SPONSOR: Lomiko Metals is focused on the exploration and development of minerals for the new green economy such as lithium and graphite. Lomiko owns 80% of the high-grade La Loutre graphite Property, Lac Des Iles Graphite Property and the 100% owned Quatre Milles Graphite Property. Lomiko is uniquely poised to supply the growing EV battery market. Click Here For More Information

- TESLA REACHES $100 BILLION MARKET CAPITALIZATION WHILE MORGAN STANLEY PREDICTS $1200 LEVEL COMING SOON

Toronto, Ontario, Feb. 25, 2020 (GLOBE NEWSWIRE) — Lomiko Metals Inc. (“Lomikoâ€) (TSX-V: LMR, OTC: LMRMF, FSE: DH8C) Lomiko Metals Inc. is pleased to announce that the company will attend the Prospectors & Developers Association Conference at the Metro Toronto Convention Centre March 1-4, 2020. Lomiko will be at booth #2547 in the Investors Exchange portion of the Conference. Lomiko is focused on developing graphite materials supply for the green economy.

Prospects for developing critical minerals mines in Quebec were buoyed when Canada and the US announced January 9, 2020 they have finalized the Canada-US Joint Action Plan on Critical Minerals Collaboration. The Plan is aimed to secure a North American supply chain for the critical minerals needed for manufacturing sectors, communication technology, aerospace and defense, and clean technology.

Canada has significant resources of graphite, lithium, cobalt, aluminum, and rare-earths.

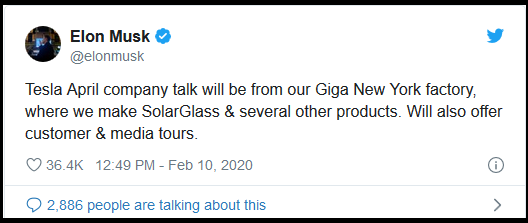

Media has also focused on Tesla in recent interviews with CEO A. Paul Gill who has consistently spoken about the coming change in consumer purchasing patterns. In the last decade, range anxiety and concerns over infrastructure have limited the penetration of electric vehicles in the North American market and this has cast doubt on the potential of Tesla. However, it is clear that those fears have been alleviated and with the onset of new electric vehicles from Ford, GM, BMW, Audi, Volkswagen, and others.

“Tesla stock price closing in on $ 1000 per share and its valuation has exceeded $ 100 billion. This is a major indicator that investors think electric vehicles will become mainstream. Every day, I see at least one or more. And every time I see one, I think about the battery it holds which contains up to 70 kgs of graphite.â€, stated A. Paul Gill, CEO of Lomiko Metals, “That’s why Lomiko looked for projects with good infrastructure, high grades, and high carbon purity so we could make strides toward participating in the supply chain of electric vehicles with materials such as spherical graphite and graphite anodes.â€

Mr. Gill has been interviewed on the Los Angles TV Show Big Biz and the Geekery Review in Salt Lake City, Utah focusing on Tesla, EV Batteries and Natural Flake Graphite.

For more information on Lomiko Metals, email: [email protected].

On Behalf of the Board

“A. Paul Gillâ€

CEO & Director

Attachment

A. Paul Gill Lomiko Metals Inc. (TSX-V: LMR) 6047295312 [email protected]