SOBR™ Safe, Inc. (OTC: SOBR) (www.sobrsafe.com), developers of the patented SOBR® Safe™ system, and its latest proprietary development, the non-invasive alcohol detection and screening system SOBR®Check™, announced today that it has contracted with Stephen Scofes for him to serve as Director of Government Affairs/Public Sector Procurement, with a focus on state legislature, law enforcement and public safety.

Steve is the Chairman and Chief Executive Officer of leading government relations and procurement firm Scofes & Associates Consulting, and brings to SOBR Safe a ready-built team of experts in their respective fields – including Steve’s partner, General Wesley Clark (ret.). Professionally involved in governmental affairs since 1985, Steve’s primary areas of expertise include legislative and political strategy, as well as business development, providing clients a sound strategy in the procurement of state, local and federal contracts. He currently represents and has represented some of the largest companies in the United States, such as Toyota, Kroger, Koch, Eli Lilly, Dell Technologies, Google, Cisco, Nokia, Blackstone and US World Meds to name a few – including work especially relevant to SOBR Safe in the manufacturing and transportation industries. Scofes & Associates has offices in Lansing, Detroit, Chicago, Indianapolis, Austin and Washington D.C.

“Steve is not just an expert at navigating the complex inner workings of government – he is also a proven producer with a track record of driving substantial returns,” stated SOBR Safe CEO Kevin Moore. “We believe he can open critical doors for us nationwide, stimulating material interest in and support for SOBR®Check™ and subsequent solutions. That a leader as accomplished as Steve has chosen to join SOBR Safe at this stage we feel speaks to our technology’s potential to create safer environments and safer lives.”

Scofes added, “My passion has always been to exercise our legislative system to create positive change, and rarely have I had the opportunity to work with a team possessing such conviction and innovative spirit – or a solution so potentially far-reaching. Communities across the country are ready to prevent the problem, and it is this company mission that has inspired me to join the SOBR Safe team.”

Each year, alcohol-related injuries, deaths and lost productivity costs American employers and insurers up to $63 billion; another $42 billion is spent on substance abuse treatment…a combined $105 billion crisis. One-half of all industrial accidents involve alcohol, and commercial fleets suffer from over 11,000 alcohol-related accidents each year. SOBR Safe believes its solution addresses this problem, and once successfully tested will be immediately applicable for delivery, service, and school bus fleet management, as well as workplace access control in manufacturing facilities and warehouses.

About SOBR® Safe™, Inc. (www.sobrsafe.com)

SOBR Safe, Inc. is developing the patented SOBR® Safe™ system, and its latest proprietary product, the non-invasive alcohol detection and screening system SOBR®Check™. SOBRCheck is a potentially disruptive solution in alcohol consumption detection – a touch-based technology with anticipated applications in school buses, commercial trucking fleets, facility access control and more. Across industries, the headlines are consistent: alcohol is a clear and present danger – impaired operation destroys lives, families and companies alike. SOBR Safe’s mission is to eliminate the destructive impact of alcohol on our roadways and workplaces…with just the touch of a finger.

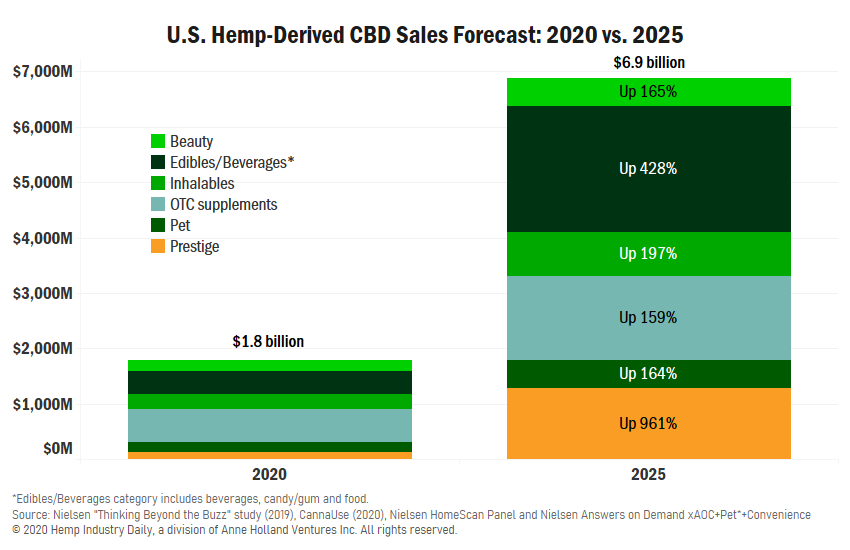

Comparably, 2025 sales are projected to increase by:

Comparably, 2025 sales are projected to increase by: