- – A minimum of $500,000 will be expended in 2018 on the companies Lithium division by New Age Metals (NAM) option/joint venture partner Azincourt Energy Corp. (TSX.V: AAZ)

(see news release dated January 15th, 2018).

- – Lithium management committee formed and first management committee meeting complete.

– The Lithium Division’s 5 projects, 3 of which are drill ready, cover over 6,000 hectares and are one of the largest claim holdings in the Winnipeg River Pegmatite field (64 square kilometres).

– NAM’s technical team is the field manager of the project and is currently finalizing a Phase 1 exploration plan for 2018. Further announcements will be forthcoming.

- – PGM Division: River Valley is the largest undeveloped primary Platinum Group Metals (PGM) resource in Canada, with 3.9Moz PdEq in Measured Plus Indicated including an additional1.2Moz PdEq inInferred. The 100% owned River Valley PGM Project has excellent infrastructure and is within 100 kilometers of the Sudbury Metallurgical Complex.

– Updated NI 43-101 resource calculations with WSP Canada have commenced and the report is expected to be completed in Q1-2018.

– Ground IP geophysics in progress to test further footwall regions of the T4 to T9 anomalies for additional footwall mineralization

– Mineralogical testing is ongoing in Sudbury at Expert Process Solutions (XPS).

– The price of Palladium, the prominent metal at River Valley is trading at $1,028.30USD (March 2018) near its all-time high based on limited supply and increasing demand.

February 22nd, 2018 / TheNewswire / Vancouver, Canada – New Age Metals Inc.(NAM) (TSX.V: NAM; OTCQB: PAWEF; FSE: P7J.F) Harry Barr, Chairman & CEO, stated; “We are pleased to update our shareholders and interested parties as to our present exploration program on our 5 Manitoba Lithium Projects and update you on our River Valley PGM project. Both of the company’s mineral divisions have aggressive exploration and development plans for 2018 and the balance of this release will provide you with more specific details.”

Exploration Plans for Lithium Division 2018

The Company has five pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in South East Manitoba.

In January, NAM announced a signed final agreement with Azincourt Energy Corp. (TSX.V: AAZ) for the Manitoba Lithium Projects. (News Release: January 15th, 2018) This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969 at the Tanco Mine. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM, under its subsidiary Lithium Canada Developments, is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field for Lithium. Azincourt Energy Corp. as our option/joint venture/funding partner, is financed for and has committed to a minimum of $500,000 to be expended on exploration this year in Manitoba. A management committee has been formed and plans are being formalized to begin the exploration process as early as possible in 2018. As per our agreement with Azincourt, it has the option to commit up to $3.85 million dollars in exploration, issue up to 3 million shares of Azincourt stock to NAM, pay NAM up to $210,000 in cash, and NAM will receive a 2% net smelter royalty on all 5 projects. Phase 1 of the 2018 program is in progress, further announcements will be forthcoming. (see Jan 15th 2018 Press Release)

Click Image To View Full Size

Figure 1: NAM Lithium Projects Manitoba

Lithium Prices and Performance

Lithium is in demand in a wide range of sectors worldwide. Last year, total consumption estimates are over 170kt Lithium Carbonate Equivalent. (Batteries had the largest share at 32%, followed by ceramics and glass at 27%.) Prior to 2015, ceramics and glass had the largest demand, but electric vehicle sales growth in 2015 resulted in batteries becoming the highest demand sector.While many commodities struggle for consumption growth, Lithium demand had an estimated growth of 8% Year over Year and has a forecasted 9% compounded annual growth rate to 2021. “Demand for battery-grade lithium compounds is expected to skyrocket in the next decades in tandem with soaring demand for electric cars as governments and individual consumers try to reduce their carbon footprint (Reuters on Fortune.com).”

Current Market Awareness Program

Conferences This Quarter

In early February, our President Trevor Richardson was in South Africa attending 3 conferences with a full schedule, including two 1-2-1 style conferences with over 25 pre-booked meetings with mine finance companies, major mine companies, institutions, stock brokers, and high net worth individuals. In mid-February, Harry Barr (CEO) and Paul Poggione (Corporate Development), had 18 pre-booked meetings at the Capital Event Conference in Whistler to meet new and existing investors, stockbrokers and institutions. In March, the entire New Age Metals team will assemble at the PDAC in Toronto (The world’s largest mining conventions), and we will also attend two smaller mining conferences before the PDAC, RAI$E Capital March 2nd where management has approximately 20 1-2-1 meetings booked and Saturday March 3rd management will be attending the Metals Investor Forum Conference, to continue our New Age Metals market awareness program. In April, management will be attending a second Capital Event conference in Arizona, which is another 1-2-1 style conference.

Third Party Social Media, Radio and Digital Marketing Campaigns

In late January, NAM signed contracts with both Stockhouse.com and Investing News Network (a fully owned subsidiary of Dig Media Inc.). We are pleased to be working with these two companies who are in contact with thousands of investors daily. In mid-February, NAM signed a contract with Corporate Profile Minute on the Larry Kudlow Show, which is America’s #1 Wall Street radio show, catering to fund managers, investment advisors, stock brokers, and personal investors.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

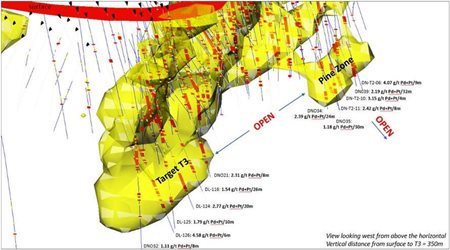

River Valley PGM Division, Sudbury, Ontario: Ground IP Geophysics Underway

The current geophysical survey on our River Valley PGM Project is a high-resolution OreVision(R) IP survey performed by Abitibi Geophysics, (Thunder Bay, Ontario), who completed last year’s survey on our new discovery, the Pine Zone to T-3 target. New drill discoveries have been made in this region from 2015-2017. OreVision IP can reveal targets at four times the depth of conventional IP without compromising near-surface resolution. The goal of the geophysical survey is to test the footwall portion to the main River Valley PGM Deposit, southward of the Pine Zone IP survey (News Release: Jun 19th, 2017) and to cover the area between target anomalies T4 to T9 (Figure 2). This area represents a survey strike length of approximately 2000 metres. The geophysics is now complete and the final report is expected before the end of March 2018. Upon completion of the present geophysical survey and management having the opportunity to review the final report, the company will outline a series of drill programs to test the new geophysical anomalies generated from the survey (T4-T9) and outline additional drilling to the north in Pine Zone and T3 where only Phase 1 Drilling has been completed to date. (see Feb. 7th, 2018 Press Release)

Click Image To View Full Size

Figure 2: Drill Hole Distribution Map in the Northern Portion of the River Valley PGM Deposit Showing Regions of Upcoming IP Geophysics. NOTE: Image only represents approximately 3.5 km of the overall strike length of the River Valley PGM deposit.

New Updated Resource Model, NI 43-101

WSP Canada (News Release: Sept 7th, 2017) is progressing through the new resource calculation for the River Valley PGM Deposit under the supervision of Todd McCracken, Manager-Mining at WSP Canada and is slated to be complete before the end of the first quarter of 2018. The new resource model and calculation will incorporate all the past data, geophysics, new drilling since 2012 and the River Valley Extensions (RVE). In 2016, the company purchased 100% of Mustang Minerals’ southern portion of the River Valley contact (River Valley Extension, News Release – Oct 5th, 2016). This added 4 kilometers of mineralized strike length to the southern portion of the company’s main River Valley Project. Approximately $5,000,000 was expended on the RVE by previous operators, including extensive drilling. This exploration work will be included in the upcoming River Valley resource calculation.

(see Feb 7th Press Release)

Mineralogical Studies

Expert Process Solutions (XPS), based in Falconbridge, Ontario has been engaged to perform mineralogical studies of the PGM mineralization. XPS provides world class quantitative mineralogy for ore body characterization and metallurgical technology services for operational support, growth initiatives and project development. They have extensive experience in many commodities including the Platinum Group Metals (PGM’s). Management believes that a better understanding and characterization of the River Valley PGM mineralization will be a guide in future endeavors and development work including improved flowsheet and processing options in preparation for a Preliminary Economic Assessment (PEA) Report. Major companies within the Sudbury Mining Complex have extra capacity to treat PGM ores.North American Palladium, Canada’s only primary producer of PGMs, ships all its concentrates approximately 1,000 km from its Thunder Bay, Ontario Lac-des-Iles mine to the Sudbury Mining Complex for processing.

River Valley PGM Exploration Plan Going Forward

To date an approximate 140,659 meters (461,480 feet) in 628 drill holes have been conducted by the company as operator on the River Valley Project. Several independent 43-101 compliant resource estimates have previously been generated for the deposit through the exploration and development phases. The River Valley Deposit’s present resource, with approximately 3.9M PdEq ounces in Measured Plus Indicated mineral resources and near-surface mineralization, covers over 12 kilometers of continuous strike length. The acquisition of the RVE adds an additional 4 kilometers for a total of 16 kilometers of strike. The company continues to explore and enhance the River Valley PGM Deposit.

River Valley PGM Goals & Objectives

During the next year the company’s exploration & development objectives are:

- 1.Complete ground IP geophysics (Q1 2018);

- 2.Complete a new resource calculation (slated for end of Q1 2018);

- 3.Continue with drilling in the northern portion of the project (slated for Q3-Q4 2018 & Q1 2019);

- 4.Explore more target areas based on recommendations of the updated 43-101 and the 2018 geophysics (slated for Q3-Q4 2018 & Q1-Q2 2019);

- 5.Complete mineralogical studies (Q2 2018); and

- 6.Continue to advance the River Valley PGM Project towards a Preliminary Economic Assessment (PEA) on the River Valley PGM Deposit.

Click Image To View Full Size

Figure 3: The Yellow Band represents the interpolated footwall potential area of the River Valley Deposit based on the results of the Pine Zone where footwall mineralization was noted to extend 140 meters eastward from the main deposit. At present the only area that has confirmed footwall mineralization is in the Pine Zone (defined from 2015 to 2017 drilling). Exploration is in progress to test other areas of the deposit.

Platinum Group Metal Prices & Performance

We are encouraged about the economics surrounding PGMs as we continue to see ongoing deficits being forecasted in both Platinum and Palladium. Most recently the price of Palladium, our primary metal at River Valley, has hit an all-time high, and outpaced all other commodities in 2017 and over the past 10 years. Our second most important metal Platinum, has come off its bottom price in late 2017 and has increased substantially to date. As a reminder to our shareholders and investors our River Valley Project also contains: Gold, Silver, Copper, Nickel, and Rhodium, most of which have experienced recent price increases.

Recently the World Platinum Investment Council forecasted a deficit in Platinum production for the next 5 consecutive years. Palladium for the 10 years from 2008-2017, has averaged 21.5% per annum while Gold averaged only 5.8% per annum over that same period. Both Platinum and Palladium, (outside of their extensive uses in catalytic converters which convert harmful gasses from hydrocarbon emissions into less harmful substances in vehicles), are considered precious metals, like Gold and are seen as a store of value.

ABOUT NAM’S LITHIUM DIVISION

The Company has five pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is the largest mineral claim holder for Lithium in the Winnipeg River Pegmatite Field. On January 15th 2018, NAM announced an agreement with Azincourt Energy Corporation (see Jan 15, 2018 Press Release) whereby Azincourt will commit up to $3.85 million dollars in exploration, up to 3 million shares of Azincourt stock to NAM, up to $210,000 in cash, and a 2% net smelter royalty on all 5 projects. Exploration plans for 2018 are currently in progress.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is Canada’s largest undeveloped primary PGM deposit with Measured + Indicated resources of 91 million tones @ 0.58 g/t Palladium, 0.22 g/t Platinum, 0.04 g/t Gold, with a total metal grade of 1.28 g/t at a cut-off grade of 0.8 g/t PdEq for 2,463,000 ounces PGM plus Gold.This equates to 3,942,910 PdEq ounces.In the Northern portion of the project (Dana North), not including the new high-grade Pine Zone, there is 24 million tonnes @ 1.58 PdEq.The River Valley PGM mineralized zones remain open to expansion.The company has recently completed a phase one drill program on the Pine and T3 Zones.

In 2016, the Company acquired the River Valley extension property from Mustang Minerals which added approximately 4 kilometres to the project’s mineralized strike length to the southern portion of the intrusion.

On February 7th 2018 NAMs management announced an aggressive 2018 exploration and development program on the River Valley Project, which includes a large geophysical program, the updated 43-101 resource calculation, and a program to outline drill targets on the company’s newly discovered footwall mineralization zones. (see Feb. 7th, 2018 Press Release)

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2018 TheNewswire – All rights reserved.