The Liberal Government announced new measures towards climate, clean energy and transport in yesterday’s throne speech. This will no doubt help accelerate the transition toward electric mobility while ensuring a cleaner, healthier economy. Here are 6 small cap companies that stand to benefit from these initiatives (in alphabetical order).

Gratomic Inc. (GRAT :TSXV) is gearing up to bring its high grade, environmentally sustainable graphite to the North American EV market. In a race that started in 2012, Gratomic is the only one of several graphite companies that has successfully brought its asset through to the final construction phase.

The Company is now ready to introduce its graphite to battery producers for use in advanced anode technology. Being of such naturally high purity, Gratomic’s vein graphite is ideal for use in this application, requiring simpler, less expensive and more efficient processing methods, resulting in a final product with naturally lower contents of deleterious elements.

In addition to its high purity levels, the Company’s Aukam graphite is a much cleaner alternative to this market’s current supply options as a sustainably sourced resource as per the Company’s September 3rd Press Release. The Company intends to establish a new benchmark for recording and guaranteeing the product’s carbon footprint, based on latest generation blockchain technology.

Gratomic is preparing the high grade Aukam Graphite mine for commercial production. The company anticipates commencement of production in Q4 of 2020 while producing 20,000 tonnes of high purity vein graphite annually to support a burgeoning market.

————————————————–

HPQ Silicon Resources (HPQ:TSXV) is a Canadian producer of Silicon Solutions that is building a line of specialty silicon products needed for electric batteries. More than just lip service, HPQ has already announced NDA’s with 2 undisclosed companies in the space and has hinted at other NDA’s that are so tight they could not even be announced.

Over the past 5 years, HPQ has teamed up with 2 world renowned technology partners, including PyroGenesis Canada (PYR:TSXV) to manufacture high purity silicon cleaner, cheaper and better than anyone in the world – because you can’t dig it out of the ground like other battery metals such as graphite, cobalt and nickel. Now HPQ is on the verge of sending samples of its industry leading silicon to NDA and other potential partners as early as December.

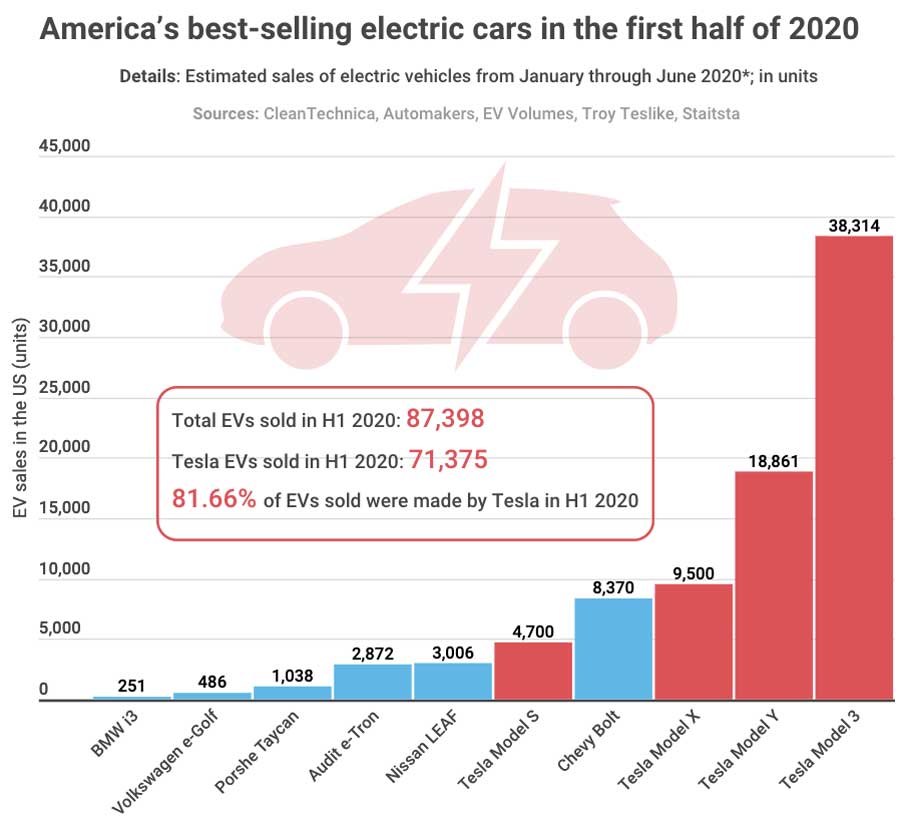

However, despite providing shareholders with a great return during this period, HPQ’s silicon plan was still met by skepticism amongst investors who found it easier to understand traditional battery metal stories …. This all changed on September 23rd 2020, when this headline emerged from Tesla’s “Battery Day”

“Tesla To Revolutionize Use Of Silicon In Batteries: Slash Costs, Increases Range”

HPQ-Silicon Resources – Hub On AGORACOM

PyroGenesis Canada – Hub On AGORACOM

————————————————–

Lomiko Metals (LMR: TSXV) discovered high-grade graphite at La Loutre property in Quebec and is working toward a Pre Economic Assessment to increase current resource to 10m/t of 10% Cg.

“Initial indications are that La Loutre Graphite Property is high-quality and high-grade and thus worthy of development.” stated A. Paul Gill, CEO. “The only operating graphite mine in North America which is the Imerys Graphite & Carbon at Lac-des-Îles, is 30 miles northwest of La Loutre and has operated for 30 years.

Lomiko is in an ideal position to participate in the Electrical Vehicle market with the potential to become a North American supplier of graphite materials.

————————————————–

New Age Metals Inc. (NAM: TSXV) is a green metals company focused on PGM and Lithium. The company’s Lithium division is the largest mineral claim holder in the Winnipeg River Pegmatite Field, where the Company is exploring for hard rock lithium and various rare elements such as tantalum and rubidium. Manitoba is THE untapped frontier for ‘Hard Rock’ Lithium.

The Company’s philosophy is to be a project generator with the objective of optioning its Lithium projects with major and junior mining companies through to production.

————————————————–

St-Georges Eco-Mining (SX:CSE) is developing new technologies to solve some of the most common environmental problems in the mining industry. The company is focused on value-adding the recovery of battery-grade nickel, ferronickel for alloying in the stainless steel industry and recovery of valuable elements such as cobalt. St-Georges is working on processing nickel and minimizing tailings with solutions to energy challenges.

The company is also working on lithium extraction technologies with non-conventional resources, such as clays, and working on ways to concentrate and reduce the environmental impact while unlocking the valuable content of the material.

More than just lip service, the Company’s lithium extraction technology has already delivered its first License agreement with Iconic Minerals in exchange for:

- $100,000 cash

- 5,000,000 shares in 3 stages

- A perpetual net revenue interest royalty (NRI) of 5% on all minerals produced on sites licensed with SX technologies in the state of Nevada

————————————————–

Tartisan Nickel (TN:CSE) – 95 Million Pounds Of Contained Nickel

Nickel is the new gold, a critical element for the growing electric vehicle market, Tartisan just announced a re-estimation of the Mineral Resource Estimate at the Kenbridge Nickel-Copper-Cobalt Project. Kenbridge holds mineral resources of 7.5 Mt of 0.58% Ni and 0.32% Cu for a total of 95 Mlb of contained nickel. Class 1 nickel sulphide deposits are emerging as a key supplier of Nickel to the growing electric vehicle market.

CEO Mr. Mark Appleby stated, “The Updated Mineral Resource Estimate was necessary to determine if Kenbridge mineralization is potentially extractable under current metal prices and exchange rates. This is a major milestone achieved by the Company as the market conditions for Class 1 nickel sulphide deposits improve. The differences between the previous P&E Mineral Resource Estimate (2008) and the current P&E Updated Mineral Resource Estimate are attributed to changes in metal prices and recalculation of NSR values.

.png)

.png)