- Entered into a Binding Memorandum of Understanding to acquire Le Royal lithium prospect located approximately 30 km north of the city of Val d’Or in Quebec

- Acquiring Le Royal lithium prospect jointly with Platypus Minerals Ltd. (ASX: PLP) on an initial 30:70 relative basis.

Montreal, Quebec / July 27, 2016 – St-Georges Platinum and Base Metals Ltd. (OTC:SXOOF) (CSE:SX) (FSE:85G1) is pleased to announce that it has entered into a Binding Memorandum of Understanding to acquire Le Royal lithium prospect located approximately 30 km north of the city of Val d’Or in Quebec.

St-Georges is acquiring Le Royal lithium prospect jointly with Platypus Minerals Ltd. (ASX: PLP) on an initial 30:70 relative basis.

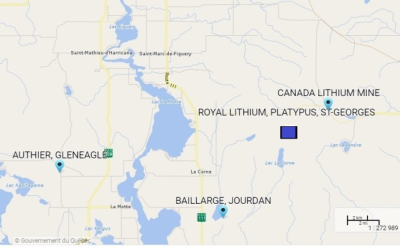

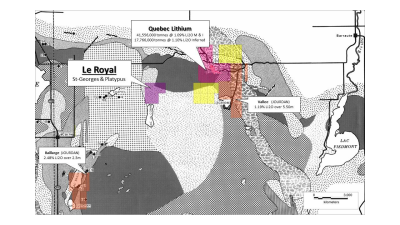

Le Royal lithium prospect comprises 5 contiguous claims, approximately 286 hectares in area and represents a virgin find within a known lithium district, albeit situated only 4 km from the Quebec Lithium Mine. Le Royal is easily accessible and lies close to infrastructure and facilities (Figures 1, 2 and 3).

The Quebec Lithium Mine hosts a resource of 47 Mt @ 1.20% Li2O (NI43-101; Measured and Indicated). The mine was recently acquired by Chinese-owned Jilin Jien Nickel Industry Co.

A preliminary site visit by an independent geologist commissioned by St-Georges and Platypus confirmed the presence of a significant amount of lepidolite within a 1.0 X 0.7 X 0.6 metre pegmatite sub angular boulder indicating a new source in the vicinity (Figures 4 to 7). Lepidolite exploration is a key focus for Platypus, given its recent acquisition of mining processing technology developer Lepidico Limited, making Platypus the owner of the L-Max(R) technology which was specifically designed to extract lithium from lepidolite and other Li-mica minerals.

Figure 1. Location of Le Royal prospect in Quebec.

Figure 2. Regional Location of Le Royal prospect

The Companies are awaiting a report from the independent geologist, which will determine whether they will proceed with the option. Samples were taken on the project claims and sent to the laboratory for analysis. The report from the Independent Geologist is expected within two weeks.

Figure 3. Claims map MRNF NTS 32C05, showing Le Royal claims in relation to Quebec Lithium Mine.

Figure 4. Lepidolite in pegmatite at Le Royal.

Figure 5. Lepidolite & spodumene in pegmatite

Figure 6. Lepidolite-rich pegmatite from Le Royal.

Figure 7. Lepidolite-spodumene pegmatite (Le Royal)

Under the terms of the MOU, Platypus will pay the vendors a C$10,000 option fee to conduct due diligence on the Le Royal claims. After the due diligence period and receipt of the independent geologist’s report, Platypus and St Georges will be able to acquire 100% of the Royal claims based on the following terms:

A finder’s fee will be paid in relation with this acquisition.

St-Georges and Platypus are concurrently negotiating formal terms of a joint venture between the two companies to develop the Le Royal prospect.

Yves Caron P.Geo. (OGQ #548) a Qualified Person under the National Instrument 43-101 has reviewed and approved the geological content of the current press release.

ON BEHALF OF THE BOARD OF DIRECTORS

“Frank Dumas”

FRANK DUMAS, President

About St-Georges

St-Georges is developing new technologies to solve the biggest environmental problems in the mining industry. If these new technologies are successful, they should improve the financial bottom line of current mining producers. The potential success of these technologies would also involve upgrading certain current known metal resources to economic status while addressing the environmental and social acceptability issues.

The Company also explores for Nickel on the Julie Nickel Project on Quebec’s North Shore.

Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX, on the US OTC under the Symbol SXOOF and on the Frankfurt Stock Exchange under the symbol 85G1. For additional information, please visit our website at www.stgeorgesplatinum.com

About Platypus Minerals Ltd

Platypus Minerals Ltd (ASX:PLP) is an ASX-listed Perth based company focused on the lithium sector. It’s current exploration assets include an option over the Lemare project in Canada; ownership of the Euriowie project near Broken Hill in New South Wales; a joint venture agreement with ASX-listed Crusader Resources (ASX:CAS) to jointly exploit lithium opportunities in Brazil; and an agreement with ASX-listed Latin Resources (ASX:LRS) to jointly exploit lithium opportunities in Peru and Argentina. Through wholly-owned subsidiary Lepidico Ltd, Platypus also owns the L-Max(R) technology, a metallurgical process that extracts lithium from non-conventional sources, specifically Li-rich mica minerals such as lepidolite and zinnwaldite, and thus has the potential to disrupt the lithium market by providing lithium from an alternative source. Platypus’s largest shareholders are Strategic Metallurgy Pty Ltd and Potash West Ltd (ASX:PWN).

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

Tags: #mining, #smallcapstocks, $TSXV, lithium