If you don’t know who David Rosenberg is, you better get to know him. Why? Forget about his title – there are plenty of useless anyalysts out there with big titles - here is his track record in what has been a very difficult decade for institutional and retail investors:

From 2001 to 2008, Mr. Rosenberg was ranked first in economics in the Brendan Wood International Survey for Canada, ranked second overall in the 2008 Institutional Investors Survey for the U.S., and was on the Institutional Investor All American All Star Team from 2005-2008. Mr. Rosenberg also ranked 4th out of 104 economists in the 2009 Thomson-Extel survey of global portfolio managers. Mr. Rosenberg also ranked 4th out of 104 economists in the 2009 Thompson-Extel survey of global portfolio managers.

He is currently the Chief Economist over at Gluskin Sheff and a Canadian. I don’t add in that last point for humour. As a Canadian, I believe he has a decidedly more rational head than his US counterparts that are typically guilty of both following the herd and looking after their own pockets. I love the fact that Rosenberg doesn’t sit on the fence. He develops a market outlook and tells you what he’s going to do about it. None of the typical, “the ying could yang, but the yang could ying” bullshit that you often hear from these guys.

More importantly, as his track record demonstrates, he is often right.

Rosenberg is a great tool for retail investors because he isn’t shy about sharing his views. He frequently speaks with both traditional media and some of the better financial blogs, including my friend Barry Ritholtz. As such, it’s pretty easy to follow his thoughts. I suggest you follow him via a Google Alert RSS Feed so that you don’t miss a thing.

RESOURCE SECTOR REMAINS A CORE HOLDING

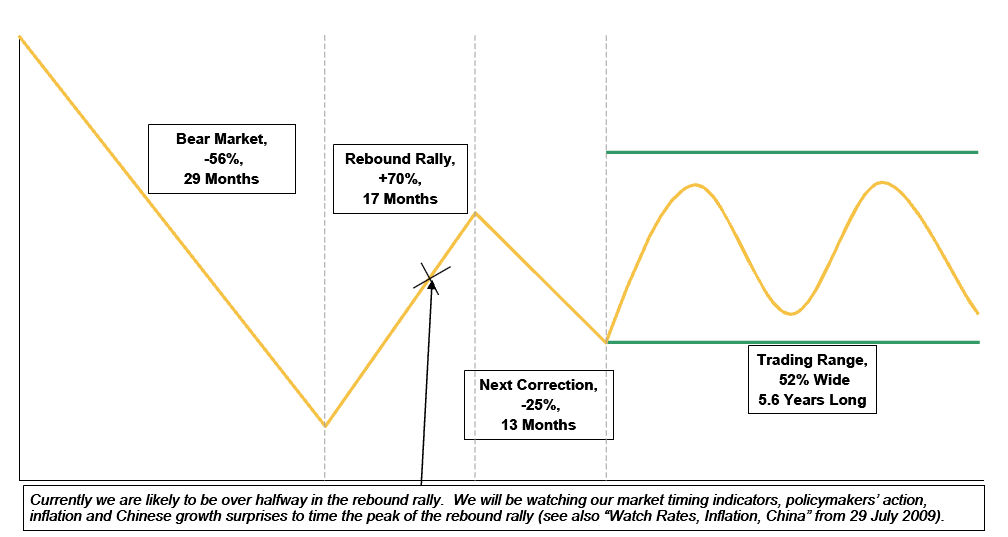

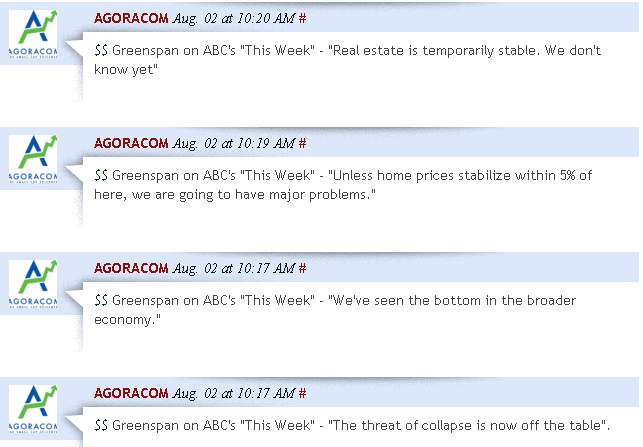

In his market commentary yesterday, he provided his typical great analysis on the state of the markets. It’s a must read as he covers inflation, deflation, the US economy, emerging markets and his recommended investment strategies. In addition, he made the following statement with respect to the resource sector:

Moreover, I don’t believe in all the stories about China collapsing. In fact, if there is a bullish story to be told, it is that the secular growth paths in not only China, but India, Indonesia and Korea and that will continue to ensure that the resource sector remains a core holding, with oil and food retaining geopolitical significance and gold remaining a critical hedge against ongoing reflationary policies that weakens the U.S. dollar in coming months as a critical mid-term election approaches.

If that isn’t telling it like it is, I don’t know what is.

Regards,

George