a novel strain of the coronavirus (“COVID-19”), including the ability of the Company to secure additional financing, risks related to the exploration stage of the Company’s properties, the possibility that future exploration (including drilling) or development results will not be consistent with the Company’s expectations, uncertainties relating to the availability and costs of financing needed in the future, failure to establish estimated mineral resources (the Company’s mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company’s activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading “Risk Factors” and elsewhere in the Company’s annual report on Form 20-F dated April 6, 2020 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

For further information, please visit our website at www.loncor.com, or contact: Arnold Kondrat, CEO, Toronto, Ontario, Tel: + 1 (416) 366 7300.