THIS IS AN UPDATE TO A POST ORIGINALLY MADE IN MARCH 2009

I originally posted this story in March of 2009 and concluded it by stating:

Wall Street is out of favor … waaayyy out of favor. Take advantage of the environment, get out there and show investors why you and your hard working small-cap company can be trusted.

So why am I repeating it? Take a look at the following quotes from two great sources this morning:

“Retail is absolutely moribund, there’s nothing going on in retail,†Sanford Bernstein’s Hintz said. “The retail investor has dug his foxhole and put on his helmet, and he’s just sitting there.â€Â Bloomberg – Wall Street Needs Off The Charts September To Rescue Quarter

“…the ongoing boycott by retail investors (who incidentally hold the bulk of the S&P’s market cap) of terminally broken capital markets may finally achieve more than all futile campaigns to pull deposits out of the TBTF banks ever could. It is no secret that regular, non computerized, investors have now shut out Wall Street as they now have absolutely no faith left in capital markets, a phenomenon we have been tracking since its inception.” Zero Hedge – Surging Retail Outflows Mean Worst Quarter For Wall Street Since 2008

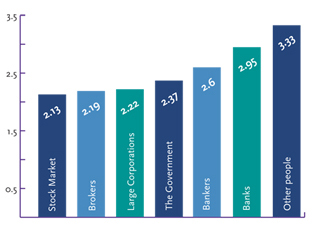

Since 2008, I’ve talked about the loss of trust being the greatest risk to markets. Specifically, investors can flow with market cycles and always come back. However, if they lose trust, it will take a long time for Wall Street to gain them back. Thanks to information provided by Dominic Jones over at IR Web Report, the data showed that trust was officially broken in 2009. He cites a number of reports here, here and here – but here are some of the highlights, starting with this telling graphic:

- Nearly two-thirds of investors (62%) trust corporations less than they did a year ago.

- Only 38% said they trust business to do what is right, a 20% plunge since last year.

- Only 17% said they trust information from a company’s CEO.

- In China, the “trust in business” score actually rose from 54% to 71% among 35-to-64-year-olds.

- Specialists remain the most trusted purveyors of information about a company, with 62% globally saying an academic or expert on a company’s industry or issues would be extremely or very credible.

- Employees and peers are also considered credible sources of information about a company, with 47% trusting what they hear from “a person like yourself” and 40% trusting conversations they have with employees.

LOST WALL STREET TRUST IS POTENTIAL SMALL CAP GAIN

In short, investors don’t trust Wall St CEO’s – but they do still trust people like themselves. Most Small-Cap CEO’s fit the description perfectly because they are typically people that resemble retail investors far more than Wall Street CEO’s.

GET OUT FROM BEHIND THE PRESS RELEASE

This tells me quite clearly that there is no better time for an online investor relations campaign by small-cap companies. I say online because this mode of investor relations provides the most direct channel of communications with online retail investors. Specifically, videos, webcasts, audio interviews, blog posts and Twitter posts are simple and cost efficient ways to speak directly with retail investors. Take advantage of the opportunity because you may never have this kind of opportunity again.

If you have any fears about speaking with investors directly, just remember that you’ve already done it dozens of times at conferences, AGM’s and other real-world meetings. Get out from behind the press release. If you’re not already doing so, you have to ask yourself, Why Am I Not Talking To Investors? If you need help answering this question, give me a call and let’s start implementing a solution.

Wall Street is out of favor … waaayyy out of favor. Take advantage of the environment, get out there and show investors why you and your hard working small-cap company can be trusted.

Regards,

George