- The length of the northeast axis of the Goldstorm System is over 850 meters

- The Southeast axis is at least 600m

- The system remains open in both dimensions, as well as to depth.

- The strongest mineralization encountered to date is from two consecutive 150m step-out holes at the northeast end of the drill grid: GS-19-42 yielded 0.849 g/t Au Eq over 780 m with the 300 Horizon averaging 1.275 g/t Au Eq over 370.5m and GS-19-47 yielded 0.697 g/t Au Eq over 1,081.5m with the 300 Horizon averaging 0.867 g/t Au Eq over 301.5m.

- Program focused on expanding the mineralized area from these two very encouraging step-out holes.

- Furthermore, we plan to continue advancing along the NE axis with yet another 150 meter step out hole. The best results from the southeast dimension came from GS-19-52 which yielded 0.783 g/t Au Eq over 601.5m with 1.062 g/t Au Eq over 336.0m within the 300 Horizon.“

Cardston, Alberta–(Newsfile Corp. – May 11, 2020) – American Creek Resources Ltd. (TSXV: AMK) (“the Corporation”) is pleased to report that its JV partner Tudor Gold Corp has begun this season’s diamond drill hole program at its flagship property, Treaty Creek, located in the heart of the Golden Triangle of Northwestern British Columbia. Diamond drilling has begun with two drill rigs on the Goldstorm Zone which is on-trend from Seabridges’ KMS Project located just five kilometers to the southwest. These first two drills have begun drilling the initial holes of the 20,000 meter exploration program.

Tudor Gold’s Vice President of Project Development, Ken Konkin, P.Geo., states: “We are very proud of the hard work and dedication that our crews exhibited during the weeks prior to the start of drilling. Due to their diligence in preparing the camp we have been able to start our drill program a month earlier than last year’s program. The priority is to continue to expand the Goldstorm System to the southeast and to the northeast.”

“The current known length of the northeast axis of the Goldstorm System is over 850 meters, and the southeast axis is at least 600 m; the system remains open in both dimensions, as well as to depth. The strongest mineralization encountered to date is from two consecutive 150m step-out holes at the northeast end of the drill grid: GS-19-42 yielded 0.849 g/t Au Eq over 780 m with the 300 Horizon averaging 1.275 g/t Au Eq over 370.5m and GS-19-47 yielded 0.697 g/t Au Eq over 1,081.5m with the 300 Horizon averaging 0.867 g/t Au Eq over 301.5m. Our program will be focused on expanding the mineralized area from these two very encouraging step-out holes. Furthermore, we plan to continue advancing along the NE axis with yet another 150 meter step out hole. The best results from the southeast dimension came from GS-19-52 which yielded 0.783 g/t Au Eq over 601.5m with 1.062 g/t Au Eq over 336.0m within the 300 Horizon.“

(The above results were from Tudors news release dated March 3rd, 2020,, in which the following metal prices were used to calculate the Au Eq metal content: Gold $1322/oz, Ag: $15.91/oz, Cu: $2.86/lb. Calculations used the formula Au Eq g/t = (Au g/t) + (Ag g/t x 0.012) + (Cu% x 1.4835). All metals are reported in USD and calculations do not consider metal recoveries. True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths.)

Tudor Gold and its associated service companies have taken extreme measures to maintain the highest professional standards while working under COVID-19 health and safety protocols. Only essential personnel are permitted to enter the camp and staging areas. An on-site certified paramedic conducts strict daily monitoring of temperatures and general health conditions of personnel and service providers who are working at the project site and the staging area.

Walter Storm, Tudor President and CEO, stated: “I am very pleased with the safe start-up of the 2020 exploration program thanks to the hard work and dedication of our crews. The Company’s intent is to advance the Treaty Creek Project with full recognition and confidence in the recommended COVID-19 safety protocols. The goal for this year is to complete enough drilling that we can begin to delineate a first resource estimation at Treaty Creek.”

Darren Blaney, American Creek President and CEO stated: “2019 was a very successful year at Treaty Creek and this year looks to be far better with an extension of the drilling season and a drill program that is over twice as big as last years. With the recent announcement of working towards a resource calculation along with baseline studies and metallurgical work for an initial economic assessment, Mr Storm was right in calling this a transformational year at Treaty Creek.”

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 is the Company‘s Vice President of Project Development, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

Treaty Creek JV Partnership

The Treaty Creek Project is a Joint Venture with Tudor Gold owning 3/5th and acting as operator. American Creek and Teuton Resources each have a 1/5th interest in the project creating a 3:1 ownership relationship between Tudor Gold and American Creek. American Creek and Teuton are both fully carried until such time as a Production Notice is issued, at which time they are required to contribute their respective 20% share of development costs. Until such time, Tudor is required to fund all exploration and development costs while both American Creek and Teuton have “free rides”.

Treaty Creek Background

The Treaty Creek Project lies in the same hydrothermal system as Pretium’s Brucejack mine and Seabridge’s KSM deposits with far better logistics.

Sulphurets Hydrothermal System

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/682/55669_1e096bdf247ef89b_001full.jpg

About American Creek

American Creek is a Canadian junior mineral exploration company with a strong portfolio of gold and silver properties in British Columbia. Three of those properties are located in the prolific “Golden Triangle”; the Treaty Creek and Electrum joint venture projects with Tudor Gold/Walter Storm as well as the 100% owned past producing Dunwell Mine.

More information about the Treaty Creek Project can be found here: https://americancreek.com/index.php/projects/treaty-creek/home

The Corporation also holds the Gold Hill, Austruck-Bonanza, Ample Goldmax, Silver Side, and Glitter King properties located in other prospective areas of the province.

For further information please contact Kelvin Burton at: Phone: 403 752-4040 or Email: [email protected]. Information relating to the Corporation is available on its website at www.americancreek.com

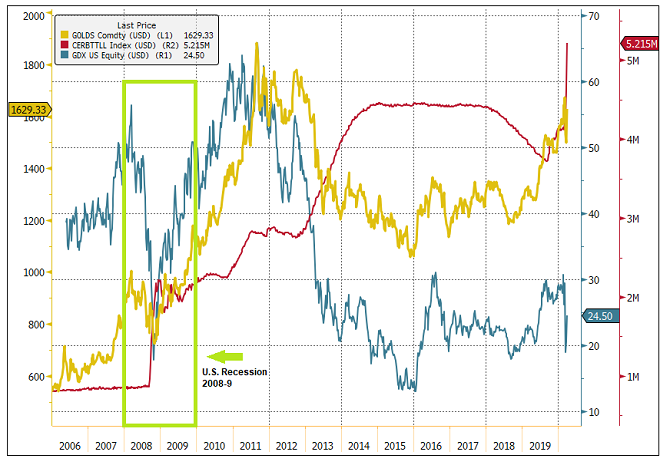

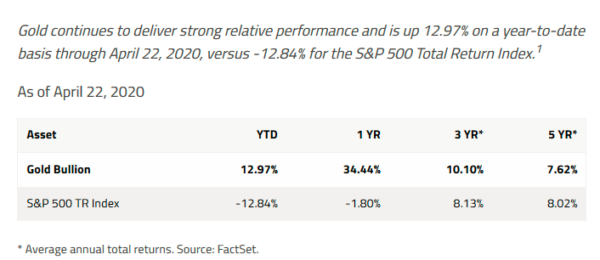

Source: Bloomberg. Data as of 3/31/2020.

Source: Bloomberg. Data as of 3/31/2020. Data as of 3/31/2020. Source: Bloomberg. 12/23/1983 represents the inception of the XAU.

Data as of 3/31/2020. Source: Bloomberg. 12/23/1983 represents the inception of the XAU.

Source: Bloomberg. Data as of 4/20/2020.

Source: Bloomberg. Data as of 4/20/2020.