TORONTO, May 14, 2020 (GLOBE NEWSWIRE) — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQB: “LONCF”) is pleased to provide an update on its activities within the Ngayu Greenstone Belt, where the Company has a dominant foot-print through its joint venture with Barrick Gold (Congo) SARL (“Barrickâ€) and on its own majority-owned exploration licences and exploitation concessions, including the Imbo exploitation concession (76.29%) that contains the Adumbi deposit and its wholly-owned exploration licence containing the Makapela deposit

Barrick Joint Venture

Loncor recently received the quarterly exploration report from joint venture partner Barrick for the first quarter of 2020. As announced in February 2020, joint venture partner and operator Barrick had identified a number of priority drill targets within the 1,894 square kilometre joint venture land package at Ngayu and drilling was due to commence in March. Some delays were encountered at the border due to additional permitting requirements resulting from the COVID-19 situation but the two drill rigs are now at the Kibali mine site and are planned to be mobilised to Ngayu in the second quarter.

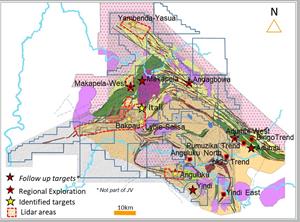

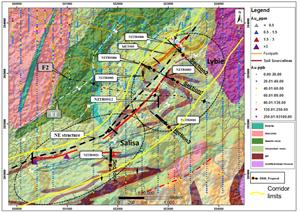

The first drill target is expected to be at Anguluku where an initial six core holes are planned. Depending on results, additional holes will be drilled at Anguluku or the drills will be moved to Salisa/Lybie where an initial twelve holes are planned. Other targets to be drilled include Yambenda/Yasua (see Figures 1 and 2 below).

A large component of Barrick’s Q1 2020 exploration program was focused on reconnaissance follow up. The goal of these reconnaissance studies was to delineate new targets for prioritisation and assess existing targets to advance them to the drilling stage or remove them from the resource triangle. At the time of reporting, of the eleven Areas of Interest identified during the last quarter, eight had been evaluated for potential of hosting tier 1 deposits. Two of the eight assessed did not pass the preliminary indicators to host tier 1 deposits. This quarter’s further assessment was completed on the Andagbowa, Zunguluka, Makapela West and Imva South blocks. At Andagbowa, two new targets were delineated for follow up work.

Andagbowa is located to the northeast corner of the Ngayu concession and about 32 kilometres northeast of the Mambati base camp. It is characterised by complex lithological and structural settings, which includes the presence of folded and fractured banded ironstone formation (“BIFâ€) and the hinge of a belt scale fold. Previous work has shown localized low grade BLEG anomaly basins, intense alluvial artisanal activities and a lack of quartz pebbles in the streams which could suggest potential for disseminated style gold mineralization.

Exploration fieldwork completed during the quarter at Andagbowa aimed at gaining geological characteristics of the area in order to evaluate its potential and perspectivity for future detailed work. The fieldwork undertaken included preliminary exploration study combining geological, structure and alteration mapping and sampling for gold analysis. Structural data confirmed the interpreted open folding system with NNW fold axis occurring within the area close to the Makapela Intrusive. The identified NE-SW, E-W and NW-SE moderate to steeply dipping mineralized sheared zones are aligned along the regional fold and parallel to the interpreted domain boundary subsidiary fault which could play a part in controlling the distribution of gold mineralization, either hosting mineralization or by acting as conduit for hydrothermal fluids.

The preliminary exploration work at Andagbowa area revealed two potential prospects for future work; namely Bon Marche and Tozali. The two prospects are characterized by sheared and brecciated rocks including BIF containing either stockworks of quartz veinelts or sheeted stringers of silica associated with pervasive sericite and weak disseminated fine to coarse sulphides.

Bon Marché prospect is located about 5 kilometres east of Bole Bole village; the area occurs structurally in the interpreted regional hinge and is characterized by:

- NE and ENE trending mineralized shear zones (up to 12 metres wide) containing sheeted quartz stringers and veinlets associated with pervasive sericite hosted by metasediment rock. Each of the two shear zones is mined along 100 metre length by artisanal miners. Assay results of up to 2 metres @ 1.07g/t Au was intercepted from channel sampling.

- 2.5 kilometres folded and fractured BIF with weak disseminated sulphide and pervasive silica with 0.83 g/t Au from litho samples.

- The potential hinge at Bon Marche is located 1.5 kilometres north of soil anomalies localized almost within the same hinge zone.

While the Tozali prospect is located 6 kilometres south-east of Bon Marché and shows:

- 1.5 kilometre potential NW trending brecciated BIF containing disseminated boxworks and stockworks of quartz-carbonate stringers. Received results revealed anomalised values up to 0.76g/t Au.

At the beginning of the quarter, LIDAR (Light Detection and Ranging remote sensing) surveys were also conducted on four exploration blocks in the joint venture. The benefits of LIDAR data compared to traditional aerial-photo-based interpretation are in more detailed identification of possible surface deposits, mapping lithology, structures and more precise edging of the geomorphologies, which could hold large scale deposits. This method also reflects more accurately the true ground surface in areas of dense vegetation. The results of the LiDAR surveys are being collated with other existing geological and geophysical layers to further generate and prioritise more targets.

Imbo Exploitation Permit (Loncor 76.29%)

Outside of the Barrick joint venture, exploration activities have continued on Loncor’s Imbo exploitation concession (76.29%) in the east of the Ngayu belt. Fieldwork by Loncor geologists have focused on the Imbo East prospect 12 kilometres west-southwest of Adumbi along the same mineralised structural trend. Gridding, soil and rock sampling are being undertaken over a strike length of 3.6 kilometres. Additional follow up will be dependent on assay results which are pending.

Qualified Person

Peter N. Cowley, who is President of Loncor and a “qualified person” as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the Democratic Republic of the Congo (the “DRCâ€). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 200 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (Congo) SARL (“Barrickâ€). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs†of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in 1,894 km2 of Loncor ground that they are exploring. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration on the said ground at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and are moving towards confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

In addition to the Barrick JV, certain parcels of land within the Ngayu project surrounding and including the Makapela and Adumbi deposits have been retained by Loncor and do not form part of the joint venture with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Loncor’s Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au). Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 76.29% of this resource being attributable to Loncor via its 76.29% interest in the project.

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com.

For further information, please visit our website at www.loncor.com, or contact: Arnold Kondrat, CEO, Toronto, Ontario, Tel: + 1 (416) 366 7300.

Figure 1 Ngayu Belt. Developing Prospectivity, Work Programs and Drill Targets for 2020

https://www.globenewswire.com/NewsRoom/AttachmentNg/572d4a28-b6e1-48d5-91bc-a419b7da1825

(From Barrick Q1 2020 joint venture report)

Figure 2 Geology of Lybie-Salisa with proposed drill holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/3c3bbe85-9561-43ab-811b-8ad43e2b6e9d

(From Barrick Q1 2020 joint venture report)

Figure 1

Ngayu Belt. Developing Prospectivity, Work Programs and Drill Targets for 2020 (From Barrick Q1 2020 joint venture report)

Figure 2

Geology of Lybie-Salisa with proposed drill holes (From Barrick Q1 2020 joint venture report)

Tags: #19$Gold, #Assay, #Barrick, #Congo, #Discovery, #DRC, #Drilling, #leadership, #Loncor, #NewmontGold, #Ngayu