Vancouver, B.C., Dec. 30, 2020 (GLOBE NEWSWIRE) — Lomiko Metals Inc. (“Lomiko”) (TSX-V: LMR, OTC: LMRMF, FSE: DH8C) is focused on the exploration and development of graphite for the new green economy. Despite the negative effects of COVID, Lomiko Management are happy to report the company has made significant strides forward over the last year.

2020 La Loutre Flake Graphite Property Developments

Lomiko formed a La Loutre Technical, Safety and Sustainability Committee (“LTSSC”), reporting to the Board of Directors. The LTSCC is comprised of A. Paul Gill, CEO and Directors, Gabriel Erdelyi and Gregg Jensen. The LTSSC will oversee the assessment of the La Loutre Flake Graphite Property, and liaise with service providers, technical staff, and stakeholders to put forward a series of crucial technical documents including, but not limited to, a Scope of Work (SOW), Graphite Characterization and Metallurgy, Response for Proposal (RFP) on a Preliminary Economic Assessment, and, if required, pre-feasibility, bulk samples, pilot plant, feasibility and construction plans. The Committee will govern the hiring of technical staff, liaise with extra-company agencies and representatives, and provide a conduit to the Board of Directors to make crucial decisions on the project. The Board and Committee has accepted a proposal by SGS Canada Inc. to conduct a Metallurgical Process Development Program with results due in early 2021.

New Board Members

Mr. Mike Petrina joined the Lomiko Board and the Lomiko Technical, Safety and Sustainability Committee (“LTSSC”) has appointed him the Project Manager for development of La Loutre. Mr. Petrina has years of executive experience with Adanac Molybdenum, Hawthorne Gold, MAG Silver and Probe Minerals. Mr. Petrina’s extensive experience with advanced stage projects in the Pre-economic Assessment (PEA) Stage will be extremely helpful as Lomiko proceeds with the La Loutre Project.

Also, Mr. Gregg Jensen joined the Lomiko Board. He has over 25 years of experience in Finance and Business management spanning several industries from technology, mining, engineering, to professional services.

Kenmar Securities Engaged to Raise $ 40 Million Cdn

Lomiko Metals engaged Kenmar Securities, LLC of New York to raise $ 40 million Cdn for the acquisition and development of critical metals projects. Kenmar Securities, LLC, is a Delaware limited liability corporation and SEC registered securities broker dealer and FINRA member.

The Advisor will assist the Company in analyzing its business, operations, properties, financial condition and prospects, prepare suitable marketing materials, contact any potential partner companies, assist and advise the Company with respect to the financial form and structure of any potential transaction.

Government Support for Critical Minerals Supply Chain Development

Lomiko has been monitoring emerging legislation aimed at reducing dependence on Chinese supply of graphite, lithium and other electric vehicle battery materials. 100% of graphite is currently imported to the United States as there is no domestic graphite mines able to produce material for graphite anodes used in Electric Vehicles. Please also refer to news release September 9, 2020 and October, 7 2020 related to changing government policies regarding critical minerals.

US Election Bonus for Critical Minerals Companies

In a boon for the critical minerals mining industry, President-elect Joe Biden’s committed to a historic investment in clean energy and innovation, developing rigorous new fuel economy standards aimed at ensuring 100% of new sales for light- and medium-duty vehicles will be zero emissions and annual improvements for heavy duty vehicles.

Biden will invest $400 billion over ten years, as one part of a broad mobilization of public investment, in clean energy and innovation. The funds will accelerate the deployment of clean technology throughout the US with a target of reducing the carbon footprint of the U.S. building stock 50% by 2035. The new government will work with governors and mayors to support the deployment of more than 500,000 new public charging outlets by the end of 2030.

Lomiko’s Opportunity in the Critical Minerals Supply Chain

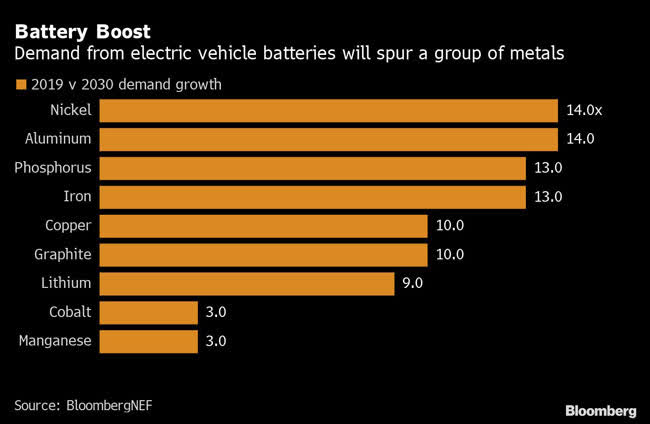

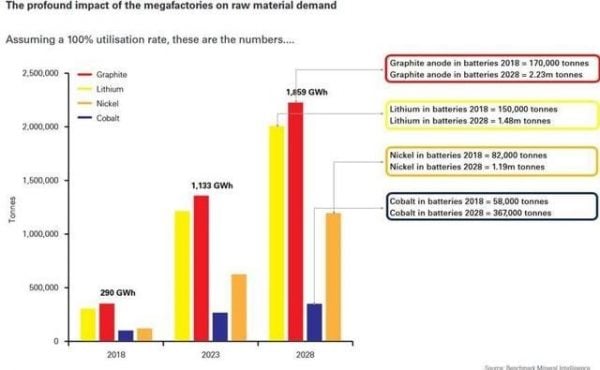

Graphite demand is expected to increase exponentially for natural graphite material, as more is used in the production of spherical graphite for graphite anodes of Electric Vehicle Lithium-ion batteries.

With a completion of $ 750,000 financing October 23, 2020, and a further $985,000 completed December 22, 2020, Lomiko plans to work on its near-term goals of the company are as follows:

1) Complete 100% Acquisition of the La Loutre Property, currently 80% owned by Lomiko Metals.

2) Complete metallurgy and graphite characterization to confirm li-ion anode grade material.

3) Complete a Technical Report to confirm the extent of the mineralization equals or surpasses the nearby Imerys Mine, owned by international mining conglomerate.

A “technical report” means a report prepared and filed in accordance with this Instrument and Form 43-101F1 Technical Report, and includes, in summary form, all material scientific and technical information in respect of the subject property as of the effective date of the technical report;

4) Complete Preliminary Economic Assessment (PEA)

A PEA means a study, other than a pre-feasibility or feasibility study, that includes an economic analysis of the potential viability of mineral resources.

For more information on Lomiko Metals, Promethieus, review the website at www.lomiko.com, and www.promethieus.com, contact A. Paul Gill at 604-729-5312 or email: [email protected].

On Behalf of the Board

“A. Paul Gill”

Director, Chief Executive Officer