CEO's Clam Up When It Comes To The Web

You’re the CEO or IRO of a public company. You can’t stop talking to shareholders at conferences, on conference calls, and other personal settings. You’re willing to expend tremendous amounts of energy to speak with shareholders one-on-one …. and then repeat those conversations over and over again as you march through your shareholder list but you’re afraid to go the last mile and utilize the efficiencies of the web.

Does that make any sense to anybody?

WHY ARE YOU AFRAID?

It makes absolutely no sense to me. It’s not as if you don’t have the confidence or charisma, you’re already speaking and sharing with shareholders on so many levels. But that all comes to a screeching halt when presented with an opportunity to continue that conversation online.

Even clients of AGORACOM limit most of their interaction to answering questions online (which is very powerful). The remainder of the interaction comes from webcast interviews in which most CEO’s freely discuss the company knowing the presentation will be posted for all to watch. My goal is to now get client CEO’s fully engaged online.

Investors love this limited interaction. They love it because only you can provide them with the confidence and education they need to see and believe in your company’s long-term future. They want more – but CEO’s suddenly clam up when it comes to communicating with a community of shareholders via the keyboard, even though they clearly have no issue with responding to individual e-mail.

Why are you afraid?

THE MYTHS AND THE MYTH BUSTERS

I believe the majority of online IR fear is based on 4 myths that are not only untrue but crippling your ability to take your company to the next step. I’ve listed the myths and the myth busters for you below. As the Founder of AGORACOM, a 2nd generation online investor relations community with raging traffic, you can take these to heart.

MYTH:Â Too many online investors are crazy, loose cannons.

This is a myth that began with the unmonitored discussion forums of sites like Yahoo Finance and Raging Bull. I don’t blame CEO’s for using this original data set to come to their conclusions – but the time has come to see those sites for what they were – ad flipping machines that cared about generating cash from page views at all costs. Spam, profanity and other non-sense proliferated because it generated cash. Nobody cared about investors or quality at the beginning of the decade.

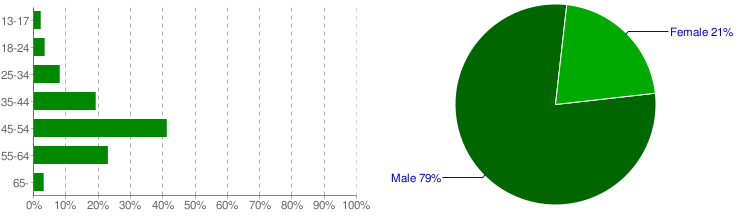

The truth of the matter is that online investors are not only real people, they are better investors than the average guy on the street. Why? They’ve chosen to take control of their finances; they conduct their own online research, they ask great questions and they collaborate with fellow investors far better than any offline investors.

As such, if you reach out, communicate and collaborate with online investors, your efforts will be well served.

MYTH:Â Any public criticism will hurt me, so I don’t want to encourage it by providing a public venue.

Newsflash ….. newsflash ….. your weaknesses exist in the minds of shareholders whether you provide a venue or not. This isn’t a case of “when a tree falls in the forest, does anybody hear”. Public Stock discussion forums, Twitter and plenty of other mediums exist that allow your investors and potential investors to discuss any weaknesses you might have.

By not dealing with them publicly, you simply allow them to perpetuate. Worse still, by not engaging in the conversation, you allow other people to control your message.

The good news is that all public companies have weaknesses. Investors expect them and unless they are material flaws, dealing with those weaknesses and your plans to overcome them will actually give you more credibility, leading to greater shareholder loyalty for years to come.

MYTH:Â I’m not allowed to communicate over the web

Wrong. Full stop. AGORACOM has provided electronic shareholder forums to more than 250 public companies as part of our online investor relations services for years. Your only obligations are to publicly disclose a shareholder community and give all shareholders equal access to it.

MYTH:Â I am exposing myself to increased liability

Again. Wrong. Full stop. The medium doesn’t change a thing. You don’t have any more liability on the web than you do in phone conversations, e-mail exchanges, TV interviews and your booth at an investor conference. As long as you follow the rules of disclosure, you’re fine in any setting.

CONCLUSION – THE OPPORTUNITY

Now that I’ve dealt with these myths, I want to impress upon you the massive opportunity presented by online investor relations and communications. Quite simply, there is no faster, more cost-efficient way to accomplish the two most important goals of any investor relations program:

1. Target and reach new relevant investors. Simple but effective tools such as search engines and online video can not be beat when it comes to attracting new potential investors to your story. They work 24 hours per day, 7 days a week, 365 days per year. They reach investors around the planet and they tell your story perfectly every time.

2. Communicate, Collaborate and Convert. Once you attract new investors, an online community (customized discussion forum, blog, Twitter ,etc.) gives you the ability to share information with everybody, everywhere, any time. More than just text, you can provide your audience with photos of your new products, videos of your drills turning and audio messages to address important developments. All of this leads to faster communication and conversion.

I hope this post has been a real eye-opener for you. Don’t worry about lack of technical knowledge, a good IR firm can do all this for you. I know the benefits of online investor relations because of I’ve watched endless companies reach their full market potential by utilizing it. I hope this inspires you to do the same.

Regards,

George

UPDATE: Dominic Jones of IR Web Report, the world’s leading independent investor relations website consultants whose clients include global industry leaders, has picked up on this story and added some eye-opening commentary. When Dominic speaks, we listen and so should you. He agrees with my thoughts on online investor relations – but he also thinks IRO’s and CEO’s may have nefarious reasons for not shifting their investor relations to the web. Unless you are a large fund manager, you should be alarmed.

I’ve provided a couple of his quotes below but be sure to read his full post here and our subsequent conversation here:

- “What’s keeping investor relations officers and CEO’s off the web? Selective disclosure, that’s what.”

- “If pro investors value 1-on-1s with execs more than all info sources, what are execs telling them in private?”