VANCOUVER, British Columbia, Aug. 11, 2020 (GLOBE NEWSWIRE) — Candente Copper Corp. (TSX:DNT, BVL:DNT) (“Candente Copper” or the “Company”) advises that Mr. Luis Miguel Inchaustegui Zevallos has resigned as Advisor and Director of our Peruvian subsidiary, Cañariaco Copper Perú S.A. (”Cañariaco”) and has been named Minister of Energy and Mines of Peru.

We thank Mr. Inchaustegui for all of his excellent advice and wish him all the best in his new endeavours.

On another matter the Company also advises that the Board of Directors has adopted a new shareholder rights plan (“Rights Plan”), which is designed to encourage the fair treatment of the Company’s Shareholders in connection with any potential take‑over bid for the Company. The Rights Plan is not intended to deter or prevent take‑over bids and is similar to plans adopted recently by several other Canadian public companies and approved by their Shareholders.

Background and Purpose of the Rights Plan

The Rights Plan will:

- encourage the fair treatment of shareholders of the Company in connection with any Offer to Acquire the outstanding Voting Shares;

- ensure, to the extent possible, that the shareholders of the Company and the Board of Directors have adequate time to consider and evaluate any unsolicited Offer to Acquire the outstanding Voting Shares;

- ensure, to the extent possible, that the Board of Directors has adequate time to identify, develop and negotiate value-enhancing alternatives, as appropriate, to any unsolicited Offer to Acquire the outstanding Voting Shares; and

- generally assist the Board of Directors to enhance shareholder value.

Take‑over bid contests for corporate control provide a singular opportunity for Shareholders to obtain a one‑time gain. After the acquisition of effective control, the opportunity for this one‑time gain normally does not re‑occur. As with most public companies, it is possible for a person to secure control of the Company through the ownership of much less than 50% of the Company’s shares. Without a shareholder rights plan, a bidder could acquire effective control of the Company over a relatively short period of time, through open market and private purchases and using various techniques permitted under Canadian securities legislation, all without making a bid available to all Shareholders. This acquisition of control would probably be an effective deterrent to other potential offerors. The person acquiring control might also be able to consolidate and increase its control, over a period of time, without the price for control ever being tested through an open market auction. Shareholder rights plans are designed to prevent this occurrence by forcing all acquisitions of control into a public offer mode.

A public offer will not necessarily achieve all of the objectives of ensuring the maximum value to Shareholders. The Rights Plan is intended to provide the Board with sufficient time to pursue alternatives and to provide Shareholders with sufficient time to properly assess any take‑over bid.

The Company is not proposing the Rights Plan in response to or in anticipation of any acquisition or take‑over bid. The Rights Plan is not intended to prevent a take‑over of the Company, to secure continuance of current management or the directors in office, or to deter fair offers for the Company’s shares. The Rights Plan does not inhibit or prevent any Shareholder from using the proxy mechanism set out in the BCBCA to promote a change in the management or direction of the Company. The Rights Plan may, however, increase the price to be paid by a potential offeror to obtain control of the Company and may discourage certain transactions.

The Rights Plan does not affect in any way the Company’s financial condition. The initial issuance of the Rights will not dilute the Company’s shares and will not affect reported earnings or cash flow per share until the Rights separate from the underlying common shares and become exercisable. The adoption of the Rights Plan will not lessen or affect the duty of the Company’s directors to act honestly, in good faith, and in the Company’s best interests. The Rights Plan is designed to provide the directors with the means to negotiate with an offeror and with sufficient time to seek out and identify alternative transactions on behalf of the Shareholders.

The Rights Plan is subject to Toronto Stock Exchange and Shareholder approval at the upcoming Annual General Meeting on September 17th, 2020. If the Shareholders do not approve the Rights Plan, it will terminate or not become effective, as applicable. The Rights Plan will also expire if the Rights are redeemed by the Company. A copy of the Rights Plan Agreement can be requested for review to [email protected].Once the Rights Plan has been approved, it will be filed on SEDAR at www.sedar.com and posted on the Company’s website at www.candentecopper.com.

About Candente Copper

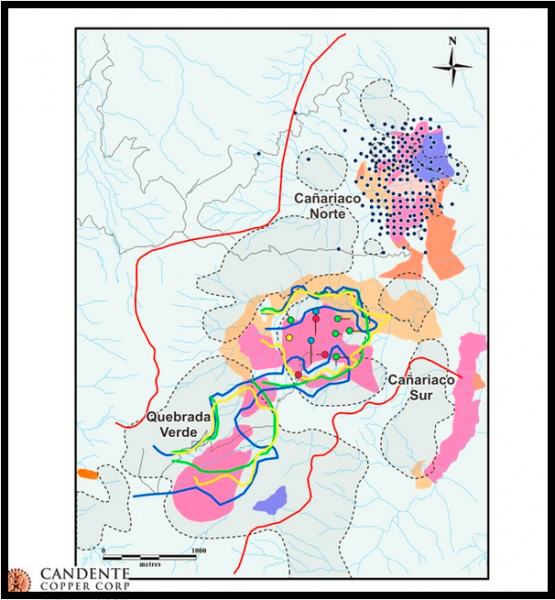

Candente Copper is a mineral exploration company engaged in acquisition, exploration, and development of mineral properties. The Company is currently focused on its 100% owned Cañariaco project, which includes the Feasibility stage Cañariaco Norte deposit as well as the Cañariaco Sur deposit and Quebrada Verde prospect, located within the western Cordillera of the Peruvian Andes in the Department of Lambayeque in Northern Peru.

At Cañariaco Norte, 7.5 billion pounds of copper have been delineated in a Measured and Indicated* resource of 752.4 million tonnes grading 0.49% copper equivalent** and an Inferred Resource of 157.7 million tonnes at 0.44% copper equivalent has also been delineated.

Fifteen drill holes have confirmed that Cañariaco Sur hosts a porphyry-copper deposit, however the average grade and full dimensions of the deposit are as yet unknown. Quebrada Verde also hosts a geochemical and geophysical target where porphyry style copper mineralization is exposed in creek beds.

Candente Copper also holds other porphyry copper-gold exploration projects in Peru.

Joanne C. Freeze, P.Geo., CEO, is the Qualified Person as defined by National Instrument 43-101 for the projects discussed above. She has reviewed and approved the contents of this release.

*The ‘Measured and Indicated Resource listed above consists of Measured Resources of 338.1Mt at 0.48% Cu , 0.08 g/t Au, and 2.0/t Ag (0.52% Cu Eq.), plus Indicated Resources of 414.3Mt at 0.43% Cu, 0.06 g/t Au, and 1.8 g/t Ag (o.46% Cu Eq.). All resources quoted in this release are based on a 0.30% copper cut-off grade and 229 drill holes completed to the end of 2008.

**Copper equivalent grade including gold and silver, metal recoveries (copper 90%, gold 55%; silver 50%) and smelter returns (copper 96.5%: gold 93%; silver 90%) applied. Copper grade equivalent calculation: Cu Eq% =(Cu % + ((Au grade x Au price x Au recovery x Au smelter return%)+(Ag grade x Ag price x Ag recovery x Ag smelter return%))/(22.0462 x Cu price x 31.0135 g/t x Cu recovery x Cu smelter return%). The metal prices used are: copper US$2.50/lb, gold US$1,035/oz and silver US$17.25/oz.

On behalf of the Board of Candente Copper Corp.

“Joanne C. Freeze” P.Geo.

President, CEO and Director

___________________________________

For further information please contact:

“Joanne C. Freeze” P.Geo.

President, CEO and Director

Tel +1 604-689-1957

[email protected]

www.candentecopper.com