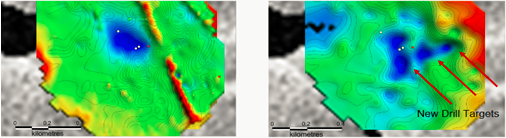

SPONSOR: Arctic Star Exploration is currently exploiting the Diagras Diamond Property, NWT. Adjoined by both Diavik and Ekati Mines, Arctic has combined known data on Diagras with modern Gravity and EM geophysical survey techniques to delineate viable Kimberlite targets. Arctic Star is currently preparing a drill program. CLICK HERE FOR MORE INFO

We have seen how the industry has undergone significant changes over the past 20 years and how smaller companies have emerged to play an increasingly important role in supplying rough diamonds to the world.

These changes have come about at least partly due to the discovery of diamonds in locations outside of Southern Africa, which was where the vast majority of diamonds had been mined for nearly a century. South Africa is also where De Beers established its dominance of the industry. The discovery of diamonds elsewhere in the world has therefore been a key factor in the diamond giant’s gradual decline in market share.

According to Kimberley Process rough diamond statistics, 22 countries produced rough diamonds in 2014. The top six producing countries accounted for over 90% of production by value. A closer analysis of global diamond mining is key to learning more about the industry’s recent evolution, and to developing an image of where it might be heading in the future.

To start, I will focus on the top six producing nations, each of whose policies and methods of distribution shape the industry.

Russia

Diamonds were first discovered in Russia in the mid 1950s in the Sakha (Yakutia) Republic in northeastern Siberia. Interestingly, the search for diamonds in Russia, which began in 1947 following the end of World War Two, was not initiated for financial gain. Stalin understood that in order to rebuild the shattered Soviet Union after the war, he would need access to a large supply of industrial diamonds. These diamonds were required for a number of mechanical operations such as drilling, abrasive grit, precision cutting and other digging processes. However, at the time, De Beers controlled the sale of rough diamonds and Stalin knew that this left him precariously dependent.

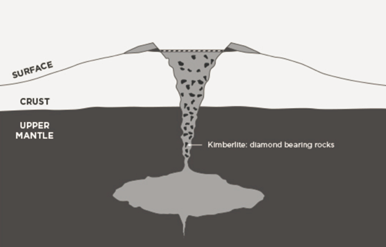

Russian geologists had recognized as early as the 1930s that parts of Siberia exhibited very similar geological characteristics to the kimberlite-rich regions of South Africa. Teams of geologists were dispatched to Siberia and these expeditions did not disappoint. In 1955, the Mirny (Mir) kimberlite was discovered and mining commenced in 1957.

The purpose of searching for diamonds in Russia was to develop a supply of industrial stones for tools and equipment. Thus, when Mir produced a vast supply of gem quality stones, the state found itself in the grips of an unexpected predicament. By the mid 1960s, Russia had begun selling its gem diamond production to De Beers, a relationship that would remain intact for more than 40 years.

Today Russia maintains more than a dozen active open-pit diamond mines and is the world’s number one producer of rough diamonds by value and by carat volume. Russia’s known diamond reserves have long been shrouded in mystery, but according to state-owned miner ALROSA, which controls the vast majority of diamond mining in the country, its reserves exceed one billion carats. This should allow the country to maintain its position as a dominant player in the industry for several decades to come.

Botswana

Botswana officially gained independence from the UK on September 30, 1966. The country’s first kimberlite was identified just five months later. This initial discovery was followed shortly by numerous others which quickly established the nation as a diamond powerhouse and helped to propel its population out of crushing poverty.

Botswanan diamonds truly took to the skies when it was determined that the AK1 mine, now Orapa, could be seen from the sky and was frequently used as a landmark by South African pilots navigating their way to Europe.

Today, Botswana ranks second only to Russia in rough diamond production by value, driven primarily by the two richest mines in the world – Orapa and Jwaneng. However, it is the country’s recent efforts to leverage its diamond resources to further benefit its people that has earned the attention of the diamond world.

In 2011, the Botswanan government and De Beers announced a landmark deal that would eventually see De Beers’ entire sorting and sales operations moved from London to Gaborone – the capital of Botswana. Also as part of the deal, the government was given the opportunity to market a portion of local production through its own subsidiary company, now known as Okavango Diamond Company. In this way, Botswana has a solid mechanism for understanding the change in market prices for its resources.

By all accounts, Botswana’s diamond revenues have been put to very good use in helping lift the country out of poverty. In the late 1960s, Botswana was one of the poorest countries in the world with a GDP per capita of around $70. Today it ranks among the top African countries for per capita GDP, and consistently ranks near the top among Africa countries in terms of literacy, education, health care and low-levels of government corruption.

The Botswanan government has embarked on a bold experiment to extract maximum benefit from its natural resources by establishing Botswana as a diamond trading and manufacturing hub, in order to achieve stability for after its resources are depleted. Other nations are taking notice, and the Botswana model may be looked to in the future more and more frequently.

Canada

Though Canada’s history as a diamond-producing nation is short, it is now the world’s third largest producer by value. In fact, diamond deposits have been found scattered across the country’s vast expanses, and it offers much promise for continued exploration and development. Two large diamond projects are set to go into production as soon as late 2016 and early 2017 – the Renard and Gahcho Que projects.

Diamonds were first discovered in Canada in the early 1990s by two geologists who resisted the conventional wisdom that local geology would not support a diamond find. The discovery of the Ekati Diamond Mine triggered one of the most intense prospecting rushes in North American history, bringing teams from all over the world to scour the area. Geologists were literally staking their claims with wooden posts, so much so that local lumber suppliers could not keep up with the demand for wood.

It is said that the team of geologists who discovered the Diavik Diamond Mine initially planned to stake out a different location, but had to “settle” for what they were given because the person ahead of them in line at the mineral claims office took the area they were first interested in.

Most of Canada’s diamond projects are clustered in the far reaches of the northern Arctic region known locally as the Barren Lands. These barely hospitable tundra experience winter temperatures that average -35 degrees Celsius, often dipping below -50. This makes mining a challenge and the mining camps in these regions function more like enclosed cities, almost entirely sheltered from the harsh weather outside.

This region is also known for having been carved from the glacial movements of the last ice age. There are so many lakes in the area, numbering in the tens of thousands, that many remain unnamed to this day. In fact, some of the country’s most prolific diamond deposits have been found located beneath lakes. The Diavik Diamond Mine, located underneath 56 meters of water in Lac De Gras, necessitated the construction of a massive retaining wall and the removal of millions of liters of water to access the high-value kimberlite underneath the lake-bed.

Angola

Diamonds were first discovered in Angola’s Lunda Norte province near the border with Zaire in 1913. Angola is rich in both kimberlite deposits and alluvial diamonds washed out from their kimberlite hosts by ancient river systems.

The country has suffered from political instability for decades after gaining independence from Portugal in 1975. Shortly afterwards gaining independence, a civil war erupted that would last more than 25 years. As a result, large mining companies have been somewhat reluctant to invest in mining in Angola, and the country is believed to possess significant diamond resources that remain undiscovered.

In 2011, Angola introduced new legislation aimed at attracting foreign investment into its diamonds sector to help boost production. The plan has shown some early results. In 2015, ALROSA announced that it would invest $1.2 billion into the country to further develop producing assets and to increase exploration work in the country.

Keeping pace with the recent string of large diamond discoveries around the world, Australia-based Lucapa Diamonds announced in February that it had unearthed the 27th largest diamond ever from its Lulu mine in Angola. The gem was sold recently for $16 million.

South Africa

For decades South Africa was the epicenter of diamond mining. The discovery of the Eureka Diamond in 1866 by a young farmer named Erasmus Jacobs set off a prospecting rush unparalleled at that time. In a few short years, numerous alluvial and kimberlite operations were established. This new supply helped to replace the dwindling supplies from Brazil and India, and make diamonds accessible to vastly more people than ever before.

While South Africa still has more than ten producing diamond mines, its importance in the diamond world is slowly declining. Many mines have reached the end of their lifecycle and have moved to underground mining, which is often slow and more expensive than mining in an open pit. Although South Africa is still the fifth largest producer of diamonds in the world, with value in excess of $1 billion annually, in the absence of a major new mine discovery its importance will decline significantly over the coming decade.

Namibia

At number six in the diamond producing nations rankings, Namibia boasts the highest value per carat diamonds in the world. Namibian diamonds are mostly found in the ocean, along the country’s 1,570 kilometer coastline. Over millions of years, the area became a drainage basin covering the Kaapvaal Craton, which emptied water into the Atlantic Ocean. This water eroded diamond-bearing kimberlites and transported diamonds into the ocean. Over time, ocean currents churned up the area and deposited the diamonds in seabed trap sites as well as inland along the coast.

Because these diamonds travelled huge distances, often in rough conditions, only the strongest diamonds survived the journey. As a result, Namibian diamonds have exhibit the highest proportion of gem quality stones anywhere in the world, and this results in a very high average value per carat. These diamonds are mined mostly from boats and barges that drill and extract material from the seabed through long hoses.

Diamond production by country has changed significantly in recent years and this has had important implications on the industry and the power of companies within it. Next week I will look at some of the smaller producing nations, some of which are on the rise while others are in decline.

The views expressed here are solely those of the author in his private capacity. No one should act upon any opinion or information in this website without consulting a professional qualified adviser.

SOURCE: https://www.ehudlaniado.com/home/index.php/news/entry/the-world-s-6-biggest-diamond-producers