AGORACOM is proud to announce the results of our Carbon Footprint findings in recognition of ‘Earth Day‘. Our digital delivery of investor relations makes AGORACOM the most ‘environment-friendly’ investor relations firm in the industry.

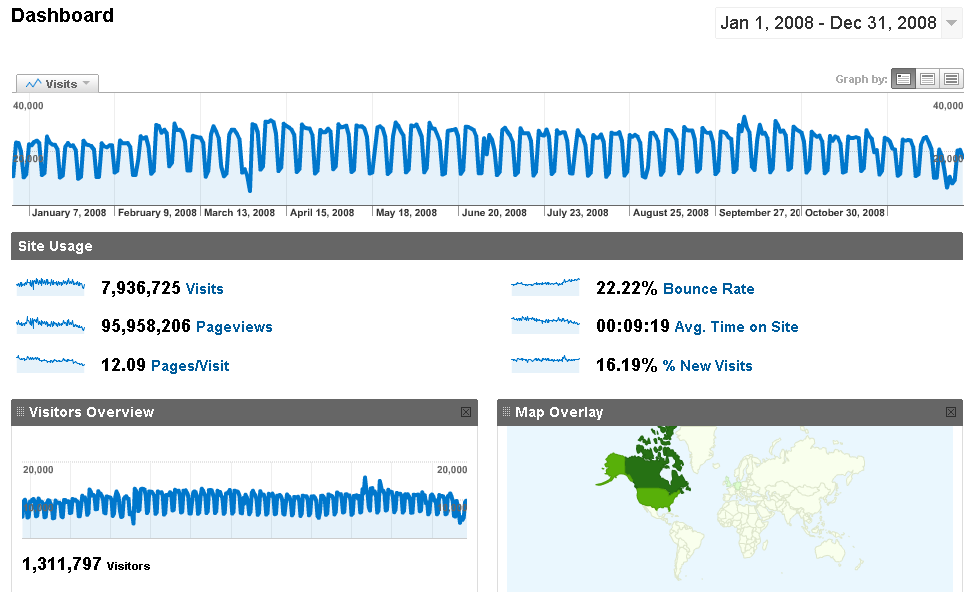

In 2008, we delivered investor relations on behalf of 85 companies to more than 1.3 million investors in over 200 countries -Â and we did it without having to take planes, trains and automobiles to meetings all over the world. Â In addition, the digital delivery of investor relations means we didn’t need to senselessly cut down a single tree to produce collateral materials that unfortunately end up in a recycling bin within 24 hours.

AGORACOM CARBON FOOTPRINT

The results from an online Carbon Footprint calculator show that AGORACOM has a carbon footprint of 76.7 tonnes per year, which translates into 5.11 tonnes per employee. To put this number into perspective, the average Torontonian’s carbon footprint measures 8.6 tonnes per year, lower than the average American’s footprint, which measures at about 11.9 tonnes.

“While we realize online calculators measuring carbon footprints only offer an approximate indication of an organization’s emissions output, the results are relative and we challenge any investor relations firm with more than 50 clients to beat us”, Tsiolis added. “As a pure online investor relations firm, I am very confident that our carbon footprint is significantly lower than any traditional IR firm. Our use of Web 2.0 tools such as electronic shareholder forums, blogs, webcasts, video and other tools allow AGORACOM to fill the information void created by the lack of small-cap coverage in the media while keeping our carbon footprint to a minimum.”

3 KEY AREAS THAT MAKE AGORACOM ‘GREEN‘:

- No Micro Meetings -Thousands Of Investors Amalgamate and Communicate In Online HUBS.

- No Traveling – Clients Are Not Forced To Travel Around The World To Meet Investors.

- No Printing – 99% of Collateral Information Is Produced and Consumed Digitally.

For those whose inner environmentalist speaks loudest on April 22, visit the Earth Day Network to make a public commitment to take an environmental action.

Happy Earth Day,

George