- 178 tonnes of product processed through the existing pilot plant

- Systematically increased the grade to commercially desirable 95% – 97% Cg (Carbon in Graphite)

- Able to upgrade this material to over 99% Cg through air classification

- 350 tonnes of graphitic material stockpiled at the processing site ready for beneficiation

TORONTO, Oct. 24, 2019 /CNW/ – Gratomic Inc. (“Gratomic” or the “Company”) (TSX-V: GRAT) (CB81–FRANKFURT; WKN:A143MR) a vertically integrated graphite to graphenes, advanced materials development company is pleased to provide further updates from its Aukam Graphite Project in Namibia.

The Company is pleased to report that is has completed the crushing and grinding circuit which has a 50 metric tonnes per hour capacity. The Company also completed the installation and setup of the Processing Plant’s Rougher, Cleaner and Scavenger flotation columns. The cumulative capacity of the columns combined with the Rougher Mixing Tank and slurry line is initially 2.8 tonnes per hour.

To date the Company has put 178 tonnes of product through the existing pilot plant systematically increasing the grade to commercially desirable 95% – 97% Cg (Carbon in Graphite). It has further indicated that it is able to upgrade this material through air classification to over 99% Cg.

Operationally, the Company has decided to put on hold an updated drying circuit pending financing of the Company. The drying circuit will be shipped to Namibia after the final payment of CAD $75,000 is made and will arrive within 39 days of the payment. The Company has decided to delay this upgrade in the short term in order to preserve available capital and will utilize the existing drying circuit which can manage the material drying requirements in the interim.

The Company has entered into an agreement with VIVO Shell in July of 2019 (the “Agreement”) to invest N$ 700,000 into the construction of a bulk 50,000 litre fuel storage facility that will be erected at the Aukam Fuel depot located within 1.2 km from the mine site. The Company is also in discussions with Namibia’s largest mining contractor “LEWCOR” and is reviewing plans to initiate mining and earth moving operations.

In preparation of product sales, a total of 350 tonnes of graphitic material has been stockpiled at the processing site ready for beneficiation. During the first two months of the LEWCOR contract, the stockpile will be further increased to 5,000 tonnes from available surface mine dumps which contain approximately 23,000 tonnes of graphitic material.

Management will be curtailing ongoing mining costs by temporarily reducing non-critical staff until the completion of a financing. The Company sees this as a positive means to decrease monthly capital requirements by approximately 75%. All staff has been paid up to date with salaries being supported primarily through capital injection by the company’s two CEOs. The non-critical mine staff that are not directly affiliated with mine construction will be rehired upon the completion of a financing to resume mining and processing activities.

Risk Factors

The Company advises that it has not based its production decision on even the existence of mineral resources let alone on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit.

Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved.

Failure to commence production would have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability.

Qualified Persons

Steve Gray, P. Geo. has reviewed, prepared and approved the scientific and technical information in this press release and is Gratomic Inc’s “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Gratomic Inc.

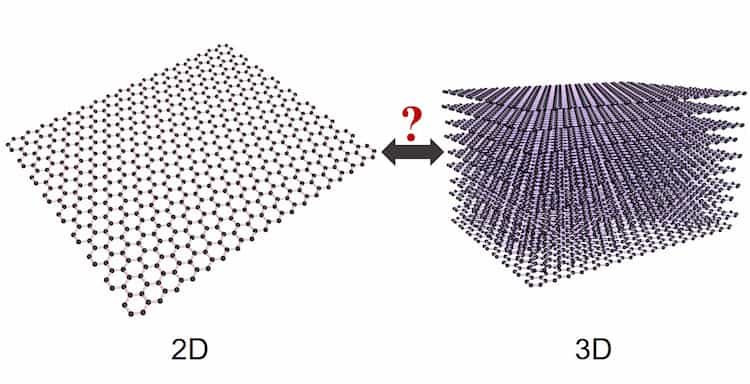

Gratomic is an advanced materials company focused on mine to market commercialization of graphite products most notably high value graphene-based components for a range of mass market products. The Company has a JV collaborating with Perpetuus Carbon Technology, a leading European manufacturer of graphenes, to use Aukam graphite to manufacture graphene products for commercialization on an industrial scale. The Company is listed on the TSX Venture Exchange under the symbol GRAT.