The Japan disaster overshadowed any and all other news in the world on Monday and Tuesday, including Libya and Bahrain, so it was pretty easy to miss press releases coming out of TSX Venture companies.

One of those press releases came out of Fire River Gold (FAU:TSXV) (FVGCF:OTCQX) (FWR:FSE) and it was simply spectacular. In fact, it is the press release of the week. Here are the headline numbers, followed by the press release:

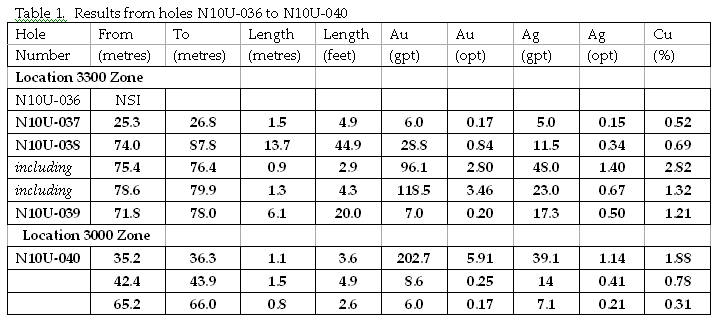

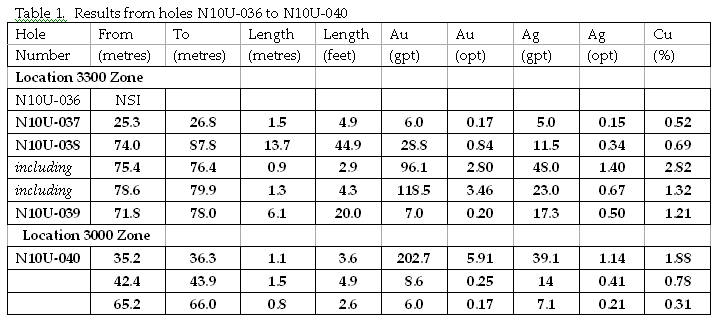

• 28.8 g/t (0.84 opt) gold over 13.7 m (44.9 ft) in hole N10U-038

o including 96.1 g/t (2.80 opt) gold over 0.9 m (2.9 ft)

o including 118.5 g/t (3.46 opt) gold plus 2.8% copper over 1.3 m (4.3 ft) at 3300 Zone

• 202.7 g/t (5.91 opt) Gold Over 1.0 m (3.6 ft) in hole N10U-040

o 8.6 g/t (0.25 opt) over 1.5 m (4.9 ft)

These results came out of the Company’s Nixon Fork Gold Mine In Alaska, which was acquired in September 2009. From 1995 – 2007, the project produced approximately 175,000 ounces of gold at an average grade of 39 grams per ton (1.14 opt).

GOLD PRODUCTION COMMENCING

As if the numbers on their own weren’t good enough, the company has announced that gold production is commencing in the summer of 2011 with a 200 tpd Mill and operating expenditures of $447/oz GOLD.

FULL PRESS RELEASE

March 14, 2011 Vancouver, Canada – Fire River Gold Corp (TSXV: FAU) (OTCQX: FVGCF) (FSE: FWR) (“FAU†or the “Companyâ€) is pleased to announce results obtained from the 2010 28,000 metre drill program at the Nixon Fork Gold Mine situated in Alaska’s Tintina Gold Belt. The Company has received assay results of holes 36 through 40 (N10U-036 – N10U-040) from the lower extension 3000 and 3300 Zones.

New significant intercepts include N10U-038 returning grades of 28.8 g/t (0.84 opt) gold over 13.7 m (44.9 ft), including 96.1 g/t (2.80 opt) over 0.9 m (2.9 ft) and including 118.5 g/t (3.46 opt) over 1.3 m (4.3 ft) at lower extension 3300 Zone and intercept N10U-040 returning grades of 202.7 g/t (5.91 opt) Gold Over 1.0 m (3.6 ft) at lower extension 3000 Zone. A complete list of significant intercepts is provided in Table 1. The widths of the intercepts are approximate to the true width of the mineralized intercept.

The Company is once again encouraged with the results from the 2010 drill program, because it is exhibiting the potential to provide additional resources to the mill. Drill results are being used to guide the six-month operating plan for the mine start up.

All core from the 2010 program was logged at the Nixon Fork Mine camp. The core was then sawn in half, and half of the sample shipped to ALS Minerals, a certified analytical laboratory located in Reno Nevada and a subsidiary of ALS Laboratory Group.

Nixon Fork Gold Mine

The Nixon Fork Gold Mine was acquired in September 2009. From 1995 – 2007, the project produced approximately 175,000 ounces of gold at an average grade of 39 grams per ton (1.14 opt). The mining and processing facilities at Nixon Fork are permitted and bonded. The deposit is a gold-rich copper silver skarn typical of other skarn systems found throughout the world. At Nixon Fork, the higher grades are found in steeply plunging pipe-like bodies which are oxidized to depths of up to 350 meters below the surface. Oxidization of the system has resulted both in secondary copper and gold, with high grades and a “nuggety” distribution.

The Qualified Person for this news release is Richard Goodwin, P.Eng, President & C.O.O for Fire River Gold.

About Fire River Gold Corp.

Fire River Gold Corp. is a near term production company with an experienced technical team focused on bringing its flagship project, the Nixon Fork Gold Mine, back into production in 2011. The Nixon Fork Gold Mine is a permitted and bonded mine which include a ~200 tpd processing plant with a gravity gold circuit, sulphide flotation circuit and a gold recovery system (CIL circuit) that is scheduled to be completed by Summer 2011. The mine also includes a fleet of surface & underground mining vehicles, a self-contained power plant, maintenance facilities, drilling equipment, an 85 person camp, office facilities and a 1.2 km long landing strip.

Fire River Gold Corp is a member of the International Metals Group.

On behalf of the Board of Directors, I look forward to keeping you updated with our corporate developments.

Richard Goodwin

President & C.O.O

Markets Are Green This Morning

Markets Are Green This Morning