VANCOUVER, BC / August 28, 2017 / GREAT ATLANTIC RESOURCES CORP. (TSXV.GR) (the “Company” or “Great Atlantic”) is pleased to announce it has received gold analytical results for rock samples collected during May and June at its Golden Promise Gold Property in central Newfoundland. Rock samples were collected in multiple areas within the property, being the initial work in a budgeted 2017 exploration program on the property. The rock sampling program confirmed gold mineralization in quartz vein boulders or outcrop in four areas. Four quartz vein samples from three different areas exceeded 1 oz. / ton gold (34.2857 grams / tonne or g/t Au), including a boulder sample returning a high value of 200 g/t Au (5.8 oz. / ton Au). Trenching has since been completed in one of these areas referred to as the Jaclyn North Zone with analyses pending for rock samples. The Golden Promise Gold Property has been expanded to the current approximate 16,500 hectares.

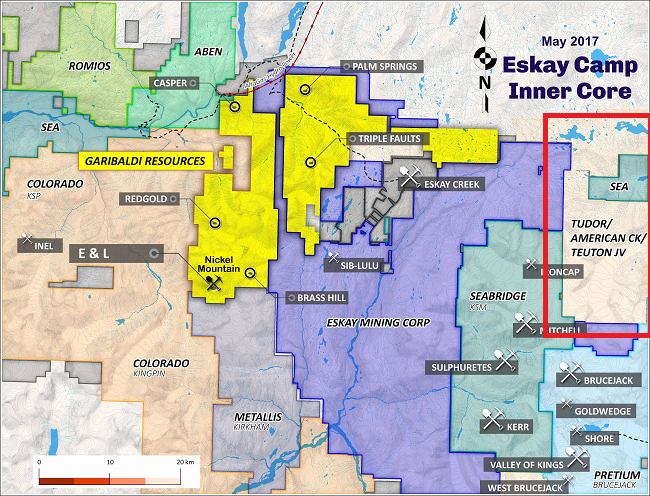

To view a map of the mining area, please click on the following link:

https://www.accesswire.com/uploads/82817_greatatlimage1.png

The Golden Promise Property hosts multiple gold-bearing quartz veins and gold-bearing float boulders. The majority of historic work is reported at the Jaclyn Main Zone in the northern region of the property. A National Instrument (NI) 43-101 compliant inferred resource of 921,000 tonnes at an average grade of 3.02 g/t Au (89,500 ounces contained gold) was reported in 2008 for the Jaclyn Main Zone. Gold recovery from a 2,241 tonne bulk sample collected in 2010 at the Jaclyn Main Zone was reported to average 4.47 g/t Au. The average tails grade for the sample was reported to be 1.12 g/t Au. A “back-calculated head grade of 5.59 g/t Au” was reported for the bulk sample. The Jaclyn Main Zone has been reportedly traced for a strike length of approximately 800 meters (northeast to east striking) through trenching and diamond drilling to approximately 420 meters vertical depth.

To veiw a Statlite map of the mining area, please click on the following link:

https://www.accesswire.com/uploads/82817_greatatlimage2.png

The May – June rock sampling program was focused in the central to northern regions of the property and included samples at the Jaclyn North Zone, Jaclyn West (Christopher) Zone, Shawn’s Shot vein and Branden float occurrence. The samples were submitted to ALS Minerals for gold and multi-element analysis. The most significant analytical results are listed in Table 1 (gold values are Screen Metallic Fire Assay gold analyses (total combined analyses of screen undersize and screen oversize fractions)).

| Sample No. |

Au (grams/tonne)

|

Au (oz./ton)

|

Float Boulder / Outcrop

|

Grab / Chip

|

Zone

|

| GP-R-17-30 |

200

|

5.833

|

Quartz Vein Float

|

Grab

|

Branden Float Occurrence |

| GP-R-17-33 |

57.2

|

1.668

|

Quartz Vein Float

|

Grab

|

Branden Float Occurrence |

| GP-R-17-200 |

0.54

|

0.016

|

Quartz Vein Outcrop

|

Grab

|

Jaclyn West (Christopher) |

| GP-R-17-203 |

48.2

|

1.406

|

Quartz Vein Outcrop

|

Chip (0.32m)

|

Shawn’s Shot |

| GP-R-17-206 |

6.11

|

0.178

|

Quartz Vein Float

|

Grab

|

Jaclyn North |

| GP-R-17-207 |

1.63

|

0.048

|

Quartz Vein Float

|

Grab

|

Jaclyn North |

| GP-R-17-208 |

70.9

|

2.068

|

Quartz Vein Float

|

Grab

|

Jaclyn North |

Table 1: May – June Golden Promise Rock Samples (grams / tonne Au /34.2857 = oz. / ton Au)

Samples GP-R-17-30 and GP-R-17-33 are 1.38 kilogram and 0.88 kilogram grab samples collected from two angular quartz vein boulders at the Branden float occurrence, located in the northeast region of the property, approximately 8.5 kilometers northeast of the Jaclyn Main Zone. Visible gold was identified in both boulders. Reported historic boulder sample assays for this area include 62.6, 72.1 and 80.0 g/t Au.

To view an image of Sample GP-R-17-30, please click on the following link:

https://www.accesswire.com/uploads/82817_greatatlimage3.jpg

A portion of sample GP-R-17-30 with visible gold (sample returned 200 g/t Au or 5.8 oz./ ton Au).

Samples GP-R-206, 207 and 208 are 1.51, 1.50 and 1.36 kilogram grab samples of quartz vein boulders in the Jaclyn North Zone, located in the northern region of the property. The Jaclyn North Zone is reported approximately 250 meters north of the Jaclyn Main Zone. The three samples were collected east of historic drill holes at this zone. These samples are also in the vicinity of recently completed trenches.

To view an image of sample GP-R-17-208, please click on the following link:

https://www.accesswire.com/uploads/82817_greatatlimage4.jpg

A portion of sample GP-R-17-208 (sample returned 70.9 g/t Au or 2.0 oz./ton Au)

The northeast striking Jaclyn North Zone has been reportedly traced for approximately 450 meters and locally to a vertical depth of 175 meters (13 diamond drill holes). The zone is reported to contain 3 quartz veined sub-zones. Reported historic drill hole intersections include:

- GP03-32: 12.13 g/t Au / 0.35m & 12.30 g/t Au / 0.30m

- GP07-76 (Upper Sub-zone): 11.28 g/t Au / 0.30m

- GP06-51 (Middle Sub-zone): 5.24 g/t Au / 1.70

- GP06-47 (Lower Sub-zone): 15.23 g/t Au / 0.30m

Sample GP-R-17-203 is a 0.94 kilogram, 0.32 metre chip sample across the Shawn’s Shot quartz vein. The Shawn’s Shot vein is reported in the central region of the property, approximately 7.5 km southwest of the Jaclyn Main Zone. This quartz vein is reported to be 0.35 metres wide, striking slightly southeast in an outcrop along a river. Historic grab samples of this vein were reported to return up to 100.5 g/t Au.

Sample GP-R-17-200 is a 1.30 kilogram outcrop grab sample from the Jaclyn West (Christopher) Zone in the northern region of the property. This sample was collected from a historic trench. The Jaclyn West Zone is reported approximately 450 meters southwest of the Jaclyn Main Zone. It is reported to have a known strike length of 35 meters and 2 metre composite vein width. A historic grab sample of a vein sub crop was reported to return 3.8 g/t Au.

To view an image of a sample site, please click on the following link:

https://www.accesswire.com/uploads/82817_greatatlimage5.jpg