- Drill results for holes 10 – 22 completed during 2018 exploration

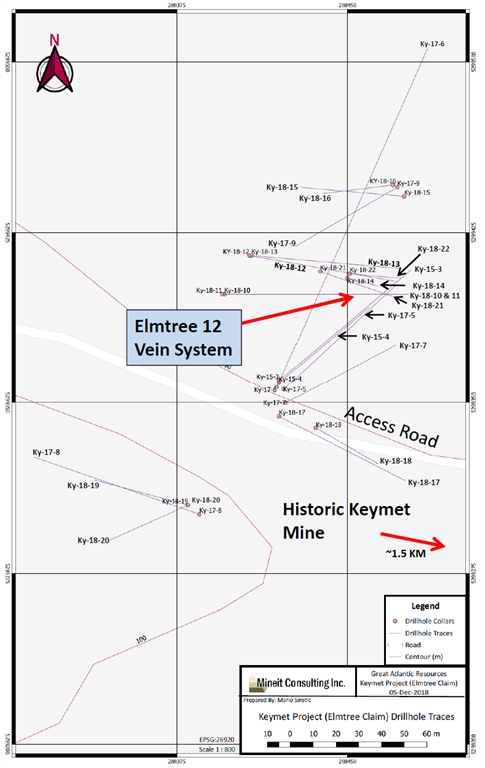

- Drilling conducted 1.5 km northwest of the historic Keymet Mine

- Ky-18-14: 7.89% zinc equivalent over 34.3 m

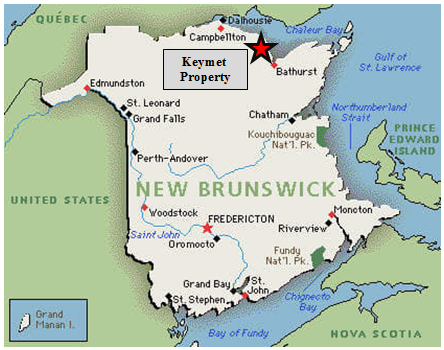

GREAT ATLANTIC RESOURCES CORP. (TSXV.GR) (the “Company” or “Great Atlantic”) is pleased to announce it has received drill core analytical results for 13 holes (Ky-18-10 to Ky-18-22) completed during the 2018 diamond drilling program at its Keymet Base Metal – Precious Metal Property, located near Bathurst, northeast New Brunswick. The program was conducted in the northwest region of the property approximately 1.5 km northwest of the historic Keymet Mine. Highlights include (core length):

- Ky-18-14: 7.89% zinc equivalent over 34.3 meters (From 46.20 m to 80.50 m)

- Ky-18-10: 10.91% zinc equivalent over 3.27 meters (From 85.03m to 88.30 m)

- Elmtree 12 vein: System traced to approximately 145 meters depth, open at depth

- Elmtree 12 vein: Strike length of approximately 110 meters and open along strike

Vein with semi-massive sulfides in Drill Hole Ky-18-14 at Elmtree 12 Vein System

The 2018 drilling program (13 holes totalling 1,484 meters) was conducted in the northwest region of the Keymet property. Eleven drill holes (Ky-18-10 to Ky-18-18, Ky-18-21 and Ky-18-22) tested the Elmtree 12 vein system as in-fill drilling and along strike with some holes testing deeper than previous drilling. Company management speculate the Elmtree 12 vein system to be striking approximately north-south and sub-vertical. Great Atlantic had previously drilled six holes in the Elmtree 12 vein system during 2015 and 2017, intersecting zinc, copper, lead and silver bearing polymetallic veins (News Releases of February 23, 2016, December 20, 2017 and March 2, 2018). Two drill holes (Ky-18-19 and Ky-18-20) tested the continuation of another base metal and silver bearing vein southwest of the Elmtree 12 vein system. This vein was discovered during 2017 drilling (Ky-17-8: 18.8% Zn, 3.5% Cu and 576 g/t Ag over 1.27 meters core length – News Release of March 2, 2018).

Sulfide Bearing Veins in Drill Hole Ky-18-14 at Elmtree 12 Vein System

Intersections from 2015, 2017 and 2018 diamond drilling programs in the area of the Elmtree 12 vein system include the following (core length):

| Hole ID | From (m) | To (m) | Length (m) | Zn Equiv. (%) | Zn (%) | Cu (%) | Pb (%) | Ag (g/t) | Au (g/t) |

| 2015 Diamond Drill Holes: | | ||||||||

| Ky-15-3 | 30.10 | 32.20 | 2.10 | | 3.28 | ||||

| Ky-15-3 | 60.80 | 62.60 | 1.80 | 22.77 | 16.68 | 1.11 | 0.44 | 152 | |

| Ky-15-4 | 90.07 | 94.35 | 4.28 | 10.44 | 8.68 | 0.29 | 0.2 | 44.8 | |

| 2017 Diamond Drill Holes: | | | |||||||

| Ky-17-5 | 81.00 | 81.80 | 0.80 | 20.24 | 13.65 | 1.20 | 0.45 | 166 | |

| Ky-17-6 | 119.45 | 131.50 | 12.05 | 8.31 | 3.54 | 0.92 | 0.28 | 115.6 | |

| Ky-17-6 | incl. 119.45 | 124.40 | 4.95 | 16.05 | 7.67 | 1.57 | 0.48 | 209.3 | |

| Ky-17-6 | 148.80 | 149.75 | 0.95 | | | | | | 4.9 |

| Ky-17-6 | 164 | 183.96 | 19.96 | 0.64 | |||||

| Ky-17-8 | 31.00 | 32.27 | 1.27 | 39.90 | 18.8 | 3.55 | 1.16 | 576 | |

| Ky-17-9 | 45.75 | 47.13 | 1.38 | 6.29 | 4.29 | 0.29 | 0.23 | 55.4 | |

| 2018 Diamond Drill Holes: | | ||||||||

| Ky-18-10 | 85.03 | 88.30 | 3.27 | 10.91 | 7.91 | 0.53 | 0.21 | 77.2 | |

| Ky-18-10 | incl. 85.74 | 86.74 | 1.00 | 25.59 | 16.80 | 1.60 | 0.55 | 223 | |

| Ky-18-11 | 108.70 | 109.40 | 0.70 | 4.95 | 3.89 | 0.11 | 0.14 | 33.9 | |

| Ky-18-12 | 78.82 | 84.55 | 5.73 | 7.88 | 4.07 | 1.19 | 0.23 | 39.2 | |

| Ky-18-12 | incl. 78.82 | 79.64 | 0.82 | 14.03 | 10.90 | 1.07 | 0.09 | 24.8 | |

| Ky-18-12 | incl. 83.35 | 84.55 | 1.20 | 21.65 | 8.90 | 3.81 | 0.60 | 157 | |

| Ky-18-13 | 80.00 | 81.00 | 1.00 | | 1.76 | ||||

| Ky-18-14 | 46.20 | 80.50 | 34.30 | 7.89 | 3.29 | 0.88 | 0.26 | 112.6 | |

| Ky-18-14 | incl. 46.20 | 49.20 | 3.00 | 56.23 | 9.04 | 9.19 | 2.16 | 1158 | |

| Ky-18-14 | incl. 62.48 | 63.00 | 0.52 | 18.49 | 15.45 | 0.96 | 0.13 | 32 | |

| Ky-18-14 | incl. 67.00 | 67.60 | 0.60 | 13.59 | 13.05 | 0.09 | 0.05 | 14 | |

| Ky-18-14 | incl. 76.00 | 80.50 | 4.50 | 14.27 | 12.08 | 0.31 | 0.30 | 59.8 | |

| Ky-18-16 | 77.20 | 77.72 | 0.52 | 33.48 | 4.47 | 7.85 | 0.72 | 478 | |

| Ky-18-17 | 10.43 | 11.00 | 0.57 | 11.72 | 6.37 | 0.10 | 6.08 | 14.5 | |

| Ky-18-17 | 67.00 | 67.50 | 0.50 | 7.23 | 6.05 | 0.21 | 0.15 | 27.5 | |

| Ky-18-18 | 72.50 | 73.50 | 1.00 | 2.74 | 2.04 | 0.09 | 0.11 | 19.6 | |

| Ky-18-19 | 13.02 | 13.72 | 0.70 | | 1.05 | ||||

| Ky-18-20 | 32.00 | 32.28 | 0.28 | 10.75 | 2.39 | 1.82 | 0.87 | 164 | |

| Ky-18-21 | 145.50 | 147.00 | 1.50 | 8.26 | 2.31 | 0.89 | 0.81 | 156.6 | |

Zinc equivalent (% Zn Equiv.) values for drill hole intersections are based on the following metal prices (as of January 16, 2019): Zinc US$2,467 / tonne (US$1.119 / lb.), Lead US$1,953 / tonne (US$0.886 / lb.), Copper US$5,881 / tonne (US$2.668 / lb.) and Silver US$15.605 per troy ounce. Metal recoveries of 100% were applied in the zinc equivalent calculations. The zinc equivalent calculation is as follows: Zn Equiv. = 100 x ((Ag Price in grams x Ag Grade) + (Pb Price x 2204.6 x Pb Grade (%) / 100) + (Cu Price x 2204.6 x Cu Grade (%) / 100) + (Zn Price x 2204.6 x Zn Grade (%) / 100)) / Zn Price x 2204.6.

Drill holes Ky-18-10 to Ky-18-13 were in-fill holes drilled east to slightly southeast at 45 to 57 degree dips. Drill holes Ky-18-14, Ky-18-21 and Ky-18-22 were collared closer to the vein system and at steeper dips (78-83 degrees) to intersect the vein system at a shallower angle to test continuity of mineralization along dip, locate possible ore shoots and gain a structural understanding of the vein’s vertical and horizontal orientations / extensions for targeted follow-up drilling. Hole Ky-18-21, drilled under Ky-18-14, tested the zone deeper. The mineralized intersection at 145.5-147 meters in this hole is the deepest intersection by the Company in the Elmtree 12 vein system and indicates the system is open at depth at this location. This interval also returned anomalous values for cobalt, including 0.07% Co over 1.0 meter core length.

The meta-sediments in the lower half of Ky-18-22 are intruded my mafic dykes, possibly cutting the vein system.

Drill holes Ky-18-15 and Ky-18-16 tested the extension of the Elmtree 12 vein system to the north. Ky-18-15 was drilled slightly northwest (approximate 55 degree dip). Ky-18-16 was drilled slightly southwest (approximate 73 degree dip). The metal rich intersection in Ky-18-16 indicates the mineralized system is open to the north at slightly deeper levels.

Drill holes Ky-18-17 and Ky-18-18 tested the Elmtree 12 vein system south of previous Company drilling. Mineralized veins and / or alteration was intersected in both holes, indicating the mineralized system to be open to the south.

Drill holes Ky-18-19 and Ky-18-20 were located southwest of the known extent of the Elmtree 12 vein system. These holes tested the extension of the high grade vein intersected in 2017 hole Ky-17-8. Ky-18-19 was drilled slightly northwest at an approximate 66 degree dip to intersect the vein deeper. Hole Ky-18-19 did not confirm the down-dip extension of the mineralized vein. Hole Ky-18-20 was drilled southwest at an approximate 55 degree dip. This hole intersected a near-surface narrow copper, lead, zinc and silver bearing zone (approximate 26 meters vertical depth) approximately 10 meters south of the high grade vein intersection of hole Ky-17-8.

Drill core from the 2018 program was geologically logged and sampled at a secure location in Miramichi, New Brunswick. Drill core samples were submitted to ALS Canada for gold analysis (Fire Assay-AA) and for 33 element analysis (including copper, lead, zinc and silver) by Four Acid and ICP-AES. Samples exceeding 1,500 g/t silver were re-analyzed for silver by Fire Assay-Gravimetric Finish. Quality Control samples were included as part of the sample submission. A Qualified Person verified the 2015, 2017 and 2018 exploration data for Great Atlantic. The Qualified Person managed these exploration programs at the Keymet Property.

Historic Keymet Mine (1950s)

The Company’s focus since acquiring the Keymet Property has been the northwest region of the property in the area of reported polymetallic veins with most work in the area of the Elmtree 12 copper-lead-zinc-silver bearing vein system. At least seven vein occurrences with lead, zinc and +/- copper, silver and gold are reported in this region of the property in addition to the polymetallic veins reported at the historic Keymet Mine (source: New Brunswick Dept. of Energy and Resource Development Mineral Occurrence Database). The Keymet Mine operated during the mid-1950s, producing copper, lead, zinc and silver. Production at this mine was terminated due to a fire at the site.

Significant precious metal – base metal deposits are reported within 4 km of the Keymet Property. The Elmtree gold deposits are located within 3 km west-southwest of the Keymet Property. The historic Nigadoo River Mine is located approximately 4 km south of the Keymet Property. Polymetallic massive sulfide veins were mined at the Nigadoo River Mine during the 1960s and 1970s with copper, lead, zinc and silver being produced. The N.B Dept. of Energy and Resource Development Mineral Occurrence Database reports shaft depth and production totals at this historic mine. Production during 1967-1971 is reported as 1.126 million tonnes at 2.2% Pb, 2.1% Zn, 0.24% Cu and 92.57 g/t Ag. Production during 1973-1977 (after a 2 year closure) is reported to be 0.733 million tonnes (only partial metal grades reported). The shaft is reported to at least 470 meter deep.

The Nash Creek Zinc Project of Callinex Mines Inc. is located approximately 15 kilometers northwest of the Keymet Property. Callinex Mines Inc. recently filed a 43-101 Technical Report (effective date March 21, 2018) which was completed by Tetra Tech Canada Inc. The report includes updated mineral resource estimates for the Nash Creek Zinc Project (Hickey and Hayes Zones) using a 1.5% Zn Equiv. cut-off. This included 13,592,000 tonnes indicated estimated resources at 2.68% Zn, 0.58% Pb and 17.8 g/t Ag; and 5,929,000 tonnes inferred estimated resources at 2.68% Zn, 0.47% Pb and 13.9 g/t Ag (source: Callinex Mines Inc. Website).

Readers are warned that mineralization at the Elmtree gold deposits, historic Nigadoo River Mine and Nash Creek Zinc Project is not necessarily indicative of mineralization on the Keymet Property.

Access to the Keymet Property is excellent with paved roads transecting the property, including a provincial highway. The property covers an area of approximately 3,400 hectares and is 100% owned by the Company.

Readers are warned that historical records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

David Martin, P.Geo., a Qualified Person as defined by NI 43-101 and VP Exploration for Great Atlantic, is responsible for the technical information contained in this News Release.

On Behalf of the board of directors

“Christopher R Anderson“

Mr. Christopher R Anderson ” Always be positive, strive for solutions, and never give up “

President CEO Director

604-488-3900 – Dir

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.