- Drills 20.33 m of 2.47 g/t Au at Adumbi

TORONTO, Nov. 30, 2020 (GLOBE NEWSWIRE) — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQX: “LONCF”; FSE: “LO51”) is pleased to announce that the first core hole of a 7,000 metre drilling program at its Adumbi deposit has intersected multiple gold sections including 20.33 metres grading 2.47 g/t gold (including 4.8 metres grading 5.40 g/t Au), 7.33 metres grading 5.80 g/t Au and 20.77 metres grading 1.72 g/t Au, on its 84.68% owned Imbo Project in the eastern part of the Ngayu greenstone belt in the Democratic Republic of the Congo (see Figure 1).

Mineralized sections are summarised in the table below:

| Borehole Number | From (m) | To (m) | Intersected Width (m) | Grade (g/t) Au |

| LADD001 | 202.58 | 223.35 | 20.77 | 1.72 |

| LADD001 | 231.27 | 237.17 | 5.90 | 1.89 |

| LADD001 | 251.27 | 258.60 | 7.33 | 5.80 |

| LADD001 | 295.25 | 298.70 | 3.45 | 2.10 |

| LADD001 | 301.62 | 321.95 | 20.33 | 2.47 |

| LADD001 | Incl. 317.11 | 321.95 | 4.80 | 5.40 |

Borehole LADD001 had an inclination of minus 65 degrees and azimuth of 220 degrees at the start of hole and regular measurements of inclination and azimuth were taken at 30 metre intervals down the hole. All core was orientated and it is estimated that the true widths of the mineralised sections are 82% of the intersected width. All intercepted grades are uncut.

The gold mineralization at Adumbi is associated with a thick package (up to 130 metres) of interbedded banded ironstone and quartz carbonate and chlorite schist with higher grade sections being found in a strongly altered siliceous unit termed “Replaced Rock” (RP) where structural deformation and alteration has completely destroyed the primary host lithological fabric. Disseminated sulphide assemblages include pyrite, pyrrhotite and arsenopyrite which can attain up to 20% of the total rock in places.

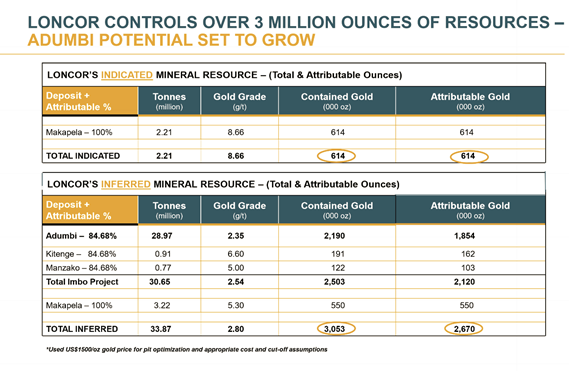

The objective of the 7,000 metre drilling program is to outline additional mineral resources to the current 2.5 million ounces on Loncor’s 84.68%-owned Imbo Project which contains the Adumbi, Kitenge and Manzako deposits (inferred mineral resources of 30.65 million tonnes grading 2.54 g/t Au). At the Adumbi deposit where there is a current inferred resource of 2.19 million ounces of gold (28.97 million tonnes grading 2.35 g/t Au), drilling is targeting mineralized zones within the US$1,500 open pit shell where closer spaced holes such as LADD001 are required to delineate additional mineral resources. Drilling will also focus on outlining mineral resources below the pit shell where the gold mineralization remains open at depth over a strike length of over 600 metres.

In addition to core hole LADD001, LADD003 has now been completed to the southeast of LADD001 and within the open pit shell and will be submitted for assay. Deeper holes LADD004 and LADD005 are currently being drilled to intercept the downdip/down plunge mineralized zone below the open pit (see Figure 2 – Longitudinal Section of the Adumbi Deposit). Hole LADD004 is targeting mineralization 150 metres below previous hole S53 drilled in 2017 which intersected 23.5 metres grading 6.08 g/t Au and 9.37 metres grading 3.70 g/t at the base of the open pit shell.

Commenting on these drilling results, Loncor President Peter Cowley said: “We are encouraged by the results of this first hole of our 7,000 metre drilling program at Adumbi where we are targeting a significant increase of resources, both within and below the open pit shell. Exploration is also ongoing on new targets along the 14 kilometre long mineralized trend on the Imbo permit in order to generate additional drill targets. If we achieve our objectives, the next step will be a Preliminary Economic Assessment to illustrate the positive economic potential that we believe is contained within Adumbi and the neighbouring deposits and other targets within the Imbo exploitation permit.”

Quality Control and Quality Assurance

Drill cores for assaying were taken at a maximum of one-metre intervals and were cut with a diamond saw, with one-half of the core placed in sealed bags by Company geologists and sent to the Company’s on-site sample preparation facility. The core samples were then crushed down to 80% passing minus 2 mm and split with one half of the sample up to 1.5 kg pulverized down to 90% passing 75 microns. Approximately 150 grams of the pulverized sample was then sent to the SGS Laboratory in Mwanza, Tanzania (independent of the Company). Gold analyses were carried out on 50g aliquots by fire assay. In addition, check assays were also carried out by the screen fire assay method to verify high-grade sample assays obtained initially by fire assay. As part of the Company’s QA/QC procedures, internationally recognized standards, blanks and duplicates were inserted into the sample batches prior to submitting to SGS Laboratory.

Qualified Person

Peter N. Cowley, who is President of Loncor and a “qualified person” as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 17, 2020 and entitled “Independent National Instrument 43-101 Technical Report on the Imbo Project, Ituri Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Additional information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled “Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

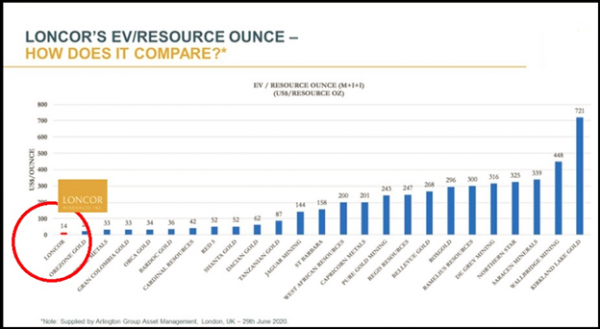

About Loncor Resources Inc.

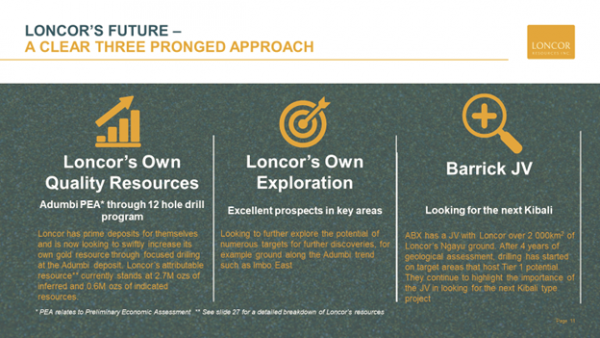

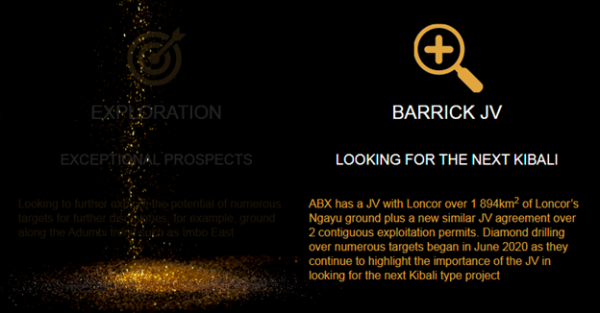

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 220 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (TSX: “ABX”; NYSE: “GOLD”). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs” of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in approximately 2,000 km2 of Loncor ground in the Ngayu Greenstone Belt that they are exploring. As per the joint venture agreements entered between Loncor and Barrick, Barrick manages and funds exploration on the said ground until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and have commenced confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

In addition to the Barrick joint ventures, certain parcels of land within the Ngayu Belt surrounding and including the Adumbi and Makapela deposits have been retained by Loncor and do not form part of any of the joint ventures with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 84.68% of this resource being attributable to Loncor via its 84.68% interest in the project. Loncor’s Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com.