- Acquired by staking the Humboldt Salt Marsh playa located in Dixie Valley, Churchill County, Nevada

- Property consists of 911 claims covering 73.6 square km/28.4 square miles (7,363 hectares/18,194 acres) of salt marsh playa staked at a cost of approximately CDN$370,000

June 28, 2016 / Vancouver, British Columbia-Nevada Energy Metals “the Company” (TSX-V: BFF; OTCQB: SSMLF) (Frankfurt: A2AFBV) is pleased to announce that it has acquired by staking the Humboldt Salt Marsh playa located in Dixie Valley, Churchill County, Nevada. The property consists of 911 claims covering 73.6 square km/28.4 square miles (7,363 hectares/18,194 acres) of salt marsh playa staked at a cost of approximately CDN$370,000.

Of the seven characteristics favorable for the formation of a Lithium brine deposit as outlined in the USGS deposit model, all seven are found in Dixie Valley. The Lithium deposit model for Dixie Valley is a Clayton Valley style brine deposit.

Dixie Valley Overview

Dixie Valley is located in west central Nevada, about 160 km east northeast of Reno. The entire basin is about 98 km long and up to 16 km wide. Humboldt Salt Marsh occupies the central part of the playa and is about 10 km north-south and 6 km east-west.

Dixie Valley is home to a large and long-lived geothermal system that is still active. The Caithness Dixie Valley geothermal power plant is producing about 64 megawatts of electricity making it the largest geothermal power plant in Nevada. The active geothermal system extends about 30 km roughly north – south along the entire west side of the valley. The heat source appears to be simple very deep circulation into the crust and is not related to igneous activity.

Very little exploration work has been directed at Lithium in this area. Geothermal water in the basin contains up to 4.89 ppm Lithium and stream sediment samples from the adjacent Stillwater range show values to 80 ppm Lithium. Geologically, recent volcanic ash from the Long Valley Caldera (Bishop Tuff) and Mono craters are expected to be found within catchment area of the basin and within the basin fill sediments. One major productive horizon in the Clayton Valley brine field is thought to be Bishop Tuff deposited and preserved in the basin (Zampirro, 2004).

Dixie Valley is a closed fault-bounded basin having the lowest elevation point (1031 m, 3383 ft.) in the Northern Great Basin as measured on the Humboldt Salt Marsh playa. Given the valley has been a closed basin for at least 500,000 years and probably much, much longer, plenty of time has elapsed for evaporative concentration of Lithium bearing geothermal and surface water. The valley appears to be about 2,000 meters deep, primarily filled with poorly sorted coarse conglomerate, gravel, sand and silt with volcanic rocks, and tuff beds, and finer sediments in the lower third of the section (Blackwell et al, 2014).

The conceptual deposit model is as the basin went through multiple wet and dry periods, Lithium dissolved by deep circulating geothermal fluids or leached from local rock units by surface and near surface water, seeped into the basin where it was concentrated by evaporation. Heavier brines sink into the deeper levels of the basin or flow downward along tilted permeable beds, potentially forming subsurface pools of Lithium rich fluids. The process can be likened to an inverted oil field, with the target material being descending fluids caught in gravity traps instead of ascending fluids caught in the tops of structures. This model is somewhat akin to placer gold deposits wherein large areas of very low grade sources are concentrated into economic grades.

The Humboldt Salt Marsh project was acquired for staking cost without royalties and a 200,000 share payment to the locator.

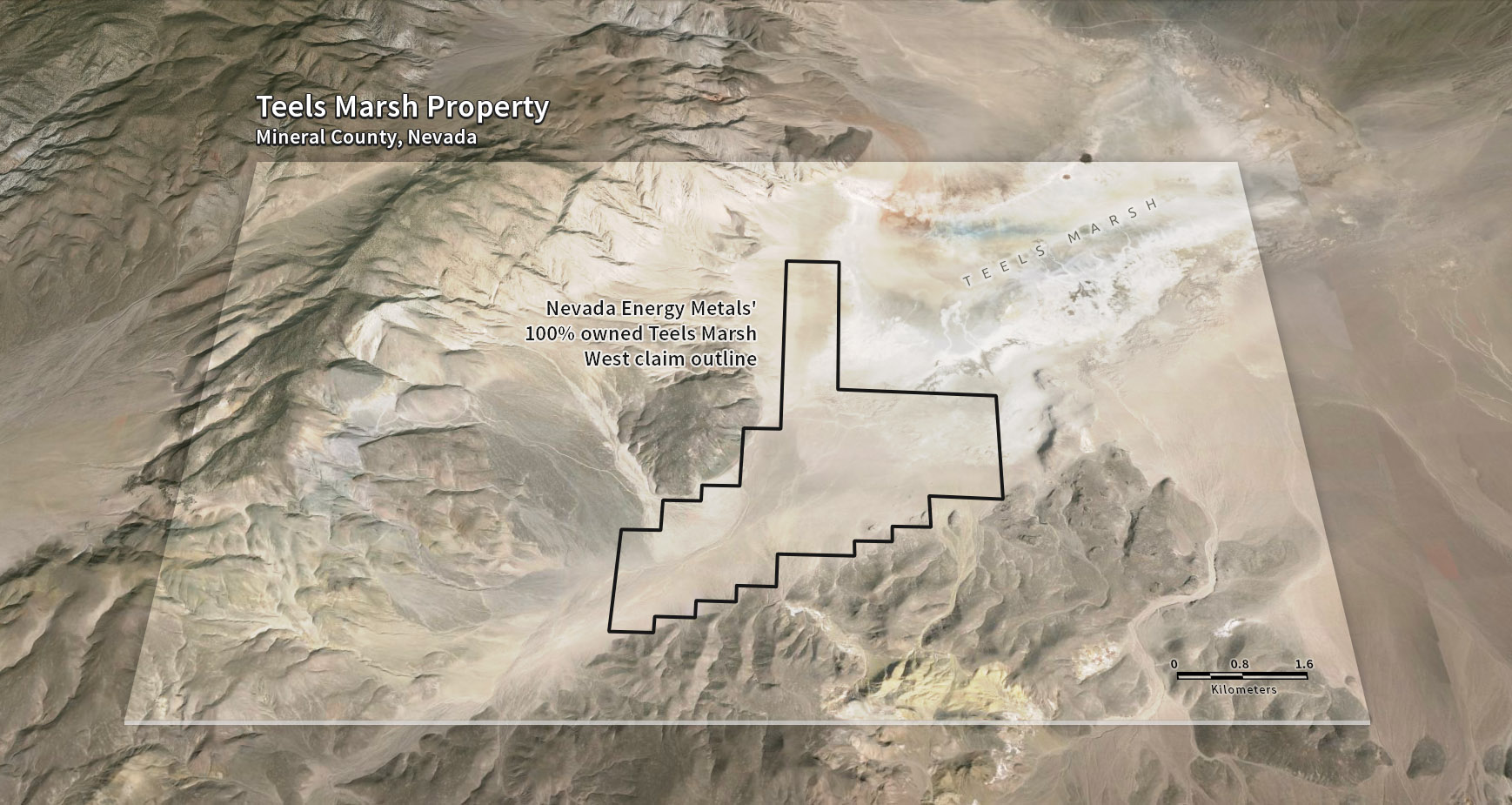

The contents of this news release has been approved by Alan J. Morris CPG who serves as the project geologist and Qualified Person on the Teels Marsh West Project.

About Nevada Energy Metals: http://nevadaenergymetals.com/

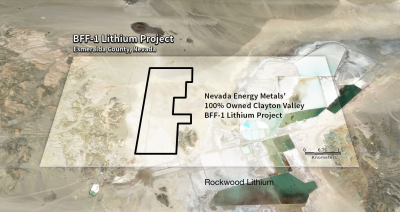

Nevada Energy Metals Inc. is a well funded Canadian based exploration company who’s primary listing is on the TSX Venture Exchange. The Company’s main exploration focus is directed at Lithium brine targets located in the mining friendly state of Nevada. The Company has recently completed (1) a 70/30 farm-out option JV on 77 claims in Clayton Valley, approximately 250m from the Rockwood Lithium mine, the only brine based Lithium producer in North America; (2) acquisition of 100% of the Teels Marsh West project (100 claims covering 2000 acres/809 hectares) in Mineral County, Nevada; (3) acquisition of 100% ownership of the Black Rock property (128 claims covering 2,560 acres/1,036 hectares) located in southwest Black Rock Desert, Washoe County, Nevada; (4) acquisition of 100% ownership in the San Emidio Project (155 claims, 3,100 acres/1,255 hectares) near Empire, Washoe County, Nevada; (5) the acquisition of the Alkali lake Project, 60% Option from Dajin Resources Corp. (191 claims covering 3,820 acres/1,558 hectares) in the Esmeralda County, Nevada.

On Behalf of the Board of Directors

Rick Wilson, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the contents of this news release.

This puts the electric vehicle industry at a very interesting inflection point. Back in 2011, McKinsey & Co. made

This puts the electric vehicle industry at a very interesting inflection point. Back in 2011, McKinsey & Co. made