Tartisan Nickel Corp. owns the Kenbridge Nickel Project in northwestern Ontario, the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru. The Company has an equity stake in; Eloro Resources Limited, Class 1 Nickel & Technologies Limited and Peruvian Metals Corp.

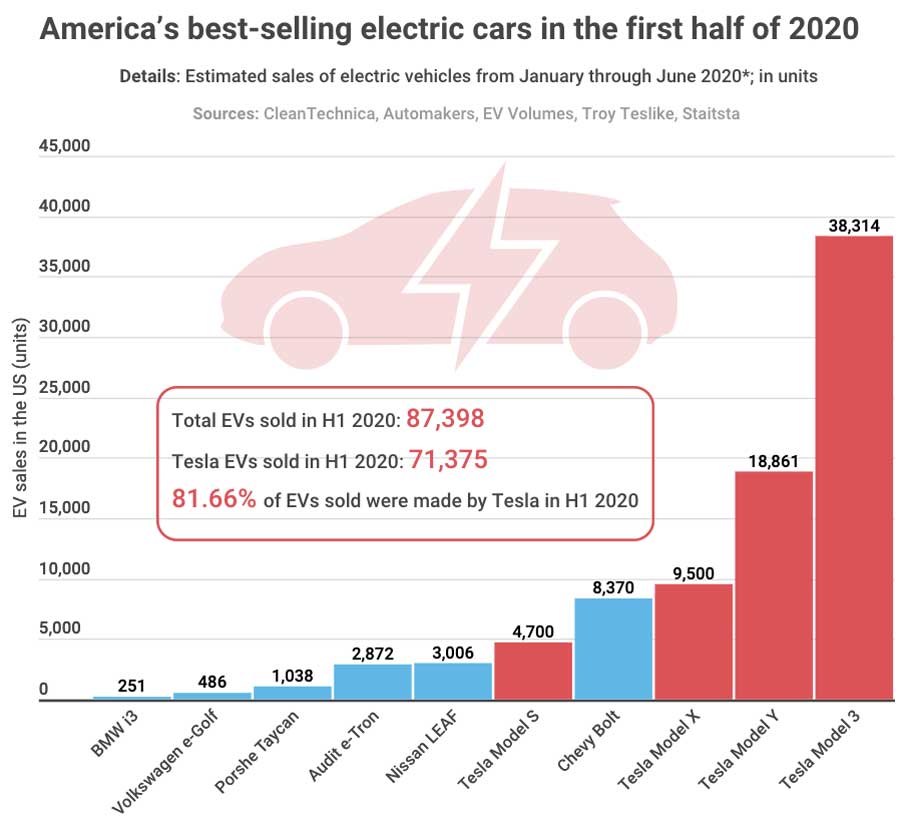

The federal government is planning investments in the electric vehicle industry to create a domestic supply chain for electric vehicle batteries that could supply the North American market. (Jonathan Hayward/The Canadian Press)

The Liberal government will use the speech from the throne to lay out a plan to create tens of thousands of jobs by connecting Canada’s resource sector with its manufacturing base to produce batteries for electric cars, Radio-Canada has learned.

“We recognize we have a unique opportunity to take advantage of our skilled labour force and we know we have a long and proud history of manufacturing vehicles, planes, ships and trains, and we also have an abundant amount of natural resources,” Innovation, Science and Industry Minister Navdeep Bains told Radio-Canada.

“We could be a world leader in [electric vehicle] battery manufacturing if we leverage our natural resources like lithium, cobalt … nickel, aluminum — the key ingredients that are required in batteries. Then we want to make sure that we manufacture them here and … use them in our trains, our buses, our ships and our planes.”

Bains said the green technology sector is expected to be worth trillions of dollars in the coming years and Canada could take advantage of that market by positioning itself as the chief North American supplier of batteries for electric vehicles.

“Not only do we want to be in a position to be building [electric vehicle] batteries here in Canada for the North American market, we want to be a global leader to take advantage of global opportunities,” he said.

CBC News has confirmed a report which first appeared in the Toronto Star — that the federal government is willing to put up to $500 million, with some money coming from the Ontario government, toward turning Ford’s Oakville plant over to the production of electric vehicles, an investment that could keep the plant open for years to come.

The paper reported that the mass production of electric vehicles and batteries is at the heart of talks between Ford Motor Co. and the union representing its employees.

When asked about the deal yesterday Ontario Premier Doug Ford said negotiations are still ongoing.

“What I can tell you is how important the auto industry is, one of the most important industries in Ontario,” he said during his daily briefing.

“This is good if we move forward. The parts are very important. We would like to manufacture the batteries here rather than bringing the batteries in from out of country. We have the capabilities and the raw materials here. Why can’t we produce the batteries? That’s my big ask to Ford.”

Adding value through manufacturing

Bains also said his government is looking at putting money into high-speed internet access — something he said the country needs more of now, with more and more Canadians working from home.

He also said the federal government is looking at investments in the agriculture sector to help make Canada “a world leader in plant proteins.”

Bains did not say if the agriculture and internet proposals will be a part of the throne speech.

“The bottom line is that we want to take advantage of what we have in Canada,” he said. “And what we have is an incredibly skilled labour workforce, we have natural resources and we have the ability to add value through our manufacturing processing initiatives.”

Source: https://www.cbc.ca/news/politics/navdeep-bains-speech-throne-batteries-1.5733220

Volkswagen

Volkswagen