Archive for the ‘HPQ-Silicon Resources Inc.’ Category

INTERVIEW: $HPQ.ca Silicon Shines Bright With Apollon Solar As They Move Towards #Solar Grade #Silicon Metal Pilot

Energy Transition: $HPQ.ca – Apollon #Solar Extend Agreement Regarding the Development of the Technological Clusters Needed for a Green and Low Cost Transformation of #PUREVAP #Silicon Into Solar Grade Silicon

- Announced that anticipated results from the mid 2019 commissioning of the PUREVAP™ Quartz Reduction Reactor pilot plant motivated the extension of the agreement with Apollon Solar SAS

- Apollon Solar is a private French company that, over the past 20 years, has become one of the world leaders in the development of the metallurgical purification steps necessary for the transformation of 1 to 2 N silicon metal (“MG-Si”) into solar grade silicon metal

MONTREAL, April 04, 2019 — HPQ Silicon Resources Inc. (“HPQ”)Â (TSX VENTURE:HPQ) (FRANKFURT:UGE) (OTC PINK:URAGF)Â is pleased to announce that the anticipated results from the mid 2019 commissioning of the PUREVAP™ Quartz Reduction Reactor (“QRR”) pilot plant motivated the extension of the agreement with Apollon Solar SAS, (“Apollon”). Apollon Solar is a private French company that, over the past 20 years, has become one of the world leaders in the development of the metallurgical purification steps necessary for the transformation of 1 to 2 N silicon metal (“MG-Si”) into solar grade silicon metal (“SoG-Si”), the critical material needed for the photovoltaic conversion of the sun energy into electricity.

CONTINUING THE VALIDATION OF THE INNOVATIVE SOLAR POTENTIAL OF THE PUREVAPTM QRR

Bernard J. Tourillon President and CEO of HPQ Silicon Resources stated: “The December 2017 agreement with Apollon was the final piece of the puzzle in the creation of a world-class technical team. Joining PyroGenesis (PYR-TSXV) and HPQ, Apollon is dedicated to establishing a Low Cost and Green metallurgical approach for the production of solar grade silicon metal (SoG-Si). The extension of the agreement, as we get ready to produce our first 4N+ Purity (99.99+%) PUREVAP™ Silicon Metal (Si) (PVAP-Si) in 2019, could not be better timing, as the identification of the technological clusters needed for the transformation of PVAP-Si into SoG-Si has already startedâ€.

The following release will take the form of a question and answer discussion between Mr. Bernard J. Tourillon (MBA, President and CEO of HPQ Silicon) who will ask the questions, and Mr. Jed Kraiem Ph.D, (General Manager at Apollon Solar) who will answer them.

Q. Hi Jed, thank you for taking the time for the Q&A session. Can you describe Apollon Solar’s expertise in the metallurgical production of Solar Silicon (SoG-Si UMG)?

A. Certainly, for almost 20 years Apollon has invested time and money in research and development related to the development of metallurgical routes for the production of solar grade silicon metal (SoG-Si). Over time, Apollon emerged as a world leaders in the definition of impurity specifications for SoG-Si and the development of technological process required (Clusters) to produce solar cells with high photovoltaic conversion efficiency using silicon produced via metallurgical processes (“SoG Si UMG”). Some of our most significant achievements are:

- We were the first company ever (and the only one) to manufacture entirely monocrystalline Czochralski (Cz) ingots made with 100% SoG Si UMG;

- Working with the UNSW (University of New South Wales), we have obtained a Voc of 690 mV on standard PHOTOSIL Multi-crystalline Si wafers with a resistivity of 0.5 Ohm.cm;

- Working with the ANU (Australian National University), we have obtained, and the results were independently validated by a third party Institute, a maximum conversion efficiency of 21.1% on N-type wafers, a world record for a solar cell made from 100% “SoG Si UMG” that is still standing today. Furthermore, without betraying any secret, we can already say that this record should be largely beaten in the coming months.

Q. Can you please describe the differences between the chemical production of Polysilicon (Siemens process) and a metallurgical production of Solar grade Silicon (SoG-Si UMG)?

A. Polysilicon was originally designed to meet the demands of the electronic industry with purities between 9N to 11N depending on end usage. The Siemens process uses hydrochloric acid to dissolve MG-Si and produce a gas compound, trichlorosilane on a fluidized bed, then that gas compound is purified and finally reduced to solid silicon or Polysilicon. This process requires significant amounts of electrical energy (about 72 kWh per kg produced) and is potentially harmful to the environment because of the usage of chloride and silane in the process. Over the years, the Siemens process was optimized around producing 6N to 9N purity Si used in the solar industry and massive investments in commercial development lead to large plants being built. The main reason the chemical approach became the dominant process until now was the absence of alternatives to polysilicon in the early 2000s, when solar energy experienced it’s first boom. At that time, solar cells using metallurgically produce Solar Grade Silicon Metal were unable to reach the same levels of performance as those reached with polysilicon.

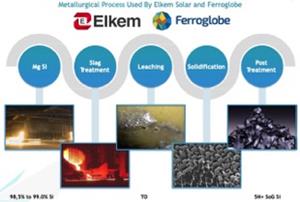

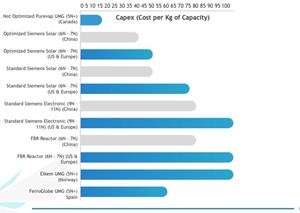

Metallurgically produced Solar Grade Silicon Metal (SoG-Si) has a purity of 5N+ with the main impurities being Boron, Phosphorus, Carbon and Oxygen. Contrary to chemical Solar Grade Si production (Siemens or FBR), the production of SoG-Si via metallurgical routes involves different liquid and solid phase processes, with at least 3 different purification steps (Cluster) needed to obtain solar requirements. Since the final purity of the product is adapted to solar application, CAPEX demands are reduced and after industrial scale optimization, operating costs (OPEX) will be significantly lower. Since 2007, many industrials have refined metallurgical Silicon into Solar Grade Silicon Metal (SoG –Si) via metallurgical processes and demonstrated that photovoltaic performances could be similar to performance attained using polysilicon.

On that point, Apollon Solar was one of the very first companies to demonstrate the possibility of obtaining very high photovoltaic conversion efficiency using 100% SoG Si UMG.

Q. Few industrial manufacturers have demonstrated an interest in metallurgical production of Solar Silicon (SoG-Si UMG), why is Apollon Solar still interested in its potential?

A. Developing a metallurgical pathway for the production of solar grade silicon metal requires time and significant investments. During the past 10 years, Apollon Solar has been involved in the development and optimization of the technologies needed to purify silicon metal (Mg-Si). Thanks to our global vision of the value chain and especially our photovoltaic expertise, Apollon Solar has identified the processes that need to be integrated in order to produce metallurgically low cost solar grade silicon metal (SoG-Si) that can reach high photovoltaic efficiency (Technological clusters).

Because of our unique expertise in both Silicon metallurgy and photovoltaic cells, Apollon Solar strongly believes in the future of the metallurgical pathway, but that is not the case for other manufacturers who generally only have one of these two core competences

Furthermore, three recent facts have reinforced our interest in the metallurgical production of SoG-Si:

- The production in the near future of 4N purity Si (PVAP-Si) at a cost similar to traditional MG Si;

- The possibility of using low resistivity wafers (higher concentration of Boron and Phosphorus) to obtain high PV efficiencies thanks to Passivated Emitter & Rear Cell (PERC)1 cell technology;

- The growing interest of public administrations and consumers for photovoltaic modules with a low carbon footprint (reduction of approximately 33% of the module’s CO2 emissions through the use of metallurgical solar Si).

Q. Can you explain why Apollon thinks that an innovation like PUREVAP™ RRQ will allow the metallurgical production of Solar Silicon (SoG-Si UMG) to compete with polysilicon production?

A. In 2017, Apollon Solar identified the PUREVAP™ QRR process as a unique metallurgical process, based on an innovative technological approach developed by PyroGenesis Canada Inc (“PCI”) for HPQ (patent pending, owned by HPQ).

Basically PUREVAP™ is a technology that is totally different from the traditional processes that transform Quartz into Metallurgical Silicon (“MG-Si”) and it is totally different from the well-known conventional physical and chemical processes of metallurgical purification of silicon (plasma, slags, acid leaching, alloys, and others).

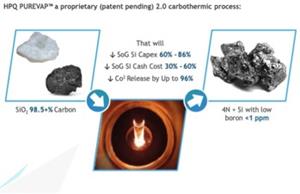

The successful industrialization of such a simpler process, as well as the production of PUREVAP™ Silicon metal of 4N + purity (99.99 +% Si) with 1 ppmw of Boron (PVAP-Si) would result in a simplification of the refining steps and an improvement in material yield, resulting in significant cost savings (CAPEX and OPEX). Although still subject to validation, the addition of the technologies required for the transformation of PVAP-Si into Metallurgical Solar Silicon (“SoG-Si UMG”) would allow for a cost reduction that could equate to 60% for CAPEX and 30% for the “cash costs” (versus the most recent factories built in China).

While there is still some way to go toward industrial validation, this is a true innovation and its potential is there, so this is why we are excited to be continuing our involvement with HPQ!

Q. Which types of solar cells is the PUREVAP™ SoG-Si UMG meant for?

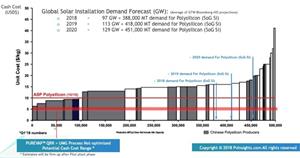

A. The first application for a PUREVAP™ SoG-Si UMG will be Multicrystalline solar cells (p-type Al-BSF and PERC) which will represent about 40% of the market in 2019 (that is about 50 GW or 175,000 MT/year of SoG Si). This is related to the fact that impurities specifications are less restrictive in multicrystalline than monocrystalline cells.

The new Mono PERC cell structures enabled higher solar cells efficiencies and lower SoG-Si consumption, monocrystalline (“mono-câ€) cells are presently gaining market shares compared to multicrystalline (multi-câ€), but this does not mean that the market for multicrystalline solar cells is not without a future.

The potential cell efficiency of a Multi PERC cell structure should be about 22.5%. Future multicrystalline market shares will depend on its costs and the speed at which cell performance will increase. Based on historical precedents, major technological advances in solar cells are always implemented first in the mono-c Si market before transferring to the multi-c Si market. When the significant cost reduction emanating from technological advances reaches the multi-c Si, it always gains back the market share lost to mono-Si.

Combining the innovations related to the increase conversion efficiency from Mono-c Si to Multi-c to the usage of a PUREVAP™ SoG-Si UMG will present a new pathway to significantly reducing the costs of the multi-c solar cells, as SoG-Si currently represents about 15% of the costs of a solar module.

Q. Can HPQ’s PUREVAP™ SoG-Si UMG be used to produce Si for industrial monocrystalline cells?

A. In the past, Apollon Solar and their partners have proven that high efficiency monocrystalline cells can be made from SoG Si 100% UMG (today’s world record at 21.1%). So this is an opportunity that will be studied as well. Indeed the difference in cell efficiency for solar cells made from SoG Si 100% UMG compared to solar cells made from polysilicon reference wafers could be less than 1.0% absolute.

Q. What is Apollon Solar’s position on perovskites solar cells?

A. Perovskites use in photovoltaic applications is a very recent innovation so this is a less mature technology compared to crystalline SoG-Si. While Perovskites base technology has made enormous progress in terms of photovoltaic efficiency in recent years and it cost and efficiency potential is very appealing, two major problems have emerged:

- A problem of long-term stability (cells are very sensitive to moisture) and;

- Lead is a major component of perovskites, making them less environmentally friendly than Silicon while its removal reduces cells performances.

Many research efforts on that topic are currently underway and could eventually solve these main problems. However, perovskites are still far from industrialization and before they are able to compete with SoG-Si, a lot of convincing results will be required regarding both performance and reliability over time.

This having been said, another interesting point seems to be the potential to use SoG-Si in combination with Perovskites. In this case, the low cost solar Silicon (“SoG-Si UMG”) produced by HPQ could probably be adapted to the industrial realization of Silicon/Perovskites tandem cells. Indeed for that type of cells, an optimum between the purity and the cost of silicon presumably exists. This is where a PUREVAP™ SoG-Si UMG would be at an advantage versus polysilicon with it high fixed costs that do not depend on the purity of the product.

Q. Do you see other markets for the PUREVAP™ RRQ process?

A. Whatever process is used to produce Solar grade Silicon (“SoG Si”) (metallurgical or chemical), the main raw material needed will always be Metallurgical Grade Silicon Metal (“Si-MG”), a product that costs producers of SoG Si approximately US $ 2.5/kg for a 2 N purity raw material.

This reality has not changed even as production costs for industry leaders went from US $ 25 per kg fifteen years ago to less than US $ 9 per kg today, therefore making the relative importance of this raw material going from less than 10% of costs about fifteen years ago, when Polysilicon selling prices were high (> US $ 50 per kg) up to approximately 33% of today’s cost, just as Polysilicon spot prices have starting reaching a price range <US $ 10 per kg.

The PUREVAP™ process, being the only process that can provide the industry with access to a superior raw material, will have a significant competitive advantage versus traditional producers of Mg-Si.

Finally, by optimizing the PUREVAP™ Silicon structure, it could be made suitable for use in a very important potential market: anodes for Lithium-ion batteries.

Q. No industrial group involved in the production of Metallurgical Silicon (MG – Si) and Solar Silicon (SoG – Si) seems interested in developing an equivalent process, why?

A. Firstly, it is important to realize that there is a real cultural difference between upstream actors, (metallurgical grade Silicon metal and Solar Grade Silicon Metal producers) and downstream producers, (photovoltaic producers). Contrary to what one might believe, the border between these two groups is not very porous. Having experienced these difficulties first hand in our previous projects, this is an area where Apollon Solar can help HPQ and PyroGenesis benefit from the lessons learned and make these two worlds work together to our advantage.

Secondly, until recently there was no significant market for high purity metallurgical Silicon 3N + (99.9 +% Si) and this may explain some of this lack of interest.

Yet, for several decades now, researchers and industrials have developed Metallurgical purification processes that are now mature and can produce Solar Grade Silicon (“SoG-Si UMG”) from Metallurgical Silicon Metal (“MG- Si”).

The industrial scaling up development of these technologies was long and costly, but some industrials did succeed in producing a commercial SoG-Si UMG. While metallurgical production of SoG-Si consumes less energy than chemical production SoG-Si (35,000 KWh/t versus 72,000 KWh/t), operational savings until now have never been enough to pay back the CAPEX required for the production of SoG-Si UMG.

Presently only REC Solar Norway (Elkem Solar) still seemed to have an industrial production of SoG-Si UMG and it is small, 8,000 MT per year, or about 2% of the global solar Si market.

One of the main reasons why industrials have limited their investment in new metallurgical process to make SoG-Si is the massive margin destruction that has been happening over the last 25 years, and this even as demand for solar panels increased exponentially. This contradictory reality is a demonstration of the price elasticity of solar energy, whereby reduction in cost of making solar energy results in an increase in demand for solar energies.

Q. What is the future trend of the Solar Grade Silicon market?

A. Just during the last 6 years, the spot prices of polysilicon (“SoG-Si”) dropped from US $25 per kg to less than US $ 10 per kg. At these new prices not even the new high-performance plants built in China, with their cash cost below US$ 9 per Kg, and their all in cost around US$ 14 per kg can continue operating for a long period with spot prices staying below US$ 14 per kg.

So if there is a conclusion I would like readers to take away from this exchange is that demand for Solar Energy is not going away, therefore demand for SoG Si is not going away either. Furthermore, since chemical processes to make SoG-Si have been optimized to the max, it is evident that very soon a new Low Cost pathway to make a SoG-Si that can produce high efficiency solar cells will be needed to meet solar demand.

The PUREVAP™ RRQ process being develop by HPQ and PyroGenesis is coming to market at the most opportune time, and when you combine this new process with our solar technological knowhow it creates a solar team with the potential to become a significant agent of change for the industry.

This press release is available on the forum “CEO Verified Discussion Forum“, a moderated social media platform that allows civilized discussion and questions and answers between management and shareholders.

About HPQ Silicon

HPQ Silicon Resources Inc. is a TSX-V listed (Symbol HPQ) resource company focuses on becoming a vertically integrated producer of High Purity Silicon Metal (4N+) and a metallurgical producer of Solar Grade Silicon Metal (“SoG-Siâ€) used in the manufacturing of multi and monocrystalline solar cells of the P and N types, required for production of high performance photovoltaic solar systems.

HPQ’s goal is to develop, in collaboration with industry leaders, PyroGenesis (TSX-V: PYR) and Apollon Solar, experts in their fields of interest, the innovative PUREVAPTM “Quartz Reduction Reactors (QRR)â€, a new Carbothermic process (patent pending), which will permit the transformation and purification of quartz (SiO2) into high purity silicon metal (4N+ Si) in one step therefore reducing significantly the CAPEX and OPEX costs associated with a metallurgical transformation of quartz (SiO2) into SoG Si. The pilot plant equipment that will validate the commercial potential of the process is on schedule to start mid-2019

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, contact

Bernard J. Tourillon, Chairman, President and CEO Tel (514) 907-1011

Patrick Levasseur, Vice-President and COO Tel: (514) 262-9239

www.HPQSilicon.com

Shares outstanding: 222,284,053

$HPQ.ca Silicon Resources Inc. – New Wind and Solar Power Is Cheaper Than Existing Coal in Much of the U.S., Analysis Finds

SPONSOR: HPQ-Silicon Resources Inc. (HPQ:TSX-V) A leader in High Purity Quartz Exploration in Quebec and vertically integrated producer of Silicon Metal, Solar Grade Silicon Metal and polysilicon. Learn More.

————————-

New Wind and Solar Power Is Cheaper Than Existing Coal in Much of the U.S., Analysis Finds

Coal-fired power plants in the Southeast and Ohio Valley stand out. In all, 74% of coal plants cost more to run than building new wind or solar, analysts found.

By Dan Gearino

Mar 25, 2019

- Not a single coal-fired power plant along the Ohio River will be able to compete on price with new wind and solar power by 2025, according to a new report by energy analysts.

- The same is true for every coal plant in a swath of the South that includes the Carolinas, Georgia, Alabama and Mississippi

Nearly three-fourths of the country’s coal-fired power plants already cost more to operate than if wind and solar capacity were built in the same areas to replace them, a new analysis says. Credit: Robert Nickelsberg/Getty Images

Not a single coal-fired power plant along the Ohio River will be able to compete on price with new wind and solar power by 2025, according to a new report by energy analysts.

The same is true for every coal plant in a swath of the South that includes the Carolinas, Georgia, Alabama and Mississippi. They’re part of the 86 percent of coal plants nationwide that are projected to be on the losing end of this cost comparison, the analysis found.

The findings are part of a report issued Monday by Energy Innovation and Vibrant Clean Energy that shows where the shifting economics of electricity generation may force utilities and regulators to ask difficult questions about what to do with assets that are losing their value.

The report takes a point that has been well-established by other studies—that coal power, in addition to contributing to air pollution and climate change, is often a money-loser—and shows how it applies at the state level and plant level when compared with local wind and solar power capacity.

“My big takeaway is the breadth and universality of this trend across the continental U.S. and the speed with which things are changing,” said Mike O’Boyle, a co-author of the report and director of energy policy for Energy Innovation, a research firm focused on clean energy.

The report is not saying that all of those coal plants could or should be immediately replaced by renewable sources. That kind of transition requires careful planning to make sure that the electricity system has the resources it needs. It also doesn’t consider the role of competition from natural gas.

The key point is a simpler one: Building new wind and solar power capacity locally, defined as within 35 miles for the report, is often less expensive than people in those markets realize, and this is indicative of a price trend that is making coal less competitive.

This shift shows how market forces are helping the country move away from fossil fuels. At the same time, coal interests have been trying to obscure or cast doubt on this trend, while seeking more government subsidies to slow their industry’s decline.

Coal Concerns in the Solar-Rich Southeast

Nearly three-fourths of the country’s coal-fired power plants already cost more to operate than if wind and solar power were built in the same areas to replace them, the report says.

By 2025, with the costs of building wind and solar power expected to continue to decline, the analysts project that 86 percent of coal-fired power plants will be more expensive than local renewable energy. Notably, the 2025 wind and solar estimates assume that expiring federal tax credits will not be extended, so any price advantage is without federal credits.

In parts of the country where power plants compete on open markets, such as most of Texas, companies may be more quick to shut down money-losing plants because plant owners are the ones bearing the losses.

It’s different in places where plants are fully regulated, as plant owners can pass extra costs on to consumers.

The Southeast, which is almost entirely regulated markets, has some of the costliest coal plants and is rich with solar resources.

“Consumer advocates and regulators there should be asking harder questions about integrating renewables,” said Eric Gimon, an energy analyst and co-author of the report.

In North Carolina, for example, a state second only to Indiana in total coal plant capacity, every one of those coal-fired power plants is “substantially at risk,” meaning the existing plants have operational costs that are at least 25 percent more than what it would cost to build wind or solar capacity, the report says.

The state’s largest utility, Duke Energy, has invested in solar. The report shows that there is room for more of this development, and that the state remains heavily dependent on coal power that is not cost-competitive.

Political Opposition in the Ohio Valley

In the Ohio Valley, some of the sunniest parts of Ohio are near the river in the southern and southwest parts of the state, areas that now have almost no solar power development. American Electric Power, a Columbus-based utility, has proposed solar arrays there, but the plans are running into fierce opposition before state regulators and it is far from clear that the projects will get approved.

The Ohio Valley is a hub for coal-fired power, with plants that were built because of proximity to coal mines and the ability to deliver coal on river barges. And yet, the report shows that most of those plants cost more to operate than building new wind and solar capacity.

One of the exceptions is the Gavin Power Plant, the largest in Ohio and one of the largest in the country at 2,600 megawatts, which is operating at a large enough scale to remain competitive. But by 2025, even Gavin won’t be able to keep up with the declining costs of wind and solar, according to the report. This doesn’t mean the plant will be unprofitable, but it signals a shift in the market that will put increasing pressure on the plant.

Some Utilities Are Factoring in Climate Impact

Colorado and the St. Louis metro area are two of the few places were coal plants would retain a cost advantage over new renewable energy in 2025, according to the analysis. The authors say that is because of a lack of available land to build cost-effective wind or solar within 35 miles and because the plants are close to coal mines, which reduces fuel costs.

But a purely cost-based analysis leaves out other reasons to shut down coal plants and build wind and solar, as shown by the largest utility in Colorado, Xcel Energy, which is doing just that.

The company’s executives said they were responding to reports about the acceleration of climate change. They have found that they can build new wind and solar capacity for little or no extra cost, which is a less precise comparison than in the new report.

And, they are preparing for the possibility that Colorado will pass a law requiring utilities to shift to 100 percent renewable energy, which is a priority of new Democratic Gov. Jared Polis.

Distance can also make a difference in cost calculations. If new resources are built far from the ones they are replacing, grid operators and utilities need to make sure they have enough power line capacity to transport the electricity. Also, there are local economic considerations. Utilities sometimes put new projects in the same metro areas as ones that are closing to help the local community. This has been part of Excel’s planning process in Pueblo, Colorado, where it is closing a coal plant and developing new solar.

Natural Gas Competition Also Plays a Role

The report’s findings about the declining viability of coal plants are in line with previous studies, including one from March 2018 from BloombergNEF with the headline “Half of U.S. Coal Fleet on Shaky Economic Footing.”

But there is a key difference. The BloombergNEF report looked at the finances of coal plants in the context of competition from all fuels, including natural gas.

William Nelson, a co-author of the BloombergNEF report, says he is leery of comparing the costs of building new wind and solar to the costs of operating existing coal plants because a coal plant is capable of running around the clock, which makes it a different type of resource than wind and solar unless there is large-scale battery storage.

And, he thinks that natural gas prices are an essential part of the conversation in places such as the Ohio Valley, where gas is plentiful and inexpensive.

Gimon of Energy Innovation says he agrees that the role of natural gas in the market is an important element, but he says the report intentionally narrowed the focus to look at the deteriorating finances of coal and the improving competitiveness of wind and solar, rather than at the electricity market as a whole.

Daniel Cohan, a Rice University engineering professor who is not involved in the new report, says “gas is more of a gamble” for power plant owners than wind or solar because of uncertainty about future gas prices.

He thinks there is more certainty that wind and solar will continue to get less expensive and that their prices can serve as a useful comparison for coal.

The decreasing costs of wind and solar will lead to a growing gap compared to the costs of operating coal plants, one that coal plant owners and regulators would be wise to prepare for, Gimon said.

“You really can’t hang tight,” he said. “It’s just going to get worse.”

Source: https://insideclimatenews.org/news/25032019/coal-energy-costs-analysis-wind-solar-power-cheaper-ohio-valley-southeast-colorado

$HPQ.ca Gen2 PUREVAP(TM) Testing of Tapping Section of Pilot Plant Design and Subsystems, De-Risking Up-Coming Pilot Plant Trials $PYR.ca

- Announced the receipt of a progress report from PyroGenesis Canada Inc (TSX Venture: PYR) describing continuous development testing of the pilot plant design and reactor related subsystems of the Silicon Melt Drainage (Tapping) part of the process. Â

- Work of the Gen2 PUREVAP™ Commercial Scalability Proof of Concept platform is undertaken in order to minimize the risk of design failure during the pilot plant trials schedule to start mid-2019.

MONTREAL, March 05, 2019 – HPQ Silicon Resources Inc. (HPQ) (TSX VENTURE:HPQ) (FRANKFURT:UGE) (OTC PINK:URAGF) is pleased to announce the receipt of a progress report from PyroGenesis Canada Inc (“PyroGenesisâ€) (TSX Venture: PYR) describing continuous development testing of the pilot plant design and reactor related subsystems of the Silicon Melt Drainage (Tapping) part of the process.  This work of the Gen2 PUREVAP™ Commercial Scalability Proof of Concept platform is undertaken in order to minimize the risk of design failure during the pilot plant trials schedule to start mid-2019.

DRAINAGE OF LIQUID SILICON MELT AT THE BOTTOM OF REACTOR (TAPPING) CRITICAL TO PROCESS

Drainage of silicon (tapping) is one of the most important aspects of the process. Efforts have been made by PyroGenesis to optimize the design of the melt drainage subsystems of the pilot plant. In order to test design efficiency and to generate computational studies to predict the tapping behaviour of liquid silicon in the Gen3 pilot plant, a few silicon melting and tapping tests using GEN2 reactor have been conducted to date.

SIMULATED TAPPING DONE USING GEN2

To simulate the tapping process of the pilot plant unit, the Gen2 reactor was ramped up to operating parameters with a standard mixture of quartz and carbon introduced at the beginning. Once the reactor reached operating temperature as-received Si is introduced in the reactor for effective melting. Once the whole Si mass melted, the tap hole was opened to drain the liquid metal and the data from the test was then used to generate computational studies.

Mr. Bernard Tourillon, President and CEO of HPQ Silicon Resources Inc stated: “We are very happy to show our first ever public picture of the Gen2 in action. What these tests demonstrate is the incredible versatility of our Gen2 PUREVAPTM QRR platform, highlighting the advancement being made on the project and toward de-risking the mid-2019, Gen3 commercial scalability testing phaseâ€.

Pierre Carabin, Eng., M. Eng., Chief Technology Officer and Chief Strategist of PyroGenesis has reviewed and approved the technical content of this press release.

This News Release is available on the company’s CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders.

About HPQ Silicon

HPQ Silicon Resources Inc. is a TSX-V listed resource company focuses on becoming a vertically integrated and diversified High Purity, Solar Grade Silicon Metal (SoG Si) producer and a manufacturer of multi and monocrystalline solar cells of the P and N types, required for production of high performance photovoltaic conversion.

HPQ’s goal is to develop, in collaboration with industry leaders, PyroGenesis (TSX-V: PYR) and Apollon Solar, that are experts in their fields of interest, the innovative PUREVAPTM “Quartz Reduction Reactors (QRR)â€, a truly 2.0 Carbothermic process (patent pending), which will permit the transformation and purification of quartz (SiO2) into high purity silicon metal (Si) in one step and reduce by a factor of at least two-thirds (2/3) the costs associated with the transformation of quartz (SiO2) into SoG Si. The pilot plant equipment that will validate the commercial potential of the process is on schedule to start mid-2019.

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman, President and CEO Tel (514) 907-1011

Patrick Levasseur, Vice-President and COO Tel: (514) 262-9239

www.HPQSilicon.com

Shares outstanding: 222,284,053

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/0a12fa2b-0337-4107-8531-a2feb7f7c2e3

Picture of Gen2 in action during simulated tapping test

INTERVIEW: $HPQ.ca Discusses PUREVAP Conversion of Low Purity Quartz Into 4N+ Silicon Metal

#HPQ Latest Gen2 Progress Report Confirms PUREVAP, QRR Ability to Convert Low Purity Quartz Into 4N+ Silicon Metal, in One Step, at Commercial Scale

- GEN2 PUREVAP™Â TESTS SUCCESSFULLY CONFIRMS THE SCALABILITY OF PUREVAP™Â QRR PROCESS

- 99.83% TOTAL IMPURITY REMOVAL EFFICIENCY REACHED DURING GEN2 PUREVAP™TESTING

- HPQ PUREVAP™ PATHWAYS TO PRODUCE SOLAR GRADE SILICON METAL PASSES MAJOR MILESTONE

MONTREAL, Feb. 26, 2019 – HPQ Silicon Resources Inc. (HPQ) (TSX VENTURE:HPQ) (FRANKFURT:UGE) (OTC PINK:URAGF) is pleased to announce the receipt of a progress report from PyroGenesis Canada Inc (“PyroGenesisâ€) (TSX Venture: PYR) describing the latest significant milestones reached during Gen2 testing of the PUREVAP™ Quartz Reduction Reactor (“QRRâ€).  Key takeaways from the report are summarized bellow.

GEN2 PUREVAP™ TESTS SUCCESSFULLY CONFIRMS THE SCALABILITY OF PUREVAP™ QRR PROCESS

2018 Gen2 PUREVAP™ Commercial Scalability Proof of Concept tests confirmed the PUREVAP™ QRR could operate under a semi-continuous mode (January 15, 2018 release). Next, additional process improvements and design modifications to Gen 2 were tested, and demonstrated that semi-continuous operation improves the PUREVAP™ QRR Production Yield1. Scaling up from Gen1 to Gen2 in semi-continuous mode, production yield increased from ~ 1% to 34% (February 15 and April 19, 2018 releases).

99.83% TOTAL IMPURITY REMOVAL EFFICIENCY REACHED DURING GEN2 PUREVAP™TESTING

While mostly focussed on testing components and processes for the final design of Gen3 PUREVAP™, the Gen2 testing also demonstrated that production yield is crucial to the final purity of the Silicon Metal (Si) produced by the PUREVAP™.

A Gen2 PUREVAP™ test provided 17.9% production yield and 99.83% total impurity removal efficiency2 compared to a Gen1 test under similar operating conditions, that provided 3% production yield and 97.14 % total impurity removal efficiency. PyroGenesis3 was able to validate that production yield does play an important role in the impurity removal efficiency of the process and final purity of Si.

Mr. Bernard Tourillon, President and CEO of HPQ Silicon Resources Inc stated: “The one step impurities removal capacity of the PUREVAP™ QRR and its direct impact on the final purity of the PUREVAP™ Si is the key milestone that will allow HPQ, working with PyroGenesis and Apollon Solar, to develop a low cost and green metallurgical process to produce Solar Grade Silicon Metal (SoG-Si). The fact that, as expected, Gen2 testing replicated and improved Gen1 results is a major milestone that bodes well for the future as we get ready to start, mid-2019, the Gen3 commercial scalability testing phase, aimed at demonstrating the PUREVAP™ QRR commercial potential.â€

HPQ PUREVAP™ PATHWAYS TO PRODUCE SOLAR GRADE SILICON METAL PASSES MAJOR MILESTONE

Using data from both Gen1 and Gen2 tests, PyroGenesis repeated the 2017 extrapolation exercise and concluded that, even using low purity feedstock (98.84% SiO2), the carbothermic part of the PUREVAP™ QRR process should allow HPQ to reach the 4N+ Si (99.99+% Si) purity threshold, assuming a production yield of +90% (or commercial scale production yield of traditional Metallurgical Grade Si (MG-Si) smelters (98.5% – 99.5% Si)).

These results exceed 2017 Gen1 base extrapolations that indicated then that the carbothermic part of the PUREVAP™ QRR process could only reach the 3N+ Si (99.9+% Si) threshold using low purity feedstock (98.84% SiO2)4, and furthermore this required a 100% production yield (November 1, 2017 release).

Mr. Bernard Tourillon, President and CEO of HPQ Silicon Resources Inc further stated: “Having a process capable of producing 4N+ Silicon Metal in one step is, according to Apollon Solar, one of the most unique and potentially the greatest advantage of the PUREVAP™ QRR process as we strive to develop a low cost and green metallurgical process to produce Solar Grade Silicon Metal (SoG-Si).â€

Pierre Carabin, Eng., M. Eng., Chief Technology Officer and Chief Strategist of PyroGenesis has reviewed and approved the technical content of this press release.

This News Release is available on the company’s CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders.

About HPQ Silicon

HPQ Silicon Resources Inc. is a TSX-V listed resource company focuses on becoming a vertically integrated and diversified High Purity, Solar Grade Silicon Metal (SoG Si) producer and a manufacturer of multi and monocrystalline solar cells of the P and N types, required for production of high performance photovoltaic conversion.

HPQ’s goal is to develop, in collaboration with industry leaders, PyroGenesis (TSX-V: PYR) and Apollon Solar, that are experts in their fields of interest, the innovative PUREVAPTM “Quartz Reduction Reactors (QRR)â€, a truly 2.0 Carbothermic process (patent pending), which will permit the transformation and purification of quartz (SiO2) into high purity silicon metal (Si) in one step and reduce by a factor of at least two-thirds (2/3) the costs associated with the transformation of quartz (SiO2) into SoG Si. The pilot plant equipment that will validate the commercial potential of the process is on schedule to start mid-2019.

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, contact

Bernard J. Tourillon, Chairman, President and CEO Tel (514) 907-1011

Patrick Levasseur, Vice-President and COO Tel: (514) 262-9239

www.HPQSilicon.com

Shares outstanding: 222,284,053

1 Production Yield of the process is the conversion efficiency of Si element in the raw material (i.e. Quartz) into elemental Silicon Metal

2 Capacity of the process to volatize impurities from raw material (Quartz or SiO2 and Carbon) while making Si

3 Pyrogenesis Canada Inc. Technical Memo: “TM-2018-894 REV 00, – Final Reportâ€

4 Pyrogenesis Canada Inc. Technical Memo: “TM-2017-830 REV 00, – Final Report-Silicon Metal Purity Enhancementâ€

HPQ-Silicon Resources $HPQ.ca – Solar shines brightest for renewables-keen investors

SPONSOR: Exclusive global partnership puts HPQ-Silicon Resources in a position to turn Quartz project into lowest cost supplier to solar industry. Click here to learn more

Solar shines brightest for renewables-keen investors

- Institutional investors surveyed by the Octopus Group have ranked grid-scale solar power as their top deployment target, amid plans to inject US$210 billion in the broader renewable sector within five years.

- A poll of 100 names published by the firm on Monday found 43% of those managing a portfolio of renewables were invested in solar, ahead of firms invested in onshore and offshore wind (28% each), hydropower (27%) and waste-to-energy and biomass (an aggregate 24%).

Institutional investors ranked uncertainty with energy prices as a top obstacle (Source: Karnakata Tata)

Institutional investors surveyed by the Octopus Group have ranked grid-scale solar power as their top deployment target, amid plans to inject US$210 billion in the broader renewable sector within five years.

A poll of 100 names published by the firm on Monday found 43% of those managing a portfolio of renewables were invested in solar, ahead of firms invested in onshore and offshore wind (28% each), hydropower (27%) and waste-to-energy and biomass (an aggregate 24%).

Of the respondents – a mix including pension funds, insurers and banks with US$6.8 trillion in combined assets under management – Australians (63%) were keenest on solar, followed by EMEA (58%), Asian (45%) and UK firms (29%).

The industry was the most sought-after also among firms currently not invested in renewables, although some appeared sceptical. Some 58% of those managing a renewables-free portfolio claimed to be considering solar plays, while 21% were not contemplating it and another 21% felt unsure.

Five years to unlock US$210 billion

Even as they singled out grid-scale solar as their top target, the

polled investors promised to scale up allocations to all forms of

renewables, with US$210 billion set to be deployed within five years.

Private banks appeared the most ambitious, sharing plans for renewables

to represent 9.7% of their portfolios over the period. They were

followed by strategic investors (8.9%) and pension funds (7.8%), while

high-net-worth individuals and family offices (5.5%) and insurers (4.7%)

were the most reluctant.

The Octopus survey evidenced the renewables momentum won’t be challenge-free, though. Energy price uncertainty, liquidity challenges and skills shortages ranked as the top concerns for the polled investors, although costs and regulatory barriers were also seen as obstacles.

Europe before its subsidy-free hour

The Solar Finance and Investment conference held in London in late January identified investors as the key enablers of subsidy-free solar in Europe. Corporate PPAs and other emerging arrangements are easing – although not fully dispelling – investors’ unease around merchant risks and potentially low returns, it was argued.

The Octopus poll placed the continent as the most in-demand destination for renewables investors. Of the top 10 countries and region, only Australia (seventh) and Japan (10th) were non-European.

The survey produced a finding likely to be welcomed by subsidy-free players. Almost one-in-two institutional investors piling into clean energy worldwide was driven by stable cash flows (a driver for 48%) and attractive risk-adjusted returns (40%); only diversification and ESG considerations placed higher.

Source: https://www.pv-tech.org/news/solar-shines-brightest-for-renewables-keen-investors

$HPQ.ca Completes Beauce Gold Fields $BGF.c Plan of Arrangement Spin Out; BGF Shares to Start Trading on the TSX Venture Exchange on February 4, 2019

- Advises shareholders that it has received confirmation from the TSX Venture Exchange that effective at the opening on Monday, February 4, 2019,

- the common shares of Beauce Gold Fields Inc. will commence trading on TSX Venture Exchange under the symbol BGF.

MONTREAL, Feb. 01, 2019 — HPQ Silicon Resources Inc. (HPQ) (TSX VENTURE:HPQ)(FRANKFURT:UGE)(OTC PINK:URAGF) is pleased to advise shareholders that it has received confirmation from the TSX Venture Exchange that effective at the opening on Monday, February 4, 2019, the common shares of Beauce Gold Fields Inc. (the “Company†or “BGFâ€) will commence trading on TSX Venture Exchange (the “Exchangeâ€) under the symbol BGF.

BGF was incorporated under the Canada Business Corporation Act on August 1, 2016, primarily for the purpose of carrying out a spinout by way of a plan of arrangement (the “Arrangementâ€) with HPQ Silicon Resources Inc. (TSXV: HPQ) (“HPQâ€), of which the certificate of arrangement was issued on November 23, 2018.

Pursuant to the Arrangement, HPQ completed the disposition of its gold assets (the “Transferred Assetsâ€) to BGFI in consideration of the issuance of an aggregate of 13,350,000 BGFI common shares (the “BGFI Sharesâ€), of which 10,680,000 BGFI Shares were distributed to the shareholders of HPQ. HPQ distribution notice was accepted pursuant to the Exchange bulletin dated December 18, 2018.

On the day of listing, HPQ will own 2,870,133 shares of BGF, or 15.3% of the outstanding float of BGF.

Mr. Bernard Tourillon, President and CEO of HPQ Silicon Resources Inc stated, “The listing of Beauce Gold Fields on the TSX Venture Exchange is the final step in HPQ plan of arrangement spin out, and we are now happy to have completed this milestone that provided HPQ shareholders shares in BGF, a Company created to showcase the Beauce Gold project, a fantastic but overlooked historical placer gold district. The Beauce is Canada’s last underexplored historical placer mining camp. It’s similar to the White Gold projects in the Yukon or the Cariboo district in B.C., that were both placer gold mining camps as well, but recently had major gold discoveries as placer to hard rock exploration projects.â€

For further information, please refer to the news releases of HPQ-Silicon dated March 11, 2016, May 4, 2016, Sept. 7, 2016, Sept. 16, 2016, March 31, 2017, Feb. 8, 2018, June 13, 2018, Aug. 17, 2018, Oct. 4, 2018, Oct. 11, 2018, Dec. 12, 2018, Dec. 17, 2018, and Dec. 18, 2018.

This News Release is available on the company’s CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders.

About HPQ Silicon

HPQ Silicon Resources Inc. is a TSX-V listed resource company focuses on becoming a vertically integrated and diversified High Purity, Solar Grade Silicon Metal (SoG Si) producer and a manufacturer of multi and monocrystalline solar cells of the P and N types, required for production of high performance photovoltaic conversion.

HPQ’s goal is to develop, in collaboration with industry leaders, PyroGenesis (TSX-V: PYR) and Apollon Solar, that are experts in their fields of interest, the innovative PUREVAPTM “Quartz Reduction Reactors (QRR)â€, a truly 2.0 Carbothermic process (patent pending), which will permit the transformation and purification of quartz (SiO2) into high purity silicon metal (Si) in one step and reduce by a factor of at least two-thirds (2/3) the costs associated with the transformation of quartz (SiO2) into SoG Si. The pilot plant equipment that will validate the commercial potential of the process is on schedule to start mid-2019.

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, contact

Bernard J. Tourillon, Chairman and CEO Tel (514) 907-1011

Patrick Levasseur, President and COO Tel: (514) 262-9239

www.HPQSilicon.com

Shares outstanding: 222,284,053

HPQ Silicon $HPQ.ca PUREVAP; Project: Milestones and Plans Going Forward

MONTREAL, Jan. 24, 2019 — HPQ Silicon Resources Inc. (HPQ) (TSX-V “HPQâ€) is pleased to provide investors this corporate overview of the milestones attained since our 2014 entry in the Quartz exploration business and our 2015 decision to become a vertically integrated producer of Solar Grade Silicon Metal through the development of the PUREVAP™ Quartz Reduction Reactor (QRR). Shareholders and prospective investors are encouraged to review the following information in its entirety to understand the progress made and plans being implemented to transform HPQ into the lowest cost and greenest producer of Solar Grade Silicon Metal, as we commence 2019 with the final assembly of the PUREVAP™ Pilot Plant, “Gen 3†and it’s mid 2019 start-up.

Mr. Bernard J. Tourillon, President and CEO of HPQ-Silicon provides his responses in the following Q&A format. The questions, for the most part, are derived from inquiries received from investors, investment professionals and industry participants. A table summarizing the Purevap™ milestones appears on page 2 of this summary:

Q. To start, could you please briefly describe the focus and objectives of HPQ going forward?

A. Most certainly. Following the successful closing of our $ 5,250,000 Financing in August 2018 and the December 2018 completion of our Beauce Gold Field assets spinout, HPQ is now entirely focused on becoming a vertically integrated producer of solar grade silicon metal. In 2019, we intend to:

- Use our 50 tpa (tonnes per year) Pilot Plant, developed by our partners PyroGenesis Canada Inc. (“PyroGenesis†or “PYRâ€), to demonstrate the commercial potential of the PUREVAPTM “Quartz Reduction Reactors†(QRR) process (patent pending), and its ability to convert Quartz (Silicon Dioxide or SiO2) into High Purity Silicon Metal of 99.9% to 99.99% Si, (referred to as 3N and 4N, respectively) in just one step;

- Use the material produced by the Pilot Plant to finalize the best metallurgical pathway (UMG) to upgrade “HPQ PUREVAP™ Si†(Silicon Metal) to Solar Grade Silicon Metal (SoG Si), through collaboration with PYR and Apollon Solar (“Apollonâ€), and in doing so becoming the world’s leading Low Cost, Low Carbon Footprint producer of SoG Si;

HPQ expects to confirm that PUREVAPTM and UMG processes will:

- Reduce CAPEX to transform Quartz to SoG Si by between 60% (China) and 86% (“Rest of the World†or “ROWâ€) 1;

- Reduce OPEX to transform Quartz to SoG Si by between 30% (China) and 60% (ROW)1;

- Reduce the Carbon Footprint to transform Quartz to SoG Si by up to 96%2;

- Investigate new opportunities for high value niche applications that need the High Purity Silicon Metal that our PUREVAPTM QRR produces in one step.

Q. Could you please briefly describe what started HPQ interest in becoming a vertically Integrated Producer of Solar Grade Silicon metal?

A. Well, the short answer is: “Necessity is the Mother of Inventionâ€. The long answer is that in 2014 HPQ had a number of gold properties that contained extensive quartz veins with which gold is typically associated. Quartz (Silicon Dioxide or SiO2) is the key ingredient required for making Silicon Metal (Si).

Silicon Metal (Si), is one of today’s key strategic metals, like Lithium and Cobalt, that is needed to fulfil the renewable energy revolution presently under way.

By early 2015, HPQ management came to the realization that in order for HPQ to succeed in the Quartz business, HPQ needed to transform its low value quartz resources into a higher value material, Silicon Metal, and ultimately Solar Grade Silicon Metal (SoG Si), which is a higher purity form of Silicon Metal that allows the transformation of the sun’s energy into electricity in photovoltaic (PV) modules.

In short, we needed to find a pathway to become a vertically integrated producer of Si, and preferably SoG Si. That is when we discovered PyroGenesis.

Q. Ok, its one thing to say “HPQ wants to become a vertically integrated producer of Solar Grade Silicon metal†but implementing is another. Could you please describe what makes the HPQ plan unique?

A. Certainly. From the start we knew that HPQ could not afford the time or money required to assemble a world-class technical team with Silicon Metal (Si) or Solar Grade Silicon Metal (SoG Si) expertise. To reach our goal, our choices were either a) collaborate with a university, knowing that it would take years just to pass the proof of concept phase, or b) outsource our R&D with a technological partner that possesses proven expertise with high temperatures processes, and a track record of successfully taking new concepts, from the lab to commercialization phase.

During 2015, HPQ concluded that to convert our Quartz into Si, and possibly SoG Si, we needed to convince PyroGenesis Canada Inc (“PyroGenesisâ€), with their vast expertise on high temperature plasma base processes, to partner with us.

PyroGenesis has an impressive track record of successfully taking new concepts from the lab to commercialization, including but not limited to, the following:

- The US Navy, developing the PAWDS™ technology from lab scale to finally being specified in the design of the new US Aircraft Carriers,

- Plasma atomization for 3D printing;

- More recently with the deployment of their DROSRITE™ technology.

PyroGenesis expertise is of such high level that:

- In addition to the US Navy, during the last 2 months, PyroGenesis has concluded exclusive partnerships with two multi-billion conglomerates to commercialize specific applications they have developed, from lab to commercial scale, on a global basis.

In 2015, HPQ’s Board of Directors accepted a testing proposal from PyroGenesis regarding laboratory scale, proof of concept, metallurgical testing of the PUREVAPTM QRR. The proposed program was to validate its capacity to produce high purity silicon metal from HPQ quartz in just one step (September 30, 2015 release).

In June 2016, the first successful lab scale tests were completed and by test #6, results confirmed the game changing potential of the PUREVAPTM QRR process.

HPQ immediately approached PyroGenesis regarding additional testing and the development of a pathway to building a pilot plant that could validate the commercial scalability of the process as quickly as possible. As they say, the rest is history.

Q. What motivated HPQ to move so fast to validate the commercial scalability of the PUREVAPTM QRR process?

A. The decision was simple; the first bench test showed all equipment and data analyzers worked. By test #6, not only did the system operate as designed, but also the PUREVAPTM QRR process was already reaching its first major milestones, the ability to transform quartz into high purity Silicon Metal (Si) exceeding 99.9+% Si “3N†(June 29, 2016 release).

HPQ and PyroGenesis came to an agreement whereby HPQ would invest 100% of project costs for 90% of the revenues to be generated by PUREVAPTM QRR and, with that, HPQ obtained the participation of a world class technical team to work on our project of becoming a vertically Integrated producer of Solar Grade Silicon Metal (SoG Si). Fundamentally, the agreement allows both Parties to reap the rewards of the new process to make High Purity Silicon Metal (Si) and eventually SoG Si using HPQ Quartz and the PyroGenesis PUREVAPTM QRR.

On August 2, 2016, PyroGenesis and HPQ announced the terms under which HPQ would invest the funds and own the PUREVAPTM QRR’s Intellectual Property3 (August 2, 2016 release), with PyroGenesis taking responsibility for the bench testing, process design, fabrication, assembly, and cold commissioning of the Pilot Plant.

Q. In your press releases you refer to Gen 1 and Gen 2 can you please describe Gen 1 and the testing milestones?

A. As we outlined above, the project started in 2015 with PyroGenesis’ technical team designing and building a laboratory scale proof of concept PUREVAPTM QRR, the Gen1 reactor.

The Gen1 PUREVAPTM QRR laboratory scale equipment completed 15 tests between March 29th and July 22th 2016 under the scope of the “Phase 1 – Proof of Concept Metallurgical Tests Programâ€. These tests confirmed that the PUREVAP™ QRR concept of combining different known steps into a one step process works at lab scale. With this milestone achieved, we then agreed to expand our collaboration to go all the way to Pilot Plant.

In September 2016, while initial Pilot Plant design was underway, HPQ also ordered a new series of lab scale R&D tests using the Gen1 PUREVAPTM QRR to provide invaluable input toward the design of the pilot plant, as well as, determine the most efficient way of scaling up the PUREVAPTM QRR process to commercial scale production.

In November 2016, another key milestones was reached as Gen1 testing results demonstrated that the PUREVAP™ QRR was capable of using SiO2 feed material below minimum industry specifications to produce Silicon Metal (Si) of greater purity than what could be achieved by traditional, status quo processes used to make Metallurgical Grade (98.5% to 99.5% Si) Silicon Metal4 today.

By the end of January 2017, in tests using a modified and expanded Gen1 PUREVAP™ QRR reactor, the yield increased from less than 0.1 g to 8.8 g (test #32), an increase of approximately 9,000% (roughly one hundred-fold), thereby confirming the potential scalability of the process.

Ongoing work to the end of Q2 2017 validated our systematic and methodical approach to the project and allowed PyroGenesis to advance the detailed engineering and design of the pilot plant.

By the end of Q2 2017, it was clear that the Gen1 PUREVAP™ QRR had reached its maximum usefulness so the decision was made to build a Gen2 PUREVAP™ QRR, pushing the design envelope of the lab scale system to a point that will allow it to be operated in a semi-batch mode to increase Silicon Metal (Si) yields. This would provide further insight into process improvements needed for the Pilot Plant, thereby saving millions of dollars in future development work.

Q. Now during 2017 you announced an agreement with Apollon Solar, can you diverge a bit and tell us how that came about, and the impact?

A. In 2017, we attracted the attention of Apollon Solar SAS, (“Apollonâ€). This is significant because Apollon is a private French company with longstanding expertise in Silicon Purification and Crystallisation, Solar Silicon, Photovoltaic Cells and Photovoltaic Modules. The team at Apollon has become one of the world leaders in the development of processes to refine Solar Grade Silicon Metal “SoG Si UMGâ€. They achieved, an independently confirmed, world record conversion efficiency of 21.1% with a monocrystalline ingot, for a solar cell made with 100% “SoG Si UMGâ€.

Apollon first completed a technological audit of the Gen1 PUREVAP™ QRR results to evaluate the potential of the innovative PUREVAP™ QRR process. They concluded that successful commercial scaling-up of the PUREVAP™ process could lead to the production of solar quality silicon at a significantly lower cost compared to those of competing process technologies (examples include Siemens chemical process, Elkem Solar, Silicor Materials, etc.).

As a result, in December 2017, HPQ and Apollon announced the signing of a consultancy agreement whereby Apollon agreed to transfer knowledge it has acquired in solar silicon over the last 20 years for the benefit of HPQ and PyroGenesis.

Q. That’s all very exciting, now can you discuss Gen 2 and the commercial scalability of the PUREVAPTM QRR process?

A. The Gen2 PUREVAP™ QRR incorporates important process modifications identified during Gen1 testing and is designed to be a scale replica of the planned larger pilot plant (Gen3 PUREVAP™ QRR). In Q2 of 2017 we set about constructing the newly redesigned reactor while awaiting the final report from the Gen1 work. In Q4, as Gen2 was being finalized, HPQ received a final report on the Gen1 PUREVAP™ QRR testing and we learned that:

- The highest silicon tested for bulk purity was produced in test #75 and measured 99.92% Silicon Metal (Si)5.

- Si yield could be increased by increasing production yield, which had been constrained around an average of about 3% in Gen1.

- Theoretical calculations indicated that purity of the Si produced under various conditions could range from 3N (99.984 % Si) to 4N (99.996 % Si) with the addition of volatilization agents for low purity feedstock, to over 4N (99.998 % Si) when using high purity feedstock5.

These results were incorporated into Gen2 and, by November 2017, the Gen2 PUREVAP™ QRR was operational, allowing the de-facto start of the pilot plant testing and commissioning, thereby reducing the risk profile of the project and allowing additional process modifications and further proof of commercial scalability work to be done in parallel with major plant fabrication, to keep advancing work.

JANUARY 2018

PyroGenesis confirmed that the Gen2 PUREVAP™ QRR was operating as designed and yielding results that were in line with expectations. By this time, we had also arranged monthly meetings with Apollon and PyroGenesis to benefit from the backend expertise of Apollon in our ongoing test work as we continued to plan for the Gen3 Pilot Plant design.

Gen2 PUREVAP™ demonstrated it could be operate and perform under the conditions demanded for optimum operational parameters to produce the purities required in one step. Again, this was another major milestone because, to our knowledge, there is no other process that does this in the world.

With the main design and equipment performance characteristics reached, significantly increasing the Yield6 and the Production Yield7 of the Gen2 PUREVAP™ became the next key objectives in contributing to final purity.

FEBRUARY 2018

By mid February 2018, the Gen2 PUREVAP™ was proving to be an invaluable bench test platform and the results were used to scale back on the size of the planned Pilot Plant from 200 tonnes per year to 50 tonnes per year. This had a massive benefit on our planned costs, timing, and on locating the Pilot Plant test site – right inside the PyroGenesis testing facility, another huge cost saver.

By the end of February 2018, the Gen2 reactor was operating within the 90th percentile of its achievable production yield. By mid April 2018, as a direct result of continuous process improvements done by PyroGenesis, Gen2 PUREVAP™ test #14 attained Yield and Production Yield numbers that surpassed theoretical expectations. The total mass of Silicon Metal (Si) produced (yield) during test 14 was 101.45 gr; and conversion of material, referred to as Production Yield, of 34.3%, the highest to date.

APRIL 2018

PyroGenesis completed a scheduled audit of the Gen2 PUREVAP™ equipment for wear and tear following test#14. The audit was needed to help identify critical operational parameters for the PUREVAP™ Pilot Plant and allowed the evaluation of additional design modifications that could be implemented for further tests using the Gen2 PUREVAP™.

JULY 2018

By the end of July 2018, the Gen2 PUREVAP™ equipment had been refurbished, re-assembled and modified to incorporate the latest design modifications and was ready to start a new series of at least 8 additional tests focused on:

- Continuing to optimize conditions for the Gen2 PUREVAP™ and the planned Gen3 PUREVAP™ Pilot Plant operation;

- Increasing the Yield and the Production Yield;

- Testing the Purity range of the Silicon Metal (Si) from low purity feed stock (98.84% SiO2) and ultra high purity feed stock (> 99.9% SiO2), analyzed using ICP-OES8;

Q. It sounds like Gen2 is giving great results and contributing to the Pilot Plant final parameters. You mentioned CO2 (“Greenhouse Gas†or “GHGâ€) reductions as another positive feature of the PUREVAP™ process can you elaborate on that?

A. Yes we are very excited about this aspect of the project. First, readers must understand that: “It’s not because photovoltaic solar panels do not emit CO2 (GHG) while producing electricity that solar energy is not a significant source of GHGâ€.9 In fact solar power has its greenhouse gas issues that lurk behind the scenes. Seventy percent (70%) of the GHG generated when building a new solar farm10 comes from the production of the Solar Grade Silicon Metal (SoG Si) needed for the fabrication of the solar panels.

Manufacturing SoG Si in China, the world’s largest producer, generates an astounding 141 kg of CO2 per kg of SoG Si produced. In Germany that ratio is reduced to 87.7 kg CO2 per kg of SoG Si produced. What we see is that solar power is not that panacea of low carbon if one looks at the entire process from start to finish.

96% REDUCTION IN CARBON FOOTPRINT – OPPORTUNITY TO RESOLVE SOLAR PARADOX

In August 2018, PyroGenesis prepared a report11 that found that the PUREVAPtm QRR process operated in Quebec should only produce 5.4 kg CO2 per kg of SoG Si produced, a 96% reduction in the carbon footprint compared to existing processes. This is why we are so excited about this “green†opportunity revolutionizing the solar energy industry.

Q. Technically it sounds like great progress is being made, how is HPQ set financially today?

A. On August 21, 2018, HPQ announced the closing of a $5,200,000 financing that included the participation of the Quebec government, via its “Créativité Québec†program, and PyroGenesis. Closing these financings, at more than a 40% premium to market price in August 2018 was a tangible demonstration that both the Quebec Government and PyroGenesis believe in the innovative potential of our PUREVAPtm QRR process (August 13 and 21, 2018 releases). Since August 2016, HPQ has invested $3,988,400 for the pilot equipment, representing 90% of the $4,430,000 design, fabrication and assembly budget.

Thanks to these new financings HPQ, in collaboration with its technical partners, will now be able to dedicate its efforts and energies toward the fulfilment of the ambitious commercial validation of the PUREVAPtm QRR process and the production of Solar Grade Silicon Metal (SoG Si) at the Pilot Plant level.

Q. Sounds like you have the financing under control. You mentioned at the onset that HPQ and partners are targeting a Pilot Plant, with bench test work well in hand and financing complete, can you give a status update of the Pilot Plant that you are now referring to as Gen3?

A. In mid September 2018, PyroGenesis took delivery of the 6 tonne furnace, the key component of the 50 tonne per year Gen3 PUREVAPTM QRR pilot plant. Delivery of the furnace marks the start of the assembly phase of the Pilot Plant, which is in an HPQ dedicated area at PyroGenesis’ production facility in Montréal. The Pilot Plant assembly will be completed during Q1 2019, commissioned during Q2 2019 and operational mid – 2019, just 3 years after the original concept was validated.

As of the date of this corporate update, the Gen2 PUREVAP™ equipment is still being used by PyroGenesis to test different operational conditions in order to gain more information about future Gen3 PUREVAP™ operation and testing is also ongoing to find new ways of increasing the Yield and the Production Yield of the Gen2 PUREVAP™.

Finally, a new progress report on the test results completed in 2018 with the Gen2 Purevap should be ready soon.

Q. How transferable are the results obtained from Gen2 to the pilot plant?

A. We believe they are very transferable. In fact, we expect the results to be even better at larger scale. By increasing the scale, we are increasing the production rate. As you can imagine, we are already extremely excited about the results we have had with Gen2, and at a larger scale, the production rate is automatically higher which, as we have already proven with Gen1, should lead to a higher conversion yield and better purity.

Q. HPQ has started talking about using a metallurgical process to transform the Si produced via the PUREVAPTM QRR to produce SoG Si. Is this just a semantic change or is HPQ changing its objectives?

A. It is more semantic than anything else; the project is advancing towards meeting our stated objectives when we started it in 2015:

“The “PUREVAP ™ Quartz Reduction Reactor is a proprietary process that uses a plasma arc within a vacuum furnace. This unique technology should allow HPQ (Uragold then) to convert its (…) Quartz Projects into the highest purity, lowest cost supplier of Solar Grade Silicon Metal (…) to the solar industry.

But this may be a good opportunity to explain in detail what makes the PUREVAPtm QRR such a game changing technology and why we have started to refer to it as a “Second Generation (2.0) Carbothermic processâ€.

Presently, using the status quo to produce Solar Grade Silicon Metal (SoG Si), you first need to transform Quartz (Silicon Dioxide or SiO2) into Metallurgical Grade Silicon Metal (MG Si) and then the MG Si needs to be further purified produce SoG Si.

PRESENT LEGACY CARBOTHERMIC PROCESS

The first step in making SoG Si involves mixing Pure Quartz (99.5%+ SiO2), Low Ash Carbon and Wood Chips and heating the mixture to very high temperatures in an electric arc furnace to create the Carbothermic process required to reduce the SiO2 to Metallurgical Grade Silicon Metal (MG Si).

The traditional smelter process to make MG Si requires six (6) tonnes of raw material to produce one (1) Tonne of Silicon Metal (Si).

To view Figure 1, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/2209e304-a764-4575-b120-e7c3fc010574

By its design, the impurities contained in the raw material end up being concentrated in the final product, that is why traditional smelters need (99.5%+ SiO2) to produce 98.0% Si.

The maximum purity that can be attained in traditional smelters is around the 99.5% Si threshold, but that requires additional post treatments. On average these postproduction processes can increase the purity of the MG Si by a factor ranging from ½ N to 1 N.

For Silicon Metal (Si) to be used in the Solar and High Tech Industries, higher purity levels than what can be attained by standard carbothermic reduction are required. Presently, less then twenty percent (20%) of MG SI produced by smelter meets the demanding feedstock purity specs required for the different additional purifications steps.

CHEMICAL DISTILLATIONS PROCESS (Siemens)

Chemical distillations process (Siemens process) to purify MG Si to purity required for Solar Grade applications or electronic applications has become the gold standard, with over 95% of the world SoG Si produced through chemical distillations, even with it negative environmental footprint.

Producing SoG Si (Polysilicon) via chemical distillations requires between 72,000 KWh/T up to 120,000 kWh/t and as the term clearly indicates chemical distillation implies that further refinement involves the use of harsh chemicals like hydrochloric acid, and the final products include liquid silicon tetrachloride and polysilicon. Each ton of polysilicon is manufactured at the cost of three to four tons of these hazardous by-products. When silicon tetrachloride is exposed to water it releases hydrochloric acid, which causes acidification of soil as well as the emission of toxic fumes.12

To view Figure 2, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/cf2fb91b-4738-4b69-9770-ee2bfd81a628

METALLURGICAL PROCESS

For many years, companies have been searching and investing funds looking for a metallurgical alternative to Chemical distillations process to transform MG Si into SoG Si.