- American Creek’s JV Partner Tudor Gold Intersects 1,152 Meters of 0.741 gpt AuEq, Including 1.561 gpt AuEq over 121.5 Meters and 0.968 gpt AuEq over 414 Meters with Hole GS-20-75

Step-Out Hole GS-20-70 Extends the Goldstorm 300 Horizon and CS-600 Zone Another 150 Meters to the Northeast as Drilling Continues with Six Drills at Treaty Creek

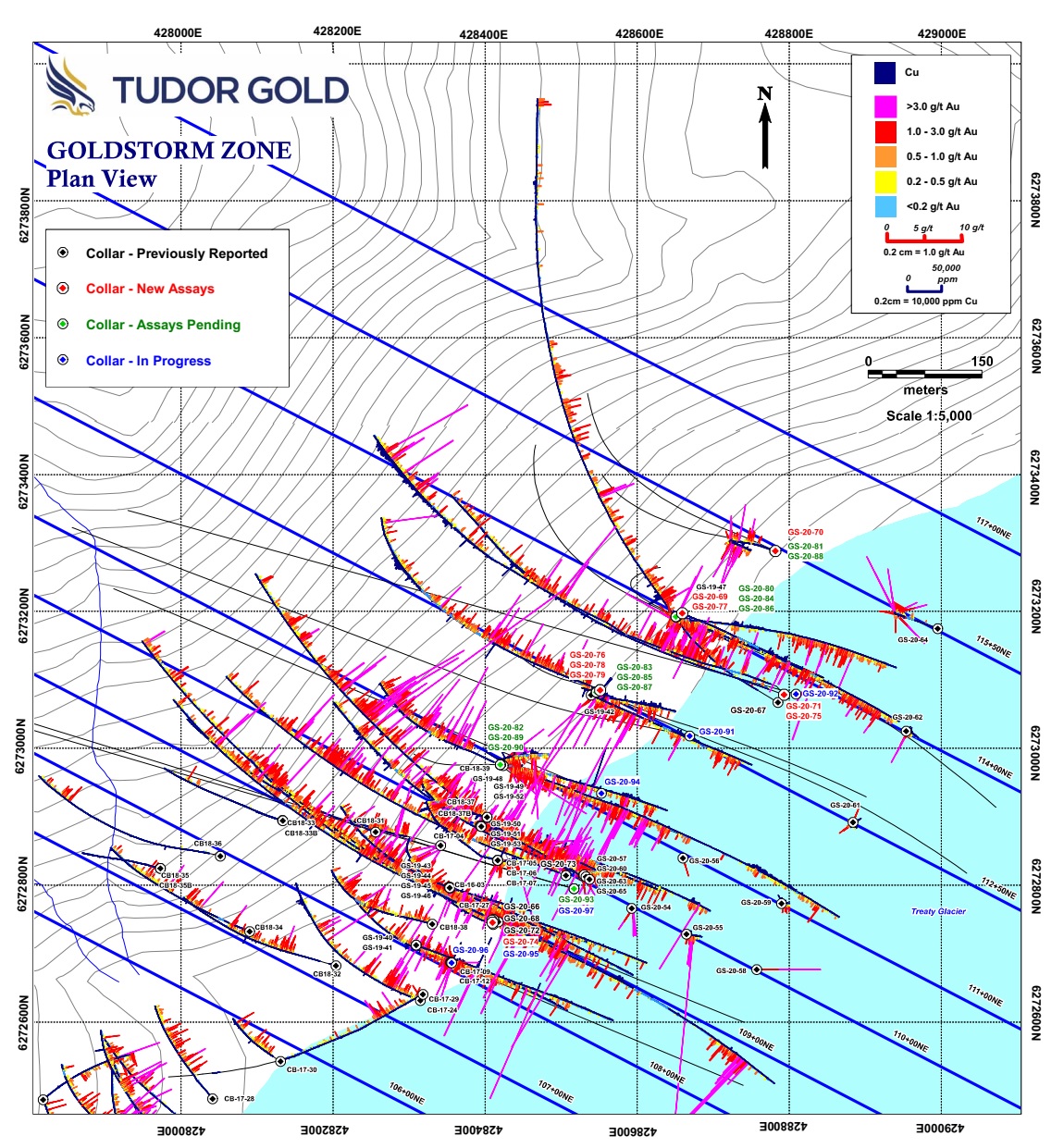

Cardston, Alberta–(Newsfile Corp. – October 26, 2020) – American Creek Resources Ltd. (TSXV: AMK) (“the Corporation”) is pleased to present results for the fourth set of diamond drill holes at their flagship property, Treaty Creek, located in the heart of the Golden Triangle of Northwestern British Columbia. Diamond drilling continues with six drill rigs currently working on the Goldstorm Zone which is on-trend from Seabridge’s KSM Project, 5 km to the southwest. All nine of the recent drill holes have successfully intersected the Goldstorm System expanding the mineralization to the northeast and southeast, as well as to depth. The Goldstorm System 300 Horizon has now been traced for 1100 meters along the northeast axis and in addition, the CS-600 and DS-5 systems have been expanded to the northeast and to depth as well. All 26 drill holes completed at Goldstorm during the 2020 program have encountered significant precious metal mineralization.

Tudor Gold’s Vice President of Project Development, Ken Konkin, P.Geo., stated: “The goal is to drill-define the limits of the Goldstorm system mineralization. We are very pleased with the results obtained from the 2020 drill holes that have yet to define limits or boundaries to the mineralized target along the northeastern and the southeastern axes, and to depth as well as we keep encountering mineralization versus non-mineralized host rock. Drill hole results from GS-20-75 demonstrate that several aspects of the mineralized horizon appear to be gaining strength at depth with significant Au-Cu-Ag mineralization encountered in the CS-600 zone which averaged 0.968 gpt AuEq over 414 meters. Our technical team has to date received drill hole results from 26 diamond drill holes at Goldstorm and three holes from the PSZ Zone, totaling 24,343.6 meters. Samples from 12 drill holes are awaiting results from MSA Labs, totaling 12,443.7 meters, with six additional holes currently being drilled that are expected to total more than 6,500 meters. The information released to date represents just over half of the drill information we plan to collect for this year’s program at Goldstorm. We have also received good news from MSA Labs that they hope to get back to our scheduled 15-day turn-around-time for results. We are confident that our combined efforts will expediate the news flow for the near-future.”

Goldstorm Highlights include:

- Nine diamond drill holes in this release totaled 10,234.2 meters, all hitting the intended targets with favorable results listed in the tables below.

- Best intercept was from GS-20-75 on Section 114+00 NE that averaged 0.741 gpt AuEq over 1152.0 metres (112.0-1264.0 m) containing an enriched portion of 121.5 meters (232.0-353.5 m) that averaged 1.561 gpt AuEq.

- GS-20-75 also had a remarkable 414.0 meter intercept (833.5-1247.5 m) of 0.968 gpt AuEq within the CS-600 Zone, which is the longest intercept for CS-600 drilled to date.

- Tudor Gold has surpassed the previous longest mineralized intercept with GS-20-79 on section 112+00 NE, 150 meters southwest of GS-20-75. This hole intersected 1338 meters (81.5-1419.5m) of 0.595 gpt Au Eq with the upper portion of the 300 Horizon averaging 0.877 gpt AuEq over 484.5 meters (81.5-566.0 m).

- A 150 meter extension of the 300, CS-600 and DS-5 Zones was confirmed by an aggressive step-out to the northeast with hole GS-20-70 on section 115+50 NE. The intercept averaged 0.500 gpt AuEq over 1218.0 meters and mineralization remains open to the northeast, northwest and southeast along Section 115+50 NE.

- The DS-5 System appears to be gaining strength to the northeast; hole GS-20-64, the north-easternmost hole, returned the strongest result for DS-5, averaging 0.983 gpt AuEq over 550.55 meters with an enriched portion averaging 1.482 gpt AuEq over 154.5 meters (Press Release July 27, 2020).

The following three tables below provide the complete list of composited drill hole results as well as the drill hole data including hole location, elevation, depth, dip and azimuth.

Table l: DDH Data October 26, 2020 Press Release

To view an enhanced version of Table I, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreektable1enhanced.jpg

Table ll : Gold equivalent composite values from nine Goldstorm Zone DDH’s.

To view an enhanced version of Table II, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreektable2enhanced.jpg

- All assay values are uncut and intervals reflect drilled intercept lengths.

- HQ and NQ2 diameter core samples were sawn in half and typically sampled at standard 1.5m intervals.

- The following metal prices were used to calculate the Au Eq metal content: Gold $1322/oz, Ag: $15.91/oz, Cu: $2.86/lb. Calculations used the formula Au Eq g/t = (Au g/t) + (Ag g/t x 0.012) + (Cu% x 1.4835). All metals are reported in USD and calculations do not consider metal recoveries. True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths.

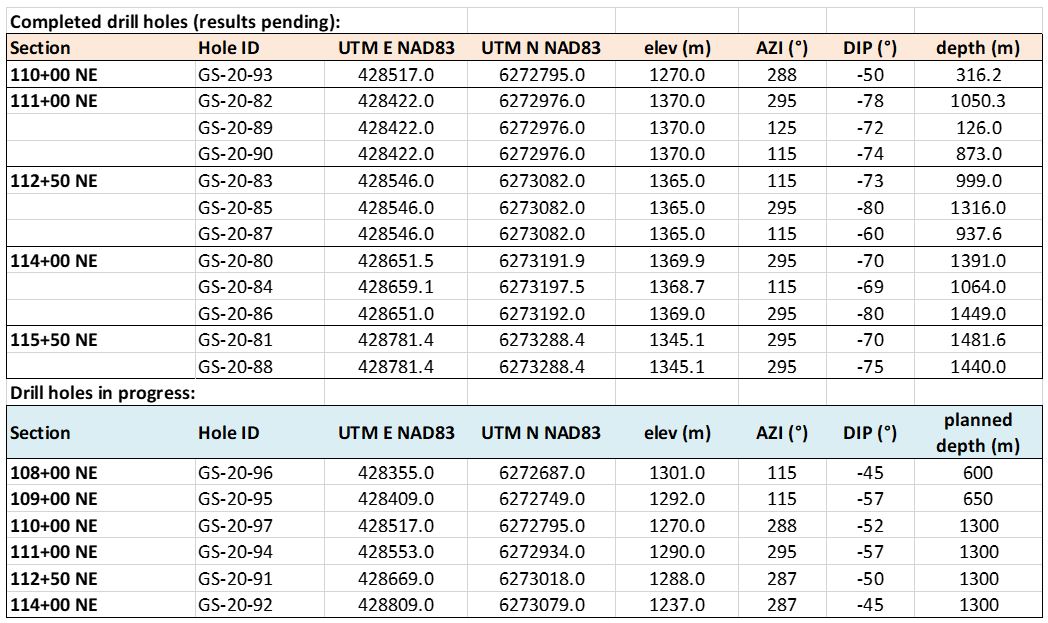

Table lll: Drill Data for Holes Completed, Pending Results and Currently Drilling

To view an enhanced version of Table III, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreektable3enhanced.jpg

Attached are Sections 109+00 NE, 112+50 NE, 114+00 NE and 115+50 NE showing holes traces with gold and copper histogram results and a Plan Map showing the drill hole and section locations.

Walter Storm, President and CEO, stated: “For the fourth consecutive press release this year, we again are very pleased to announce a result that surpassed our finest result from the 2019 drill program. Last year, we had an excellent intercept from hole GS-19-47, which yielded 0.697 gpt Au Eq over 1081.5 meters (Section 114+00 NE)- and now we have yet another hole, GS-20-75 with a comparable result that was drilled along the same section but in the opposite direction from GS-19-47. Drill hole GS-20-75 averaged 0.741 gpt Au Eq over an impressive 1152.0 meters. With every hole our technical team completes, we are further defining the mineralized area. Clearly, however, much more drilling is required to locate the limits of the system due to the size and robust nature of the mineralization. Our commitment is to advance the project as far as possible this year and our team will push the winter elements to continue drilling as long as the conditions permit. We are proud of what we have achieved in these last two years of exploration. Given the amount of geological potential that the entire project possesses with the Goldstorm, Perfect Storm Z, Eureka and Orpiment Systems, we believe that similar results will continue to enhance the prospects for the Treaty Creek Project.”

Darren Blaney, CEO of American Creek commented: “The Goldstorm continues to impress. Yet another step out hole has hit significant gold mineralization and has extended the zone another 150m to the northeast. Even after all this 2020 drilling, we still don’t know the extent or bounds of the Goldstorm but clearly, it’s a truly massive gold zone. I congratulate Walter, Ken, and the whole Tudor team on the incredible effort and the associated incredible success as they continue to keep six drills turning at Treaty Creek. I also commend Sean and the More Core Drilling team for their commitment and Get it Done attitude and professionalism.”

Tudor Gold Corp and associated service companies have taken extreme measures to maintain the highest professional standards while working within COVID-19 health and safety protocols. Only essential personnel are permitted to enter the camp and staging areas. Of those who are at the project site and staging site, we have strict daily monitoring of the workers’ temperatures and general health conditions. We have a certified paramedic at the staging area to examine all in-coming and out-going Tudor personnel and all service providers.

The Treaty Creek Project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek. American Creek and Teuton are both fully carried until such time as a Production Notice is issued, at which time they are required to contribute their respective 20% share of development costs. Until such time, Tudor is required to fund all exploration and development costs while both American Creek and Teuton have “free rides”.

Treaty Creek Background

The Treaty Creek Project lies in the same hydrothermal system as Pretium’s Brucejack mine and Seabridge’s KSM deposits with far better logistics.

For a better understanding of the mineralized zones at the Goldstorm, please view this video (which shows the original 20,000m planned drill program opposed to the 40,000m+ drill program that has taken place).

https://orders.newsfilecorp.com/files/682/66819_f86fe5d5142ddbed_004full.jpg

About American Creek

American Creek is a Canadian junior mineral exploration company with a strong portfolio of gold and silver properties in British Columbia.

Three of those properties are located in the prolific “Golden Triangle”; the Treaty Creek JV with Tudor Gold/Walter Storm, the D-1 McBride, and the 100% owned past producing Dunwell Mine.

The Corporation also holds the Gold Hill, Austruck-Bonanza, Ample Goldmax, Silver Side, and Glitter King properties located in other prospective areas of the province.

See additional images of drill locations in this press release at www.americancreek.com.

For further information please contact Kelvin Burton at: Phone: 403 752-4040 or Email: [email protected]. Information relating to the Corporation is available on its website at www.americancreek.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Actual results could differ materially because of factors discussed in the Corporation’s management discussion and analysis filed with applicable Canadian securities regulators, which can be found under the Corporation’s profile on www.sedar.com. The Corporation does not assume any obligation to update any forward-looking statements.

Goldstorm Zone Plan View

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreekfigure1enhanced.jpg

Goldstorm Zone Section 109+00 NE

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreekfigure2enhanced.jpg

Goldstorm Zone Section 112+50 NE

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreekfigure3enhanced.jpg

Goldstorm Zone Section 114+00 NE

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreekfigure4enhanced.jpg

Goldstorm Zone Section 115+50 NE

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/682/66819_americancreekfigure5enhanced.jpg