SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Click Here for More Info

In this update I am not going to repeat the points made in the last fairly comprehensive update, instead we are going to focus on the importance of the resistance level just above where the price is now, and impact of the killing of the Iranian General and its potential implications for the gold price.

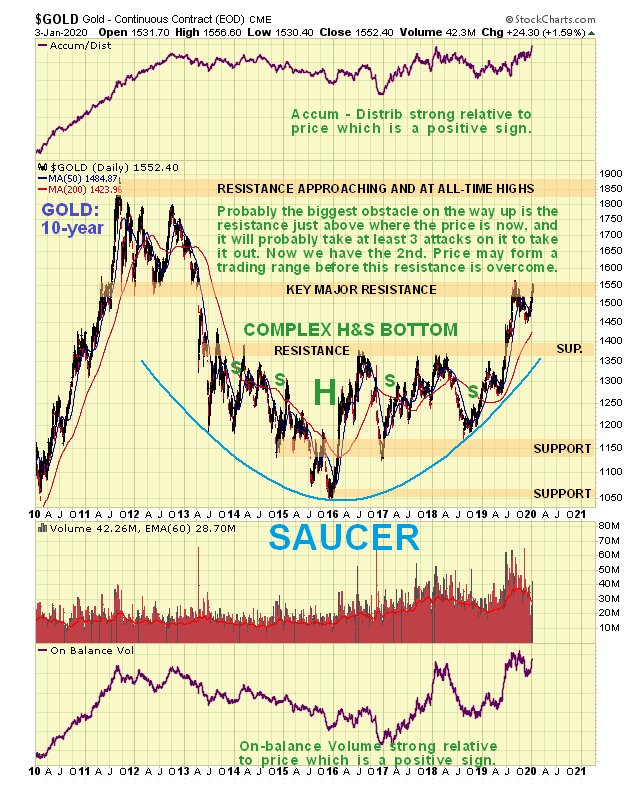

On the latest 10-year chart we can see that gold is making a 2nd attack on the key major resistance level in the $1530 – $1560 zone, which is hardly surprising considering what happened last week.

The reason that this resistance level is of such major

importance is made abundantly clear by the following chart made by a

subscriber and kindly forwarded to me, which I reproduce with his

permission. As we can see gold made no less than 5 significant lows at

this level between 2011 and 2013, before it finally crashed this support

and plunged 15% in 2 days, so it is clearly of huge significance and is

the biggest hurdle by far on the way up. Therefore, even given the

latest mayhem in the Mid-East, we should not be surprised if it now

stalls out here and possibly backs off for a while to form a trading

range, which is also made likely by its now being critically overbought

on its RSI indicator and by the latest COTs, which we will look at lower

down the page, coming in with really extreme readings again. This makes

sense given that we now at a time of maximum tension.

From a subscriber – highlighting gold’s key support at the $1530 – $1560 level, which is now of course strong resistance…

Detail showing the plunge that was triggered the failure of this support…

On the 6-month chart we can see how, after breaking out of the

corrective downtrend in force from early September, gold has risen

steeply, without one down day so far to become critically

overbought on its RSI indicator as it drives into the zone of strong

resistance with volume becoming heavy on Friday. This of course

increases the chances of its reacting back the moment tension over the

Mid-East situation eases, even if only slightly.

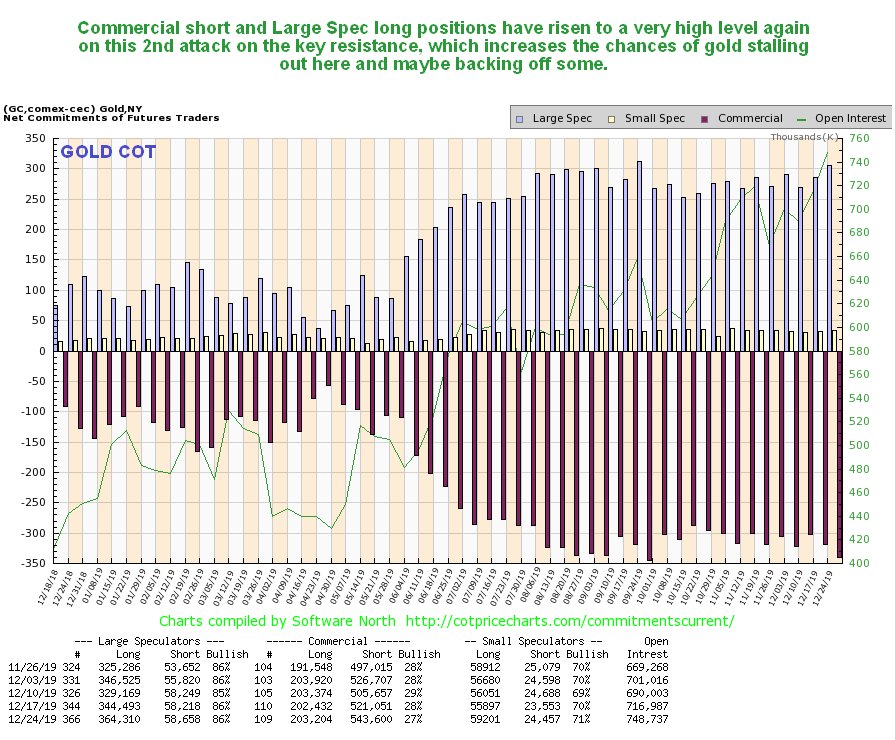

As for the COTs, they are showing extreme readings once more

(chart is for 24th December), which suggest that, especially if tension

over the Iran situation eases short-term, gold will probably back off

some into a consolidation pattern that will enable it to charge up

sufficiently to take out the key resistance in due course.

Click on chart to popup a larger, clearer version.

Now we come to the possible impact of the US killing of the top

Iranian General. In order to figure out the real motivation for this

act, we simply have to ask the usual question “Who stands to gain?†The

first interest group that stands to gain is the US military, which

receives about $700 billion of taxpayers’ money every year, and probably

about $500 billion of this is in excess of what it needs to defend the

Homeland. So in order to justify this bloated budget it creates enemies

and conflicts around the world. The next interest group is Israel, which

controls the US and uses the US military as a sledgehammer to achieve

its objectives which include dominance of the Mid-East. Iran is the big

prize. Finally the Republicans and Trump himself stand to gain at the

polls later this year as the population will predictably “rally round

the flag†as a result of conflict with Iran. Knowing all this, we can

quickly deduce that the killing of the Iranian General was an act of

extreme provocation designed to trigger some kind of counter attack by

Iran that can then be used as an excuse to launch a bombing campaign

against it. Even if Iran exercises maximum restraint and does nothing

beyond making empty threats to assuage its angry populace, it may still

fall victim to an onslaught after a calculated false flag attack which

is blamed on it. So whatever it does, it loses – it’s been put in a

classic “zugzwang†situation.

For all the bluster, Iran’s military is no match for that of the US of course, which spends more than the rest of the world put together on arms. The best way for Iran and Islam in general to “get even†with the West for all its many decades of Colonial interference in the Mid-East, exploitation and massive destruction inflicted on places like Iraq and Libya and the Palestinians therefore (looked at from their point of view) is to conduct “asymmetrical warfareâ€, invade Western countries and attack their churches and institutions etc, and then take them over gradually by outbreeding them. Western societies are now too corrupt, decadent, morally bankrupt and weak to stop this happening, and it is happening right now in Europe, and the only reason it isn’t happening to the same extent in the US is that it is a lot harder to pilot a rubber dingy across the Atlantic Ocean than the Mediterranean Sea, although as we know the Democrats and the Left appear to trying to take up the slack by destroying the country from within in places like Portland, L.A. and San Francisco, and this rot will spread unless right minded people take a vigorous stand.

All this is mentioned because it is clear that the killing of the Iranian General is the prelude to a military strike against Iran, which will probably take the form of an extensive and intensive bombing campaign that both Israel and the US have been looking forward to for years, because a ground invasion is out of the question due to the geography and logistics. The goal as usual will be to destroy its military capability and wreck its infrastructure with the eventual aim of installing a puppet government and opening up the country to Western exploitation, and the wild card in all this will be whether Russia and China will do anything to prevent it, or just stand and watch. It is thought that they don’t have the nerve to intervene. In any event, if such a campaign is launched, we can expect the world to be gripped by an acute sense of crisis and gold will spike. Iran may have the ability to disrupt the flow of oil out of the Persian Gulf, albeit temporarily, which would trigger an oil price spike and a stockmarket crash.

Last week’s updates concluded with a look at the highly bullish charts for gold measured against the Australian dollar and the Japanese Yen, and this week we will look at gold against the Canadian dollar and the Swiss Franc.

While many investors are still agonizing about whether gold is in a bullmarket or not, that is because they are fixated on the charts for gold in US dollars. When you look at gold in other currencies you realize that it is already very much in a bullmarket, and recently made new highs against many currencies, like the Canadian dollar shown below…

Even against the Swiss Franc, which amongst currencies enjoys

some safe haven status, gold is performing better than it is against the

dollar…

…and we should remember that the dollar may not remain as “king

of the hill†forever, especially as a number of major powers in the Asia

especially are preparing to ditch it.

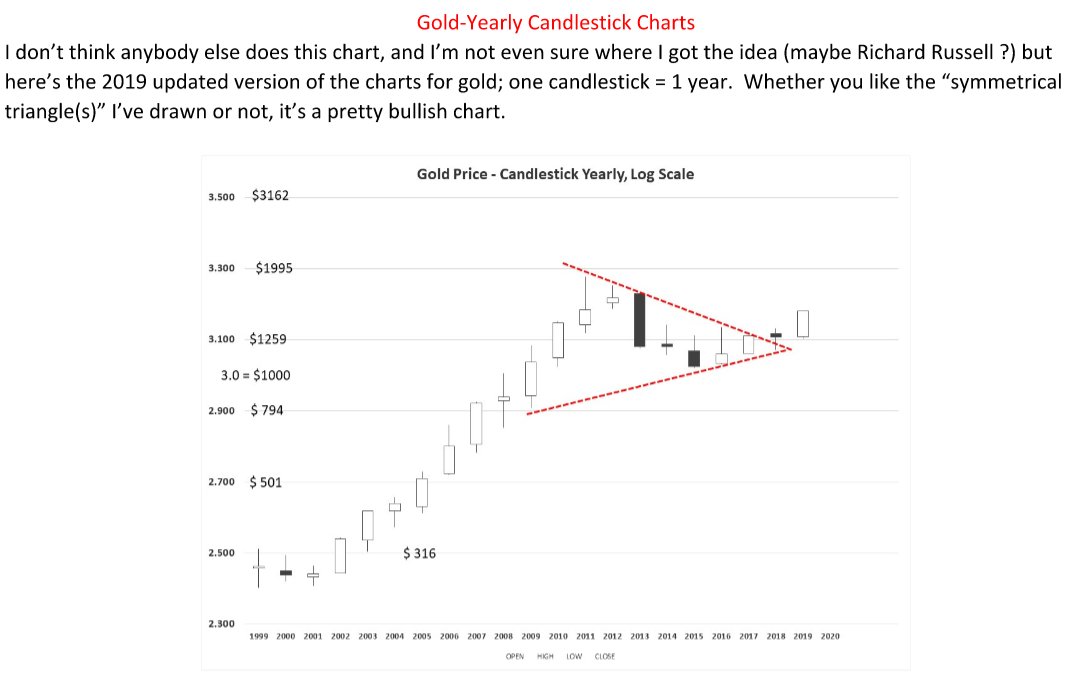

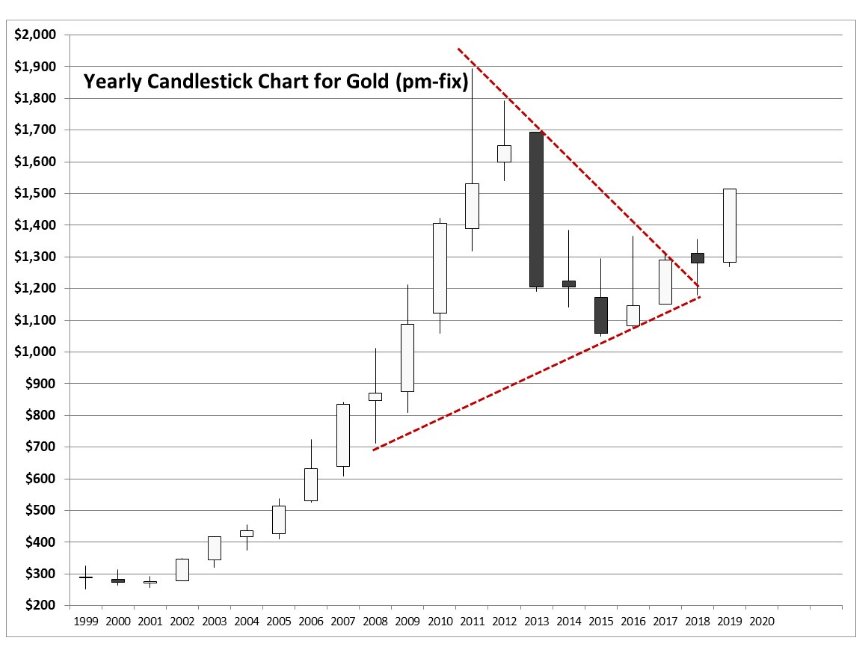

Finally, we are going to take a quick look at an unusual chart for gold submitted by the same subscriber as some of the charts above. It is unusual because it is a yearly candlestick chart, meaning that each candle on it is for an entire year. Its supreme advantage is that it keeps things simple. The Triangle shown on it is his interpretation, not mine. It certainly looks positive here with a big white candle for 2019, with the arithmetic version shown looking even more bullish. This type of chart also has a potential advantage for the writer, as if only this chart were used, I would only have to write these updates once a year.

Courtesy of Clive Maund: https://www.clivemaund.com/gmu.php?art_id=68&date=2020-01-05

Tags: #Ashuanipi, #Discovery, #Drilling, #Greenstone, #Hopedale, #LAB, #Labrador, #LabradorGold, #Newfoundland, gold