- Barrick Gold commenced drilling on several high priority gold targets

- Since entering the JV agreement with Loncor in January 2016, Barrick has conducted various exploratory programs to define drill targets that offer the early potential of attaining “Tier 1†status.

- “Tier 1” deposits target a minimum of 5 million ounces

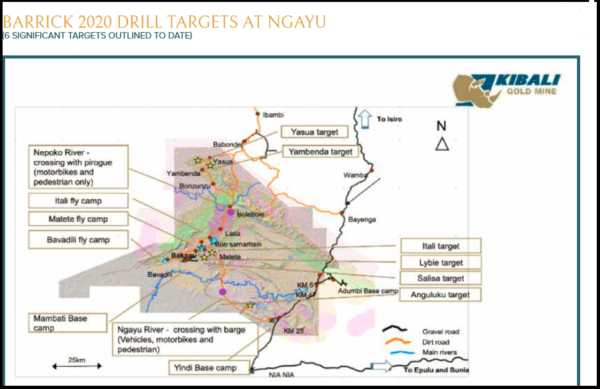

TORONTO, June 22, 2020 (GLOBE NEWSWIRE) — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQB: “LONCF”) announces that Barrick Gold (Congo) SARL has commenced its core drilling program on several priority gold targets within the Ngayu greenstone belt in the northeast of the Democratic Republic of the Congo (“DRCâ€). The beginning of the drilling campaign signals a significant step in the sequence of events necessary to assess numerous areas of potential. Since entering the JV agreement with Loncor in January 2016, Barrick has conducted various exploratory programs to define drill targets, targets that offer the early potential of attaining “Tier 1†status.

Commenting on the start of drilling at Ngayu, Loncor’s CEO Arnold Kondrat said: “Barrick continues to illustrate the progress that can be made in the DRC. Having built the successful Kibali gold mine approximately 220 kms away, Barrick has now embarked on its drilling program at Ngayu, an area that we believe holds the potential for further significant gold discoveries similar to our own Adumbi deposit.â€

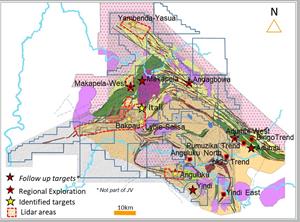

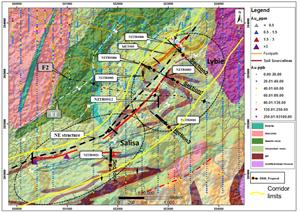

The drilling on the Anguluku prospect is targeting a folded and thrust sequence of mineralised banded ironstone formation (“BIFâ€). Further drilling is planned to be undertaken by Barrick at the other priority targets of Medere, Makasi, Lybie, Salisa and Bakpau NE in the Imva area in the west of the Ngayu belt (see Figure 1 below)

Loncor Continues to Explore – Imbo Exploitation Permit (Loncor 76.29%)

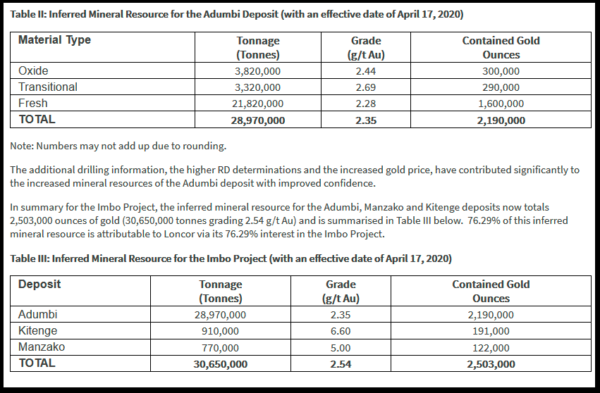

Outside of the Barrick joint venture, exploration activities by Loncor continued on Loncor’s Imbo Project in the east of the Ngayu belt. The Imbo Project contains 2.5 million ounces of inferred mineral resource (30.65 million tonnes grading 2.54 g/t Au), which includes the 2.19 million ounce inferred mineral resource of the Adumbi deposit (28.97 million tonnes grading 2.35 g/t), with 76.29% of this resource being attributable to Loncor via its 76.29% interest in the Imbo Project. Fieldwork by Loncor geologists have been focusing on the Imbo East prospect 12 kilometres southwest of the Adumbi deposit, along the same mineralised structural trend. Gridding, soil and rock sampling are being undertaken over a strike length of 3.6 kilometres at Imbo East.

In addition, two new targets have been generated. Both these target areas were identified from the compilation and interpretation of previous, historical exploration data including soil geochemistry, rock chip and channel sampling. At Mambo Bado, 1.5 kilometres northwest of the Adumbi deposit, a prominent geochemical gold in soil anomaly is located on an extensional, E-W structural jog along the 14-kilometre northwest trending mineralised shear zone within the Imbo permit area. No drilling has been undertaken previously on this promising target. Two kilometres south of the Adumbi deposit, at Lisala, altered and brecciated BIF with anomalous rock sampling requires further follow up with gridding, soil sampling and additional channel sampling.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the northeast of the Democratic Republic of the Congo (the “DRCâ€). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 220 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (Congo) SARL (“Barrickâ€). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs†of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in 1,894 km2 of Loncor ground that they are exploring. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration on the said ground at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and are moving towards confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

In addition to the Barrick JV, certain parcels of land within the Ngayu project surrounding and including the Adumbi and Makapela deposits have been retained by Loncor and do not form part of the joint venture with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 76.29% of this resource being attributable to Loncor via its 76.29% interest in the project. The Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com.