Toronto, Ontario–(April 29, 2015) – Avalon Rare Metals Inc. (TSX and NYSE MKT: AVL)(“Avalon” or the “Company“) is pleased to announce that it has entered into an agency agreement with Secutor Capital Management Corp. (“Secutor“), pursuant to which Secutor will act as agent on a best efforts basis in an offering of units of the Company (the “Units“) and flow-through shares of the Company (the “Flow-Through Shares“) for up to $5 million in gross proceeds (the “Offering“).

The Offering is comprised of up to 7,352,941 Units at a price of $0.34 per Unit, and up to 6,410,256 Flow-Through Shares at a price of $0.39 per Flow-Through Share. Each Unit consists of one common share (a “UnitShare“) and one-half of one non-transferrable common share purchase warrant (each whole warrant, a “Warrant“). Each Warrant entitles the holder to purchase one common share of the Company at a price $0.425 per share, for a period of 18 months following the issuance of the Warrants. Each Flow-Through Share will qualify as a “flow-through share” within the meaning of the Income Tax Act (Canada).

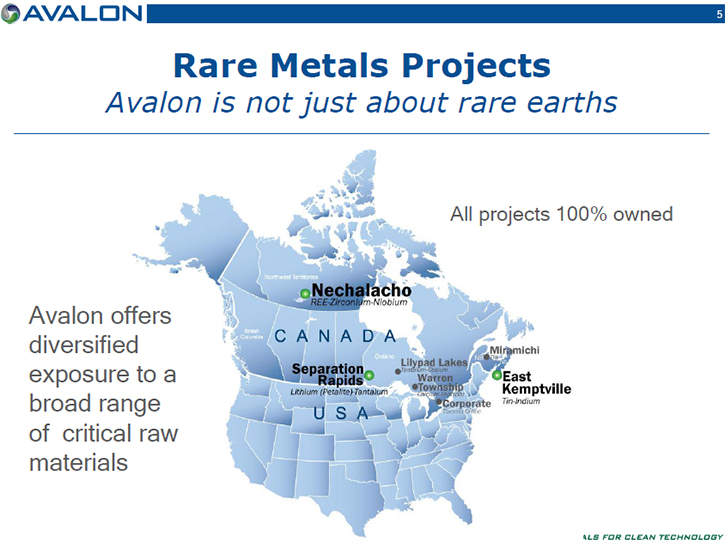

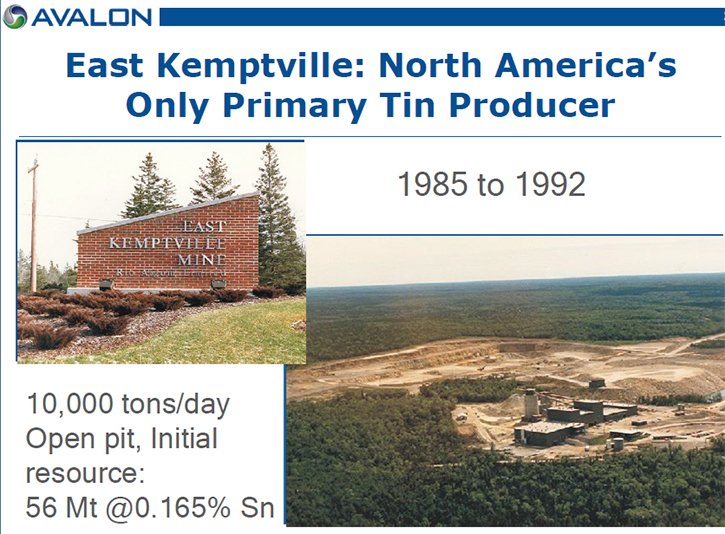

The Company intends to use the gross proceeds from the sale of the Flow-Through Shares for work on three mineral properties: the Nechalacho Rare Earth Elements Project, the East Kemptville Tin-Zinc-Copper-Indium Project and the Separation Rapids Lithium Minerals Project and the net proceeds from the sale of the Units for working capital and general corporate purposes.

The Corporation has granted Secutor an option (exercisable in whole or in part, in Secutor’s sole discretion), for a period of 30 days from closing of the Offering to purchase up to an additional 2,064,479 Units at a price of $0.34 to cover over-allotments, if any, and for market stabilization purposes.

The Offering is expected to close on or before May 12, 2015, subject to customary closing conditions, including the conditional approval of the Toronto Stock Exchange and the NYSE MKT.

The Offering is being made outside of the United States by way of a prospectus supplement dated April 29, 2015 to the Canadian base shelf prospectus dated September 10, 2013. The prospectus supplement relating to the Offering has been filed with the applicable provinces and territories in Canada and is available on SEDAR at www.sedar.com. The prospectus supplement forms part of the shelf registration statement filed with the United States Securities and Exchange Commission (the “SEC“), File No. 333-190771, which was declared effective by the SEC on September 12, 2013, and will be filed with the SEC pursuant to General Instruction II.L. of Form F-10 under the U.S. Securities Act registering for distribution under the U.S. Securities Act the Unit Shares, Warrants and Flow-Through Shares and will be available at the SEC’s websitewww.sec.gov.

This press release shall not constitute an offer to sell or solicitation of an offer to buy these securities, and these securities may not be offered or sold in any jurisdiction in which their offer or sale would be unlawful.

About Avalon Rare Metals Inc.

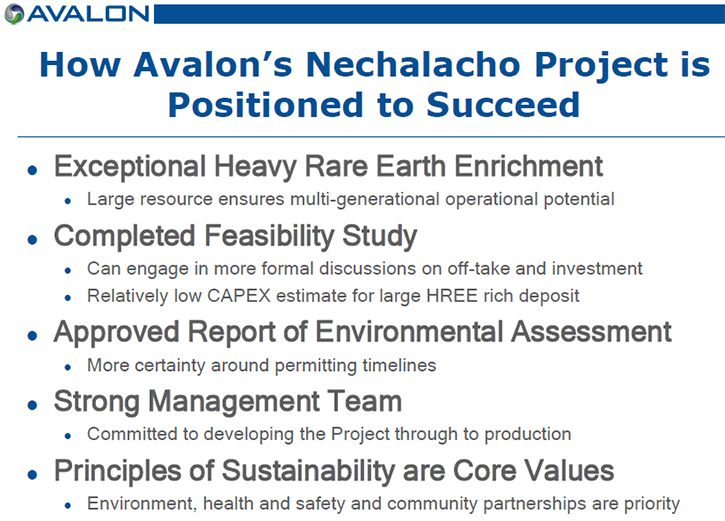

Avalon Rare Metals Inc. is a mineral development company focused on rare metal deposits in Canada, with three advanced stage projects. Its 100%-owned Nechalacho Deposit, Thor Lake, NWT is exceptional in its large size and enrichment in the scarce “heavy” rare earth elements, key to enabling advances in clean technology and other growing high-tech applications. Avalon is also advancing its Separation Rapids Lithium Minerals Project, Kenora, ON and its East Kemptville Tin-Indium Project, Yarmouth, NS. Social responsibility and environmental stewardship are corporate cornerstones.

For questions and feedback, please e-mail the Company at [email protected], or phone Don Bubar, President & CEO at 416-364-4938.

This news release contains “forward-looking statements“ within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements related to how the Companyplans to use the net proceeds from the Offering and the anticipated closing date of the Offering. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “potential“, “scheduled“, “anticipates“, “continues“, “expects“ or “does not expect“, “is expected“, “scheduled“, “targeted“, “planned“, or “believes“, or variations of such words and phrases or state that certain actions, events or results “may“, “could“, “would“, “might“ or “will be“ or “will not be“ taken, reached or result, “will occur“ or “be achieved“. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Avalon to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made. Although Avalon has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking statements include, but are not limited to market conditions, the need for continued cooperation and performance of the parties to the transaction, as well as those risk factors set out in the Company‘s current Annual Report,Management‘s Discussion and Analysis and other disclosure documents available under the Company‘s profile at www.SEDAR.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements have been provided for the purpose of assisting investors in understanding the Company‘s plans and objectives and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking statements. Avalon does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.