Sponsor: Affinity Metals Corp. (TSX-V: AFF) is a Canadian mineral exploration company building a strong portfolio of mineral projects in North America. The Corporation’s flagship property is the drill ready Regal Property near Revelstoke, BC where Affinity Metals is making preparations for a spring drill program to test two large Z-TEM anomalies. Click Here for More Info

Dear Investors:

Are you looking for securities to buy to take advantage of the carnage in the financial markets from the coronavirus? Baron Rothschild, the 18th-century British banker advised that “The time to buy is when there’s blood in the streets, even if it is your own.†He made a fortune buying government bonds in the panic that followed the Battle of Waterloo against Napoleon. But it’s not sovereign debt of the world’s superpowers that is on sale today; it’s not the S&P 500 or Dow either.

US government bonds already had their biggest year-over-year rally ever, and at record low yields, they are no bargain. As for US stocks, it’s only the first month after what we believe was a historic market top. The problem is that the pandemic just so happened to strike at the time of the most over-valued US stock market ever based on a composite of eight valuation indicators tracked by Crescat, even higher than 1929 and 2000. It also hit after a record long bull market and economic expansion. The stock market was already ripe for a major downturn based on an onslaught of deteriorating macro and fundamental data even before the global health emergency.

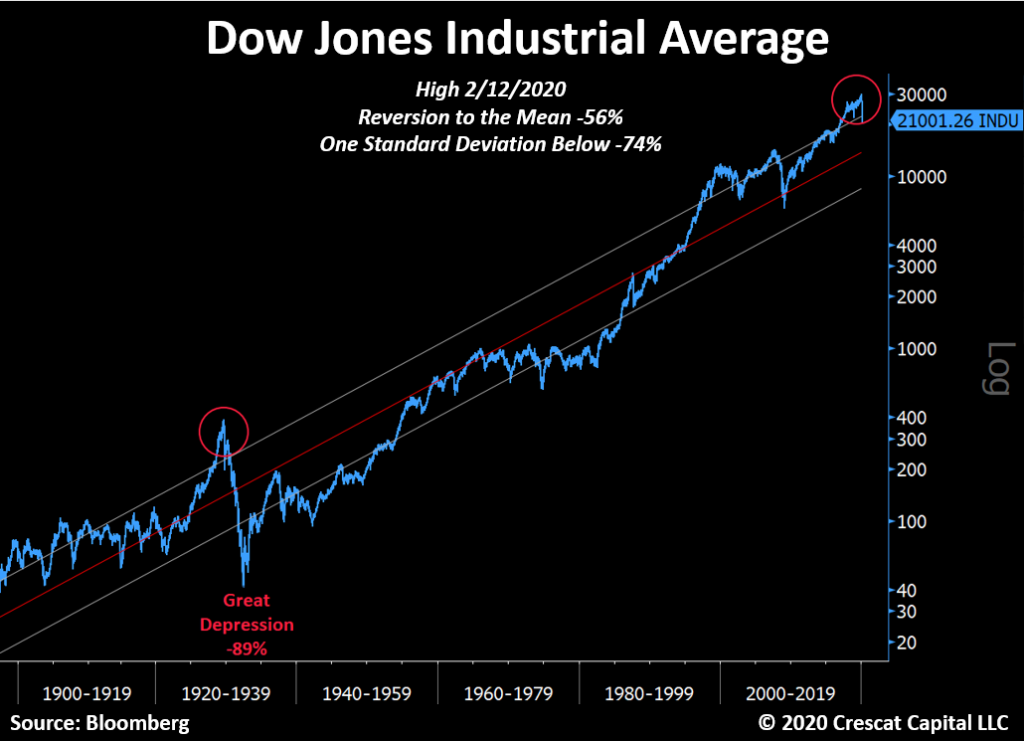

As we show in the chart above, we believe there is much more downside still ahead for US stocks as a major global recession from nosebleed debt-to-GDP levels has only just begun. Corporate earnings are now poised to plunge and unemployment to surge. These things are perfectly normal. There is a business cycle after all. It must play out as always to purge the economy and markets of their sins and prepare the way for the next growth phase. From the February top for large cap stocks, it would take a 56% selloff just to get to long term mean valuations, a 74% decline to get to one standard deviation below that. In the worst bear markets, valuations get to two standard deviations below the mean. Such realities happened at the depth of the Great Depression, the 1973-4 bear market, and the 1982 double-dip recession. 1932 was an 89% drop from the peak. The initial decline in this market so far is comparable to 1929 in speed and magnitude. There will certainly be bounces, but even after an almost 30% fall in the S&P 500 through yesterday’s close, we are not even close to the “blood in the street†valuations that should mark the bottom for stocks in the current global recession that has only just begun.

But value investors do not have to despair today. There is one area of the stock market that already offers historic low valuations and an incredible buying opportunity right now. Small cap gold and silver mining companies just retested the lows of a 9-year bear market. Last Friday, they were down 84% from their last bull market peak in December 2010! This was a double-bottom retest at a likely higher low compared to the January 2016 low when they were down 87%. Now that is what we call mass murder! In the chart below, we show that precious metals juniors reached record low valuations last Friday relative to gold which is still up 18% year-over-year. Mad value. Look at that beautiful divergence and base. The baby was thrown out with the bathwater in a mass margin call. Last time the ratio was in this vicinity, junior gold and silver miners rallied 200% in 8 months. Crescat owns a portfolio of premier, hand-picked juniors as part of our precious metals SMA and in both hedge funds where clients can gain exposure today. We significantly increased our exposure in our hedge funds amidst the massacre last week.

The entire precious metals group was a casualty of a liquidity crisis, the forced margin call selling for stocks and corporate credit at large in the precipitous market decline. But it was also a victim of a meltdown in dubious levered gold and silver ETF products. These products such as JNUG and NUGT already had a horrific tracking error. Nobody should have ever been investing in them in the first place. Gold stocks are volatile enough on an unlevered basis.

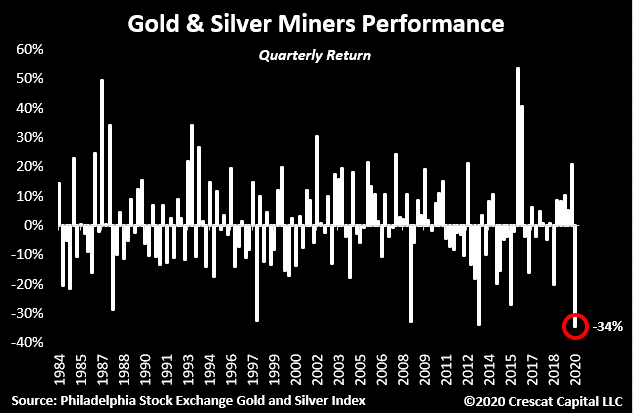

The chief culprit in the ETF space last week was the $3 billion leveraged assets, Direxion Daily Jr. Gold Bull 3x ETF. It absolutely imploded, dropping 95% through last Friday from its recent high on February 21. The fiasco in JNUG was insult to injury for long-time precious metals investors, especially those invested in silver and in junior miners. It was also an incredible buying opportunity that Crescat took advantage of, especially in its hedge funds, where the profits from our short positions at large allowed us to step up. Last week’s action may have marked a major bottom for precious metals mining stocks and ideally a bottom for battered silver this week. As of Friday, miners were on track for their worst quarter ever as we show below.

The gold and silver stock selloff has exposed enormous free cash flow yields today among precious metals mining producers of 10, 20, 30, 40, even 50%. This is completely opposite the stock market at large. Meanwhile, the pure-play junior mining explorers have some of the world’s most attractive gold and silver deposits that can be bought at historic low valuations to proven reserves and resources in the ground. These companies are the beneficiaries of under-investment in exploration and development by the senior producers over the entire precious metals bear market. That rebound may have started yesterday in the mining stocks especially the juniors. It is a historic setup right now for the entire precious metals complex. Central banks are coming in, guns blazing.

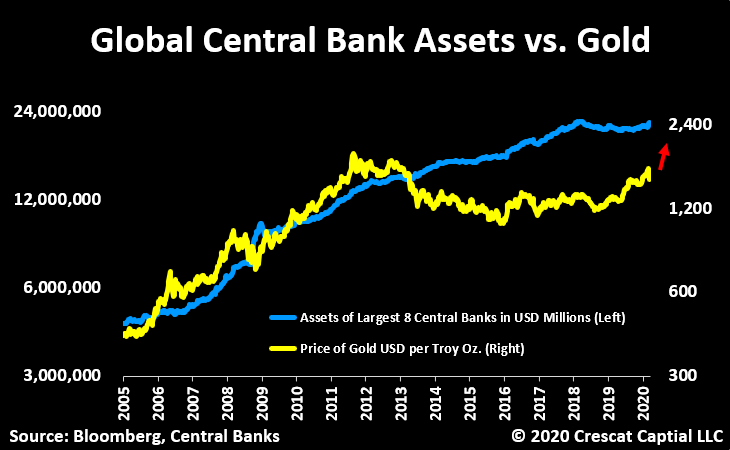

Meanwhile, the fundamentals have never been better for gold and silver prices to rise making the discounted present value of these companies even better. Global central bank money printing is poised to explode which is important because the world fiat monetary base is the biggest single macro driver of gold prices. Gold itself is already undervalued relative to global central bank assets which targets gold at $2400 an ounce today.

At the same time, the price of gold is the biggest macro driver of the price of silver, which is gold on steroids. Silver today is the absolute cheapest it has ever been relative to gold and represents an incredible bargain. We think silver is poised to skyrocket along with mining stocks in what should be one of the biggest V-shaped recoveries in the entire financial markets in the near term.

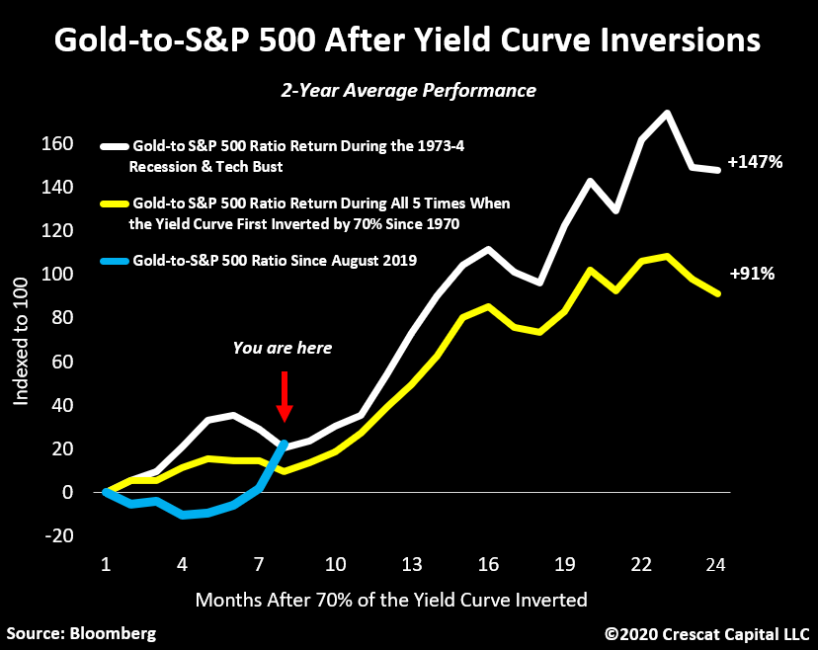

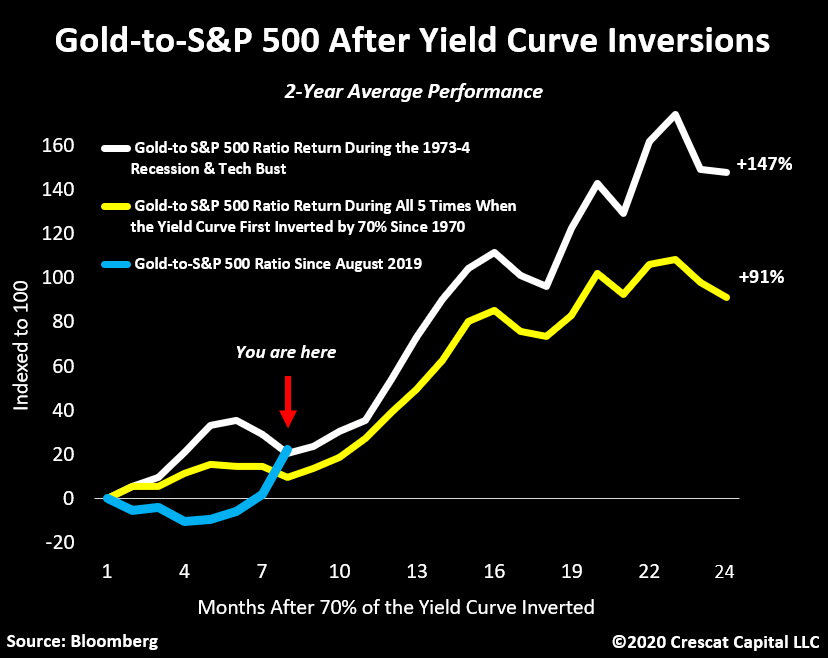

As we have shown in our prior letters, when the yield curve first inverts by 70% or more, there is a high probability of a recession and bear market. At that point, historically it has paid to buy gold and sell stocks for the next 2 years. We went above 70% inversions in August 2019. At Crescat, we continue to express both sides of this trade in our hedge funds and our firm at large. The gold-to-S&P 500 ratio is up 28% since last August. The first part of the move was mostly driven by the rise in gold. Since February 19, its been driven by the decline in stocks. Now we’re at the place where historically both legs start to work in tandem, and yesterday that was evident with one of our best days ever in both Crescat hedge funds.

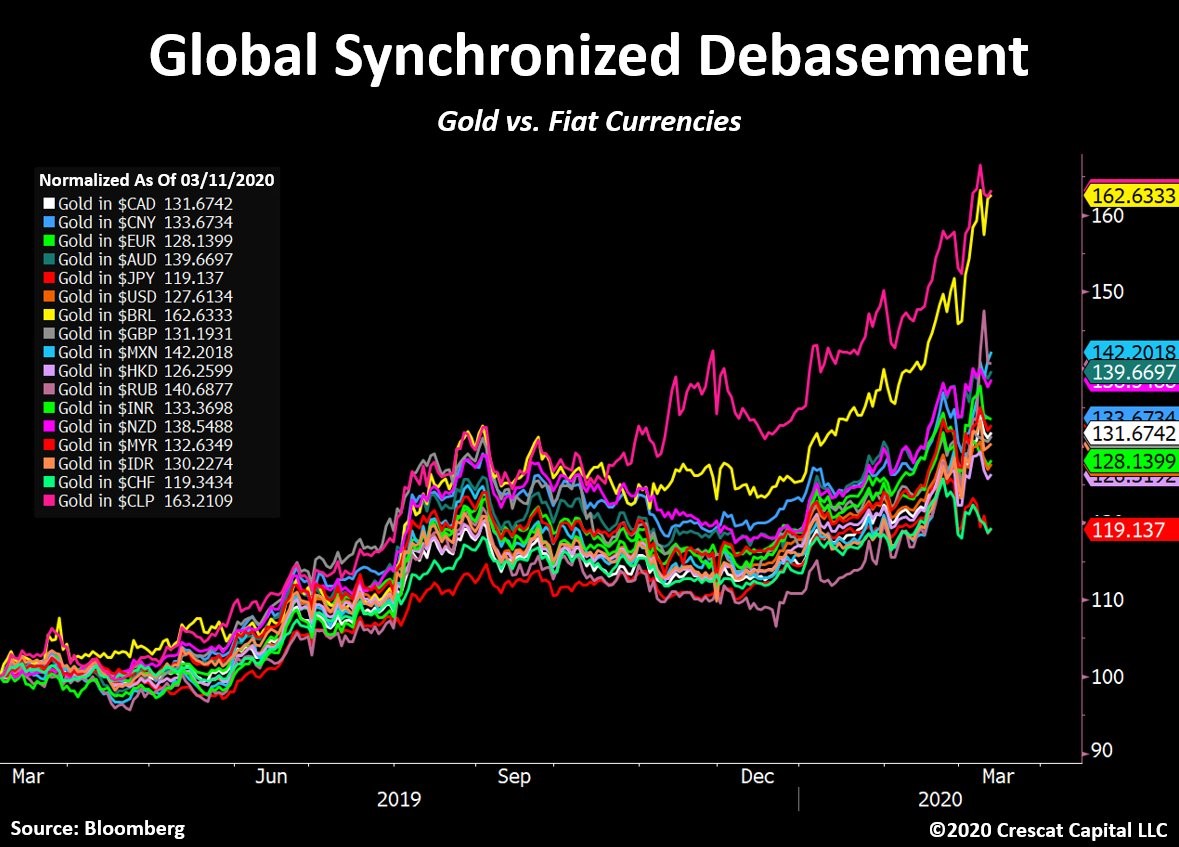

The Fed has not exhausted all its bullets. It has many forms of monetary stimulus. It can print more money and take interest rates into negative territory if need be. As the downturn in the business cycle becomes more pronounced, these policies will become increasingly called upon. That’s precisely what we are seeing today. Rate cuts everywhere, QE announcements, even forms of helicopter money are being implemented. It won’t save the economic cycle from its normal course, instead, it should only invigorate the reasons for owning precious metals. Central bank money printing and inflationary fiscal policy will almost certainly intensify. This is incredibly bullish for precious metals. We are in a global synchronized debasement environment. Gold has already been appreciating in all major fiat currencies in the world over the last year.

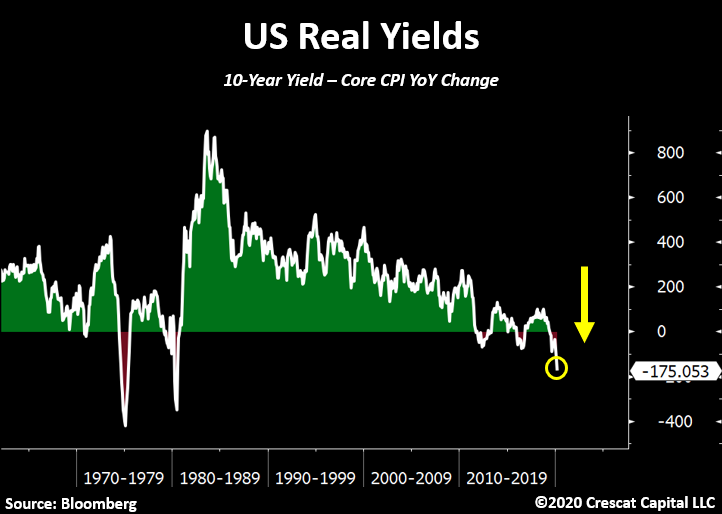

While yields continue to make historic lows worldwide, in real terms they have reached even more extreme levels. For instance, the US 10-year yield is now almost 2 percentage points below inflation. This just further strengthens our precious metals’ long thesis.

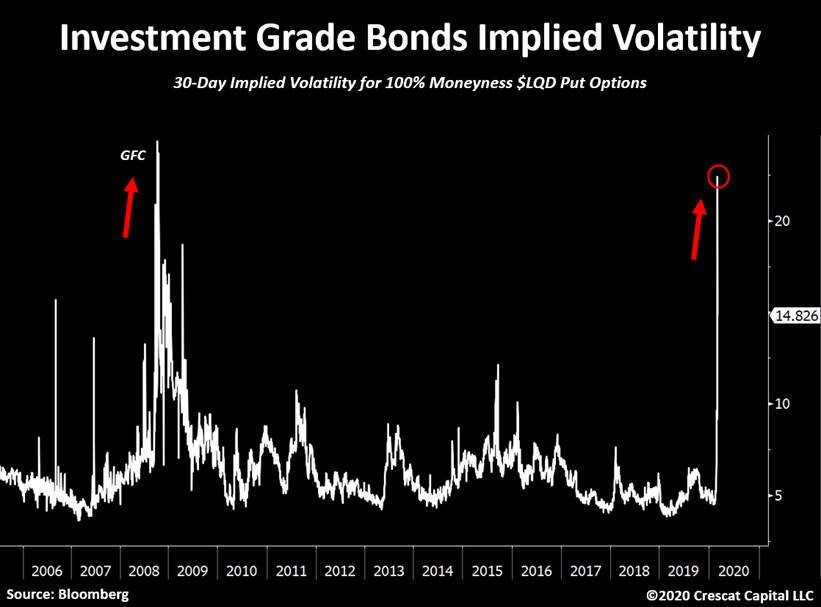

Even investment grade (IG) bonds are now blowing up. Implied volatility for IG bonds is surging! It’s now at its highest level since the Great Recession. Last week, the LQD (ETF) plunged 8% in 3 days, which is equivalent to a 10 standard deviation move. Declines as such only happened one other time in history, September 2008. We believe the corporate debt market crisis has just begun.

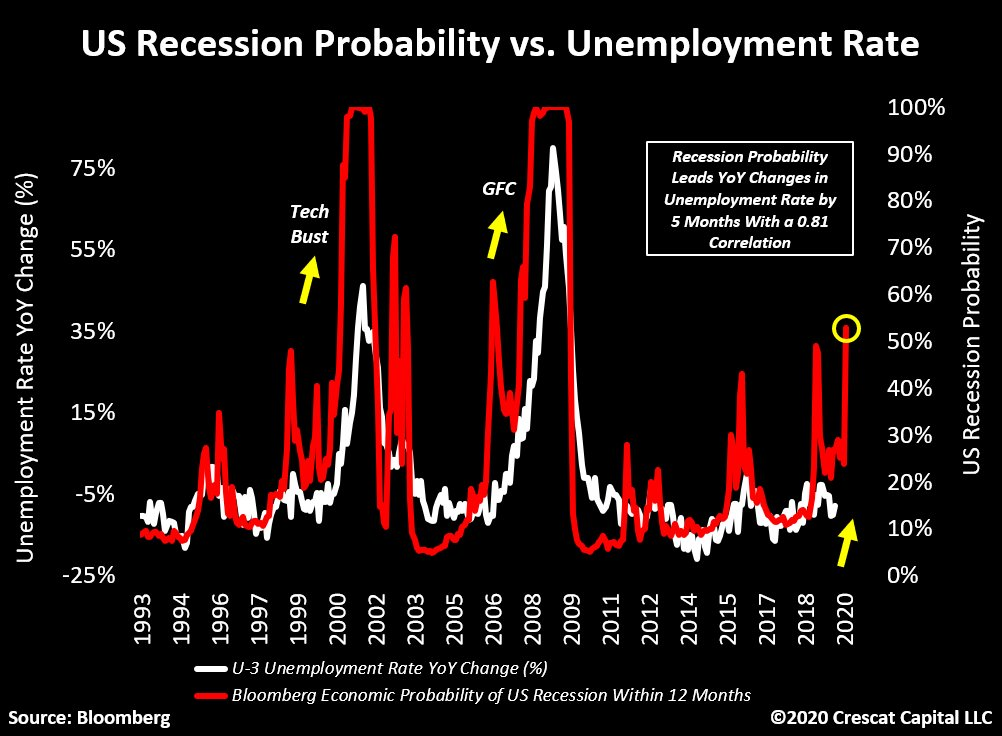

Stocks are acting like it’s the Great Depression again and we believe a recession has already begun. The probability for a US recession, as measure by this Bloomberg indicator, just surged above 50%. It’s currently at its highest level since the global financial crisis. This indicator leads changes in unemployment by 5 months with a 0.81 correlation. It suggests that the labor market has peaked.

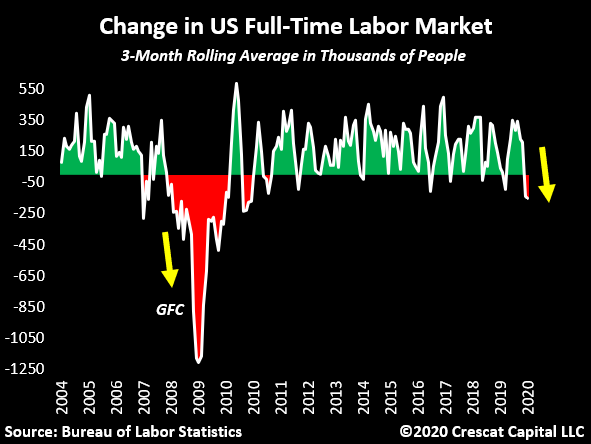

We have also recently noted that the number of full-time employed people is now contracting. This was already rolling over in January. With the recent impacts from the virus outbreak, we believe this number will be plunging imminently.

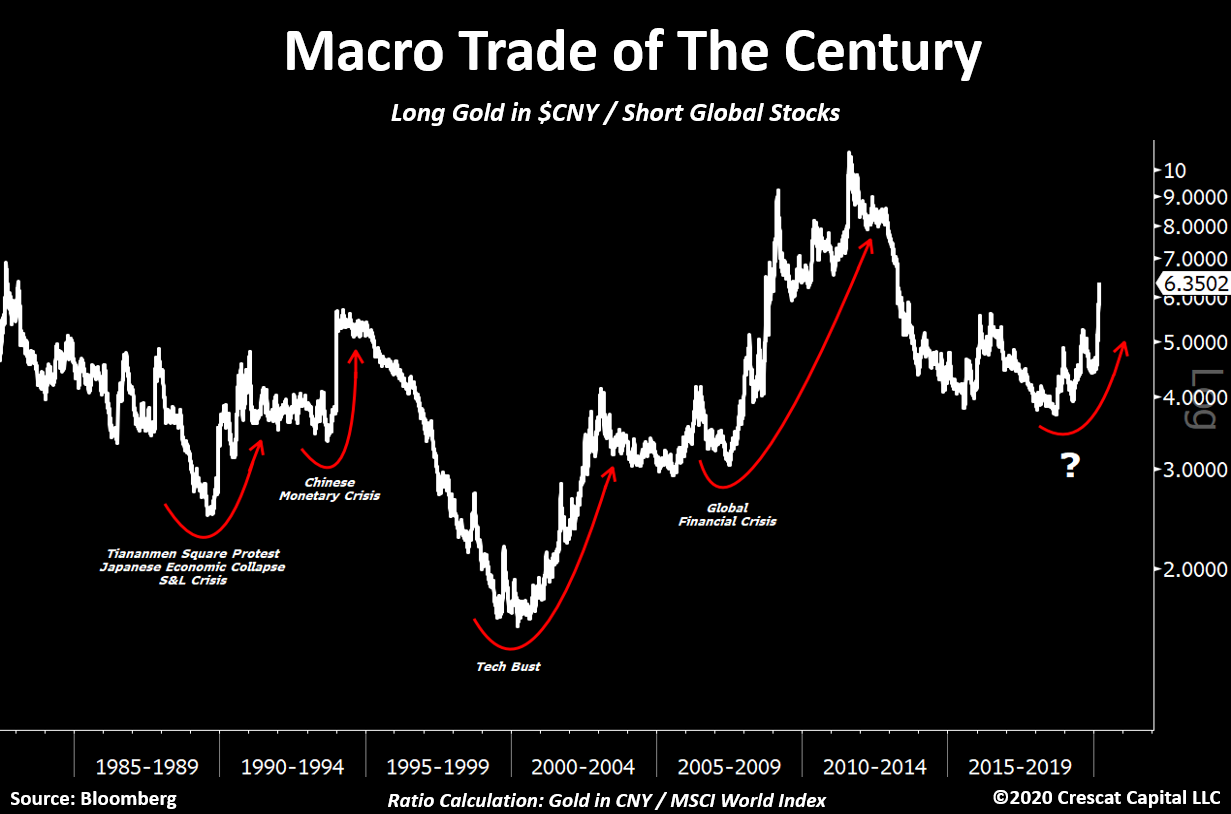

Macro Trade of the Century

Crescat’s “Macro Trade of the Century†has been working phenomenally well since the market top. We believe our in-depth analysis looking at the history of economic cycles and the development of macro models is paying off tremendously. This is just the beginning of this three-legged trade. The global economy has just entered a recession and the fundamental damage of the virus outbreak on an already over-leveraged economy will be greater than anything we have ever seen. We have massive underfunded pensions with governments and corporations record indebted, while wealth inequality is at an extreme across the globe. It is not the ideal mix for asset prices that remain grossly overvalued worldwide.

When investors ask us if our macro themes to position for the downturn have already played out, the answer is absolutely not. There is so much more to go. We explain it in three ways:

1) The bursting of China’s credit bubble, the largest we’ve seen in history, has yet to materialize in its most brutal manner. As macro imbalances unfold worldwide, the Chinese current account should only continue to shrink and exacerbate its dollar shortage problem. We expect that a large devaluation in its currency versus USD is coming soon. We haven’t seen anything yet. We remain positioned for this in an asymmetric way through put options in our global macro fund in the yuan and the Hong Kong dollar.

2) Except for last year, gold, silver, and the precious metals’ miners haven’t yet performed in the way we think they will. Instead they have recoiled in a major way YTD. Meanwhile, central banks are clearly losing control of financial markets and further monetary stimulus appears unavoidable. The entire precious metals’ industry should benefit from this macro backdrop. The near- and medium-term upside opportunity in the entire precious metals complex has never looked more attractive than it does today.

3) Equity markets remain about 30% above their median valuations throughout history. The coming downturn is one that will likely not stop at the median. As we showed above, we believe there is much more downside ahead for stocks at large before we reach the trough of the current global recession.

In our hedge funds, we added significantly to our precious metals positions with gains from our short sales late last week. We have also recently been harvesting profits in some of the most beaten down of our shorts. We remain net short global equities but much less so than a month ago and with less gross exposure overall. As a value-oriented global macro asset management firm, we believe there is so much more to play out as the economic cycle has only just begun to turn down. We are not perma-bears, but we are determined to capitalize on this downturn.

Crescat Performance Update

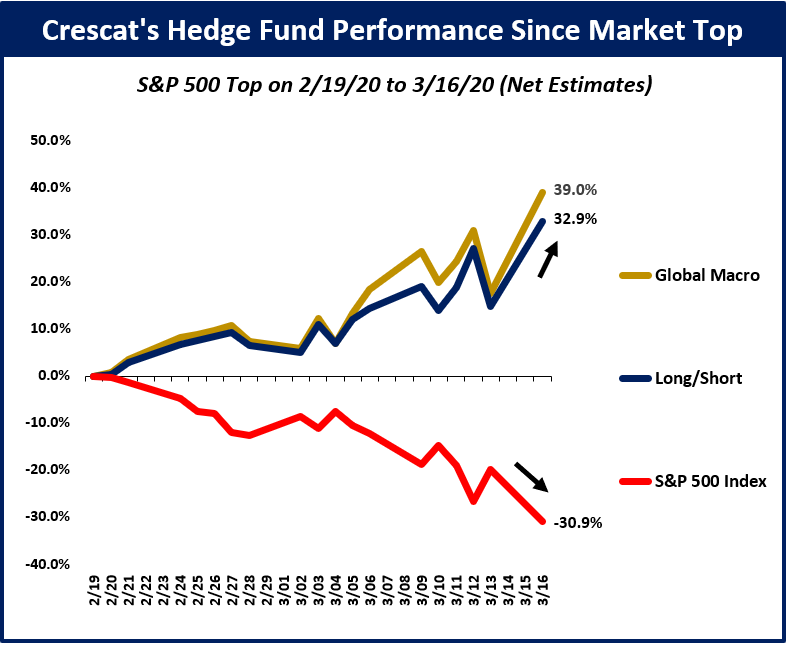

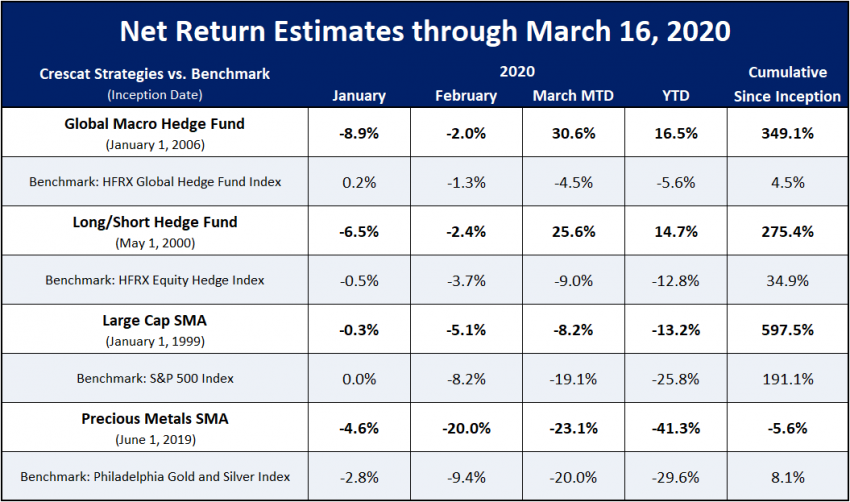

We have been telling our hedge fund clients for the past several quarters that we have been tactically positioned for a market and economic downturn ripe to unfold. Indeed, it has finally begun. Below, we show how our hedge funds have been performing since the top in the S&P 500 on February 19:

If you are interested in learning more about Crescat or investing with us, we encourage you to contact Linda Carleu Smith at [email protected] or (303) 228-7371.

Sincerely,

Kevin C. Smith, CFA

Chief Investment Officer

Tavi Costa

Portfolio Manager

© 2020 Crescat Capital LLC