CANDENTE HIGHLIGHTS:

- Canariaco Included in Goldman Sachs 84 Top Copper Projects Worldwide

- Cañariaco in Lowest Quartile of Copper Industry Production Costs

- Definitive Feasibility 50% Complete

- Higher grade throughput of 0.54% CuEqMill Feed Grade during first 3 years

- Rising Copper and Gold Prices Impacting 2011 PFS

- Fortescue Metals Group Ltd. owns 19.92% interest

- Joint technical committee created to identify optimum strategy for Cañariaco development

Project Highlights:

Cañariaco Norte is a 100% owned feasibility-stage porphyry copper deposit

- A single, contiguous, open-pit mineable deposit of 7.5B pounds Measured and Indicated,

- 1.4B pounds Inferred Porphyry Copper Deposit

- Annual production of 262,000,000lbs of copper, 39,000 oz gold & 911,000 oz silver over initial mine life of 22 yrs(@ 95,000 tpd)

Pre-Feasibility Study

- NPV of US $922M and IRR of 17.3% (using US$2.25 copper and an 8% discount rate)

- Payback of preproduction capital in 4.4 years (after-tax)

- Copper Production of 262,000,000 pounds per year

- Initial Mine life of 22 years+

- Throughput rate of 95,000 tonnes per day

- Operating costs of US$0.988 per pound of copper (including onsite/offsite costs, taxes and byproduct credits)

- Minimal infrastructure required, excellent locations for all site facilities, close to existing highway (42km away) and power grid (57km away) & abundant water at site

- Very strong community & regional support

The Cañariaco Norte Copper Project

- Canariaco in Top 80 Deposits slated for Development according to Goldman Sachs

- 42 in South America –Cañariaco Included

- Cañariaco in Lowest Quartile of Copper Industry Production Costs

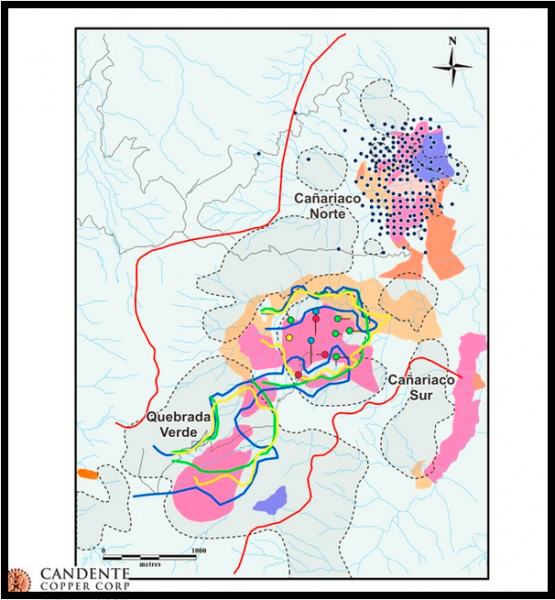

- Large scale porphyry copper–gold-silver deposit in Northern Peru

- 7.5B pounds Measured and Indicated, plus 1.4B pounds Inferred Porphyry Copper Deposit

- Deposit and Scope of Project Development well defined by Pre-Feasibility Studies in 2011

- Annual production of 262,000,000lbs of copper, 39,000 oz gold & 911,000 oz silver over initial mine life of 22 yrs(@ 95,000 tpd)

- Operating costs of US$0.988 per pound of copper (including onsite/offsite costs, taxes and byproduct credits

- Strong Government support

Resource and Mine Plan

123 Million tonnes @ 0.58% Cu Eq (0.4% Cu cutoff) Measured

752 Million tonnes @ 0.52% Cu Eq (0.3% Cu cutoff) M & Indicated

1.0 Billion tonnes @ 0.46% Cu Eq(0.2% Cu cutoff) M & I

Current Mine Plan 728.2 Million tonnes @ 0.46% CuEqMill Feed Grade

- Higher grade throughput of 0.54% CuEqMill Feed Grade during first 3 years

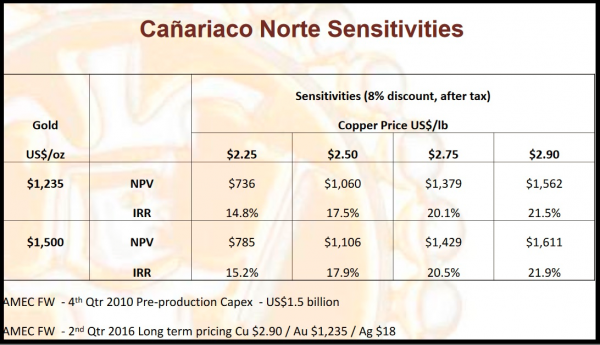

Canariaco Price Sensitivities Chart

- Rising Copper and Silver Prices dramatically Project Economics

- Based on 2011 Pre-Feasibility Progress Report