Agoracom Blog Home

Archive for the ‘AGORACOM Small-Cap TV’ Category

- Aukam processing plant has been commissioned successfully

- An initial shipment of graphite concentrate has been delivered

- 4.5 tonnes of graphite concentrate grading between 88%-95% Carbon as Graphite delivered

- Perpetuus Carbon Technologies will manufacture graphenes to be used in the tire industry.

TORONTO, May 07, 2018 (GLOBE NEWSWIRE) – Gratomic Inc. (“Gratomic†or the “Companyâ€) (GRAT.V) (CB81.F) a vertically integrated graphite to graphenes, advanced materials development company is pleased to announce that its Aukam processing plant has been commissioned successfully and an initial shipment of graphite concentrate has been made.

The Aukam processing plant was constructed between December 2017 and March 2018, with initial throughput and optimization reached during March and April 2018. To date, the plant has generated 4.5 tonnes of graphite concentrate grading between 88%-95% Carbon as Graphite (“Cgâ€) of which 2.25 tonnes of concentrate has been shipped to Perpetuus Carbon Technologies (“Perpetuusâ€) for the manufacture of graphenes to be used in the automobile bicycle tire industry. Gratomic and Perpetuus are currently in collaboration to build on Perpetuus’ capability to initially provide 500 tonnes of surfaced modified graphenes per annum to support the volumes required by the tire manufacturing industry (see March, 4, 2018 news release). The first cycle tire order for the graphenes to a globally recognised brand is planned for delivery at the end of the second quarter of 2018. Additional applications that have now been generated in a preproduction format include radiant heating membranes and super hydrophobic coatings with an addressable market that includes: marine, oil & gas, power generation, industrial (repair & maintenance), infrastructure (new build) and automotive & transportation among others.

Gratomic’s CO-CEO Arno Brand stated, “The successful start-up of our Aukam processing plant is a major milestone for the Company, one that allows us to begin feeding concentrate to Perpetuus for the manufacturing of graphenes for use as a material enhancing filler within tire elastomers.”

The Aukam processing plant uses a simple crushing, grinding and flotation system with a current capacity of 600 tonnes per annum. Construction is already underway for the installation of a larger mill with a 10,000 tonne per annum capacity.

Graphite Feed for the Aukam processing plant is obtained from screening and sorting of stockpiles existing from historical and recent mining. An average feed grade of 56.29% Cg with a range of 41.55% Cg to 63.87% Cg was determined from ten, 2kg to 30kg, grab samples from across the stockpiled lumps (see June 3, 2016 and July 12, 2016 news releases). Note that assays of grab samples should not be taken as representative of the mineralization on the Aukam property as a whole.

The technical content of this News Release was reviewed and approved by Roger Moss Ph.D., P.Geo, a qualified person as defined by National Instrument 43-101.

About Gratomic Inc.

Gratomic is an advanced materials company focused on mine to market commercialization of graphite products most notably high value graphene-based components for a range of mass market products. We are collaborating with a leading European manufacturer of graphenes to use Aukam graphite to manufacture graphene products for commercialization on an industrial scale. The company is listed on the TSX Venture Exchange under the symbol GRAT.

For more information: visit the website at www.gratomic.ca or contact:

Arno Brand, Co-CEO, +1 416-561-4095

E-mail inquiries:Â [email protected]

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.â€

FORWARD LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward looking statements are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All of the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at www.sedar.com).

Tags: #graphitestocks, #Gratomic, #mining, #smallcapstocks, #Tires, $GRAT.ca #GRAT Graphene Graphite, $TSXV

Posted in AGORACOM News And Events, AGORACOM Small-Cap TV, All Recent Posts, Graphite, Small and Micro-Cap Space | Comments Off on $GRAT.ca Gratomic Announces Successful Startup of Aukam Proccesing Plant

AUGUSTA INDUSTRIES (AAO:TSXV) LOCK-UP AGREEMENT IS A WINNING STRATEGY

On September 29, 2016, Major Shareholders and Directors of dynaCERT announced a Lock-Up of more than 55,000,000 shares for 180 days, representing ~ 23% of the Company’s shares. The purpose of the Lock-Up was stated as follows:

“Given the significant progress that has been achieved in recent months, we felt a Voluntary Lock-Up Agreement would demonstrate to shareholders and potential investors the commitment and confidence that management, directors and certain major shareholders have in the future of dynaCERT.â€

The Company proceeded to make significant progress and its stock achieved the following performance over the next 12 months.

Augusta Industries Announces Lock-Up Agreement

On November 9th, Augusta Industries announced a Lock-Up Agreement for Directors and Officers holding 83.4 Million shares, representing 32% of the Company’s outstanding share amount. One major term of the Agreement is the agreement to vote the shares in support of the Augusta Spin-Off of Fox-Tek Canada Inc.

Allen Lone, President and CEO of Augusta stated:

“The company continues to work with its advisers to ensure the success of the proposed spinoff of Fox-Tek and to ensure that it is done it a manner that is beneficial to its shareholdersâ€

In both scenarios, management and major shareholders agreed to act in unison for the long-term benefit of each respective company and its shareholders. Though a Lock-Up on it’s own does not create the kind of share price appreciation experienced by dynaCERT, both the underlying fundamental strengths and the shareholder unison can’t be denied as harbingers of a bright future.

HIGHLIGHTS:

- Augusta revenues for 2016 / $4.6M

- Augusta market cap is ~ $10,000,000 as of November 9, 2017

- The proposed Spin-Off of FOX-TEK is expected to return up to $25,000,000 of stock to existing shareholders of Augusta.

- Though terms of the Spin-Off are yet to be finalized, the proposed $2.5:$1 benefit to shareholders is now one step closer with the announcement of the Lock-Up Agreement.

For more information about Augusta and the proposed Spin-Off, watch this interview with Allen Lone on AGORACOM.

Tags: #lockupagreement, #Oil&Gas, #shareholdervalue, #smallcapstocks, $AAO.ca, $TSXV

Posted in AGORACOM News And Events, AGORACOM Small-Cap TV, All Recent Posts, Featured | Comments Off on AUGUSTA INDUSTRIES (AAO:TSXV) LOCK-UP AGREEMENT IS A WINNING STRATEGY $PHO.ca $DYA.ca $OPS.ca

This is one of the best new clients AGORACOM has presented to members in years. Highlights include as follows:

- 2015 Revenues .. $USD 7.36 Million … Up 53%

- Q4 Revenues … $USD 2.49 Million … Up 101%

- Tier-1 Customers … Adobe, Tyson Foods, FMC Technologies and many more

- Tier-1 Partners … IBM Security, Juniper Networks, Verisign and many more

Managed Cybersecurity is an industry that is going to grow for years and VirtualArmor provides small cap investors with an opportunity to invest at a very early stage.

Tags: Managed Cyber Security, Small Cap Cloud Security, Small Cap Security, VirtualArmor

Posted in AGORACOM Small-Cap TV, AGORACOM Via Satellite, VirtualArmor | Comments Off on VIDEO – VirtualArmor Discusses Huge Revenue Growth In Cyber Security $VAI.ca

YOUR CANADA DAY GIFT

- Agricultural Company Producing Fertilizer and Revenues RIGHT NOW

- $8.5 Million In 2015 Sales Contracts

- Supplying World’s Largest Agricultural Region

- Doubling Capacity To 160,000 Tonnes Per Year

- Increasing To 240,000 In 2016; 320,000 In 2017

- Strong Institutional Financial Backing

WHO IS THIS COMPANY?

WATCH GEORGE’S INTERVIEW WITH CEO

- George Calls DuSolo A SmallCap 2.0Â Company

- Real Products, Real Customers, Real Revenues

- Ridiculously Low CapEx To Achieve Production

DO YOU DUE DILIGENCE … WATCH THIS INTERVIEW NOW

Hub On AGORACOM / Watch Interview Now!

Posted in AGORACOM Client Feature, AGORACOM Small-Cap TV, DuSolo Fertilizers Inc. | Comments Off on Your Canada Day Small Cap Gift – DuSolo Fertilizers (DSF:TSXV) (ELGSF:US) (E6R:Frankfurt)

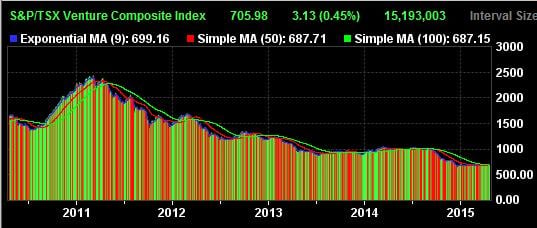

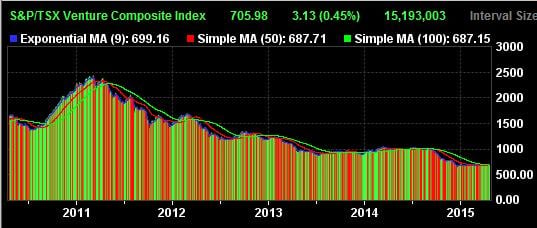

It is no secret that Canadian small-cap companies have taken a massive beating in the last 4 years, falling from 2,500 to 650 or ~ 75%. Â That is a brutal melt down and here is a visual:

Nobody escaped unscathed. Â If you were lucky, you survived – barely. Â The rest just died. Â AGORACOM survived largely because we saw the oversupply and called it as far back as 2008 when I posted the following right here on this same blog”

“Let the fly by nights die, consolidate those with decent assets and let the superstars stand up on their own two feet.”

Our industry, however, didn’t learn our lesson and chose to keep the fly by nights going in the name and pursuit of greed.  Unfortunately, Mr. Market doesn’t like an oversupply of non-performing assets, so he chose to teach us the lesson by turning fly by nights into zombies.  For the record, I want to thank Tony Simon for quantifying the term … but have to give credit to our very own Chief Market Commentator, Allan Bary Labouchan, for first applying the term Zombies to the TSX Venture Walking Dead … watch this clip.

THAT WAS THE BAD NEWS … HERE IS THE GOOD NEWS … I’M NOW CALLING A MELT UP

I’m calling it, right here, right now … the Canadian Small Cap Market is now entering a Melt UP Phase that will last for a minimum of 4 years. My call is based on the following:

- The Zombies may still be walking around but we all know who they are and they no longer pose a risk.

- Investors have ended the “mourning” phase and are now seeking new investments to build their future with. Â This is supported by our traffic metrics clearly demonstrating investors are spending more time researching even while the TSXV bottomed out in 2014.

- The Buzz at PDAC was much more focused on making real deals and moves between the strong companies that survived the melt down.

- The survivors are trading at ridiculously cheap prices.

- The TSX Venture Exchange is starting to see healthy diversification via “real” companies from the tech and medical space. Â I emphasize REAL because these companies have real products, customers and business plans.

More than just lip service, here is my video call. Â If your small cap company is ready to take advantage of the multi-year melt up, be sure to get in contact with us to discuss our CASHLESS online programs!

Posted in AGORACOM Allan Barry Reports, AGORACOM Best Of The Best, AGORACOM News And Events, AGORACOM Small-Cap TV, Small-Cap Investor Education, Trading School, TSX Venture | Comments Off on VIDEO: AGORACOM Predicts TSX Venture Small-Cap “Melt-Up”

This is the next installment in our Small Cap Leadership Series in which interview small cap resource companies that we consider to be leaders by virtue of their ability to advance promising projects at a time when most companies are just trying to keep the lights on.

OVERVIEW

This is a great interview with:

Dunnedin Ventures

DVI:TSXV

Chris Taylor, CEO

Allan Barry Laboucan, Special Advisor

- “Kahuna Diamond Project” (the “Project”), located in Nunavut, Canada. Kahuna is an advanced stage / high grade diamond project / discovered in 2001.

- Three main diamondiferous kimberlite dikes have been discovered, the Kahuna, PST and Notch.

- These have strike lengths, widths and grades comparable to producing diamond mines.

- The largest diamond recovered was a 5.43 carat stone from the Kahuna dike that had been broken during the sample preparation process and was reconstructed as having an original size of 13.42 carats

- Rapidly advancing the project towards feasibility

- Why diamond projects are set to become very valuable again

Posted in AGORACOM Best Of The Best, AGORACOM Small-Cap TV, AGORACOM Via Satellite | Comments Off on AGORACOM CEO Interview – Newest Diamond Player Dunnedin Ventures. Rapidly Advancing Towards Feasibility

AGORACOM – The Small Cap Epicenter reports on the day’s best small cap and micro cap press releases.

Good afternoon to you all. Please find enclosed a summary of the breaking small-cap and micro-cap financial news we highlighted on our TV show. It’s August 14th and we’ve found 12 great press releases to report on. It’s another great day for small-cap and micro-cap financial news.

If you miss an episode or want to search for your company in our archive, you can visit our industry leading Small-Cap Podcast site at any time:

If you want to subscribe to our Small-Cap RSS Feed or download our podcast everyday via iTunes, or your favourite podcatcher, just use the following:

TODAY’S SMALL-CAP AND MICRO-CAP BREAKING FINANCIAL NEWS

Today’s show features:

Almaden Minerals (AMM.T),

Canamex Resources (CSQ.V),

Midway Gold Corp. (MDW.T),

Redknee Solutions (RKN.T),

BSM Technologies (GPS.T),

Garibaldi Resources (GGI.V),

Klondex Mines (KDX.T),

Premier Gold Mines (PG.T),

Fission Uranium (FCU.V),

Dalradian Resources (DNA.T),

New Gold Inc. (NGD.T),

Lake Shore Gold (LSG.T)

Tags: $TSXV, Almaden Minerals (AMM.T), amex, BSM Technologies (GPS.T), Canamex Resources (CSQ.V), Dalradian Resources (DNA.T), finance, Fission Uranium (FCU.V), Garibaldi Resources (GGI.V), investing, investment, investor relations, Klondex Mines (KDX.T), Lake Shore Gold (LSG.T), micro-cap stocks, Midway Gold Corp. (MDW.T), New Gold Inc. (NGD.T), nyse, otcbb, pink, pink sheet, pink sheets, pinksheet, pinksheets, Premier Gold Mines (PG.T), Redknee Solutions (RKN.T), small cap stocks, stock, stock market, stocks, tsx, tsx-v, venture

Posted in AGORACOM Allan Barry Reports, AGORACOM Small-Cap TV, All Recent Posts | Comments Off on AGORACOM Small Cap Stock TV – Week of August 14, 2014

AGORACOM – The Small Cap Epicenter reports on the day’s best small cap and micro cap press releases.

Good afternoon to you all. Please find enclosed a summary of the breaking small-cap and micro-cap financial news we highlighted on our TV show. It’s July 30th and we’ve found 8 great press releases to report on. It’s another great day for small-cap and micro-cap financial news.

If you miss an episode or want to search for your company in our archive, you can visit our industry leading Small-Cap Podcast site at any time:

If you want to subscribe to our Small-Cap RSS Feed or download our podcast everyday via iTunes, or your favourite podcatcher, just use the following:

TODAY’S SMALL-CAP AND MICRO-CAP BREAKING FINANCIAL NEWS

Today’s show features:

Peregrine Diamonds (PGD.T),

Fission Uranium (FCU.V),

Continental Gold (CNL.T),

Kaminak Gold (KAM.V),

Mountainn Province Diamonds (MPV.T),

Rockhaven Resources (RK.V),

Dentonia Mines (DML.T),

Primero Mining (P.T),

Klondex Mines (KDX.T)

Tags: $TSXV, amex, Continental Gold (CNL.T), Dentonia Mines (DML.T), finance, Fission Uranium (FCU.V), investing, investment, investor relations, Kaminak Gold (KAM.V), Klondex Mines (KDX.T), micro-cap stocks, Mountainn Province Diamonds (MPV.T), nyse, otcbb, Peregrine Diamonds (PGD.T), pink, pink sheet, pink sheets, pinksheet, pinksheets, Primero Mining (P.T), Rockhaven Resources (RK.V), small cap stocks, stock, stock market, stocks, tsx, tsx-v, venture

Posted in AGORACOM Small-Cap TV, All Recent Posts | Comments Off on AGORACOM Small Cap Stock TV – July 30, 2014

AGORACOM – The Small Cap Epicenter reports on the day’s best small cap and micro cap press releases.

Good afternoon to you all. Please find enclosed a summary of the breaking small-cap and micro-cap financial news we highlighted on our TV show. It’s July 23rd and we’ve found 6 great press releases to report on. It’s another great day for small-cap and micro-cap financial news.

If you miss an episode or want to search for your company in our archive, you can visit our industry leading Small-Cap Podcast site at any time:

If you want to subscribe to our Small-Cap RSS Feed or download our podcast everyday via iTunes, or your favourite podcatcher, just use the following:

TODAY’S SMALL-CAP AND MICRO-CAP BREAKING FINANCIAL NEWS

Today’s show features:

Virtutone Networks VFX.V),

BlackBerry (BB.T),

Fission Uranium (FCU.V),

Cayden Resources (CYD.V),

Rockhaven Resources (RK.V),

Pilot Gold (PLG.T)

Tags: $TSXV, amex, Blackberry (BB.T), Cayden Resources (CYD.V), finance, Fission Uranium (FCU.V), investing, investment, investor relations, micro-cap stocks, nyse, otcbb, Pilot Gold (PLG.T), pink, pink sheet, pink sheets, pinksheet, pinksheets, Rockhaven Resources (RK.V), small cap stocks, stock, stock market, stocks, tsx, tsx-v, venture, Virtutone Networks (VFX.V)

Posted in AGORACOM Allan Barry Reports, AGORACOM Small-Cap TV | Comments Off on AGORACOM Small Cap Stock TV – July 23, 2014

AGORACOM – The Small Cap Epicenter reports on the day’s best small cap and micro cap press releases.

Good afternoon to you all. Please find enclosed a summary of the breaking small-cap and micro-cap financial news we highlighted on our TV show this morning. It’s July 16th and we’ve found 6 great press releases to report on. It’s another great day for small-cap and micro-cap financial news.

If you are new to the show, it is a daily, fast-paced, edgy report that we put out Mon – Thurs that strictly reports on the best small cap and micro cap news of the day. You can watch AGORACOM TV right from our home page.

If you miss an episode or want to search for your company in our archive, you can visit our industry leading Small-Cap Podcast site at any time:

If you want to subscribe to our Small-Cap RSS Feed or download our podcast everyday via iTunes, or your favourite podcatcher, just use the following:

TODAY’S SMALL-CAP AND MICRO-CAP BREAKING FINANCIAL NEWS

Today’s show features:

Integra Gold (ICG.V),

Rockhaven Resources (RK.V),

Ascot Resources (AOT.V),

Klondex Mines (KDX.T),

Dominion Diamonds (DDC.T),

Yorbeau Resources (YRB.A.T)

Tags: $TSXV, amex, Ascot Resources (AOT.V), Dominion Diamonds (DDC.T), finance, Integra Gold (ICG.V), investing, investment, investor relations, Klondex Mines (KDX.T), micro-cap stocks, nyse, otcbb, pink, pink sheet, pink sheets, pinksheet, pinksheets, Rockhaven Resources (RK.V), small cap stocks, stock, stock market, stocks, tsx, tsx-v, venture, Yorbeau Resources (YRB.A.T)

Posted in AGORACOM Allan Barry Reports, AGORACOM Small-Cap TV | Comments Off on AGORACOM Small Cap Stock TV – July 16, 2014