- Palladium mineralization is still open to expansion by drilling to the east, particularly testing a strong IP chargeability high located about 400 metres along strike, and also by drilling down-dip to the south

- Hole PZ-20-04 intersected 1101 ppb Pd+Pt+Au (1.250 g/t PdEq) over 12 metres from 50 metres downhole, including 1361 ppb Pd+Pt+Au over 8 metres in the Pine Zone; and

- Hole PZ-20-01 intersects 1287 ppb Pd+Pt+Au (1.477 g/t PdEq) over 3 metres from 168 metres downhole in the Pine Zone

June 2nd, 2020 – Rockport, Canada – New Age Metals Inc. (TSXV:NAM); (OTC:NMTLF); (FSE:P7J) – The Company is pleased to announce new results from the 2020 Phase 1 exploration drilling program at its 100% owned River Valley Palladium Project. This district-scale land package and large mineral resource is located near the City of Sudbury, Ontario,

and its world-class mining and processing facilities.

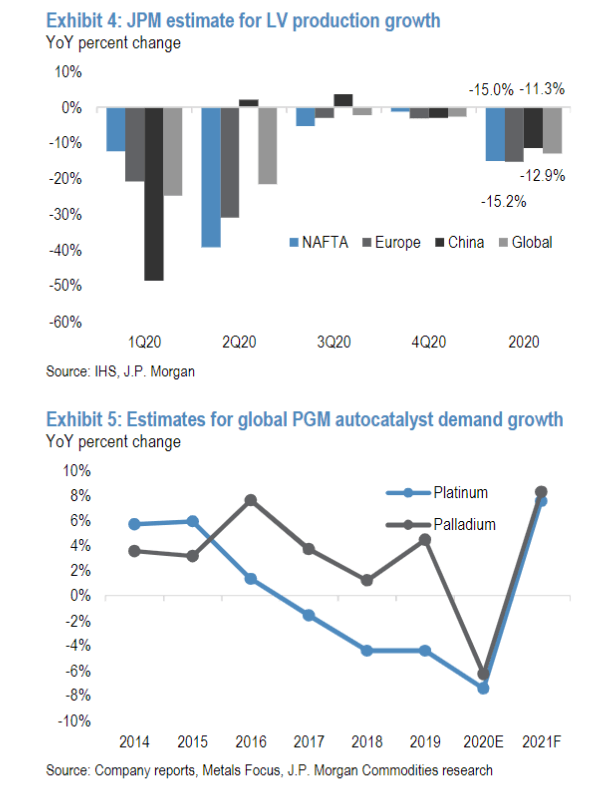

Chairman and CEO Harry Barr stated; “Phase 1 of the 2020 drill program was successful in extending the known limits of the Pine Zone Palladium mineralization 50 metres up-dip to the north and 50 metres along strike to the east. The Palladium mineralization is still open to expansion by drilling to the east, particularly testing a strong IP chargeability high located about 400 metres along strike, and also by drilling down-dip to the south (see Figure 1). The 2020 drilling was also successful at broadly establishing the presence of Palladium mineralization at the connection of the Pine Zone to the Dana North Zone.”

This release describes results from 1,685.5 metres of drilling in 8 holes completed in Q2 2020 on the Pine Zone-Dana North Zone area of the multi-million-ounce River Valley Palladium Project. The objectives of the drill program were threefold: 1) expand the limits of the Pine Zone Palladium mineralization; 2) investigate possible connection of the Pine Zone to the Dana North Zone at depth; and 3) test Palladium mineralization continuity within the 2019 Block Model.

The drill program was successful in extending the Pine Zone mineralization up-dip to the north and along strike to the east, thereby demonstrating opportunity to further expand the Mineral Resources in support of a Prefeasibility Study in 2021-2022.

The Pine Zone was discovered by drilling an IP chargeability high in 2015-2016, in the footwall to the main River Valley deposit at the Dana North Zone, at the north end of the Property and under the main access road. Seven holes were drilled into the Pine Zone-T3 area in 2015-2016 and 14 in 2017 plus the 5 in 2020 for a total of 26 holes. Before 2015, seven holes had been drilled through the Dana North Zone and into the Pine Zone prior to recognition of the latter as a separate, differently oriented zone.

2020 Palladium Highlights

Highlights of the Phase 1 2020 drill program are as follows:

– Hole PZ-20-04 intersected 1101 ppb Pd+Pt+Au (1.250 g/t PdEq) over 12 metres from 50 metres downhole, including 1361 ppb Pd+Pt+Au over 8 metres in the Pine Zone; and

– Hole PZ-20-01 intersects 1287 ppb Pd+Pt+Au (1.477 g/t PdEq) over 3 metres from 168 metres downhole in the Pine Zone

Palladium Results

The details of the Phase 1 2020 drill program are presented in Tables 1-2 and Figure 1.

Holes PZ-20-02 and PZ-20-04, -05 and -06 were drilled to expand the Palladium mineralization beyond the 2019 Mineral Resources at the Pine Zone. Hole PZ-20-02 targeted an IP chargeability high and intersected 0.597 g/t PdEq from 125 metres downhole, which expands the mineralization 50 metres along strike to the east from the Mineral Resource Block Model. Holes PZ-20-04, -05 and -06 were drilled to expand the Palladium mineralization up-dip to the north, by 10 metres,

50 metres and 100 metres, respectively. Hole PZ-20-04 targeted an IP chargeability high and intersected 12 metres grading 1.250 g/t PdEq from only 50 metres downhole, including

8 metres at 1.542 g/t PdEq, and 5 metres grading 0.499 g/t PdEq from 66 metres downhole.

Hole PZ-20-05 intersected 3 metres grading 0.857 g/t PdEq from only 50 metres downhole.

This intersection appears to be slightly more copper rich (Table 2). Hole PZ-20-06 lacked significant assay results but did intersect the breccia unit, the favourable host rock for the Palladium mineralization at River Valley.

Holes T3-20-01, T3-20-02 and PZ-20-03 were drilled to test for the presence of Palladium mineralization where the Pine Zone may be connected at depth to the main River Valley Palladium deposit at the Dana North Zone. Palladium mineralization was intersected in all three holes:

1) Hole T3-20-01 intersected 17 metres grading 0.744 g/t PdEq from 248 metres downhole;

2) T3-20-02 intersected 17 metres of 0.622 g/t PdEq from 318 metres downhole; and 3) PZ-20-03 intersected 0.412 g/t PdEq from 197 metres downhole.

Hole PZ-20-01 was designed to test Palladium grade continuity within the 2019 Mineral Resource Model. PZ-20-01 was collared 50 metres from the nearest previously drilled hole and intersected 3 metres grading 1.477 g/t PdEq from 168 metres downhole. This intersection lies within the Block Model volume of the 2019 mineral resource.

Click Image To View Full Size

* Collar coordinates are UTM NAD83 Zone 17N

Click Image To View Full Size

Notes: 1000 ppb = 1 gram/tonne

The lengths reported are core lengths, but should approximate true widths

nsa = no significant assays

PdEq g/t = Pd g/t + (Pt g/t x 0.89) + (Au g/t x 1.20) + (Cu% x 1.34) + (Ni% x 2.55) + (Co% x 9.01)

For PdEq calculation details, see 2019 Technical Report, “Updated Mineral Resource Estimate and Preliminary Economic Assessment of the River Valley Project”, by P&E Mining Consultants Inc. and DRA Americas Inc.

Click Image To View Full Size

Figure 1. Location of 2020 Phase 1 drill holes (labelled) and previously drilled holes plotted on an inverted IP chargeability image (coloured) and 3-D wireframe model of the Dana North Zone and Pine Zone (covered), River Valley Palladium Project near Sudbury (Ontario, Canada). Note from the inset map that the River Valley Palladium Project is located 60 linear km ENE of the City of Sudbury.

Discussion

The Palladium mineralization at the Pine Zone remains open to expansion by drilling to the east, particularly testing a strong IP chargeability high located about 400 metres along strike, and also by drilling down-dip to the south. Palladium mineralization was also broadly established at the connection of the Pine Zone to the Dana North Zone.

The results of the 2020 Phase 1 drilling bring the cumulative total number of holes intersecting the Pine Zone to 33. The number of Palladium mineralized intersections within the Pine Zone now totals 41, over an area measuring up to 250 metres along strike and 550 metres down-dip.

Note again that the Pine Zone remains open down-dip and particularly to the east, where the most tantalizing IP chargeability high is located.

Assay Procedures & QA/QC

The 2020 Phase 1 drilling was completed by Jacob & Samuel Drilling Ltd. of Sudbury, Ontario under the supervision of NAM geologists. The drill core samples were sent to the SGS Canada Inc. Laboratory in Lakefield, Ontario for sample preparation and assay analyses. The preparation involved crushing of 3 kg of each sample to 90% passing 2 mm, and then pulverizing 0.5 kg to 85% passing 75 um. Palladium, Platinum and Gold were assayed by fire assay with ICP-AES finish (GE-FAI313). Copper, Nickel and 32 additional metals were assayed by two acid digestion and ICP-OES finish (GE-ICP14B). Blanks and blind certified standard samples were submitted at regular intervals for assay with the core samples as part of NAM’s rigorous Quality Assurance/Quality Control program.

Next Steps

NAM is considering its next steps in Palladium exploration and project development at River Valley in 2020. The next steps include any one or a combination of the following activities:

– Analyze significant Palladium core intersections in the Pine Zone for Rhodium;

– Update the 3-D geological modelling of the Pine Zone;

– Carry out further environmental baseline studies (including an archaeological survey);

– Complete Phase 2 drilling, particularly at the priority footwall IP chargeability high,

the Pine Zone-Dana North Zone connection, and down-dip;

– Conduct borehole-IP surveys for off-hole anomalies outside the known resource; and

– Undertake Phase 2 metallurgical studies

The purpose of these activities would be to advance the River Valley Palladium Project and support the Prefeasibility study planned for 2021-22.

About the River Valley Palladium Project

The details of the updated Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) were announced in the press release dated August 9, 2019 and are described on NAM’s website. The pit constrained Updated Mineral Resource Estimate formed the basis of the PEA. At a cut-off grade of 0.35 g/t PdEq, the Updated Mineral Resource Estimate contains 2.867 Moz PdEq in the Measured plus Indicated classifications and 1.059 Moz PdEq in the Inferred classification. The PEA is a preliminary report, but it demonstrates that there are potentially positive economics for a large-scale mining open pit operation, with 14 years of Palladium production. Refer to the NAM website (www.newagemetals.com) for details.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration and development of green metal projects in North America.

The Company has two divisions; a Platinum Group Metals division and a Lithium/Rare Element division. The PGM division includes the 100% owned River Valley Project, one of North America’s largest undeveloped Platinum Group Metals Projects, situated 100 km from Sudbury, Ontario and the Genesis PGM Project in Alaska. The Lithium division is the largest mineral claim holder in the Winnipeg River Pegmatite Field where the Company is exploring for hard rock lithium and various rare elements such as tantalum and rubidium. Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production. New Age Metals is a junior resource company on the TSX Venture Exchange, trading symbol NAM, OTCQB: NMTLF; FSE: P7J with 137,347,966 shares issued to date.

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to [email protected] or Harry Barr at [email protected] or Cody Hunt at [email protected] or call 613 659 2773.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

Qualified Person

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Bill Stone, P.Geo., a consulting geoscientist for New Age Metals. Dr. Stone is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.