Lomiko Metals Interviewed at Venture Capital Radio

Why Invest in Graphite?

- Global consumption of natural graphite has increased from approximately 600,000 tonnes in 2000 to roughly 1.2 million tonnes in 2011

- Demand for graphite has been increasing by approximately 5 per cent per year since 2000 due to the continuing modernization of China, India and other emerging economies

- Graphite also has many important new applications such as lithium-ion batteries, fuel cells, and nuclear and solar power

- There is roughly 10-20 times more graphite in a lithium-ion battery than there is lithium

Quatre Milles Graphite Property

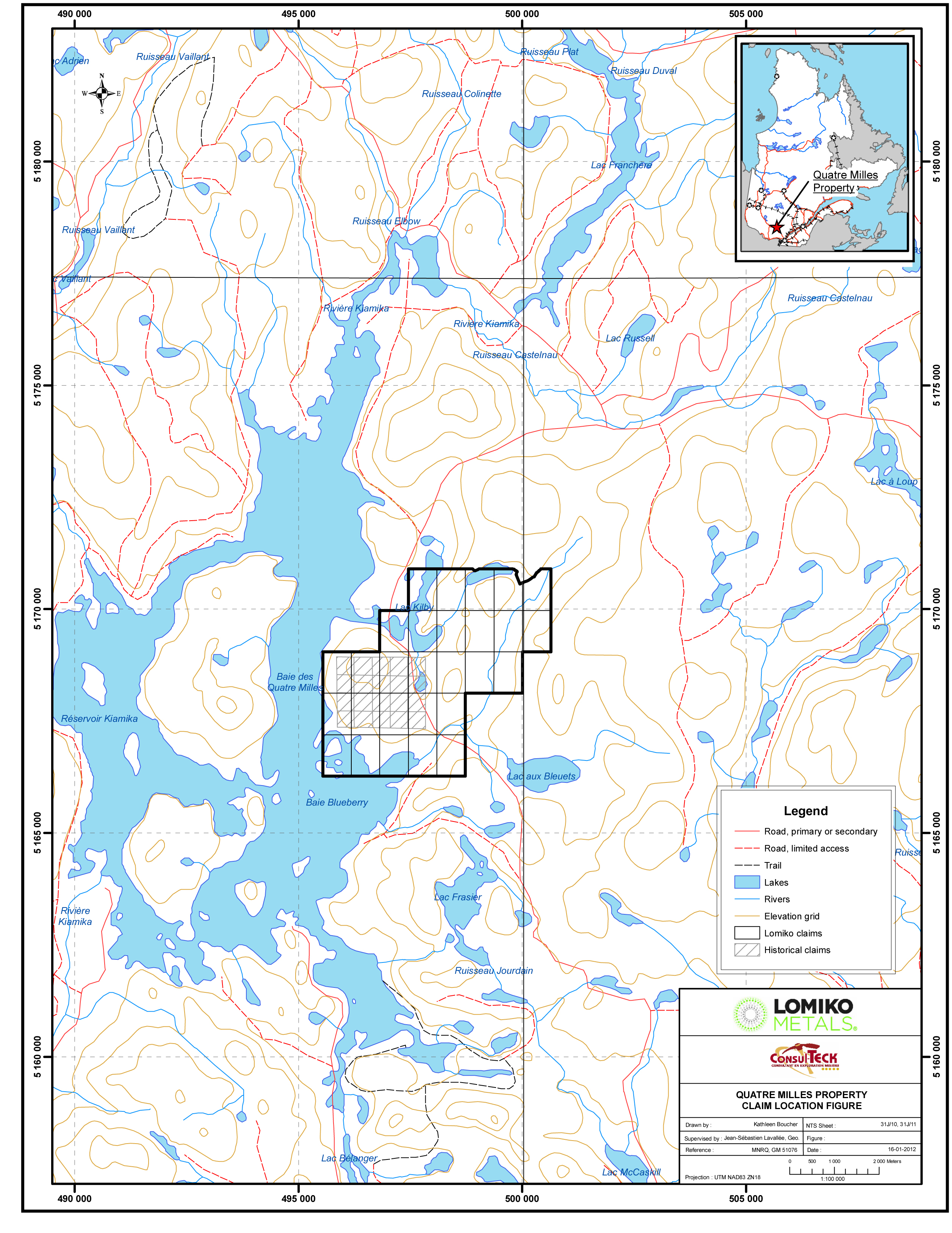

The Quatre Milles Property is road accessible and is located approximately 175 km northwest of Montreal and 17 km due north of the village of Sainte-Veronique, Quebec. The property consists of 28 contiguous claims totaling approximately 1,600 hectares.

The property was originally staked and explored by Graphicor Resources Inc. (“Graphicorâ€) in the summer of 1989 based on the results of a regional helicopter-borne EM survey. The underlying geology consists of intercalated biotite gneiss, biotite feldspar gneiss, marble, quartzite and calc-silicate lithologies of the Central Metasedimentary Belt of the Grenville Province.

Historical Highlights

Graphicor completed reconnaissance mapping and prospecting as well as ground geophysics and a 26 hole diamond drill program totaling 1,625 metres. The work identified several conductive trends in the central portion of the property and at least three, relatively flat lying graphitic beds. Three surface samples were collected and analyzed returning results of 14.16% Cgf, 18.06% Cgf and 20.35% Cgf. 23 of the initial 26 drill holes intersected graphite concentrations with graphite concentration in range of 4.69% in hole Q90-1 to a highlight of 8.07% Cgf over 28.60 metres in hole Q90-7. The highest individual assay was reported in hole Q90-10 reporting 15.48% Cgf over 0.50 metres.

The Company cautions that it has not had the chance to verify the quality and accuracy of the historic sampling and drilling results reported in this news release which predate the introduction of NI 43-101 and cautions readers not to rely upon them. The historic figures were generated from sources believed to be reliable, however, they have not been confirmed. Although the sampling and drilling results are relevant, they have not been verified.

Graphicor geologists commented that the results of the initial drill program were extremely encouraging and recommended additional detailed drilling to properly understand and evaluate the potential of the propert

Salar de Aguas Caliente Lithium Brine Property

Lomiko Metals Inc. announced June 22, 2009 that it has purchased 100% of 8 pedimentos (claims) making up 1900 Ha of the Chilean Salt Lake known as Salar de Aguas Calientes. The Company now owns eight (8) of nine (9) claims that make up the Salar. One (1) claim of 400 Ha is currently owned by Sociedad Quimica y Minera de Chile S.A. (NYSE: SQM), the primary producer of Lithium in the region.

-

– The Claims are in an excellent location adjacent to a main paved highway.

- – The Salar has significant surface brines known to contain Lithium, Sulfate and Potash

- – The brines located on Lomiko claims were staked because of their excellent porosity and transmissivity *, which is required for economic extraction.

- – The claims purchased surround a mining concession held by Sociedad QuÃmica y Minera de Chile S.A. (NYSE: SQM) at Lomiko’s Salar de Aguas Calientes.

- – Producers such as SQM are searching for new sources of Lithium to meet or increase production requirements to meet current and anticipated market demand

- – The claims are within 70 km of the SQM production facility located at Salar de Atacama.

- – The potential for partnership exists with SQM, the leading producer in the region.

- – The current market for Lithium Ion batteries is anticipated to grow 25% per year.

- – The introduction of the electric car powered by Lithium Ion batteries will require new development of high grade Lithium Deposits to meet additional demand.

- – The ‘Lithium Triangle’ located at the borders of Chile, Argentina and Bolivia contains 70% of the world’s economic Lithium deposits.

- – Forbes Magazine referred to the region as the “Saudi Arabia of Lithiumâ€.

The Vines Lake Property – Exploration Opportunity

Lomiko Metals Inc. holds the rights to 5,403 Ha located in the south western corner of the Cassiar Gold District or ‘Cassiar Gold Camp’ as it is often referred in the Liard Mining District, NTS 104P, (Figure 4.2). The Vines Lake property’s northern boundary crosses Hwy 37N 7 kilometers south of the unincorporated settlement of Jade City. Highway 37 N bisects the property north to south.

Tags: #graphitestocks, #mining, #smallcapstocks, $TSXV, LOMIKO METALS INC