FULL DISCLOSURE: GGX Gold is an advertising client of AGORA Internet Relations Corp

FULL DISCLOSURE: GGX Gold is an advertising client of AGORA Internet Relations Corp

About ZEN Graphene Solutions Ltd.

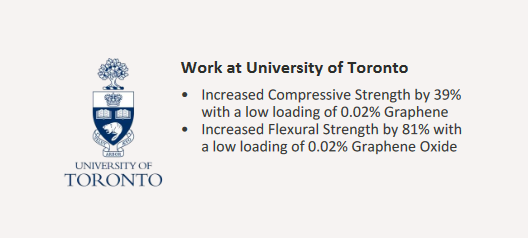

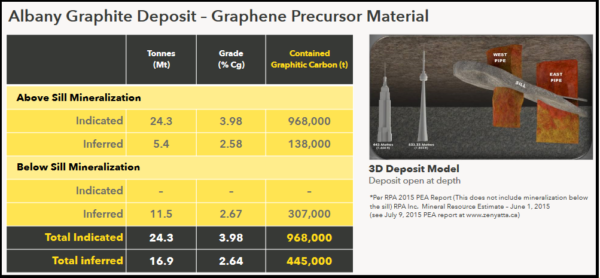

ZEN Graphene Solutions Ltd. is an emerging graphene technology company with a focus on development of the unique Albany Graphite Project. This precursor graphene material provides the company with a competitive advantage in the potential graphene market as independent labs in Japan, UK, Israel, USA and Canada have demonstrated that ZEN’s Albany Graphite/Naturally PureTM easily converts (exfoliates) to graphene, using a variety of simple mechanical and chemical methods.

ZEN Graphene Solutions Hub on Agoracom

FULL DISCLOSURE: ZEN Graphene Solutions is an advertising client of AGORA Internet Relations Corp

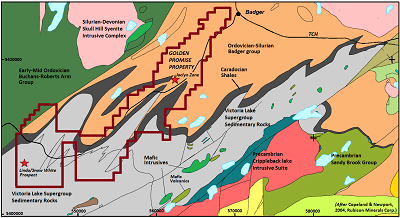

Golden Promise Project, Central Newfoundland

VANCOUVER, BC / ACCESSWIRE / May 16, 2019 / GREAT ATLANTIC RESOURCES CORP. (TSXV.GR) (the “Company” or “Great Atlantic”) is pleased to announce it has received a diamond drilling permit for the Company’s Golden Promise Gold Property, located in the central Newfoundland gold belt. The Company has also begun its 2019 exploration program on the Golden Promise Property, currently conducting focussed prospecting and geochemical sampling at high priority targets within the property. The drilling permit allows for up to 24 drill holes in the northern half of the property at the gold-bearing Jaclyn Zone, specifically at the Jaclyn Main Zone (JMZ) and Jaclyn North Zone (JNZ). Planned drilling will consist of the following:

The Company reported a National Instrument 43-101mineral resource estimate for the JMZ in late 2018 (News Release of December 6, 2018; and Sedar-filed National Instrument 43-101 Technical Report on the Golden Promise Property, Central Newfoundland (revised), dated December 4, 2018 by Mr. Greg Z. Mosher, M.Sc. App., P.Geo., and Mr. Larry Pilgrim, B.Sc., P.Geo.). The reported inferred mineral resource estimate for the JMZ is as follows:

| Resource | Cutoff Au g/t | Au Cap g/t | Au Uncap g/t | Tonnes | Au Ounces Capped | Au Ounces Uncapped |

| Total | 1.1 | 9.3 | 10.4 | 357,500 | 106,400 | 119,900 |

| Pit-Constrained | 0.6 | 11.4 | 14.1 | 157,300 | 57,800 | 71,200 |

| Underground | 1.5 | 7.5 | 7.6 | 200,200 | 48,600 | 48,700 |

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

Mineral

resource tonnage and contained metal have been rounded to reflect the

accuracy of the estimate, and numbers may not add due to rounding.

Mineral resource tonnage and grades are reported as undiluted.

Contained Au ounces are in-situ and do not include recovery losses

The majority of planned diamond drill holes at the Golden Promise Property will be in-fill drill holes at the JMZ to provide data for an up-dated JMZ mineral resource estimate, engineering studies and studies of mineralizing controls. Drilling is also planned testing continuation of the JNZ east along projected strike. The Company conducted trenching during 2017 along the projected east strike of the JNZ. The trenching generally failed to reach bedrock due to thick glacial till. However gold bearing quartz vein boulders were excavated from multiple trenches, with some boulder samples returning high grade gold (including 163.99, 208.51 and 332.67 g/t gold: News Release of August 31, 2017). A qualified person managed the 2017 trenching program and sampling and verified the analytical data.

Great Atlantic has begun it’s 2019 exploration program on the Golden Promise Property. Prospecting and geochemical sampling is being conducted at high priority targets in multiple regions within the property. During the 2017 and 2018 programs, the Company identified / confirmed areas with gold bearing quartz vein float or bedrock; and gold soil anomalies. The objective of the current program is to further define trenching and drilling targets within these target areas.

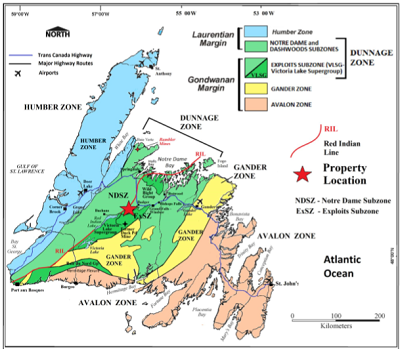

The Golden Promise Property hosts multiple gold bearing quartz veins and is located within a region of recent significant gold discoveries. The property is located within the Exploits Subzone of the Newfoundland Dunnage Zone. Within the Exploits Subzone, the property lies along the north-northwestern fringe of the Victoria Lake Supergroup (VLSG), a volcano-sedimentary terrane. The northwestern margin of the Golden Promise Property occurs proximal to, and, in part, contiguous with a major (Appalachian-scale) collisional boundary, and suture zone, known as the Red Indian Line (RIL). The RIL forms the western boundary of the Exploits Subzone. Recent significant gold discoveries in this region of the Exploits Subzone include those of Sokoman Minerals Corp. (TSXV.SIC) at the Moosehead Gold Project and Marathon Gold Corp. (TSXV.MOZ) at the Valentine Lake Gold Camp.

During 2018 Sokoman Minerals Corp. (TSXV.SIC) announced a high-grade gold discovery on its Moosehead Property, located approximately 40 kilometers east-northeast of the Golden Promise Property. The discovery was made during the 2018 diamond drilling program. A drill intersection of 44.96 g/t gold over 11.90 meters core length was reported including a 1.35 meters core length quartz vein intersection of 385.85 g/t gold (Sokoman Iron Corp. News Release of July 24, 2018). The Valentine Lake Gold Camp of Marathon Gold Corp. (TSXV.MOZ) is located approximately 55 kilometers southwest of the Golden Promise Property. As reported on Marathon’s website, the Valentine Lake Gold Camp currently hosts four near-surface, mainly pit-shell constrained, deposits with measured and indicated resources totaling 2,691,400 oz. of gold at 1.85 g/t gold and inferred resources totalling 1,531,600 oz. of gold at 1.77 g/t. Readers are warned that mineralization at the Moosehead Property and Valentine Lake Gold Camp is not necessarily indicative of mineralization on the Golden Promise Property.

High-grade gold is reported in quartz veins and quartz vein boulders within the Golden Promise Property. Gold bearing quartz veins are reported in multiple areas of the property, including at least 5 gold bearing quartz vein systems reported in the Jaclyn Zone. Much of the reported historical exploration within the property has been focused on the Jaclyn Zone with gold bearing vein systems reported at the JMZ, JNZ, Jaclyn South Zone, Jaclyn East Zone and Jaclyn West Zone. The majority of historic drilling (2002-2010) was conducted at the JMZ. Gold bearing veins and gold bearing float are reported in other regions of the property. These include the Linda/Snow White vein in the southern region, Shawn’s Shot vein in the central region and Branden boulder occurrence in the northern region of the property.

As reported in the National Instrument 43-101 Technical Report on the Golden Promise Property, Central Newfoundland (revised), dated December 4, 2018 by Mr. Greg Z. Mosher, M.Sc. App., P.Geo., and Mr. Larry Pilgrim, B.Sc., P.Geo., the JMZ was modelled as a single quartz vein that strikes east-west and dips steeply to the south. Modelled vein thickness was based on true thickness derived from quartz vein intercepts. The estimate is based on 220 assays that were composited to 135 one-meter long composites. A bulk density of 2.7 g/cm3 was used. Blocks in the model measured 15 meters east-west, 1-meter north-south and 10 meters vertically. The block model was not rotated. Grades were interpolated using inverse-distance squared (ID2) weighting and a search ellipse that measured 100 meters along strike, two meters across strike and 50 meters vertically. Grades were interpolated based on a minimum of two and a maximum of 10 composites with a maximum of one composite per hole so the grade of each block is based on at least two drillholes thereby demonstrating continuity of mineralization. For the capped mineral resource estimate, all assays that exceed 65 g/t gold were capped at 65 g/t gold. All resources were classified as Inferred because of the relatively wide spacing of drill holes through most of the zone.

Because part of the vein is near surface the resource estimate was constrained by a conceptual open pit to demonstrate reasonable prospects of eventual economic extraction. Generic mining costs of US$2.50/tonne and processing costs of US$25.00/tonne were used together with a gold price of US$1,300/ounce. A conceptual pit slope of 45° was assumed with no allowance for mining loss or dilution. Based on the combined hypothetical mining and processing costs and the assumed price of gold, a pit-constrained cutoff grade of 0.6 g/t was adopted. For the underground portion of the resource a cutoff of 1.5 g/t was assumed. The cutoff grade for the total resource is the weighted average of the pit-constrained and underground cutoff grades.

Jaclyn Main Zone Total Inferred Mineral Resource Estimate

| Resource | Cutoff Au g/t | Au Cap g/t | Au Uncap g/t | Tonnes | Au Ounces Capped | Au Ounces Uncapped |

| Total | 1.1 | 9.3 | 10.4 | 357,500 | 106,400 | 119,900 |

| Pit-Constrained | 0.6 | 11.4 | 14.1 | 157,300 | 57,800 | 71,200 |

| Underground | 1.5 | 7.5 | 7.6 | 200,200 | 48,600 | 48,700 |

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

Mineral

resource tonnage and contained metal have been rounded to reflect the

accuracy of the estimate, and numbers may not add due to rounding.

Mineral resource tonnage and grades are reported as undiluted.

Contained Au ounces are in-situ and do not include recovery losses

David Martin, P.Geo., a Qualified Person as defined by NI 43-101 and VP Exploration for Great Atlantic, is responsible for the technical information contained in this News Release.

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.

On Behalf of the board of directors

“Christopher R Anderson”

Mr. Christopher R. Anderson ‘Always be positive, strive for solutions, and never give up’

President CEO Director

604-488-3900 – Dir

Investor Relations:

Please call 604-488-3900

Fortis Metals, the world’s leading producer of minor metals, recently forecast a tellurium supply deficit that, “as of 2020 could be as big as a staggering 370 metric tonnes.â€

Noting the rapidly-growing use of tellurium for thin-film solar panels, Fortis stated:

“At the moment, we are still seeing (tellurium) inventories in China but these are being eaten away by the two main suppliers of First Solar (the world’s largest thin-film solar manufacturer). It is only a matter of time before the market will understand the new dynamics and prices will start to reflect the growing deficit. We would not be surprised to see prices break the previous record seen in 2011.â€

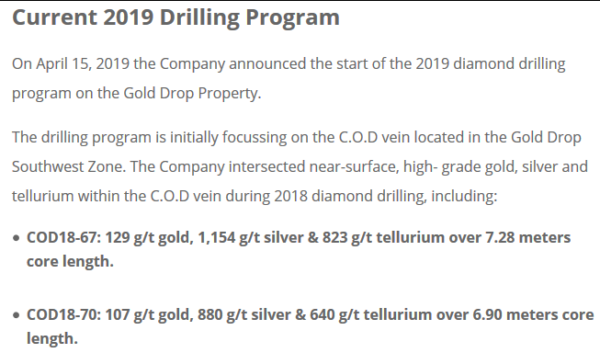

GGX has produced some of the highest grade drill intercepts in the world over the 2018 drill season, which compliment High Grade Gold intercepts of:

FULL DISCLOSURE: GGX Gold is an advertising client of AGORA Internet Relations Corp

About ZEN Graphene Solutions Ltd.

ZEN Graphene Solutions Ltd. is an emerging graphene technology solutions company with a focus on development of the unique Albany Graphite Project as a precursor graphene material product opportunity and product market development. The Albany Graphite Project provides the company with a competitive advantage in the potential graphene market as independent labs in Japan, UK, Israel, USA and Canada have demonstrated that ZEN’s Albany Graphite/Naturally PureTM easily converts (exfoliates) to graphene, using a variety of simple mechanical and chemical methods.

For further information:

Francis Dubé, Co-Chief Executive Officer

Tel: +1 (289) 821-2820

Email: [email protected]

FULL DISCLOSURE: American Creek Resources is an advertising client of AGORA Internet Relations Corp.

VANCOUVER, BC / ACCESSWIRE / May 14, 2019 / VERTICAL EXPLORATION INC. (TSX-V: VERT) (“Vertical” or “the Company”) is pleased to announce that, further to its press release dated April 29, 2019, the Company has received positive results from its Phase 1 Research and Development program that was conducted by AGRINOVA using wollastonite from the Company’s St-Onge deposit. All of the research and testing in the Phase 1 program was managed and monitored by AGRINOVA, a highly-regarded Center for Research and Innovation in Agriculture in Quebec, in an effort to optimize the potential agricultural uses of wollastonite and help improve production methods for farmers and agricultural companies located in Quebec.

The Phase 1 program conducted by AGRINOVA over the past year focused on research and testing in two key component areas, including characterizing and confirming that Vertical’s wollastonite can meet regulatory requirements for agricultural applications in Quebec and investigating potential markets for the St-Onge wollastonite resource. The third key component of the Phase 1 program, which involves developing applied research programming in order to allow Vertical’s wollastonite to be upgraded according to regulatory requirements and markets, will be the subject of a further study to be undertaken by AGRINOVA in the upcoming months.

The first component results provided by AGRINOVA clearly indicate that Vertical’s St-Onge wollastonite could be Bureau de nomalisation du Quebec (“BNQ”) certified or registered under the Fertilizers Act in Quebec, and potentially be used in the manufacture of slow-mineralizing fertilizer. The safety profile of Vertical’s wollastonite was successfully demonstrated by a germination and elongation test with barley. AGRINOVA went on to report that the St-Onge wollastonite has a neutralizing power and efficiency which compares it favorably with current lime products, and that it has appreciable levels of major and minor elements (Silicon, Calcium, Magnesium and Manganese) that are essential for plant nutrition and growth. Another benefit of Vertical’s wollastonite that was identified by AGRINOVA is its high bio-availability of silicon that leads to both enhanced plant growth and resistance to abiotic and biotic stress in a range of agricultural crops, as studies have shown there is a significant need for this element that is not being filled by commercial fertilizers.

Results for the second market study component that was undertaken by AGRINOVA, indicate that wollastonite has a significant potential to be used for maple production (maple syrup production), organic agriculture, sod production, large-scale crops (cereals, corn and soybeans) and boreal forestry (spruce budworm control and post-fire regeneration). Based on these uses, the potential agricultural demand for wollastonite in the initial target market of Quebec could be in the order of 6,400 tonnes for the Saguenay-Lac-Saint-Jean region, and approximately 274,000 tonnes for the province of Quebec as a whole. AGRINOVA also estimates that there could be additional demand of approximately 59,000 tonnes from the Maritime Provinces of Canada, based on the increased potential for wollastonite to be used for regional blueberry and potato crops.

Peter P. Swistak, president and chief executive officer of Vertical Exploration, commented: “These initial results from AGRINOVA’s Phase 1 program are very encouraging and show that Vertical’s wollastonite can potentially become BNQ certified for agricultural use in Quebec, which again is an important and necessary step for Vertical to take before it can move forward with its marketing and sales efforts in Quebec. The AGRINOVA report also verifies that our St-Onge wollastonite has a number of valuable natural mineral properties that support overall soil health, help control pests and bolster yields for maple trees, barley and blueberries alike. I am also very pleased to find that Vertical’s wollastonite has the potential to be classified as an organic certified fertilizer and soil amendment. Given these very positive results, we are now moving forward to engage AGRINOVA to conduct additional work on the third component of the Phase 1 program over the coming months. This component will involve AGRINOVA designing and implementing an applied research program in order to allow Vertical’s wollastonite to be upgraded for other potential uses and then tested according to varying regulatory requirements and markets. We look forward to providing updates and results from this important third research component as they become available.”

The complete AGRINOVA Phase 1 program report will be uploaded and made available to shareholders and the public on the Company’s website (https://vertxinc.com).

ABOUT AGRINOVA

AGRINOVA (www.agrinova.qc.ca), the Center for Research and Innovation in Agriculture, is a Technology Access Centre located in Alma, Quebec that provides technical help and services to farmers and agricultural companies throughout the province in order to help them access new technologies and assist them with the adoption of innovative new technologies and practices. AGRINOVA’s technology support focuses primarily on consumer concerns (milk quality); reducing greenhouse gas (GHG) emissions; organic or natural products; comfort and well-being of animals; digital adoption; and the economic efficiency of companies.

ABOUT VERTICAL EXPLORATION

Vertical Exploration’s mission is to identify, acquire, and advance high potential mining prospects located in North America for the benefit of its stakeholders. The Company’s St-Onge Wollastonite property is located in the Lac-Saint-Jean area in the Province of Quebec.

ON BEHALF OF THE BOARD

Peter P. Swistak, President/CEO

FOR FURTHER INFORMATION PLEASE CONTACT: Telephone: 1-604-683-3995 Toll Free: 1-888-945-4770

VANCOUVER, British Columbia, May 14, 2019 (GLOBE

NEWSWIRE) — Labrador Gold Corp. (TSX-V: LAB) (“Labrador Gold†or the

“Companyâ€) is pleased to announce the appointment of Mr. Kai Hoffmann to

the board of Directors.

Mr. Hoffmann holds a Bachelor of Business Administration from the University of Bedfordshire in the UK and is a businessman with years of experience in the capital markets and commodities industry. He is the CEO of Soar Financial Group, consisting of a boutique merchant bank and corporate communications company, a publishing house and Oreninc, a website that tracks financings for Canadian listed exploration and mining companies. He is a regular keynote speaker at leading industry conferences and events.

“On behalf of the existing Directors, I welcome Kai to the Labrador Gold Board, and we look forward to working with him.†said Roger Moss, President and CEO. “His experience in marketing and capital markets will benefit the company as we anticipate another exciting year in Labrador.â€

“I am excited to be joining Roger, Shawn and the Labrador Gold team. The coming months mark a pivotal time in the company’s development, and I am looking forward to not only support the team but also to help achieve the corporate goals.†comments Kai Hoffmann.

The Company also announces the grant of 500,000 options to purchase common shares of the Company to Mr. Hoffmann and an additional 1,100,000 options to the existing directors, officers and a consultant. The options are exercisable at a price of $0.20 for a period of five years.

Roger Moss, PhD., P.Geo., is the qualified person responsible for all technical information in this release.

About Labrador Gold:

Labrador Gold is a Canadian based mineral exploration company focused on the acquisition and exploration of prospective gold projects in the Americas. In 2017 Labrador Gold signed a Letter of Intent under which the Company has the option to acquire 100% of the 896 square kilometre (km2) Ashuanipi property in northwest Labrador and the Hopedale (458 km2) property in eastern Labrador.

The Hopedale property covers much of the Hunt River and Florence Lake greenstone belts that stretch over 80 km. The belts are typical of greenstone belts around the world but have been underexplored by comparison. Initial work by Labrador Gold during 2017 show gold anomalies in soils and lake sediments over a 3 kilometre section of the northern portion of the Florence Lake greenstone belt in the vicinity of the known Thurber Dog gold showing where grab samples assayed up to 7.8g/t gold. In addition, anomalous gold in soil and lake sediment samples occur over approximately 40 kilometres along the southern section of the greenstone belt (see news release dated January 25th 2018 for more details). Labrador Gold now controls approximately 57km strike length of the Florence Lake Greenstone Belt.

The Ashuanipi gold project is located just 35 km from the historical iron ore mining community of Schefferville, which is linked by rail to the port of Sept Iles, Quebec in the south. The claim blocks cover large lake sediment gold anomalies that, with the exception of local prospecting, have not seen a systematic modern day exploration program. Results of the 2017 reconnaissance exploration program following up the lake sediment anomalies show gold anomalies in soils and lake sediments over a 15 kilometre long by 2 to 6 kilometre wide north-south trend and over a 14 kilometre long by 2 to 4 kilometre wide east-west trend. The anomalies appear to be broadly associated with magnetic highs and do not show any correlation with specific rock types on a regional scale (see news release dated January 18th 2018). This suggests a possible structural control on the localization of the gold anomalies. Historical work 30 km north on the Quebec side led to gold intersections of up to 2.23 grams per tonne (g/t) Au over 19.55 metres (not true width) (Source: IOS Services Geoscientifiques, 2012, Exploration and geological reconnaissance work in the Goodwood River Area, Sheffor Project, Summer Field Season 2011). Gold in both areas appears to be associated with similar rock types.

The Company has 56,514,022 common shares issued and outstanding and trades on the TSX Venture Exchange under the symbol LAB.

For more information please contact:

Roger Moss, President and CEO

Tel: 416-704-8291

Or visit our website at: www.labradorgold.com

TORONTO, May 14, 2019 /PRNewswire/ – Gratomic Inc. (“Gratomic” or the “Company”) (TSX-V: GRAT) (CB81–FRANKFURT) a vertically integrated graphite to graphenes, advanced materials development company announces the entering into of a definitive off take agreement for graphite concentrate to be produced from its Aukam Graphite mine (“Aukam“) in Namibia (“Offtake Agreement“).

As part of the Graphite Concentrate sales Agreement (Sales Agreement), Gratomic has appointed Phu Sumika (“PSK“) as its exclusive marketing agent, in continental Europe, for the sale of graphite concentrate to the refractory, lubricant and battery Markets.

Pursuant to the Sales Agreement, PSK will purchase up to 7,500 Dry Metric Tonnes annually, for a period of five years from the date commercial production commences at Aukam. The contract contemplates the sales of graphitic product ranging from 80% Carbon to 99.9% Carbon at prices ranging between US$500-US$2800 per Metric Tonne (depending on grade, moisture content and industry use).

Gratomic is satisfied with the high value range of product pricing for the selected markets.

Gratomic has delivered PSK with samples grading 92%, 97%, 99% and 99.9% over the past 3 months for testing in a verity of end uses. The results now positively match buyer specifications and will qualify the sales agreement for deliveries going forward.

Aukam Production Update

Gratomic has recently consulted with a processing expert in Toronto and has been able to produce several batches of Battery Grade Graphite grading over 99.9% the Company is currently compiling a budget to integrate the suggestive plant adjustment onto its processing circuit within the next 3 months. This will allow the company to commence with the production and sale of battery grade Graphite targeted towards the rapidly growing battery industry mainly being dominated by the increase of demand for electric vehicles worldwide.

In addition Gratomic expects the delivery of the final components of its Aukam processing plant within the next 49 days, this will complete the construction of the first phase of our Processing facility and bring it up to a 3 metric tonne per hour Processing Capacity.

The company continues its focus on further developing and commercializing its Graphene Processing capacity in wales through its partnership with Perpetuus carbon technologies and anticipates soft launching its Gratomic fuel efficient tire in the summer. Gratomic has recently prepared an additional 2 tonnes of Graphite concentrate which it will be shipping to wales in the coming days for converting into high quality Graphenes targeted for the use and development of several high value Graphene applications.

Gratomic’s CO-CEO Arno Brand stated, “The entering into of the sales agreement and exclusive marketing agreement with Phu Sumika is the culmination of several years of work, Gratomic is now well positioned and ready to monetize its operations through graphite sales. We thank our loyal shareholders for their support throughout the years and their contributions in helping us in commercialize the Aukam Mine”

About Phu Sumika

Phu Sumika was established in 2003 to provide raw chemical materials for leading companies in the abrasive, refractory and battery industries across Europe. They offer a wide scale of commodities from around the World. A professional organization with significant experience and a vast sales network allows them to provide the highest quality with competitive pricing.

About Gratomic Inc.

Gratomic is an advanced materials company focused on mine to market commercialization of graphite products most notably high value graphene based components for a range of mass market products. We are collaborating with a leading European manufacturer of graphenes to use Aukam graphite to manufacture graphene products for commercialization on an industrial scale. The company is listed on the TSX Venture Exchange under the symbol GRAT.

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”